The concept of an Initial Coin Offering (ICO)

has made massive progress since its emergence in 2013 – evolving from makeshift efforts on Bitcointalk to unbelievable campaigns which raked in millions of dollars in mere minutes. Today, we take a look back, as well as try to predict the future of the market of ICOs, together with one of its largest players – the Waves Platform and its CEO Alexander Ivanov. ICO is the practice of securing funds for an early-stage company, issuing a digital token, cryptocurrency and selling a part of its total supply to the intended audience of the project. That way, the startup is able to fund further development of its product, and in return, the users get a tradable asset that may appreciate in value with the future success of the company.

As the name suggests, ICOs are somewhat similar to a much older concept of an Initial Public Offering (IPO), although they aren’t as clearly defined or regulated. Like almost everything in the Blockchain industry, the question of how an ICO should be organized and conducted is an ongoing evolutionary process and a rapid one at that. It’s not hard to surmise that ICOs are a godsend to the young Blockchain-powered startups, which often manage to build a large and loyal fan following based on the idea alone, but may struggle to convince the conservative and incredulous venture capitalists. However, there’s still a long road ahead for the community, before an ICO truly becomes a standard in funding such projects. This ongoing progress can be defined in terms of several prominent trends described below.

Growing numbers

The most evident is the growth in sheer numbers. More and more campaigns are being launched year-on-year and each one of them is able to bring in more and more money, as time goes by. The earliest examples of ICOs, which weren’t even called that at the time, were ad hoc efforts conducted in 2013 by the developers of various cryptocurrencies on the Bitcointalk.org forum. Such projects as NXT and Mastercoin had a proof-of-concept and a fan base but not much money. To them, it seemed reasonable to fund the development of the final product by selling a part of the total supply of coins to the enthusiastic crowd.

And so they did, perhaps unknowingly giving birth to what we now call an Initial Coin Offering. As improvised as they were, these efforts were rare and not too mind-blowing money-wise, at least by today’s standards. Mastercoin has managed to secure a little over half a million dollars, while NXT has grabbed a mere $6,000. But, the precedent was set, and in the next year, it was a massive success. Ethereum, a decentralized applications platform, has secured over $18 mln in a crowd sale of its ETH tokens in July to August 2014.

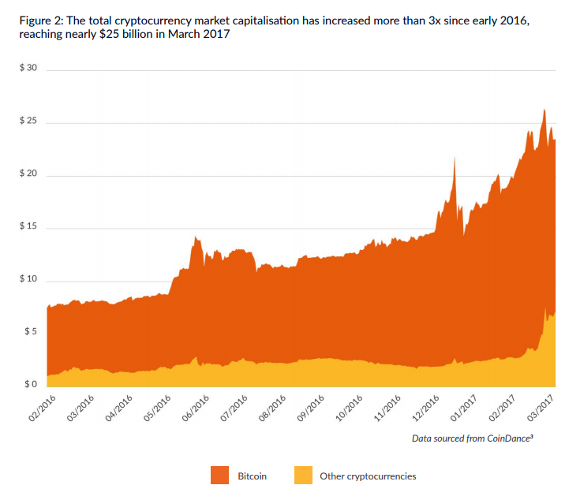

Some may argue that this was the breakout, needed to propel the concept of ICOs to popularity, especially considering that Ethereum developers made good use of the collected money. Today, the cryptocurrency can boast the second-highest capitalization, only exceeded by Bitcoin itself. It only went uphill from there, as the community realized that any Blockchain-based project can be funded this way, not just the cryptocurrencies. Waves Platform, SingularDTV, ICONOMI, Golem – 2016 truly became the year of ICOs, with 64 campaigns bringing in an incredible total of $103 mln.

Cointelegraph: What is your opinion on the fast rate of growths of the ICO market? Some have noticed similarities to the early days of the dot-com boom. Are we in for a bubble burst, or is this a natural growth driven by real demand?

Alexander Ivanov:

“It’s certainly real demand. These are real projects, with real people and companies behind them. The rate of growth is fast but it’s not fake. People are simply starting to access funds a different way. If it’s not possible to start a business with a loan from a bank or with VC funding – as it’s not for many people – they will turn to the alternatives. The ICO market is a subsection of the crowdfunding sector more broadly, and we’ve seen how popular platforms like KickStarter have been.”

Perhaps, the most impressive testament to the strong – if reckless – appetite the Blockchain community has acquired for this new paradigm of fundraising was The DAO. The absolute record in the history of crowdfunding, it was able to secure over $150 mln, which it would hold to this day, were it still active. The DAO was built as a decentralized autonomous VC fund, meaning that it didn’t have a conventional management structure, and was instead governed by software. Soon after the ICO was finished, some unidentified hackers have exploited a software vulnerability to siphon off one-third of The DAO’s funds, leading to its eventual demise.

Self-regulation

Although the investors did get most of their money back, in the end, adequate preventative measures would have likely made the attack impossible in the first place. Thus, the story of The DAO highlights another major trend present on the ICO market – evolving self-policing measures and increasing compliance with financial regulations. Hacker attacks aren’t the only danger here. The anonymous and permissionless nature of cryptocurrencies often allows scammers to dupe investors out of their money in a crowd sale and then disappear into thin air, never to be heard of again.

Legitimate startups have quickly realized that self-imposed restrictions are the only way to ensure the investors’ trust and, by extension, their contributions. So, gone are the days when a good idea backed by a fuzzy whitepaper were enough for a developer to secure the money to move forward. Today, if an ICO wants to be taken seriously, it has to provide a whole range of detailed data regarding the developers, the project, its goals, the terms and conditions for the investors, and so on.

The use of escrow wallets to store the collected funds is basically a given. These wallets ensure that the money for development is released in parts and only after certain milestones have been reached on the project’s roadmap. Otherwise, the danger of the company just unilaterally withdrawing all the money and disappearing with it is too high. Waves Platform, a service which allows anyone to set up their own digital token and use it in an ICO, is a prime example of this trend. It works exclusively with fully AML/KYC-compliant fiat gateway organizations. Not only that, it has also established its own, decentralized analogue of those regulations, which allows to pinpoint and eliminate unscrupulous actors from the network.

Cointelegraph: What customer protection measures are implemented on your platform, and what is their importance?

Alexander Ivanov:

“With a decentralized platform, it’s hard to have the kinds of protections that people take for granted with existing crowdfunding solutions. Waves is an Open Blockchain platform, so by design, you can’t stop people from issuing their own tokens on it. What we have done is start a system of community-based due diligence through the creation of the Waves Community Token. This will allow holders to vote on a project and make a collective decision about whether it is viable and trustworthy.”

ICO platforms

In fact, Waves is also an example of another big movement on the ICO market – the development of platforms designed specifically to serve as aggregators of ICOs. They provide the necessary tools for the startups to set up their campaigns, and for the investors to look for and contribute to them. Crowdfunding was an option long before the Kickstarter was a thing, but it was the appearance of this platform, where the projects and backers could find each other with unprecedented ease, which made it into the multi-billion dollar industry it is today. Platforms such as Waves and ICONOMI are trying to do to ICOs what Kickstarter did to crowdfunding. By creating a single place for Blockchain startups to list their campaigns and the potential investors to find them, they may soon enable a similar explosion of growth on the ICO market.

Cointelegraph: How is the experience of launching an ICO on a specialized platform different from launching your own token? In which ways is it better?

Alexander Ivanov:

“It’s hugely different. All of the infrastructure is taken care of. It’s a very simple matter to launch a token on the Waves platform – it takes less than a minute and costs less than a dollar. And it’s very easy to distribute those tokens to your investors. Compare that with creating your own coin from scratch – cloning and altering bitcoin, at the very least, or coding a new platform from the ground up; bootstrapping the network and ensuring its ongoing security; creating a custom solution for crowdfunding investment, and then distributing coins. All of this has a significant financial and technical overhead. It’s hard to do well and security is key. Waves is a proven and secure solution that takes that headache away from token issuers – which is why a growing number of regular businesses are using it.”

Looking into the future

Trying to predict what’s going to happen next is never easy, especially in a such a fast-growing and changing environment as ICOs. Perhaps, the most likely scenario is that we’ll keep seeing more of the same: continued growth in numbers, the emergence of legal regulations, further development of the tools and practices involved in conducting a campaign.

It’s definitely not too early to say that 2017 is turning out to be a good year for emerging startups. Qtum, a platform for mobile decentralized applications, has secured over $15 mln back in March. Humaniq, a Blockchain-powered decentralized bank for the unbanked, has just collected $5.4 mln for the ICO. ChronoBank, an innovative time banking platform, has grabbed more than $2.7 mln in January. The $103 mln secured in ICOs in 2016 are impressive, but it’s still nowhere near the $34 bln valuation of the crowdfunding industry as a whole. As the crowd sales of digital tokens become more accessible to the newcomers – especially with the development of the ICO platforms and evolving regulatory environment – we may see larger numbers of crowdfunding enthusiasts taking part in them.

Cointelegraph: Any predictions you might have for the near future?

Alexander Ivanov:

“Well, interest will only increase – both in Blockchain and in ICOs. It’s likely that Blockchain crowd sales will grow to a point where they rival and even overtake VC funding in the coming years. That point will probably come sooner rather than later as we see a large number of small ICOs as well as more multi-million dollar ones.”