Bitcoin vs. Bitcoin Cash: Can Both Survive?

Industry leaders comment on which will dominate the market: Bitcoin or Bitcoin Cash.

You could be forgiven for thinking Bitcoin Cash was dead; the currency had slumped to about $600 before a sudden revival last week caused the price to soar to $2,600 while simultaneously knocking Bitcoin down a few notches.

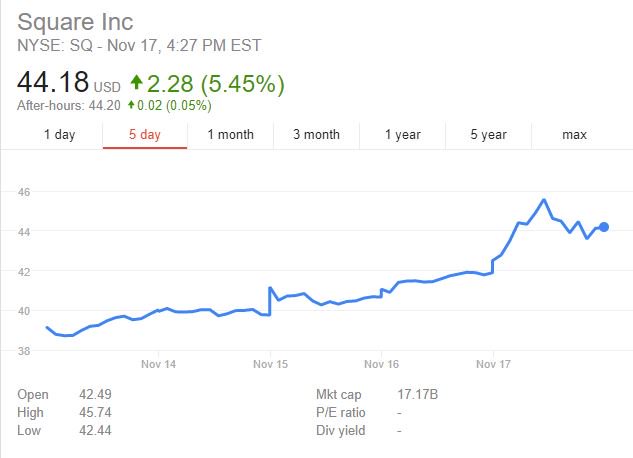

As a brief recap, Bitcoin recorded a new all-time high of about $7,800 on Wednesday, November 8 followed by a downward trend, which saw Bitcoin fall by nearly 30 percent to under $5,630 by Sunday, November 12. The root of this was that the Bitcoin community couldn’t reach a consensus to proceed with the proposed SegWit2x hard fork. However, it didn’t take long for Bitcoin to return to its previous values and seek new highs.

The discussions of a hard fork finds its root in the one megabyte block size limit that the original developer of Bitcoin, Satoshi Nakamoto, set to make the digital currency more secure. Given the limit of only 21 million Bitcoins, Satoshi most likely didn’t envisage that Bitcoin will be as huge and valuable as it is today. That’s certainly understandable since nothing like it had ever existed.

However, now that the digital currency has become more popular than Satoshi probably envisaged, the currency is dealing with the modesty of its original design. Bitcoin’s lack of capacity has led to the growing amount of time it takes to process Bitcoin transactions. Those who would like to have their transactions confirmed in a timely manner have to pay relatively more transaction fee as an incentive for transaction validators (miners) to prioritize their transactions.

According to a website that tracks Bitcoin fees, the current “fastest and cheapest transaction fee is currently 770 satoshis/byte.” For reference, a comment on BitcoinTalk pointed out that the recommended fee (same as the fastest and cheapest fee) as of January 2017 was 120 satoshis. That’s over 500 percent increase in the recommended transaction fee since the beginning of the year.

This is contrary to the promise of speed and affordability that has been publicized as one of the advantages that Bitcoin offers over the traditional ways of conducting financial transactions.

The aim of the shelved SegWit2x hard fork was to solve these challenges by increasing the amount of transaction data that each block can handle to two megabytes. Once this fork was cancelled, some investors grew weary and pulled out of Bitcoin and moved into Bitcoin Cash, a digital currency that resulted from a Bitcoin hard fork in August.

Bitcoin Cash recorded an all-time high of over $2,500 when Bitcoin was falling on November 12. Considering that the scaling limitations inherent in the Bitcoin system still lie unfixed, coupled with the social buzz around Bitcoin Cash, investors are likely to be worried about what the future holds for Bitcoin. Here are some thoughts from industry experts.

The Lack of Consensus Makes Bitcoin Vulnerable To Big Money Manipulation

According to DNX Community CEO Conradie Graeme, the failure to push the SegWit2x hard fork through is a setback for Bitcoin.

“Everyone is focused on scalability issues, but I believe there’s a bigger vulnerability issue about Bitcoin Think about it, as it stands, if you can afford to pay more in transaction fee, you can have your transactions confirmed quickly and there is no limit to the amount of Bitcoin you can buy or sell. And in reality, it’s only the big money investors/traders who can afford to pay more in transaction fees. So in theory, big money can pump and dump Bitcoin using the unfair advantage of being able to get their transactions confirmed quickly by paying more. They can dump before anyone else to take profits. This could mean that Bitcoin will remain highly volatile and high volatility could hinder it from ever becoming huge in the digital payment space.”

Bitcoin’s Value Will Decline

Maksim Balashevich, CEO and Founder of Santiment, believes that Bitcoin will drop in value.

There is always time to accumulate and then also time to reduce the risks. #bitcoin is risky now more than rewardy #cryptocurrency pic.twitter.com/FC2PnhX3bZ

— Santiment (@santimentfeed) November 7, 2017

Santiment believes Bitcoin’s value will drop, being redistributed among other ‘cash payments protocols’ such as Bitcoin Cash, Ethereum, Dash, Monero and Ripple. He adds:

“The Bitcoin Core [developers] (and Blockstream) should feel the real pressure and pain for what they’ve been denying for too long time. Once this pain is obvious and on all discussion boards, we might find the way for relief.”

There’s Room for Coexistence

Eric Jackson, CEO and Co-Founder, CapLinked, on the other hand, believes that Bitcoin’s widespread institutional support and adoption means that it will likely be here to stay, adding that its recent price rebound confirms that. That doesn’t mean Bitcoin Cash has no chance. Here are his words:

“I also believe that it is possible for Bitcoin Cash to coexist with Bitcoin. Bitcoin’s appreciation over the past half-decade has turned it into a store of value more comparable to gold than a currency. The very notion that Wall Street is developing derivatives of Bitcoin also suggests that it is on its way to becoming the world’s first digital commodity. Bitcoin has smaller block sizes and higher transaction fees compared to [Bitcoin Cash], making [Bitcoin Cash] mechanically better suited as a payment option than Bitcoin. Thus, assuming the rise of [Bitcoin Cash] is in part due to the need for a more flexible digital payment mechanism, I think there is room in the world for both.”

Clem Chambers, CEO of global stocks and shares website ADVFN also shares the view that several digital currencies can coexist:

“There is room in the market for both Bitcoin and Bitcoin Cash, and for that matter many other coins including eccentric issues like Bitcoin Gold. In classic coinage, there are many denominations for the very same reason that there will be many different cryptocoin denominations. There are also many different currencies on top of denominations and for that matter an infinite set of designs. Cryptocurrency will follow a similar path.”

At press time, Bitcoin is trading at an all time high of just under $8300.

Author: Craig Adeyanju 11/21/2017 – 04:39

Posted by David Ogden Entrepreneur

Alan Zibluk – Markethive Founding Member

Implementing an Effective Email Marketing Campaign

Implementing an Effective Email Marketing Campaign