Bitcoin – Look out for the Holiday Bear Trap

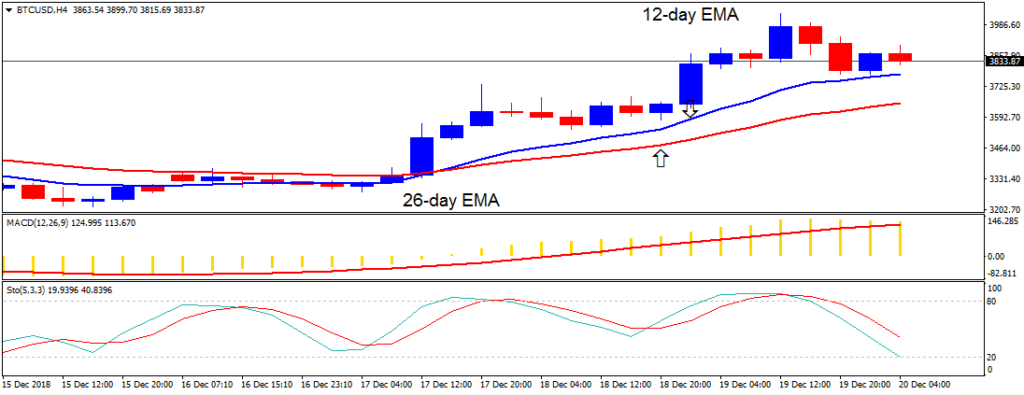

Bitcoin in positive territory early on, though will need to hit $4,000 levels to avoid a reversal later in the day.

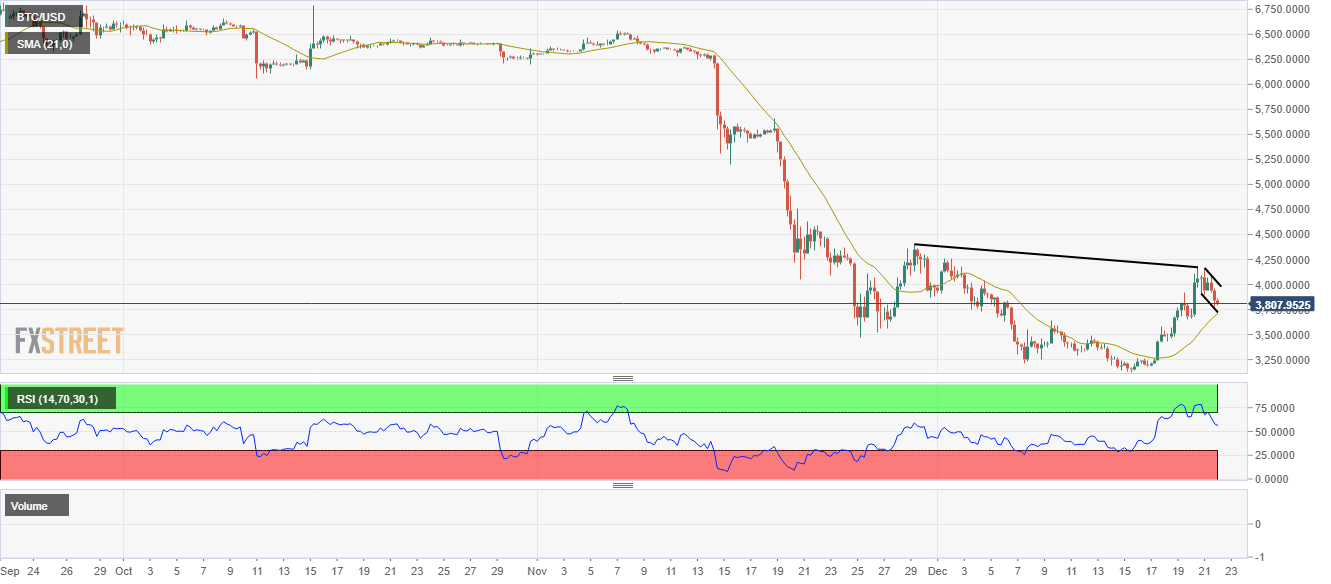

Bitcoin slid by 5.58% on Tuesday, reversing Monday’s 1.67% gain, to end the day at $3,909.6, a first sub-$4,000 end of day since last Friday’s $3,976.

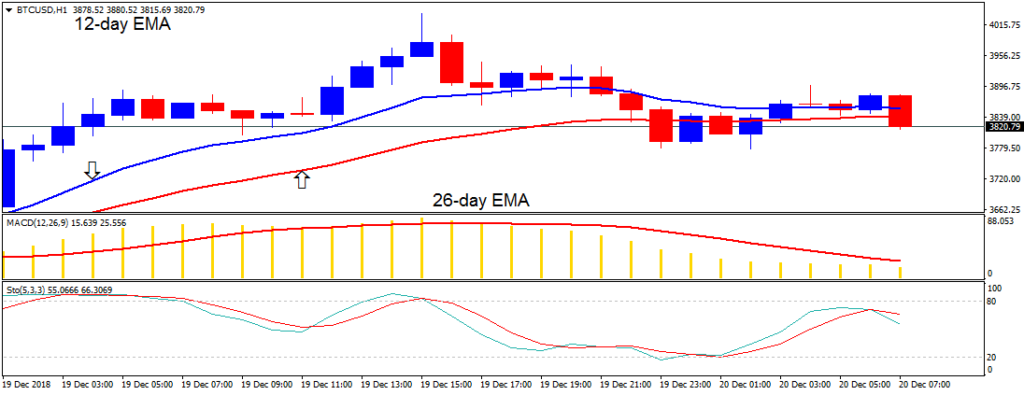

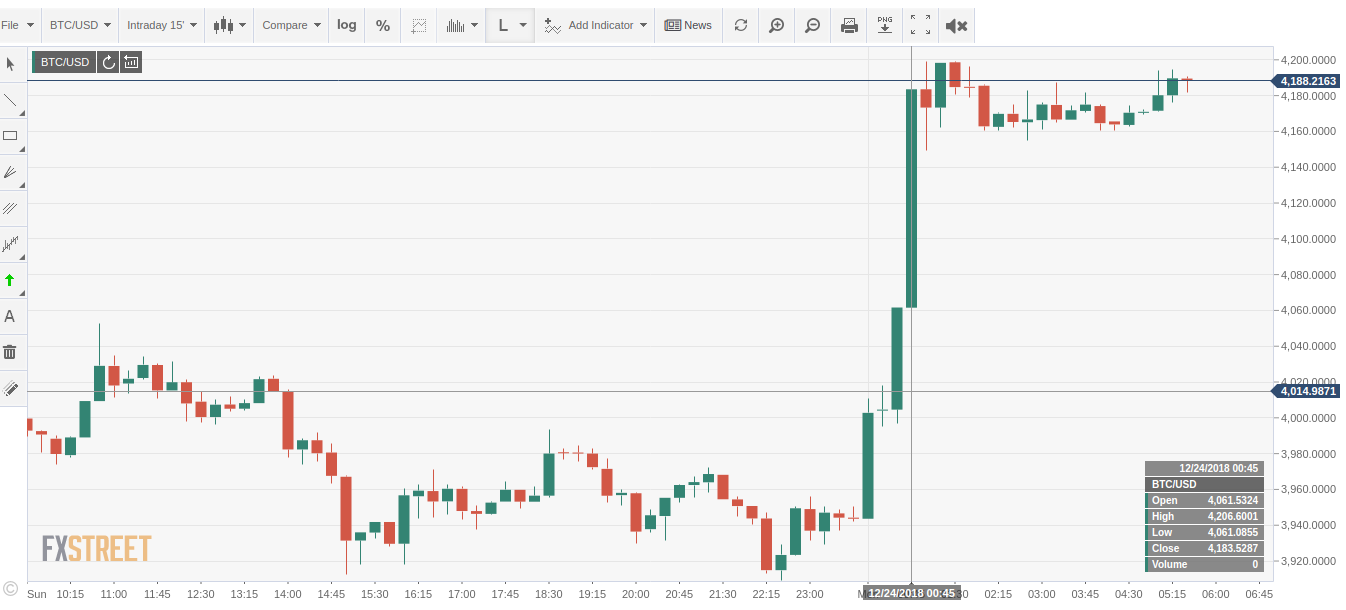

A broad based cryptomarket sell-off came at the start of the day, with Bitcoin sliding from an intraday high $4,155 to a morning low $3,827.9, the reversal seeing Bitcoin fall through the first major support level at $4,011.80 and second major support level at $3,882.9 before steadying.

Range bound through the 2nd half of the day, Bitcoin eased to an early afternoon intraday low $3,812.1 before recovering to $3,900 levels, an afternoon high $3,957.7 seeing Bitcoin come up short of $4,000 levels and to pin Bitcoin back from a break back through the first major support level at $4,011.80, leaving the bearish trend intact.

The Bitcoin bulls would have been hoping for another day of gains, off the back of the start of a week bounce from last week’s rally, the news wires hitting the majors in the early hours to give the bears the market for the day.

Tuesday’s sell-off saw the cryptomarket’s total market cap fall back to $131.52bn, while Bitcoin’s dominance held relatively steady, with sub-52% levels continuing to point to some further upside near-term, in spite of the extended bearish trend, formed at early May’s swing hi $9,999.

Get Into Cryptocurrency Trading Today

At the time of writing, Bitcoin was up 1.21% to $3,957.1, moves through the early morning seeing Bitcoin rise from a start of a day morning low $3,883.1 to a morning high $3,990.0 before easing back, the day’s major support and resistance levels left untested early on.

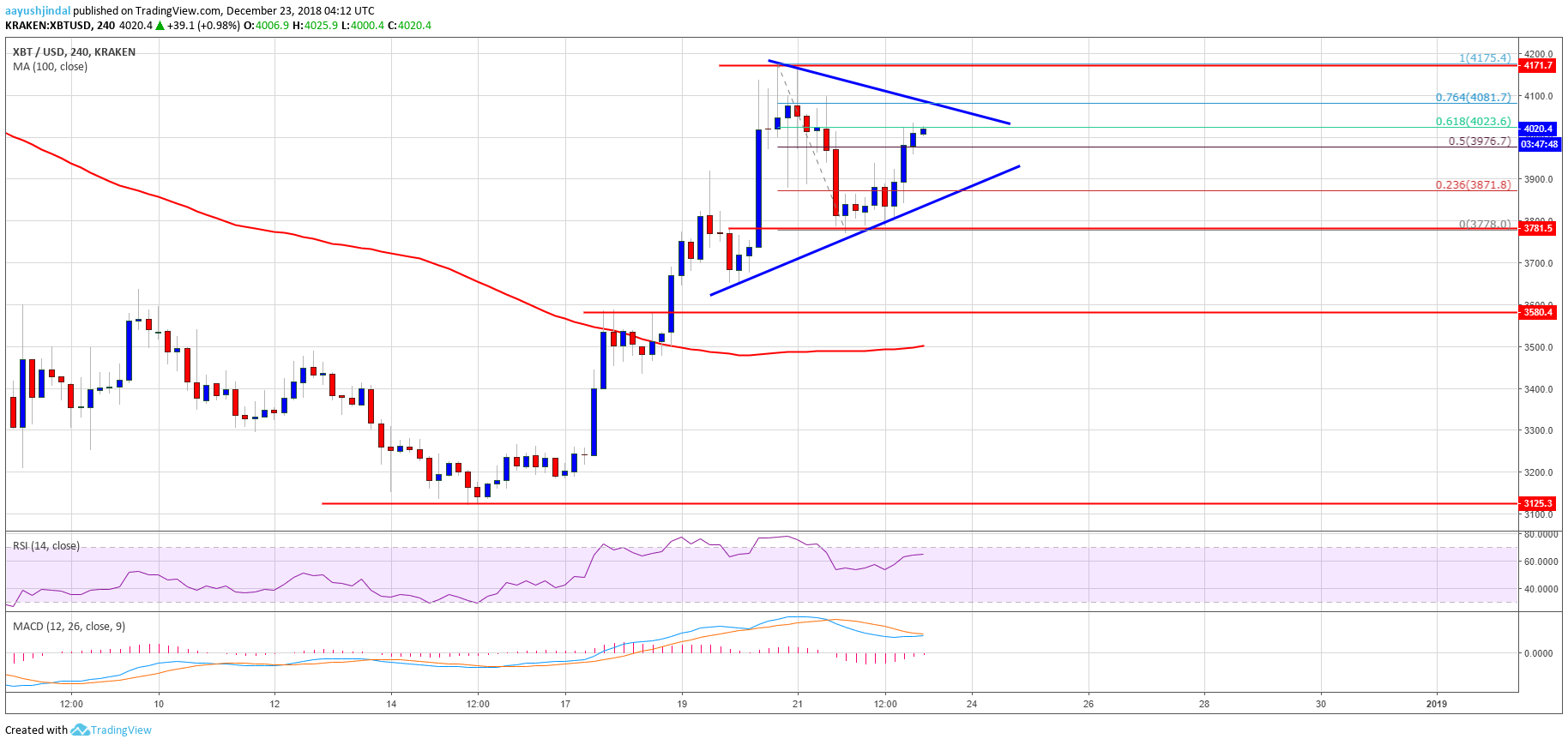

For the day ahead, a move back through the morning high $3,990 would support a run at $4,000 levels, while Bitcoin may come up short of the first major resistance level at $4,105.77 on the day, Bitcoin having failed to break out from $4,300 levels struck on Sunday.

Failure to move back through the morning high $3,990.0 could see Bitcoin pullback to $3,800 levels to bring the first major support level at $3,762.87 into play before any recovery, sub-$3,700 support levels unlikely to be in play through the day.

For the Bitcoin bulls, another positive week is going to be needed to support upward momentum going into the New Year, with Bitcoin needing to take a run at $5,000 levels by year end, else face the prospects of another January reversal.

With the holiday season in full swing, with volumes on the lighter side, though still well above levels seen in the first week of December, amidst the crypto sell-off, supporting Bitcoin and the broader market, though a failure to hold onto $3,900 through this morning could see investors pay later in the day and that’s never a good thing when the global equity markets are in meltdown mode.

Bob Mason

Alan Zibluk Markethive Founding Member

![Bitcoin [BTC/USD] Technical Analysis -Prices climb up as the bulls are back in town](http://seriouswealth.net/wp/wp-content/uploads/2018/12/Untitled-4.png)

c

c