What are the Indicators of the Next Crypto Bull Market? Are they at odds?

Recognizing if a crypto bull market is returning depends on which indicators we look at ultimately. Some indicators suggest that a bullish crypto market is just around the corner, while others suggest that the bear market will soon reoccur. This article examines these conflicting indicators, sheds light on what they signify in simple terms, and elucidates where the crypto market could be headed.

Price Action

First up is price action, as it’s everyone’s favorite indicator. Many crypto experts define a crypto bull market as a long period of positive price action. In other words, multiple months of higher highs and higher lows for the most significant cryptos. As the graph below indicates, BTC has had four consecutive months of positive price action, which began in January. BTC is, therefore, in a new bull market, according to Coinbureau’s basic definition.

Screenshot: Coinmarketcap.com

However, there are a few caveats: First, this multi-month rally has yet to happen for most major altcoins apart from ETH. Almost every major altcoin has been moving sideways over the last four months. In an actual crypto bull market, you see breadth in the positive price action meaning that most altcoins ride on BTCs’ coattails.

The absence of this effect is evidence of a bear market rally, not a bull market. ETH's price action can provide additional proof of this being a bear market rally. ETH didn't have the same double top as BTC during the previous bull market. ETH’s price action looked more like what you'd see in a standard market cycle and could be due to institutional investment.

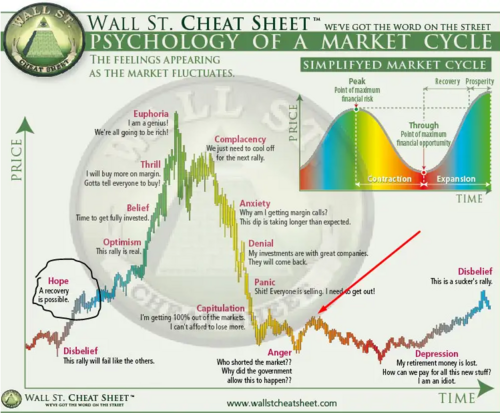

Comparing ETH’s price action to the famous Wall Street cheat sheet suggests we're just past the anger stage. That said, ETH could easily be in the disbelief phase that comes before the beginning of a new bull market.

Image credit: Newtraderu.com

This ties into the second caveat, and that's trading volume. Data from Coinmarketcap suggests that trading volume for BTC has continued to decline as prices have risen. This effect is even more pronounced for ETH. This divergence of increasing prices and falling volume is further evidence of a bear market rally and also suggests that a reversal could be imminent.

However, this decline in trading volume could be due to institutional investors investing in crypto via centralized proxies like futures contracts that are settled in cash due to concerns around crypto regulation. It would explain why ETH's trading volume is so low relative to BTC.

Screenshot: Coinmarketcap.com

Also, ETH has been looking extremely weak against BTC and has been in a long-term downtrend against BTC since around July of last year. The same trend can be seen in most major altcoins. Again for this to be an actual crypto bull market, there must be breadth and broad participation, at least among most major altcoins.

To be fair, we could soon start to see more money rotate out of BTC into ETH and most major altcoins. If this happens, it will be additional evidence of a new bull market. For the time being, though, Bitcoin dominance continues to increase. For context, Bitcoin dominance measures how much of BTC’s total market cap comes from crypto. Bitcoin dominance is currently at around 46% and has been in a long-term uptrend since last September, showing no signs of slowing.

Regulations

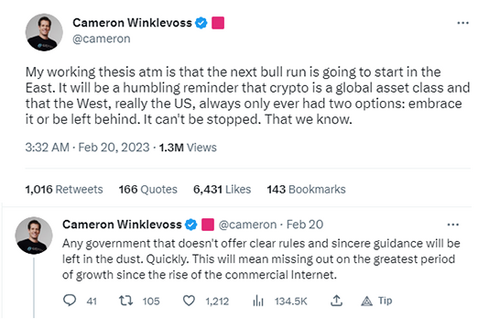

If BTC doesn’t rotate into ETH and the most significant altcoins, it could be due to another factor previously mentioned: Crypto regulations. Like it or not, crypto regulations are required for institutions to invest their trillions into the crypto market. The largest institutional investors are based in the United States. US institutional investors were likely the most significant contributors to the previous crypto bull market. Unfortunately, the regulatory situation in the US has deteriorated significantly over the last few months.

In addition to the threats against specific crypto projects and companies by the SEC, the Fed and other banking regulators have been actively working to de-bank the crypto industry. Their primary targets have been 24/7 payment systems analogous to the Fed's upcoming Fed Now payment system.

Stablecoin issuers are at the top of the Fed's hit list. It’s problematic because the crypto industry relies heavily on stablecoins to function. If anything were to happen to a stablecoin issuer in the United States, it could severely damage the crypto market and be a disaster for the entire DeFi niche.

However, not all stablecoin issuers are based in the United States, and most crypto trading happens against offshore stablecoins, namely, Tether’s USDT. This means the crypto market would be mostly fine if a US-based stablecoin were taken down. A crackdown on a US stablecoin issuer may also not materialize. More importantly, other countries with many institutional investors are introducing sensible crypto regulations.

This article about the countries that will drive the next crypto bull market discusses that the list includes the UAE, Saudi Arabia, Hong Kong, Singapore, and France. These jurisdictions will introduce these sensible crypto regulations very soon. France has technically done so already. The Markets in Crypto Assets (MiCa) regulation was passed by European politicians less than a month ago. Money is already flowing into EU crypto startups as a result.

Moreover, it looks like Hong Kong is next. Officials there recently announced that crypto licensing requirements would be revealed by the end of the month, with retail access to crypto coming on June 1st. Lots of money from the Chinese Mainland may enter the crypto market via Hong Kong. It's also likely that lots of crypto companies will relocate to the region. That's because Hong Kong requires banks to open accounts for crypto clients.

This is significant because crypto companies in crypto-friendly jurisdictions, like the UAE, are still reportedly struggling to open bank accounts. The caveat is that crypto investment from Hong Kong will reportedly be limited to the largest cryptocurrencies by market cap, and crypto niches like DeFi could be completely off-limits. Even so, there are many ways of accessing altcoins once you've acquired a crypto like BTC or ETH.

Notwithstanding, the passing of favorable crypto regulations in these countries will likely be enough to increase the conviction in crypto’s recent price action and confirm that it's the beginning of a new bull market. However, this assumes that macro conditions encourage crypto investing in these regions.

Interest Rates

Interest rates are the primary macro factor moving the crypto market, specifically the interest rate decisions coming from the Federal Reserve. The fact that the Fed is near the end of its rate hiking cycle has contributed to the recent rally. Another contributor has been the expectation that the Fed will soon be forced to pivot, i.e., start lowering interest rates. Investors believe the Fed will do this in response to a crisis; an example could be the stress in the commercial real estate sector.

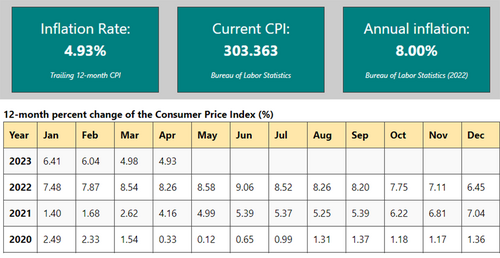

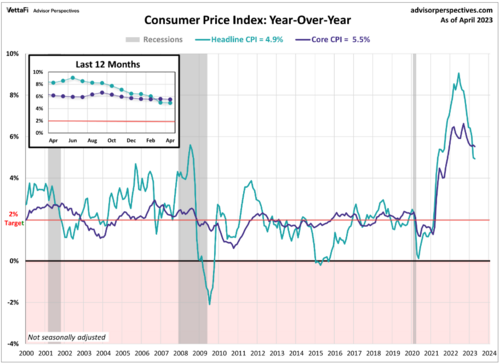

The irony to this expectation is that if the Fed is forced to pivot in response to a crisis, chances are the situation will also crash the markets. Case in point, sudden rate cuts have historically corresponded to stock market crashes, not rallies. A rate cut may have the same effect on the crypto market. However, in the absence of a crisis, only falling inflation will convince the Fed to pivot. As it happens, headline inflation has fallen fast over the last few months. The question is whether inflation will fall to the Fed’s 2% target, and the answer here is unclear.

Image source: In2013dollars.com

Core inflation figures of all kinds suggest that services-related inflation isn't coming down nearly as quickly. If core inflation gets stuck at 4%, the Fed will likely keep interest rates slightly above that level. The longer the Fed keeps interest rates high, the higher the likelihood that markets will crash, that something in the financial system will break – or both. Risk assets like cryptocurrencies could be hit the hardest because they rely on lower interest rates for positive price action.

Image source: Advisor Perspectives

For those who are wondering why this is, the answer is liquidity. Liquidity is the amount of money circulating in the market and the economy. As interest rates rise, liquidity gets drained out of the financial system as people rush to pay off more expensive debts and have difficulty accessing loans. As it happens, the supply of money in the US economy, as measured by M2, has been shrinking faster over the last few months than in decades.

This situation should have caused risk assets like crypto to crash, but they pumped instead. The simple explanation is that there is more to the world than the United States. Although the money supply has decreased in the US, countries like China and Japan have continued to stimulate, and this money has been slowly but surely finding its way into US assets. The caveat is that this stimulus may not continue for much longer, at least in China, where economic growth is returning.

Another reason why risk assets have rallied is because of the Fed and the treasury. The Fed recently expanded its balance sheet in response to the banking crisis. Meanwhile, the treasury has been spending money from its de facto checking account due to the debt ceiling, which is increasing liquidity. However, the Fed's balance sheet recently started decreasing again, and the debt ceiling will soon be raised, allowing the treasury to reissue bonds. Both factors could further drain liquidity, further prolonging a crypto bear market.

Geopolitics

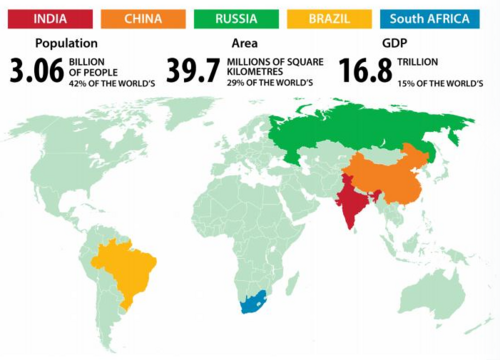

As stated earlier, there is more to the world than the United States. Much of the world has been trying to escape the US dollar. This could positively affect the crypto market during the next bull cycle. Some countries, such as Iran, reportedly use crypto for trade, and others, such as Russia, may follow suit. This could change crypto's categorization from a risk asset to something analogous to a commodity, like gold, at least in these regions.

Steady crypto demand from these regions could create a price floor for significant cryptos like BTC and ETH, the same way central banks created an apparent price floor for gold, and they accumulated record levels of gold last year. This was predominantly due to the sanctions against Russia, which caused many central banks to think twice about keeping large reserves in US dollar assets.

In retrospect, sanctions could be the catalyst that killed the dollar. While these central banks haven't begun accumulating crypto yet, the Bank for International Settlements announced last December that central banks will be allowed to hold up to 2% of their balance sheets in crypto starting in 2025. By then, the crypto bull market should be in full swing, and if it's not, that will likely be the catalyst that kicks it off. Some central banks may have begun secretly accumulating crypto already.

Additionally, trust in the financial system is deteriorating at a rapid rate, and the crypto market will continue to grow as trust in the traditional financial system continues to decline. This is evidenced by how much the crypto market pumped in response to the banking crisis. If the banking crisis continues in some form, you can expect to see more of the same positive price action for most cryptocurrencies.

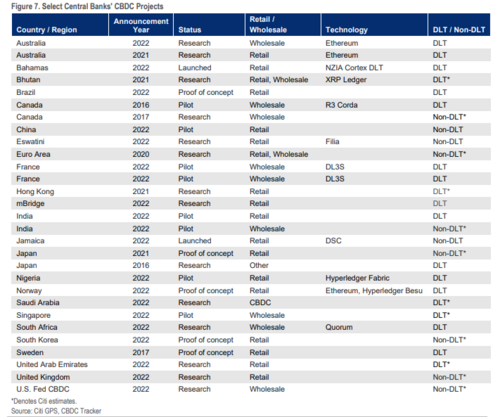

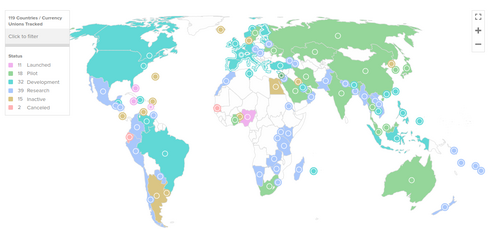

Even if the banking crisis doesn't continue, central bank digital currencies (CBDCs) are coming, and they could have the same effect on the crypto market. The reason is that CBDCs will allow governments and central banks to control how you spend and save. As with the banking crisis, the average person will quickly realize that government money is not a safe place to store their wealth and will seek alternative stores of value.

The average person will likely allocate a small percentage of their portfolio to assets outside the financial system, including crypto. This percentage will become more extensive as these alternatives become easier to use. It's already happening worldwide; individuals and institutions are turning to crypto because their currencies are collapsing, their banking systems are struggling, or because CBDCs are being rolled out. This combined buying could set a price floor for many cryptocurrencies; this price floor will likely rise as the appeal of traditional currencies continues to decline.

As such, we could be at the beginning of a crypto super cycle, or at least a crypto market cycle unlike any other. The caveat to this is that the incumbents will not go quietly. This potential supercycle will likely be accompanied by unprecedented price volatility as entities in the existing financial system try to crush or control crypto. Some would say this has already started, and the recent price action is proof.

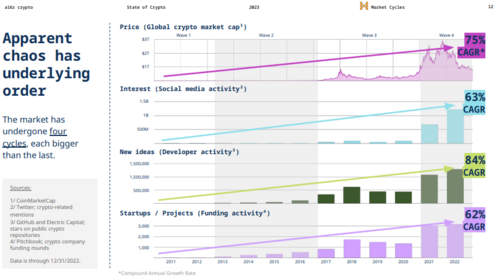

The Crypto Market Cycle

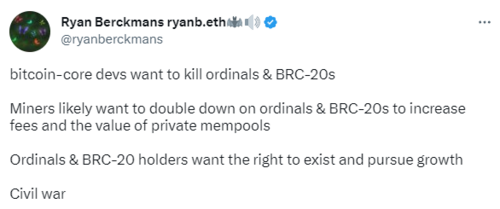

As you may be aware, crypto tends to follow a four-year cycle and is believed to be because of the Bitcoin halving, which occurs roughly every four years. The last Bitcoin halving happened in May 2020, and what followed was an almost two-year-long crypto bull market. However, many argue that the crypto bull market began before the previous halving. BTC had already been in a strong uptrend for months, hitting $14k in May 2019. That early 2019 rally looks eerily similar to the one we're seeing now, four months of green; all be it with much more volume.

This begs the question of whether history will repeat itself, specifically whether BTC will experience a flash crash that retests its bear market lows of around $15K. In theory, this is unlikely because the previous flash crash, when we saw BTC sink to about $3K, was caused by the beginning of the pandemic in March 2020.

In practice, however, this is still possible, and that's because there are so many similar catalysts to choose from.

- A 2008-style financial crisis caused by commercial real estate,

- a war between China and the US over Taiwan,

- civil wars due to inflation and political polarization,

- or that global cyber attack predicted by the World Economic Forum.

Even if history repeats, a retest of the crypto bear market lows will likely be short-lived. The fact remains that we're in the same time frame when the previous crypto bull market arguably began – one year before the next Bitcoin halving, which is scheduled for April 2024. However, this analysis only applies to BTC.

As shown in the graph below, the historical price action of most major altcoins flatlined between May 2018 and the Bitcoin Halving in May 2020. You'll also see that most of them only hit their bottoms during the pandemic flash crash. This means that even if the crypto bull market has begun, you still have at least a year to accumulate your favorite altcoins, and you may still manage to catch the bottom of some of them.

.png)

Screenshot: Coinmarket.com

The caveat is that some of these altcoins will never recover, especially if interest rates stay higher for longer. However, the effects of high-interest rates on the crypto market are not evident because the crypto market has never experienced a period of sustained high rates. Some argue that most cryptocurrencies, possibly even prominent altcoins like ETH, will not fare well under such conditions.

For established Proof of Stake cryptos, like ETH, the yield on staking rewards needs to be higher than the yields on traditional financial investments to capture the interest of institutions. In some cases, the rewards must be much higher to compensate for the additional risk of investing in crypto, e.g., Crypto vs. Bonds.

For most other altcoins, there needs to be lots of speculation to receive heavy inflows, and these levels of speculation and inflows require lower interest rates. Some say the most speculative cryptos are all the Ethereum competitors, as they stand to capture the most value if they succeed.

Image credit: Markethive.com

Speculation

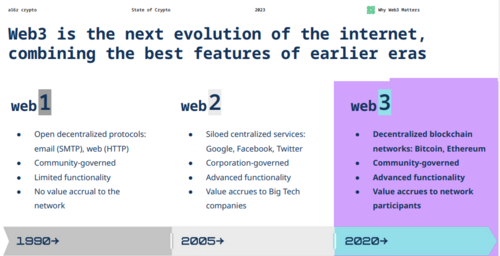

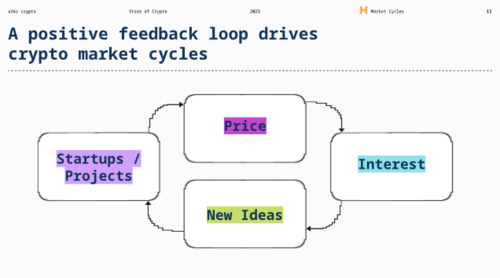

As shared by Delphi Digital, “Crypto has primarily been a speculator’s market, and that’s still true today. But speculation isn’t inherently evil. The term “speculation” tends to carry a negative connotation. But, like most things, it sits on a spectrum. Hype and excitement drive interest, which attracts capital and gives entrepreneurs the resources to build innovative products leveraging new technologies.”

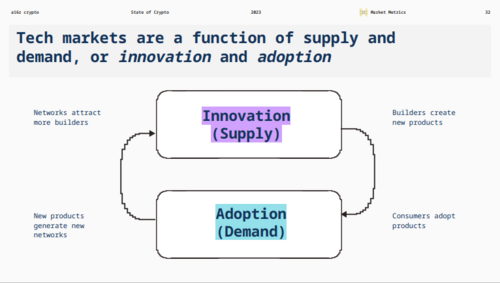

Without speculation, capital wouldn’t flow to such risky ventures, and society would still be stuck in the stone age or the throes of tyranny due to escalating adverse events of today. Arguably, speculation is more than beneficial; it’s imperative at this stage. The crypto industry has gone through multiple hype cycles, each fueled by speculation on the back of emerging innovation triggers. Each hype cycle brought more attention, users, and capital to the crypto ecosystem and built upon the advances made by those previously.

This article explains why experts say a bear market is a good thing. There’s much truth in the mantra “bear markets are where you build” – many of today’s prominent protocols and applications were built in the depths of prior downturns. In the early stages of any emergent technology, much attention must be focused on the technical aspects of what’s being built.

The building is on one side of the equation; demand is on the other. It’s what’s needed to maximize the value of all the sweat equity that goes into bear market building. Demand leads to more usage, leading to faster feedback cycles, and better products, leading to more demand and use.

The visionaries and entrepreneurs see the need for innovation as the increasing pressure from the centralized totalitarian regime orchestrated by globalists tightens. To shift the balance of power, decentralization with an alternative financial system to the one currently failing us is a solution.

A primary example of this is Markethive – The Ecosystem for Entrepreneurs. It is a community-funded pioneer in the blockchain and cryptocurrency space's social media, marketing, and broadcasting sector.

Markethive is consistently delivering new integrations and updates to its platform in preparation for its launch into the crypto industry, and the timing couldn’t be better. It’s an entirely different animal and one of the most promising projects in the entire social media and marketing niche, with varied use cases and real-world applications that have the potential to change the media landscape.

This next-generation platform perfectly exemplifies how this technology can benefit more people beyond just leveraged speculation. Markethive provides valuable utility for its community that understands the potential of applications in this new world.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

.png)

.png)

.png)

(27).gif)

.png)

.png)

.png)

(5).gif)