Inequality? Or Just A Fact Of Life?

How Do The Rich Get Even Richer?

I think most of us have heard the saying, “the rich get richer, while the poor get poorer.” And the rich keep getting richer mainly because many are paying little in the way of taxes, if anything at all. How is this possible? What are the brazen loopholes and tricks that the 1% use to stay ahead and continue to gain wealth?

Over the years, there has been much discussion, studies, and headlines around a billionaires tax and what it means for us non-billionaires. So why is there all this talk about billionaires and taxes in the US once again?

Well, that's for two key reasons. Firstly, the policymakers in Washington are trying to go after this class of people with new tax proposals to help fund the American Families Plan.

The other fundamental reason it’s back in the spotlight is the amount of wealth accumulated over the last decade by specific individuals. And their wealth has been taxed at extraordinarily low rates.

Image Source: Lisa Larson-Walker/ProPublica.

Thanks to the Secret IRS files, the data was recently brought to light, essentially a leak of tax information that ProPublica covered in June. The leak contained vast troves of IRS data on the tax returns of thousands of the nation's wealthiest people covering more than 15 years.

The Secret IRS Files

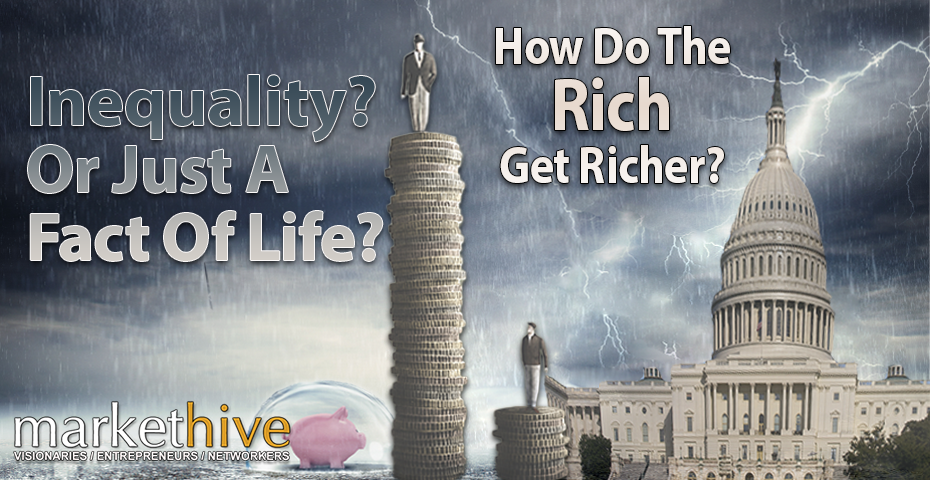

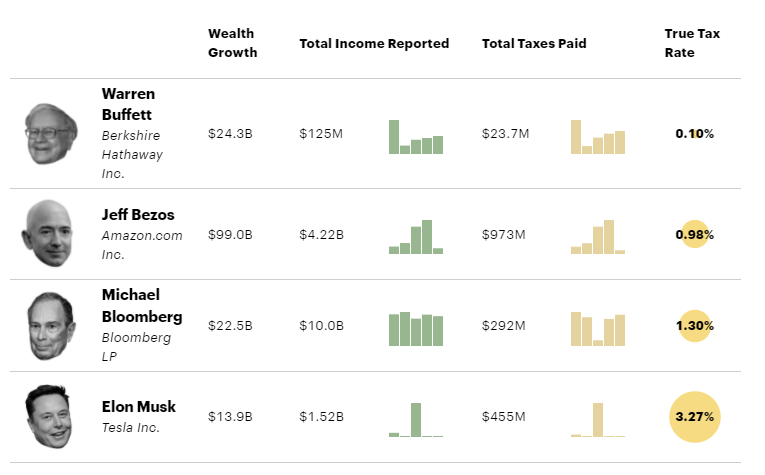

This report uncovered some of the most Illuminating stats of people like Mark Zuckerberg, Elon Musk, Jeff Bezos, Warren Buffett, etc. From 2014 to 2018, the 25 richest Americans increased their wealth by a collective $401 billion.

However, they only paid taxes of $13.6 billion during that period, equating to an effective rate of about 3.4%. Crazy, right? And if we were to drill down into some of the richest of this rich list, the numbers get even crazier.

The illustration below shows the taxes paid on wealth growth for Buffett, Bezos, Bloomberg, and Musk. Buffett only paid an effective rate of 0.10%. Paying such low tax rates, it's no wonder that Buffett has become one of the biggest proponents of raising rates on the uber-wealthy like himself.

Image Source: ProPublica

Now, you can see the effect of rates is 0.98%. 1.30% and 3.27% for Bezos, Bloomberg, and Musk, respectively.

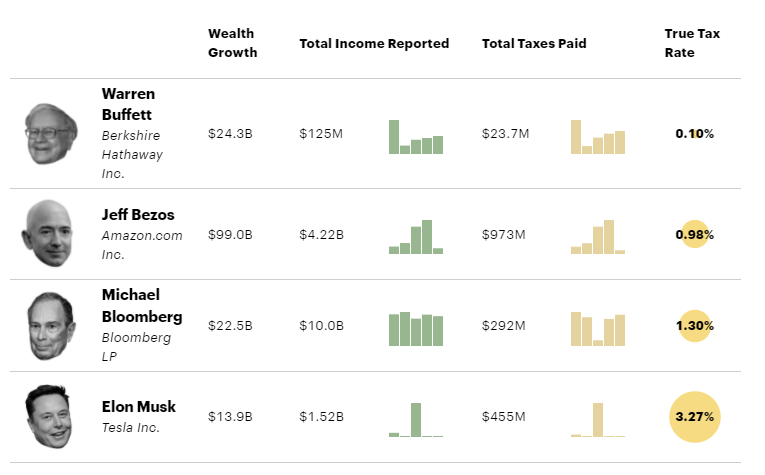

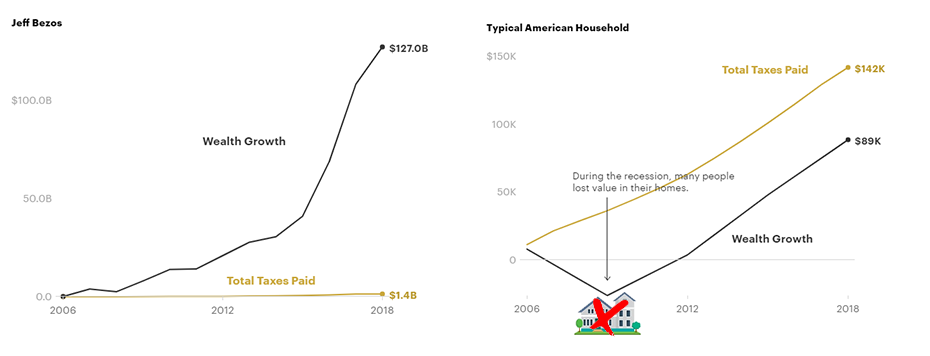

Another interesting graphic from this report is the one below. It compares wealth growth and taxes paid by Bezos and the average American family. That noticeable dip on the household graph is that during the 2008 recession, many families lost their homes, where the bulk of their assets were. Bezos mostly owned stock, so he escaped any foreclosure.

Image Source: ProPublica

The point here is not to shame these billionaires, as they have built successful companies, and capitalism rewards risk-takers. Moreover, it's also worth pointing out that all these folks have been paying what is legally owed.

They've been doing what any rational person would be, using the tax code to their advantage. But this report highlights that the burden of proportional tax is borne much harder by those less well-off. And the reason for that is because of that same tax code.

The Enigmatic Codes

So let's take a closer look into these complex codes. Before we can delve into the specific tactics used by the rich, we have to understand precisely how most of them make their money. That's because the way that they make money will impact the type of taxes they'll pay.

Most people will pay an income tax on their income which is mostly your primary source of income. In the case of most of society, this is their salary or wage. This income is taxed at different rates and goes up to 37% at the US Federal level for the highest tax bracket.

The examples used are from US taxes. Although the practice is broadly the same in other countries, This income tax is usually hard to avoid, as it's taxed when it's earned, and in many cases, taken out of your paycheck.

However, when it comes to the uber-rich, they own assets that are taxed as a capital gain only when they appreciate. Notably, long-term capital gains tax for assets held for more than a year is much lower than income tax.

For example, the top tax rate for capital gains in the US is 23.8%, which is much lower than the maximum rate on ordinary income. Based on the raw percentage, that would be the same rate of tax paid by someone who earns between $86k and $164k. So, you can now see why so many of these billionaire founders of companies choose to take token salaries.

Bezos earns a measly $80k, and Steve Jobs famously took a one-dollar salary. Mark Zuckerberg and Larry Ellison have followed suit. By doing this, they're avoiding having to pay any income taxes at all. They are taking stock and options on a stock that will only be taxed at the capital gains rate, over 13% lower than they would have paid, should they have opted to take income.

But the critical point is this capital gains tax is only due to being paid once the gain is realized, in other words, sold. They are not obligated to make this sale in any way, shape, or form. They can hold on to these assets for a lifetime and never pay tax on them, and that is precisely what most of them do.

So, how can these guys afford to live without realizing those gains? There’s a common misconception that wealthy people try to avoid debt, and it’s actually quite the opposite. They are among the most prolific users, and they do it in ingenious and efficient ways. One of these is borrowing against their assets and living off borrowed money. They're using their vast assets as collateral to take out debt.

Buy Borrow Die Tactic

They’re doing this because they don't have to sell those assets and realize that gain, so they can avoid paying any taxes on the rapid appreciation in their wealth and still live like kings. This self-explanatory tactic is called, Buy, Borrow, Die.

In a nutshell, they accumulate valuable assets that can be used as collateral assets such as stocks, bonds, real estate, art, etc. Then once they have these assets, they move on to the next step, looking to borrow cash using the assets as collateral. Then, of course, the inevitable happens, and they leave their fortune to their heirs.

The first two steps may sound similar to a home equity line of credit, but it's much more favorable than that. We usually have pretty onerous terms when we apply to get credit and use our house as collateral. We have higher interest rates, and the amount of credit we get on our homes is limited.

However, if you offer a bank highly liquid securities as collateral, you can get an absolute bargain. According to this piece in the Wall Street Journal, some of these lenders don't even need credit reports. Goldman Sachs’s private bank has even offered securities-based loans on anything from $75k to $25 million, with no personal financial statements, tax returns, or paper applications.

In terms of interest rates, Merrill Lynch quotes 3.2% for those with assets of over $1 million and a low 0.87% for those with assets of over $100 million. Those are rates of interest and terms that we could only dream about. Then once they have this cash, they can do whatever they want with it.

Yes, they have to pay interest, but it's trivial. Moreover, the value of their assets usually appreciates more than the interest rate. This is termed Positive Carry, where they end up better off than before.

But the real kicker is that interest on loans is tax-deductible. These interest payments can be used to offset their already low tax bill. And, of course, they don't really ever have to pay this off. The banks are okay with rolling it over into perpetuity.

You get to live your best life and still retain the upside on all those assets. You see, it benefits the banks to have such high-value collateral. It's easy to liquidate, unlike houses, and the bank itself can earn high returns on those assets. It’s the rehypothecation process, and most of the nearly 1000 wealthiest Americans use this tactic.

For example, Elon Musk, and cable billionaire, John Malone have pledged $150 billion of their stock for loans. There is the risk that the stock collateral falls in price and that these billionaires will get a margin call. Still, these assets generally appreciate, especially with all that money printing going on at the FED.

Image Source: Tenor. Funarg

Now, there's a lot of accumulated capital gains sitting out there, and by some estimates, it's as large as $5 trillion. This wealth has never been taxed and never will be taxed in some cases. That's because of the final step required of these billionaires, which is to die.

When these billionaires with so much wealth eventually die, they leave that wealth to their heirs. They may have outstanding loans that these heirs then pay off; however, they keep the assets. These assets may incur an estate tax, but several strategies around gifting, donations, and charitable foundations lessen the burden, but that's irrelevant when considering that these heirs won't have to pay those accumulated unrealized capital gains.

It is all thanks to something called the Step-Up in Basis. Essentially, when people die and their heirs inherit their fortune, the “cost” of the investment in the eyes of the IRS is the value of the asset that they received. That makes the asset free from any capital gains tax. If or when the asset appreciates again in value, the tax payable is only the difference, not the original price.

This is how some family dynasties have held onto their wealth for generations. They can pay legions of estate planners and accountants to structure the most sophisticated of vehicles that are beyond the reach of us mere mortals.

The Ongoing Debate

Many progressive politicians looked upon these tax strategies for the elite rich with some indignation. They are now at the forefront of a debate around billionaire taxes in the US. A proposal by the Biden Administration plans to come after the unrealized gains of assets held by wealthy individuals to help fund the massive social spending and climate bill.

Irrespective of what the bill will finally contain, it's clear that part of the effort to pay for it involves taxing wealthy individuals. For example, back in May, the initial target of the bill was the Capital Gains Tax rate.

As they were aware of the fact that CGT was much lower than income taxes, the Democrats proposed increasing the top rate for CGT to 39.6%. If you include the Medicare surtax, it will be 43.4%, with some state taxes increasing those numbers.

This proposal was a tough sell as it applied to anyone with over $1million in income, which is a much larger subset of people than just billionaires, so that was overturned. The Biden White House returned with the proposal to tax the unrealized capital gains of some of the wealthiest Americans, a much smaller subset of around a thousand people.

That didn’t go down too well either, as it sounded like a wealth tax, and in fact, that’s how it was marketed to some progressives. Janet Yellen explained that it was “merely a capital gains tax on liquid assets held by extremely wealthy individual billionaires. I wouldn't call it a wealth tax.”

The Terminology Not The Real Issue

Whatever they want to call it, it is clearly a tax designed to go after the wealthy for their unrealized gains, a tax that many legal Scholars said may even be unconstitutional. But it's not the terminology that was controversial; it’s the whole concept itself. Who would determine whether an asset was sufficiently liquid? Where do you draw the line?

And if you do draw the line, would this discriminate against some billionaires in favor of others? Would those billionaires who have most of their wealth in stock have to pay that unrealized gain tax, while others who own land don't?

What if these billionaires have to pay that tax in one year on a Gain, but the following year, there's a loss? Shouldn’t they be entitled to a tax refund on the back of that loss? Will the IRS pay that out?

What if some of the most ultra-wealthy have to sell their holdings to pay these taxes? What impact could that have on the broader market? Assuming someone like Elon Musk or Jeff Bezos had to sell tens of billions worth of stock in the companies they own, would that not harm the stock market? The same stock market that millions of middle-class Americans are invested in with their 401ks. All of that, for a mere potential tax benefit of $250 billion.

In response to the above questions, the answer lies in the evidence of how these wealth taxes have worked previously in Europe. In 1990, twelve European countries had a wealth tax, and however, there is only four today. One of the most recent casualties of the wealth tax was France which scrapped it in 2017.

This has provided a practical case study to analyze the real effects of these wealth taxes. In France’s case, since the 1980s, it has had an annual wealth tax on all those individuals who had over 1.3 million euros in assets.

The first and most obvious impact of this wealth tax was that it drove the billionaires out. There was an exodus of wealthy people from France when it was in place, and because billionaires are the people who have the most means to move their tax domicile, they can easily move to more friendly regimes. By the prime minister's estimate, some 60,000 people with 35 billion euros worth of assets left between 2000 and 2016.

Furthermore, the wealth tax was tough to enforce and costly. According to French Economist Eric Pichet, the cost of administering the tax was twice as much as was brought in. The country's fiscal budget was not only worse off than if it hadn't gone after this tax, but it now had even fewer billionaires to tax in the first place.

Source: The Economic Consequences of the French Wealth Tax

Many other countries in Europe came to the same conclusion – the administrative burden just didn't make much sense. There were so many exemptions and loopholes that the rich could almost wholly avoid it. Then, of course, there was the impact this had on general Investments.

Despite what most people tend to think about billionaires, their Investments do help to fuel innovation and economic growth. This was precisely the reason given by the Austrian government when it eliminated its tax, and it placed an “economic burden on Austrian Enterprises.” Switzerland also illustrates the potential drawbacks of a wealth tax in this article.

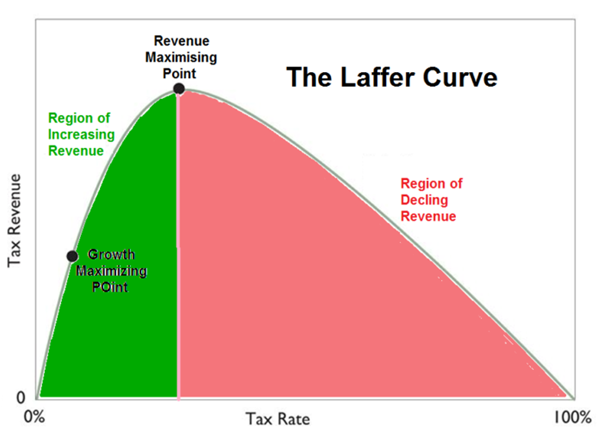

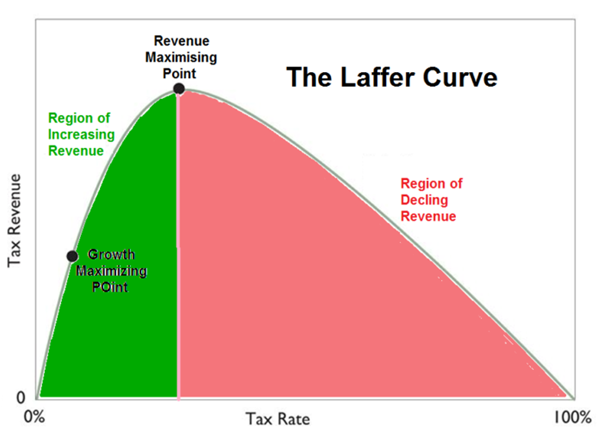

Consequently, Europe got a real-life practical example of the Laffer Curve. This well-known economic theory shows the decreasing marginal returns of taxes, and you get to a point where increasing taxes brings in even less revenue.

Image Source: Fee.org.The Laffer Curve

Closing Thoughts

Now we’re faced with the pandemic that destroyed our economies and pushed millions into unemployment, but the rich got even richer during this time. Not only that, but they managed to accumulate most of that wealth without having to pay their fair share of tax on it.

Naturally, this has led to a backlash from the populace. It feels just so inherently wrong that Warren Buffett pays 0.10% on his taxes, while his secretary pays over 37%. But to Warren's credit, he has been the one to point out this disparity.

However, having said all of that, the alternatives don't sound too appealing either. Taxing unrealized gains is a recipe for potential disaster that could bog the IRS down for years. A proposal that the rich would fight tooth and nail and which could be proven to be unconstitutional.

General wealth taxes have also been highly ineffective when implemented in European countries. Their impact has made governments and citizens poorer, while the rich simply migrate to other more favorable jurisdictions and enjoy their wealth there instead.

Some argue that we shouldn't be taxing success. If you disincentivize someone enough, then they will reduce their economic output. (That's the Laffer Curve.) I’m sure many would not be happy if the government wanted to tax all the gains on the cryptocurrency they’re hodling that has not been sold or has any intention to sell.

I’m sure that many homeowners feel the same about their houses or apartments. Does this mean that the billionaires who own stock cannot feel similarly angered by the proposal? It's a complex and sensitive predicament for sure.

The fact remains, though, as pointed out by the likes of Joseph Stiglitz and many others, that inequality is a blight on our society; tackling inequality would make life better for billions of people and supercharge the world economy yet, it's easier said than done.

Perhaps instead of targeting the wealthy individuals at the top of the pyramid. It would be better and fairer to go after the corporations that have made them rich in the first place. The corporations with billion-dollar profits and tiny tax bills. The corporations that offshore their income and treat their workers appallingly in many cases.

Individual enterprise should be allowed to flourish, but corporate greed is a much more insidious and damaging force in the world. So, maybe they should go after that instead. What are your thoughts?

Resources: Coin Bureau, ProPublica

.png)