Bitcoin Gold Launches Today

After weeks of preparation, Bitcoin Gold (Bgold; BTG) is finally launching today, November 12, 2017.

Bitcoin Gold is the second project to fork away from the Bitcoin blockchain to create a new coin this year; on August 1, Bitcoin Cash (Bcash) was the first. Where Bcash attempted to offer an on-chain scaling solution by increasing Bitcoin’s block size limit (while removing the Segregated Witness code), Bgold is an attempt to counter Bitcoin’s mining centralization.

The most important difference between Bitcoin and Bitcoin Gold is a new proof-of-work mining algorithm. Instead of SHA256, the new coin uses the memory-hard Equihash proof-of-work function that’s also used in the privacy-focused altcoin Zcash. This means that specialized ASIC hardware that has come to dominate Bitcoin’s mining ecosystem will not be able to mine Bgold.

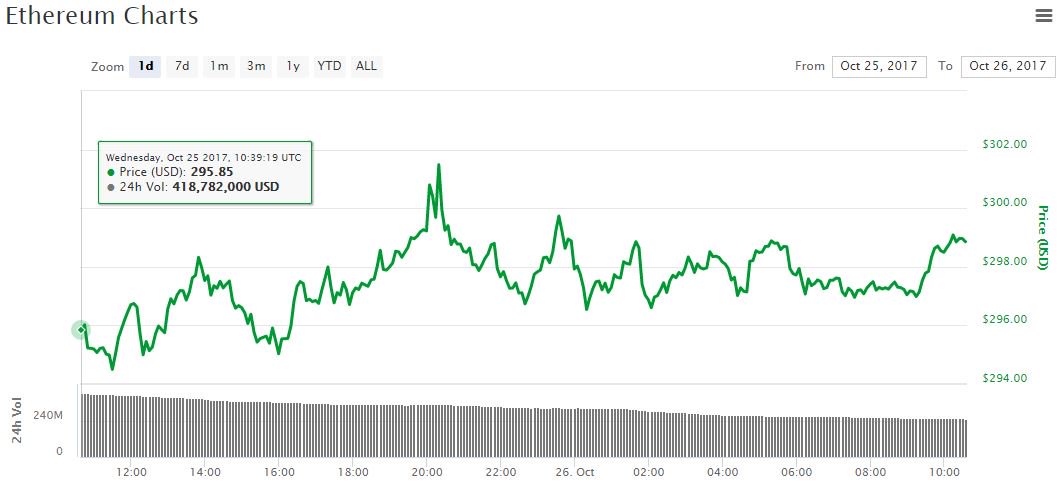

Although Bgold is launching this weekend, the fork “officially” occurred on October 25. Anyone who held bitcoin (BTC) on that day (specifically, when Bitcoin block 491406 was mined) will have an equivalent amount of BTG attributed to their private keys. These private keys can be imported into a dedicated Bgold wallet, which, starting tomorrow, will allow users to spend the coins. (But note that this does not come without risks and tradeoffs: If you’re not sure what you’re doing, it’s best to ignore BTG until you do. For more information also see this article.)

Block 491407 on the Bgold blockchain will be the first block to deviate from the Bitcoin protocol. In other words, this will be the first block where Bgold splits off to become its own currency. However, somewhat controversially, the first 8000 blocks will be privately mined by the Bgold team. Only after these 8000 blocks will Bgold’s mining difficulty ramp up to normal levels, and will anyone be allowed to mine the coin. The resulting 100,000 BTG worth of block rewards will pay for project development and more. (For more details, see the Bitcoin Gold roadmap.)

Other changes implemented by Bitcoin Gold are mostly to ensure a smooth split away from Bitcoin. This includes a new difficulty re-adjustment algorithm named “DigiShield” that adjusts the mining difficulty each time a block is found — instead of once every two weeks. Bgold also includes strong replay protection, ensuring that no users spend BTC when they mean to spend BTG, and vice versa. Additionally, BGold implemented a new address scheme, preventing users from spending BTC to BTG addresses and vice versa.

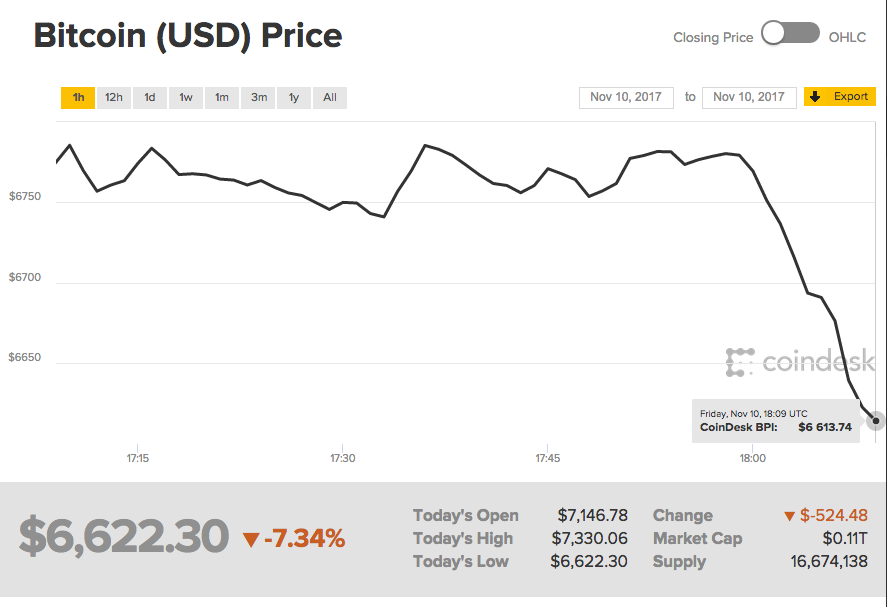

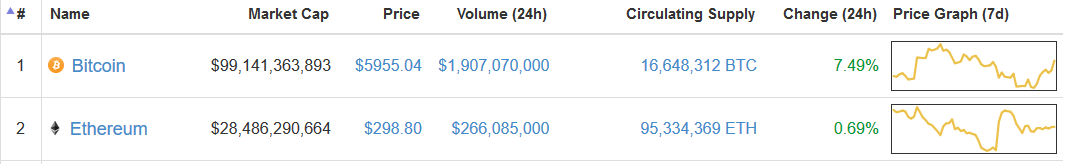

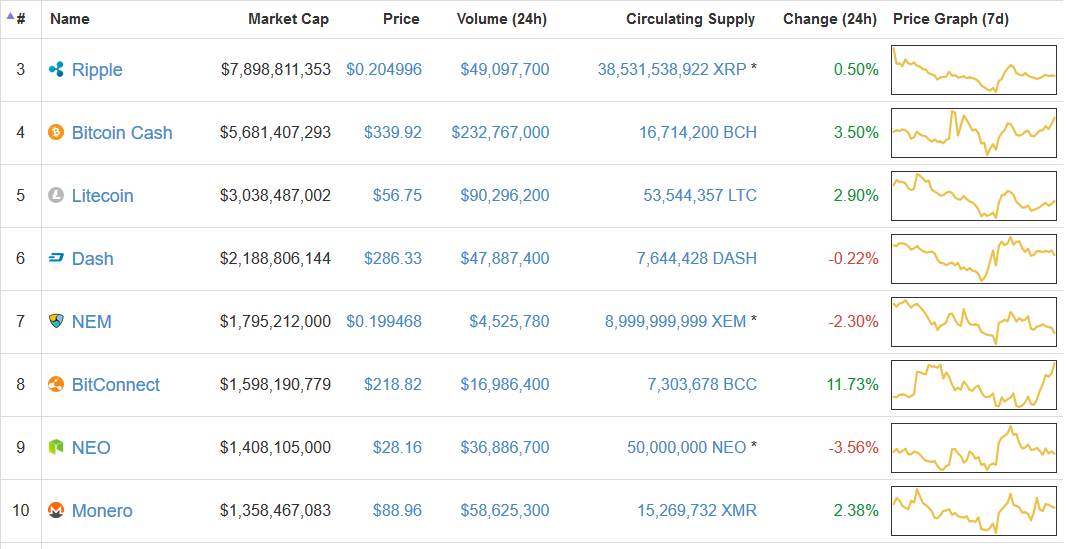

Bitcoin Gold will be supported by a relatively large number of exchanges, including major players like Bitfinex, OKex and HitBTC. Several of these exchanges are effectively supporting BTC/BTG trading already through futures markets. Ignoring an initially inflated price, these futures have traded at around 0.02 BTC in recent weeks, with a notable surge to about 0.042 BTC over the past few days. If this holds up, 1 BTG would be worth almost $250, and Bgold would immediately become a top-5 altcoin on websites like coinmarketcap.com.

For more information on Bitcoin Gold, see Bitcoin Magazine’s earlier article on this project.

Author: Aaron van Wirdum

Posted by David Ogden Entrepreneur

Alan Zibluk – Markethive Founding Member