Monthly Archives: March 2023

Understanding Your Options: Is Investing in Bitcoin or the Bank a Wise Financial Move?

Understanding Your Options: Is Investing in Bitcoin or the Bank a Wise Financial Move?

Many people are concerned that the recent banking crisis may have precipitated a global financial crisis.

In fewer than a week, three banks have failed. In an effort to avert more panic, U.S. government authorities have stepped up to backstop losses. In addition to the possibility that other banks will fail, there are legitimate questions about whether it was the proper decision to bail out two poorly run institutions with serious irregularities while allowing the third to fail.

So, should you withdraw funds from your bank and hide them under your mattress or invest in cryptocurrency?

Crypto and traditional banking are two very different options for storing your money. While banks are a familiar and trusted option, crypto, such as bitcoin, is a decentralized and volatile digital currency. So, the question arises, should you keep your money in Bitcoin or a bank?

This article will help you consider the options of either keeping your savings balances in cryptocurrency or in the bank. We will start by looking at what Bitcoin is before moving on to why people choose to use it as an investment vehicle and how they can use it safely and securely.

Image source: https://bitcoinbriefly.com/21-million-bitcoin/

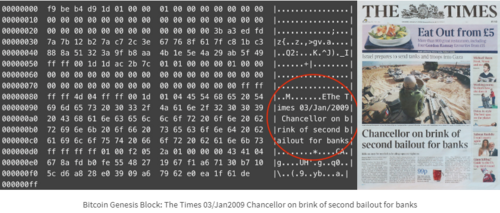

Why was Bitcoin Created?

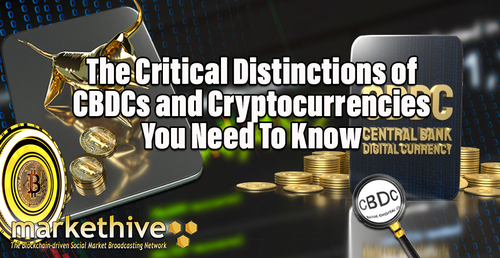

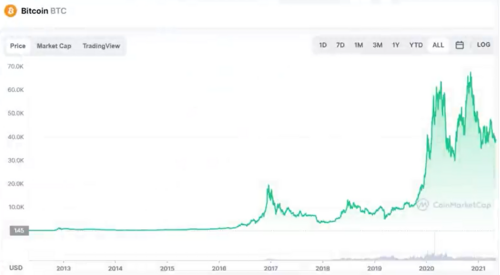

As many have already stated, the early financial crisis of 2008, known as the great recession, gave rise to the creation of bitcoin. The very first block of the blockchain came with a message concerning bailouts for banks. In contrast to the tightly entwined public and private banking sectors, it was created to remove third parties as an intermediary from the internet money system by making users accountable for their own keys.

The 2008 financial crisis was a significant event that shook the global economy, causing widespread unemployment, foreclosures, and bank failures. It highlighted the shortcomings of the traditional financial system and the need for alternative systems that could provide excellent stability, security, and decentralization.

Bitcoin was created as a decentralized digital currency that operates outside the traditional financial system. Its underlying technology, blockchain, allows for peer-to-peer transactions without intermediaries like banks. This gives users more control over their money and eliminates many fees and delays associated with traditional banking.

While Bitcoin's creation was not a direct response to the financial crisis, it is often seen as a product of the growing dissatisfaction with the traditional financial system and the need for more transparent and secure alternatives. Bitcoin was initially created as a response to the flaws of the traditional financial system. Still, it has since grown into a global phenomenon with unique characteristics and potential benefits.

One of the key advantages of Bitcoin is its decentralized nature. Unlike traditional currencies, which governments and financial institutions control, Bitcoin is not controlled by any central authority. This makes it more resistant to government or institutional manipulation and potentially more secure from hacking or other types of cyber attacks.

Another advantage of Bitcoin is its potential for anonymity. While Bitcoin transactions are not completely anonymous, they offer privacy that is not always available with traditional banking. This can be particularly useful for individuals concerned about their financial privacy or living in countries with strict financial regulations, such as China or Russia.

Bitcoin's potential as a global currency has also been touted as a potential benefit. With Bitcoin, sending and receiving payments across borders is possible without currency conversions or other barriers. This could make it easier for people to conduct business internationally and help level the playing field for small businesses and individuals.

While Bitcoin was not explicitly created as a response to the 2008 financial crisis, it is viewed by many as a potential solution to some of the problems highlighted by the crisis. Its decentralized nature, the potential for anonymity, and global accessibility make it a unique and potentially valuable addition to the financial landscape.

Are We on the Verge of Another Global Financial Crisis?

A systemic banking crisis can be extremely damaging. They tend to push the affected economies into deep recessions and sharp current account reversals. Some situations were contagious and quickly spread to other countries with no apparent weaknesses.

The many causes of banking crises include unsustainable macroeconomic policies (including large current account deficits and unsustainable government debt), excessive credit booms, large capital inflows and weak balance sheets, and various political and economic requirements resulting in political paralysis.

In September 2008, a global financial crisis caused by the collapse of housing markets led to a worldwide recession. The United States has recovered, but the rest of the world is still in recovery. This global financial crisis is the second largest in history and is predicted to be even bigger than the first.

Experts are worried that the United States is heading towards another global financial crisis, but it will be much worse this time. Many factors lead experts to believe that it will be more challenging to recover from the economic recession this time. Some of the reasons are increased global debt, over-leveraged banks, low economic growth, and rising oil prices.

There are concerns that the recent bank collapse and other economic crises could lead to another global financial crisis, as noted by several news articles. According to a report by The Guardian, the global banking system is reeling from a series of shocks over the past week, prompted by the collapse of California's Silicon Valley Bank. This has stoked fears that this is the start of a more severe crisis.

Similarly, an article by ABC News states that the potential next phase is a global credit crunch, which could lead to another worldwide financial crisis. However, regulators and central banks are pulling out all stops to prevent that.

In addition, an article by The New York Times notes that the banking crisis hangs over the economy, rekindling recession fears, and even optimistic forecasters on Wall Street in recent months have said that the chances of a recession had risen ten percentage points to 35 percent.

However, it is important to note that the situation is still developing, and it is difficult to predict with certainty whether or not we are on the verge of another global financial crisis. It will depend on the effectiveness of the measures taken by regulators and central banks to mitigate the risks and prevent the crisis from spreading.

Which is Better: Bitcoin or Bank?

Money saved in a bank account is typically considered a safer option for storing the value as it is backed by government guarantees, such as deposit insurance, which can protect a certain amount of funds in case of a bank failure. Bank accounts also offer the convenience of easy access to funds, as well as potential interest earnings. However, these are currently quite low in many countries due to low-interest rates.

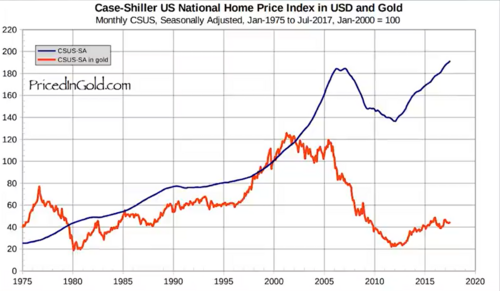

On the other hand, Bitcoin has shown the potential for significant gains over the long term, and it also carries the risk of substantial losses, particularly in the short term. Bitcoin is not backed by government guarantees, which means there is no protection for investors if the value of Bitcoin were to decline sharply or if their Bitcoin were to be lost or stolen.

Bitcoin's status as a safe haven asset during times of crisis varies depending on the situation. Cryptocurrencies acted as a store of value during the COVID-19 crisis and as a safe haven. Also, before the pandemic, Bitcoin served as a safe haven, a hedge, and a diversifier versus a range of international currencies.

However, Bitcoin's volatility remains a concern as it can experience massive price swings, making it a risky store of value asset in the short term. On the other hand, money saved in the bank may provide stability and security, but its value may be affected by inflation, changes in interest rates, and other economic factors.

Whether to use Bitcoin or money saved in the bank as a safer store of value is subjective and depends on an individual's risk tolerance and investment goals. However, it's important to note that Bitcoin's status as a safe haven asset during times of crisis is not guaranteed and may vary depending on the situation. It's essential to consider each option's potential benefits and risks carefully and to seek the advice of a financial professional before making any investment decisions.

Bottom Line

Today's bank failures are incredibly unusual and would likely result in a great deal of anxiety, as was the case with the collapse of Silvergate Bank, a free-floating entity cut off from the rest of the economy. How distinct can private and public interests truly be when SVB and Signature participated in both the ups and downs of the Fed policy-created tsunami of cheap money?

Considering the previous and recent economic upheaval, should you retain your money in a bank if the U.S. government is formally bailing out banks, or should you seek a better alternative?

Ultimately, the decision of where to keep your money depends on your individual circumstances, risk tolerance, and financial goals. It may be helpful to speak with a financial advisor or conduct additional research to make an informed decision.

The Big Reveal Of The Twitter Files MSM Ignores Time To Be Awakened

The Big Reveal Of The Twitter Files MSM Ignores. Time To Be Awakened

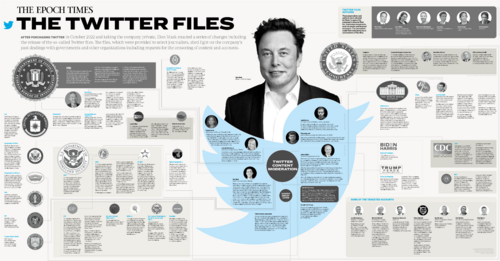

A particular comment by stalwart Elon Musk went viral after he orchestrated the first Twitter files release in December 2022. “Almost every conspiracy theory that people had about Twitter turned out to be true.” Since that time, 19 more Twitter Files have been released. They've revealed a concerning relationship between the government and big tech, which will likely evolve as online censorship laws come into force.

This article outlines the Twitter Files, including why they're being released, who's been publishing them, what they say, and how the powers that be will push back. As many will know, Tesla and SpaceX CEO Elon Musk finalized his acquisition of Twitter in October 2022. In the months preceding the acquisition, Elon promised to bring more transparency to the social media platform to increase trust. In November, he delivered. He tweeted,

Image source: Twitter

In December 2022, American author and journalist Matt Taibbi released the first set of Twitter files in a thread. Naturally, the first set of Twitter Files explained what they are precisely and discussed the now infamous suppression of a story about President Joe Biden's son Hunter Biden leading up to the 2020 election.

What Are The Twitter Files?

So, what are the Twitter Files, and why are they significant? In short, the Twitter Files are a collection of internal documents that prove that the US government was working closely with the social media platform to censor certain information. It’s significant because free speech is protected under the First Amendment in the United States.

To be clear, Twitter is a private company, meaning it is not obligated to abide by the First Amendment. However, the US government is obliged to comply with the First Amendment. According to some constitutional experts, its use of Twitter to suppress free speech could therefore be illegal.

Another reason the Twitter files are significant is that they suggest the US government could be censoring other social media platforms. This article explains the collaboration of 3 letter agencies with legacy social media and evidence to support this hypothesis; the Twitter Files add to the pile.

As previously mentioned, there have been 19 sets of Twitter files so far, and they've been posted as lengthy threads by multiple renowned journalists. Besides Matt Taibbi, the list includes Michael Shellenburger, Bari Weiss, Lee Fang, David Zweig, and Alex Berenson, all well respected. But of course, they've all since become substantive enemies of the state for being involved in this.

Image source: The Epoch Times

It's important to point out that the Twitter files aren't just sitting there waiting to be reported. In an interview with Kim Iverson, David Zweig revealed that even though they have unrestricted access to Twitter data, thanks to Elon, it's been challenging to dig up the information they're looking for.

This is partly because Twitter systems weren't designed to be searched. In other words, it’s like they have access to the entire internet but no search engine to search through it. The difficulty is also due to the obstruction and sabotage that the journalists faced from Twitter employees, most of whom have since been fired.

The silver lining is that it's been easy for them to know when they found something. Matt Taibbi gave an amusing example in an interview with Joe Rogan: A document containing phone numbers for a secret social media censorship group chat for big tech companies was simply and openly titled ‘Secret Phone Numbers.’ So with that information in mind, we’ll look at what they found.

Incidentally, both political parties were involved in social media censorship. As was almost every single branch of the US government, particularly the intelligence agencies. The difference is that Republican-affiliated entities sought to suppress the discussion of specific subjects, namely panic buying at grocery stores at the start of the pandemic. By contrast, Democrat-affiliated entities demanded the suppression of particular people, specific tweets, and retweets.

.png)

Image source: Running List of All Twitter Files Releases – Jordan Sather

Part One Of The Twitter Files

The first set of Twitter Files discussed the suppression of a story about Hunter Biden. The short story about Hunter Biden is that he left a laptop at a computer repair shop containing information that suggested that his dad, “the big guy,” was doing shady stuff.

The New York Post published the story in October 2020, shortly before the November 2020 election. Twitter and other social media outlets suppressed the story at the request of Democrat interests. Given the testimony of former Twitter executives, many Republicans have since argued that the 2020 election outcome would have been different were it not for the censorship of the story.

Part Two Of The Twitter Files

The second set of Twitter Files was published a few days later. The topic was Twitter's secret blacklisting policy, also known as Shadow Banning. For context, Twitter executives had denied that the platform shadowbanned users for years and would never do so for political purposes.

However, the second set of Twitter Files confirmed that Twitter had a shadowbanning system designed to limit the reach of specified users. This suppression was almost always political. It also went into overdrive during the pandemic, with users skeptical of pandemic restrictions being targeted.

Parts 3, 4, and 5 Of The Twitter Files

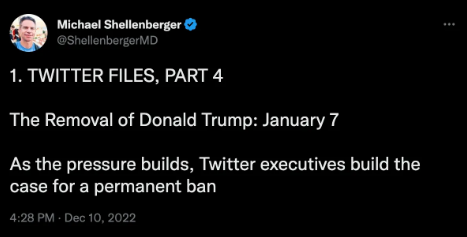

The third set of Twitter Files was published the same day as the second. The topic was the controversial removal of the then-US President, Donald Trump, from the platform. This was also the topic for the fourth and fifth sets of Twitter files, all outlined here for the sake of simplicity.

To begin with, Twitter's top staff worked tirelessly to suppress Trump's reach on Twitter. Following the contentious events of January 6th, 2020, Twitter's team devised a new content policy to justify banning Trump. The files seemed to imply that they were pushed to do this by Democrat interests.

This undertaking involved axing Twitter's Public Interest policy, which stated that information should remain on the platform, no matter how controversial, so long as it's not illegal. The Public Interest policy was replaced by a new approach called the ‘Glorification of Violence' policy, with Trump as the first offender.

As explained by Matt in the interview with Joe Rogan, mentioned above, the glorification of violence policy includes an assessment of who follows a person on Twitter to determine whether that person incited violence. So, if even a single account that’s “deemed violent” follows Trump, it means that person was violating the policy.

Some may think the new policy is justified, but if you take a moment to consider that almost every account on Twitter probably has at least one follower that Twitter could consider to be violent. In other words, the policy could be applied to whichever accounts Twitter wants to eliminate, which is brutal.

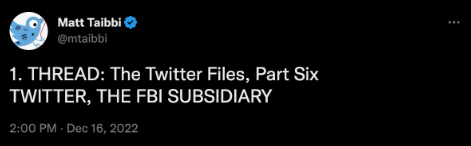

Part Six Of The Twitter Files

The sixth set of Twitter Files is even more formidable. They revealed that Twitter was in such frequent contact with the FBI that the social media company could be considered a subsidiary of the intelligence agency.

The FBI provided hundreds of takedown requests, and Twitter always complied. Also, the number of former FBI agents working at Twitter was so large that they'd created their own Slack channel. For reference, Slack is a platform used to coordinate workplace communications.

Much of the sensitive info in the Twitter files came from these Slack discussions. These files also revealed that Twitter complied with censorship requests from NGOs. Matt concluded, “What most people think of as the Deep State is really a tangled collaboration of state agencies, private contractors, and NGOs. The lines become so blurred as to be meaningless.”

Part Seven Of The Twitter Files

The seventh set of Twitter Files returns to the topic of the suppressed Hunter Biden story. This is because the independent journalist discovered that both Twitter and the FBI were aware that the contents of the laptop were likely genuine but insisted that it was Russian disinformation.

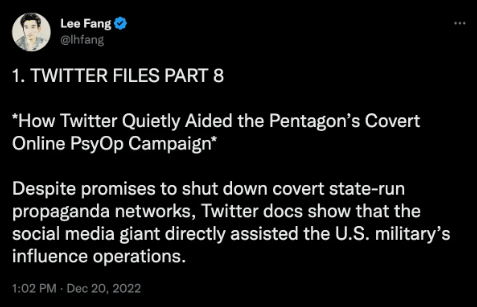

Part Eight Of The Twitter Files

The eighth set of Twitter Files was about another formidable subject, and that's how Twitter aided and abetted the US military to execute propaganda operations overseas. They shape narratives about foreign conflicts that put the US in a positive light and even use fake accounts with AI-generated deep fakes to this end.

In August 2022, a Stanford Internet Observatory report.pdf exposed a U.S. military covert propaganda network on Facebook, Telegram, Twitter & other apps using fake news portals and deep fake images and memes against U.S. foreign adversaries. The U.S. propaganda network relentlessly pushed narratives against Russia, China, and other foreign countries. They accused Iran of "threatening Iraq’s water security and flooding the country with crystal meth" and of harvesting the organs of Afghan refugees.

Part 9 Of The Twitter Files

The ninth set of Twitter Files was about Twitter's relationship with all the other US government agencies. This set of Twitter Files seems to have responded to the FBI's response to the previous set of files which the feds predictably claimed were all a “conspiracy theory to discredit the agency.”

Funnily enough, the Twitter Files found that the FBI acted as a concierge between Twitter and other US government agencies, allowing them all to submit content takedown requests. This included censorship of discussions about atrocities related to the war in Ukraine.

The long list of US Government agencies included local police departments, which had the power to search and censor users and posts. These privileges were granted by all the big tech companies involved in online censorship meetings, including Facebook, Microsoft, and even Reddit.

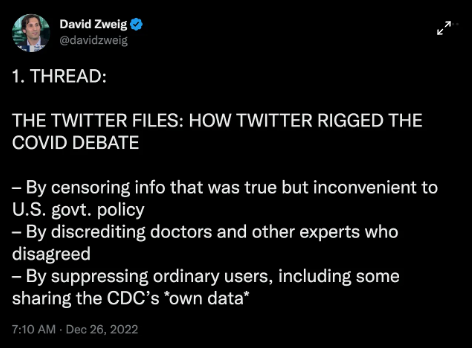

Part Ten Of The Twitter Files

The 10th set of Twitter Files is about the very contentious topic of the pandemic. These Twitter files found that accurate information was suppressed and censored if it went against the official pandemic narrative. The instructions for this suppression came directly from the White House, both under former President Trump and current President Biden. Whereas the Trump White House was concerned about panic-buying, the Biden White House asked Twitter to censor specific people and posts.

That list of people included former New York Times journalist Alex Berenson and Dr. Martin Kulldorff, an epidemiologist at Harvard Medical School. The posts included those that cited official government statistics or statements about the pandemic, which discredited the official narrative, what they call ‘the science.’

Part 11 Of The Twitter Files

The 11th set of Twitter Files explains the history of the social media platform’s partnership with intelligence agencies. This set of files suggests this collusion only began in 2017 when Democrat interests insisted that Trump had won the 2016 election due to Russian interference.

According to the Twitter files, there appears to be no evidence of significant Russian interference in the 2016 election. On the contrary, Russian interference was used by US government agencies as an excuse to infiltrate big tech companies further and dictate how information is shared online.

Part 12 Of The Twitter Files

This ties into the 12th set of Twitter Files, suggesting that Twitter was coerced into complying with the US government. Twitter was struggling with the problem of public and private agencies bypassing them and going straight to the media with lists of so-called suspicious accounts. They would have politicians push for anti-big tech legislation and leak information to the press whenever Twitter refused to comply with their censorship requests.

This combination of private and public pressure intensified when the pandemic began. US government agencies pressured Twitter to suppress information about the pandemic's origins. The US government has since pulled a complete 180° with the FBI confirming original suspicions were indeed correct.

Part 13 Of The Twitter Files

The 13th set of Twitter Files conducted by Alex Berenson discusses how Twitter suppressed the debate about treatments for Covid, particularly the tweet from Dr. Brett Giroir claiming that natural immunity was superior to vaccine immunity was "corrosive" and might "go viral." After being pressured by a top Pfizer board member, Dr. Scott Gottlieb, Twitter censored content challenging the narrative, saying it might hurt sales of Pfizer’s mRNA vaccines which his company directly benefits from.

He also went after another tweet about Covid’s low risk to children. Pfizer would soon win the okay for its mRNA shots for children, so keeping parents scared was crucial. Gottlieb claimed on Twitter and CNBC that he was not trying to suppress debate on mRNA jabs. These files prove that Gottlieb, a board member at a company that has made $70 billion on the shots, did just that.

Part 14 Of The Twitter Files

The 14th set of Twitter Files was released in mid-January. They reveal how trending hashtags on Twitter that went against popular narratives were attributed to Russian bots and suppressed despite Twitter having zero internal evidence of Russian involvement. Twitter warned politicians and media they not only lacked evidence but had evidence the accounts weren’t Russian but were roundly ignored.

You may remember that Russian bots were blamed for almost everything a few years ago. These Twitter Files recount how this baseless claim became overblown to the point that mainstream media alleged Russian bots controlled both sides of the narrative.

The Russians were also blamed for #ReleaseThe Memo, #Schumer Shutdown, #Parkland Shooting, and even #Gun Control Now to “widen the divide,” according to the New York

Times. The Russiagate scandal was built on the cowardly dishonesty of politicians and reporters, who ignored the absence of data to fictional scare headlines for years.

Part 15 & 16 Of The Twitter Files

This relates to the 15th set of Twitter Files, which reveals that intelligence agencies started alleging Russian bots were running large republican-leaning accounts. These allegations were so extreme that even Twitter's censorship policy teams pushed back against suppression requests.

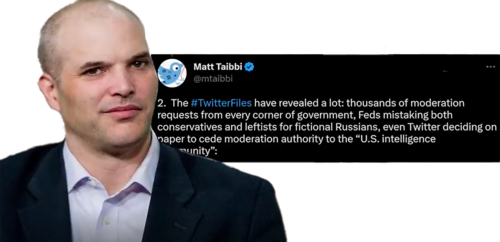

In mid-February, Matt Taibbi published the 16th set of Twitter Files and provided an excellent summary of the previous 15 files.

“The Twitter files have revealed a lot: thousands of moderation requests from every corner of government, Feds mistaking both conservatives and leftists for fictional Russians, even Twitter deciding on paper to cede moderation authority to the US intelligence community.”

Matt also laments that there's been next to no mainstream media coverage of the Twitter Files except that Donald Trump had requested Twitter take down a spiteful tweet. Matt then highlighted a few more egregious cases of such requests to see if the media would cover them. All he got was crickets.

Part 17 Of The Twitter Files

The 17th set of Twitter files was published in early February 2023 and is relative to a US Government agency, The Global Engagement Center (GEC), created in Obama’s last year of presidency. The GEC is an interagency group whose initial partners include the FBI, DHS, NSA, CIA, DARPA, and Special Operations Command (SOCOM), et al.

They reveal that it used Twitter for geo-political purposes, with agencies instructing the social media platform to suppress and censor posts and accounts assumed to be affiliated with foreign intelligence. Similarly to the obsession with Russian bots, hundreds, if not thousands, of Twitter accounts were incorrectly labeled as associated with Indian or Chinese intelligence.

The Twitter Files thread reveals that the bombshell reports have managed to attract the attention of US politicians, who summoned two journalists, Matt Taibi and Michael Shellenburger, to a hearing on March 9th, 2023.

Part 18 Of The Twitter Files

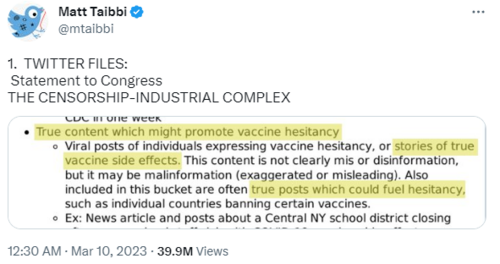

The 18th set of Twitter Files relates to the Censorship Industrial Complex, which demonstrates that Twitter was a partner to the government. Along with other tech firms, it held a regular “industry meeting” with the FBI and DHS. It developed a formal system for receiving thousands of content reports from every corner of government: HHS, Treasury, NSA, and even local police.

At its essence, the Censorship-Industrial Complex is a bureaucracy willing to sacrifice factual truth to serve broader narrative objectives. It’s the opposite of what a free press does. The Twitter Files show the principles of this incestuous self-appointed truth squad. It’s moving from law enforcement/intelligence to the private sector and back, claiming a special right to do what they say is bad practice for everyone else: be fact-checked only by themselves.

Part 19 Of The Twitter Files

Since then, new information released on the Twitter Files on March 17th, 2022, revealed that the US government and major social media companies worked hand-in-hand with Stanford University to censor or limit accurate information about COVID-19.

Independent Journalist Matt Taibbi tweeted,

"The Virality Project in 2021 worked with government to launch a pan-industry monitoring plan for Covid-related content. At least six major Internet platforms were 'onboarded' … daily sending millions of items for review."

For reference, the Virality Project is a ‘coalition of research entities focused on supporting real-time information exchange between the research community, public health officials, government agencies, civil society organizations, and social media platforms,’ per their website.

The goal of the project, created by Stanford University, was to identify people on social media who said things about COVID-19 that the government did not want them to say. Perhaps the most glaring issue Matt Taibbi highlighted in the Twitter Files drop was that the Virality Project was “repeatedly, extravagantly wrong.”

Autocrats Push Back

How will the ‘powers that be’ push back against the Twitter Files? The thing is, they’ve been pushing back Elon Musk for the entire time. One of the main ways they've been doing this is by going after Elon's other enterprises. Tesla has been hit with a barrage of baseless lawsuits and regulatory threats.

Twitter has also been the target of a relentless propaganda campaign, claiming its fresh free-speech approach is destroying the world in every possible way. Many would say that’s unfair, considering that Twitter and other mainstream social media platforms had made the world a nastier place long before Elon got involved.

Most of this propaganda came from the European Union, which will begin enforcing its online censorship laws mid-year. Conceivably, the pressure on Elon and Twitter will only increase as we get closer to the 2024 election in the United States. It's clear that Twitter significantly influences political discourse in the USA. What's said on the platform could affect the next election's outcome, which gives Elon lots of power.

Considering that he voted Republican for the first time last year, it's likely that he will be promoting whichever conservative candidate is selected to run. Bearing in mind that most US agencies seem to be aligned with the Democrats, it's likely they will do everything they can to prevent a Republican victory.

This begs the question of how exactly they will take down Twitter. After all, Elon is a formidable foe; he's one of the wealthiest men in the world, has many connections, and has a massive loyal following. He can access advanced technologies thanks to all the companies he owns and operates. And therein lies the answer; cutting-edge technologies.

Putting on the ‘tin foil hat’ for a moment, it's plausible that US Agencies could attempt to take down Twitter by flooding it with deep fakes or images related to elections. This could give them the perfect excuse to return to Twitter, saying they're not taking content moderation seriously. US Agencies already have a history of doing this. (recall the eighth set of Twitter files above.)

Luckily Elon is a smart guy and probably saw this coming from a million miles away, and arguably one of the reasons why the paid verification badges were introduced. It makes it easy to identify which accounts are malicious. A digital forensics technique can also identify deep fakes, providing it stays vigilant of fast-paced emerging technology. This will make it easy for Twitter to scrub most, if not all, deep fake content before the 2024 election. The caveat is that it could simultaneously require everyone using Twitter to complete KYC to use the platform.

At that point, the US government agencies would need to find a way to remove Elon from Twitter and install someone who will use this information for their own agenda. This takeover could happen to all legacy social media.

In politics, deepfakes are the inevitable next step in the attack on truth. In addition, deepfakes weaponize information to maximize the dynamics of a social media ecosystem that prizes traffic above nearly all else.

The Panacea For This Coup d'etat

The only solution to this takeover is decentralized alternatives. Many platforms are popping up to combat government agencies' perverse centralization and infiltration. Former Twitter CEO Jack Dorsey has backed the development of an alternative micro-blogging platform like Twitter called Bluesky. Dorsey described it as “an open decentralized standard for social media.”

Markethive has gone one step further by incorporating an inbound marketing, social network, and content broadcasting platform for entrepreneurs. The ecosystem is a conceptual cottage industry, including a merchant accounting system and cryptocurrency. It has adopted the necessary measures to thwart any power plays by autocrats and heading toward total decentralization. CEO of Markethive, Tom Prendergast, says,

"Now more than ever, we rely on Web3 technology, so the safest and most logical way to go to achieve financial freedom, peace of mind, and self-sovereignty is online with a Blockchain-driven Market Network that is divinely inspired and will withstand and survive the perils, the world is now facing. We are in a time of biblical proportions Markethive is building the proverbial ark."

The transition from centralization to decentralization would be highly bullish for the cryptocurrency blockchains that support decentralized social media platforms. Given the calamity of the geopolitical corruptness and failing monetary system, an alternative crypto economy is making more sense than ever.

Silvergate Capital Silicon Valley Bank amp Signature Bank Have All Collapsed More To Come?

Silvergate Capital, Silicon Valley Bank, & Signature Bank Have All Collapsed. More To Come?

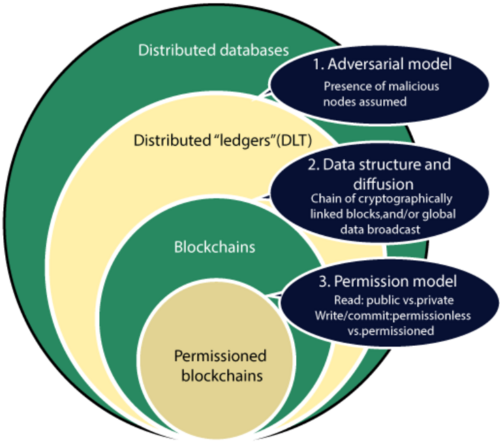

The recent scandals of Signature Bank, SVB, and Silvergate Bank have made headlines and left the industry reeling. However, the ramifications of these financial institutions' missteps for the crypto sector are yet to be entirely clear. To understand the impact, one must first look at the fundamental principles of blockchain technology and how it has upended traditional banking models.

The failure of these Banks in the United States means that many are questioning the sustainability of the cryptocurrency sector. The companies in question have all gone bankrupt, but this isn't the first time a major company has failed in the crypto sector. For example, the collapse of Mt. Gox and its affiliates in 2014 has cast a shadow on the industry, but this is not the only failure incident in this sector.

New York state financial regulators closed Signature Bank in what is believed to be the result of the Silicon Valley bank failure, as nervous depositors pulled funds out of Signature Bank. The bank's stock began to fall. The collapse of Silicon Valley Bank is expected to put pressure on several other small and regional banks in the United States.

In less than seven days, the largest bank for tech companies and two banks most accommodating to the cryptocurrency industry collapsed. The sad incidents generated uncertainty in the stablecoin market, despite cryptocurrency values rising Sunday night as the federal government intervened to offer depositors a safety net.

Silvergate Capital announced that it would be closing down and liquidating its bank. Major startup lender, Silicon Valley Bank, failed after its customers withdrew more than $42 billion in response to the bank's disclosure that it needed to borrow $2.25 billion to strengthen its balance sheet. Banking officials seized Signature on Sunday night; it had a significant crypto emphasis but was far bigger than Silvergate.

Approximately half of all venture-backed startups in the United States had cash on hand at Silicon Valley Bank, various firms that deal in digital assets, and venture capital funds that support cryptocurrencies. For bitcoin businesses, the two leading banks were Signature and Silvergate. The federal government stepped in to guarantee every deposit SVB and Signature depositors made. This action increased confidence and caused the price of bitcoins to increase briefly.

Nic Carter of Castle Island Ventures argues that the government is once again pursuing a loose monetary policy rather than one tightening since it is willing to support both banks. Historically, this has benefited speculative asset classes like cryptocurrency. However, the instability once more highlighted the frailty of stablecoins, a part of the bitcoin ecosystem that investors can often rely on to maintain a particular price. Stablecoins are intended to be tied to the value of a physical good, such as a fiat currency like the U.S. dollar or a commodity like gold. Yet, good financial conditions may prevent them from falling below their pegged value.

Image Source: Coindesk

Not Entirely Stablecoin

With TerraUSD's demise in May of last year, many of crypto's issues over the previous year have roots in the stablecoin industry. Meanwhile, during the last several weeks, regulators have focused on stablecoins. After much pressure from New York regulators and the SEC on its issuer, Paxos, Binance's dollar-pegged stablecoin, BUSD, saw significant withdrawals.

USDC lost its peg over the weekend and fell as low as 87 cents after its issuer, Circle, acknowledged having the sum of $3.3 billion banked with SVB. As a result, the sector's trust suffered once more. Circle has established itself as one of the best in the ecosystem of digital assets because of its links to and support from the conventional banking industry. It has long intended to go public and secured $850 million from investors like BlackRock and Fidelity.

Another popular dollar-pegged virtual currency, DAI, partially supported by USDC, dropped as low as 90 cents. For these reasons, USDC to dollars conversions has been temporally halted on Coinbase and Binance. Tether, the biggest stablecoin in the world with a market valuation of more than $72 billion, has seen many conversions from DAI and USDC in the past few days. The issuing company had no exposure to SVB. However, there have been concerns about tether's operations and the state of its reserves.

Circle published a post stating that it would "fill any gap utilizing company resources," this enabled the stablecoin market to recover. Since then, the USDC and DAI have turned back toward the dollar.

Reasons Behind The Ruins of Crypto-Friendly Banks

Silvergate Capital, a holding company for a bank that had made significant bets on serving the burgeoning crypto economy since 2016, announced that it would cease operating as a bank. State authorities ordered the closure of Silicon Valley Bank (SVB), which had long performed a similar function by handling funds for businesses with venture capital funding.

In broad strokes, the same problem classic bank runs brought down both banks. Whether they are crypto exchanges or software firms, their former clients deal with significant commercial difficulties, partly due to the current financial and economic climate. As a result, deposits have decreased, and cash withdrawals have increased at a time when many of the banks' long-dated non-cash holdings have also been negatively impacted by the markets.

Hence, Silvergate and Silicon Valley Bank were forced to sell those underlying assets at significant losses when cash demands reached a certain level. In the fourth quarter of last year, Silicon Valley Bank, which had a bigger total balance sheet, and Silvergate reported losses on the sale of assets of $1 billion and $1.8 billion, respectively. Importantly, a substantial amount of the losses in both situations were attributable to the liquidations of U.S. Treasury bonds.

This serves as a valuable counterpoint to the careless mischaracterization of FTX's collapse as a "bank run" by several prominent media outlets back in November. There are a few similarities between what occurred at FTX and the liquidity difficulties that impacted Silvergate and SVB. These challenges have two upstream causes: the business cycle and the Federal Reserve's tightening interest rates. These elements are connected and fundamentally refer to disturbances brought on by COVID.

Image source: cryptoofficiel.com

The initial pressure that destroyed Silvergate and SVB resulted from Fed rate rises. It was clear that the increasing Treasury rates would discourage new investment in high-risk industries like tech and cryptocurrency. But another, mostly disregarded danger to the health of banks is the rise in interest rates. As the Wall Street Journal notes in uplifting clear language, issuing new Treasury bonds with greater yields has decreased the market value of pre-hike Treasuries with lower yields.

Most banks are legally required to keep significant quantities of Treasury securities as collateral, so they are susceptible to the same risk that affected Silicon Valley Bank and Silvergate. That's one of the reasons why bank stocks, especially those of regional or mid-sized banks, are falling.

Yet, Silvergate and Silicon Valley Bank had unique business cycle problems that might only apply to a select audience. Both catered to markets that witnessed enormous runups in the early phases of the COVID-19 pandemic, namely the crypto and venture-funded tech industries. The COVID lockdowns benefitted both industries, but cryptocurrency specifically profited from the pandemic relief funds distributed to Americans.

So, through 2020 and 2021, both banks had significant inflows. The balance sheet of Silicon Valley Bank quadrupled between December 2019 and March 2021. In 2021, Silvergate's assets also rose significantly. When interest rates on those bonds were still at or near 1%, both banks would have purchased more of them as collateral to support that deposit growth. Because of Fed rate increases, rates on new bonds are now closer to 4%, which reduces demand for older bonds. That's why Silvergate and SVB were forced to sell liquid assets at a loss when clients in booming or turning industries began withdrawing their deposits.

We're still in Covid Economy

If you focus only on one aspect of the situation, you can cherry-pick explanations to blame this disaster on whoever suits your prejudices. But the reality is that everyone is trying to escape the same COVID-caused disaster in the same leaky lifeboat, battling over who gets eaten first.

Some people may criticize the Fed for raising interest rates, especially the crypto traders, yet doing so is required to control inflation.

The inflation, in turn, was brought on by COVID-19-related actual cost increases and a materially increased money supply due to COVID relief and bailout actions. An anti-Fed criticism at this time is, at best, reductive since it will take years to fully assess the total cost and value of such initiatives.

On the other hand, it will be alluring for many in the mainstream to attribute the impending banking crisis to the cryptocurrency industry as a whole. The fact that Silvergate, ‘the crypto bank,’ failed first is the strongest argument in favor of this assertion. You could hear it described as “the first domino to fall" or other such nonsense in the coming weeks, but that isn't how things stand.

Due to its involvement in a sector-wide degenerate long bet on cryptocurrencies that was well in advance of real acceptance and a sustainable source of income, Silvergate was more vulnerable. Yet that wasn't what started its liquidity issue, and its decline won't significantly contribute to any further bank failures in the future.

Instead, all American banks are subject to many of the same structural forces, regardless of whether they are financing server farms or the physical corn and pea version. A deadly virus that has killed more than six million people is the core cause of their severe economic upheaval. If there is one thing to learn right now, adjusting financial levers won't completely eliminate that type of instability in the present chaotic world.

ESG: A Woke Ideology Wreaking Havoc As Anti-ESG Rhetoric Heightens

ESG: A Woke Ideology Wreaking Havoc As Anti-ESG Rhetoric Heightens

.png)

With all the craziness happening in the world right now, you probably won’t be surprised to know that laws are being proposed that would limit food production due to ESG mandates. The EU's controversial ESG regulations came into force in January 2023, and their advocates have described them as the most ambitious yet.

These laws would severely restrict companies' ability to choose suppliers and buyers without first studying their ESG credentials, made possible through the EU’s ‘Corporate Sustainability Reporting Directive.’ The provisions in the regulations don't just apply to companies in the EU. They apply to non-EU companies, which work with EU companies, and possibly even to consumers as well.

While most EU lawmakers think these regulations will help increase the quality of life, the exact opposite is likely to occur. Not only will they crush competitiveness, but they could throw the EU into another energy and cost of living crisis that will have a knock-on effect globally. This article discusses the EU’s ESG directive, which provisions are the most disturbing, and reveals why the elites are so obsessed with ESG.

Image source: Early metrics

ESG Explained

To recap from previous articles, ESG stands for Environmental, Social, and Governance, defining an investment trend driven by financial elites since the pandemic's start. In short, ESG expresses that environmental, social, and governance issues are more important than production output or profits.

Logically, this imperative is incompatible with basic economics. Purposely pursuing more expensive energy sources, hiring people based on their personal identity rather than their abilities, and letting governmental and non-governmental organizations make business decisions is a recipe for disaster.

ESG’s incompatibility with basic economics is why it's more accurate to refer to ESG as an ideology rather than an investment methodology. Any company that complied with ESG criteria would quickly find itself out of business. This is why the ESG ideology was mostly ignored during the first 15 years of its existence.

The term ESG was coined in a 2005 report by the United Nations, the World Bank, and the Swiss government. However, the ESG criteria needed to be more consistent and clear, contributing to their lack of adoption among businesses. But in mid-January 2020, it all changed when BlackRock CEO, Larry Fink, wrote an open letter to all the shareholders of the companies the asset manager is invested in, ordering them to comply with ESG.

The Standardization Of ESG Criteria

In late January 2020, the world's elite gathered in Davos, Switzerland, for the World Economic Forum (WEF) annual conference. There, the big four accounting firms standardized ESG criteria. The ESG criteria have since become synonymous with the UN's Sustainable Development Goals (SDGs). For reference, the SDGs are a set of 17 goals that are supposed to be met by all 193 UN countries by 2030.

Image source: Weforum.org

The convergence between ESG and the SDGs comes from the strategic partnership the WEF signed with the UN in mid-2019. The announcement states that the WEF will help "accelerate the development of the SDGs.” In other words, they will provide private-sector funding and compliance. Besides developing the digital ID, SDGs mandate the development of smart cities, central bank digital currencies (CBDCs), and carbon credit scores to track and reduce an individual’s consumption.

All these technologies are being developed by companies closely affiliated with the WEF, but as mentioned above, ESG is not compatible with basic economics. This begs the question of why the private sector is on board. Well, the short answer is ‘artificial profits.’

Companies that comply with ESG get lots of investment from asset managers and better loan terms from mega banks. Companies, which refuse to comply with the ESG, see investments pulled and risk losing access to financial services altogether. Meanwhile, on the public sector side, they risk excessive regulations and bad press from governmental and non-governmental institutions working with these asset managers and mega banks.

This terrifying situation comes from the unnatural accumulation of wealth caused by a financial system where limitless amounts of money can be created. The short story is that asset managers and mega banks borrow lots of money at low-interest rates and then use it to buy assets, influence, and further push their ideologies. Understand, the ESG ideology would not exist in a sound money system; it would not be possible.

The ESG Push

Now although the ESG push has come primarily from private sector entities affiliated with the WEF, there are a few public sector exceptions. The biggest one is the European Union (EU), whose ESG initiatives are rooted in the Next Generation EU pandemic recovery plan.

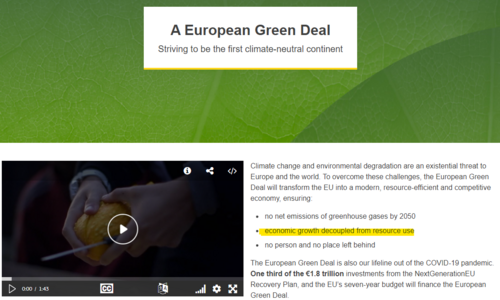

Not surprisingly, the implicit and explicit purpose of Next Generation EU is to help all European countries meet the UN's SDGs by 2030. The recovery plan is expected to cost over €1.8 trillion. In other words, it provides public sector funding and compliance, complementary to the WEF’s initiatives.

Image source: commission.europa.eu

One-third of all this printed money will fund the EU's green deal, which was announced at the pandemic's start. Now, to give you an idea of just how ideological the green deal is, one of the three goals noted on its website is to ensure that “economic growth is decoupled from resource use.” This impossible goal is why it's appropriate that the EU’s ESG regulation is part of the green deal.

The Corporate Sustainability Reporting Directive

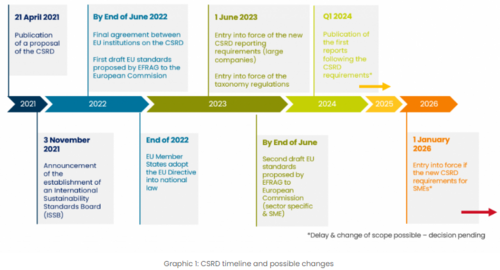

The ESG regulation in question is called the Corporate Sustainability Reporting Directive (CSRD). It was first introduced in April 2021, was passed in November 2022, and went into force this January.

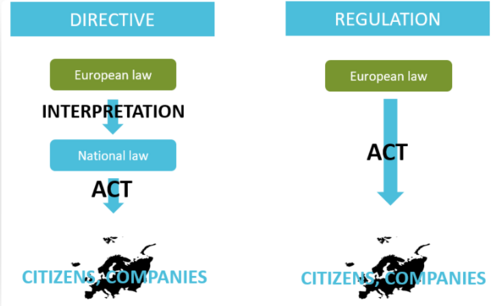

However, there are two caveats here. The first is that the CSRD is technically a directive, not a regulation. Whereas an EU regulation requires all EU countries to comply with the EU law as it's written, an EU directive allows EU countries to adjust the EU law and can take their time rolling it out.

Image source: Kvalito.ch

This ties into the second caveat: going into force and being enforced are two different things. While the CSRD went into force this January, it won't be enforced until 2025. To clarify, ESG reporting standards will be published in June. In 2024, EU companies will start collecting data using these standards. In 2025, this data will be reported.

Image Source: DFGE.de

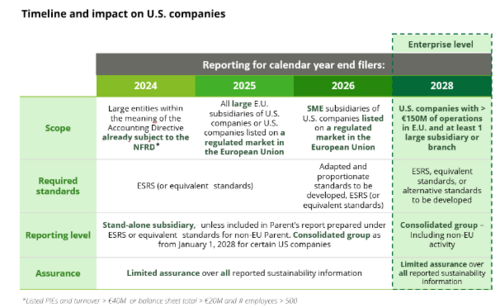

A spokesperson for the agency tasked with setting these standards specified that over 1,000 ESG data points must be reported. In a December 2021 interview, one of the architects of the CSRD revealed that the directive's purpose is to “bring sustainability reporting to the same level as financial reporting.” He also indicated that all the reported data would have to be digitized and that this won't be easy or cheap.

Failure to comply with the EU ESG disclosures will result in sanctions that should be “effective, proportionate, and dissuasive.” The CSRD will require governments to publicly shame the companies that didn't comply, order them to stop violating ESG criteria, and fine them. The CSRD is expected to apply to around 50,000 companies operating in the EU, but because of the absurdly low bar for what counts as a large company, the actual figure will probably be much higher.

An EU company is considered a large company if it meets two of the following three criteria; it has a revenue of more than €40 million per year, has more than €20 million in assets, or has more than 250 employees. Publicly listed EU companies will also be required to comply with the CSRD regardless of their size.

Moreover, the CSRD will also apply to non-EU companies which meet the following criteria; it returns more than €150 million each year for two consecutive years and has a subsidiary in the EU or a branch that takes in more than €40 million each year.

Another big reason the CSRD will apply to more than 50,000 companies is because of highly concerning provisions in the CSRD, which, as mentioned above, could apply to small and medium-sized businesses inside and outside of the EU and possibly even to consumers.

Image source: WSJ/Deloitte

The Double Materiality Provision

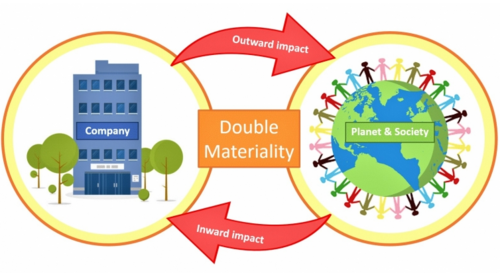

The most problematic provision is called Double Materiality. As stated by KPMG, the third largest accounting firm and one of the big four auditors, "double materiality requires companies to identify both their impacts on people and environment – Impact Materiality, as well as the sustainability matters that financially impact the undertaking – Financial Materiality.”

Double materiality sounds like yet another bureaucratic buzzword. However, these two insignificant words open the door to forcing small and medium-sized companies and possibly even consumers to comply with the CSRD’s ESG reporting requirements.

This is simply because double materiality requires companies directly affected by the CSRD to collect ESG-related data from individuals and institutions which lie upstream and downstream from their actual business operations.

In other words, in addition to the company’s own data, it would have to collect and report extensive ESG-related data from all suppliers they buy raw materials from – Upstream part of the provision. Then the company would need to chase up its largest consumers who have purchased its product and ask them to provide their ESG data for its reporting purposes. This is the downstream part of the provision.

In a real-world scenario, the company may have trouble collecting the data due to non-compliance, or the supplier may fall short in their ESG ratings. In this case, they would have to switch to ESG-aligned suppliers to meet the CSRD criteria to avoid a low ESG score and being fined. In such circumstances, the company could quickly end up in bankruptcy.

However, BlackRock comes to the rescue with investment, and the bank gives the company a loan. It stays afloat and finally gets all its most significant suppliers and consumers to provide detailed ESG data. There's just one problem: they all scored poorly on ESG, they need to use more renewable energy, their workforces need to be more diverse, and they are not members of the WEF. (Remember, ESG stands for environmental, social, and governance.)

BlackRock and the bank see the company’s annual ESG report and inform them that they won't be able to provide any more financial support unless they force its suppliers and consumers to improve their ESG scores. The company tries to jump a few more hurdles, but after trying so hard to comply, the company ultimately goes bankrupt.

Image source: contextsustainability.com

The Harsh Reality

The reality is the CSRD has the potential to impact individuals and institutions worldwide. Large companies in the EU will bear the brunt of the burden. The time and money they will take to report ESG criteria will be a massive expense.

Any small or medium-sized businesses, which lie upstream or downstream from these large companies, will likewise be required to report, and their expenses will be even greater in percentage terms. Never mind the costs and the surveillance that will come with digitizing all this sensitive ESG data.

In the 2022 conference held by the WEF in Davos, the ESG panelists agreed that small and medium-sized businesses would eventually have to comply with ESG to get investments and loans from financial institutions. One of the panelists gave an example of compliance with the ‘social’ criteria of ESG, stating that small and medium-sized businesses must pay their employees a “fair wage.”

Some argue this is code for paying their employees as much as a big enterprise can, which small and medium-sized companies often cannot do. With the CSRD applying pressure from the public sector and ESG investing applying pressure from the private sector, it's more than likely that many small and medium-sized businesses affected will go bankrupt.

As far as the elites are concerned big business taking over everything was always inevitable. The only things that will protect small and medium-sized businesses from going under will be investments from asset managers, loans from megabanks, and grants from governmental authorities.

This will give them the power to pick winners and losers based on their compliance with the ESG ideology, not on output. Assuming this ESG ideology continues to grow, we could see a scenario where businesses are occasionally prevented from providing goods and services to consumers on ESG grounds.

Excuses could include climate change, social inequality, and the inability to track what's been purchased. Again, basic economics says this would not be sustainable, but printed and borrowed money would make it so.

The EU could achieve its goal of having an economic output with zero input. It would just be rising numbers on a screen, with inflation kept in check by capital controls on digital currencies. Quality of life would quickly diminish as no actual inputs means no tangible outputs. There would be frequent and chronic shortages of critical goods and services, which the elites will blame on the same crises that ESG claims to solve. If it's allowed to be discussed at all, ‘real’ inflation will be off the charts.

.png)

Image source: cryptonews.com

The Elite’s ESG Obsession

So why are the elites so obsessed with ESG? The answer is ‘inflation.’ The byproduct of ESG policies creates inflation. The fact is, the wealthiest individuals and institutions have trillions of dollars of debt that they can't ever hope to pay back. And as mentioned above, most of this debt was used to buy assets and influence, all to push dystopian ideologies which go against the natural laws of economics.

In theory, most of the issues ESG seeks to fix could be more easily fixed with a sound monetary system. Saving is incentivized, wealth accumulation is arduous, and harmful ideologies are more difficult to finance. In practice, the elites default on their debts and lose all their assets and influence.

That's why there's only one solution in their eyes: to centralize control so intensely that it becomes impossible for them to default. This requires controlling where you go, what you say, and how you spend. If you look at the bigger picture, you'll realize that this is the true purpose of the SDGs and ESG.

.png)

Image source: US Debt Clock

The Silver Lining

The silver lining is that the elites will likely fail in implementing ESG policies. Evidence of this was in mid-2022 when energy prices soared, and we saw a rise in anti-ESG rhetoric because people knew ESG was the ultimate cause.

Although ESG saw a comeback after energy prices fell, this won’t last long. That's because the energy market fundamentals still need to be addressed. There needs to be more supply relative to demand, and energy companies are reluctant to expand in the face of ESG opposition.

When energy-driven inflation comes back, and it will, ESG will become Public Enemy #1 again, and rightfully so. When energy prices spike, you'll see governments declare oil, natural gas, and nuclear energy as green and spend $500 billion to burn so-called ‘dirty’ coal to keep the lights on as Europe and the UK have already done, and that's just what will happen in the developed world.

In the developing world, entire countries will go under; revolutions will arise, along with mass migrations, and all those angry people will know that ESG is ultimately to blame. This will lead to global instability, which will thwart the UN and the WEF’s plans.

Recently, Vanguard, the world’s second-largest asset manager, resigned from the Net Zero Asset Managers initiative, stating they were “not in the game of politics.” Moreover, Vanguard doesn’t believe it should dictate company strategy, saying it would be arrogant to presume that the firm knows the right strategy for the thousands of companies that Vanguard invests with.

Vanguard’s decision to withdraw, citing a need for independence, has perpetuated the anger of climate extremists since the Pennsylvania-based asset manager refused to rule out new investments in fossil fuels in May 2022.

Now, the elites are hyper-aware of this, so they're trying to move quickly to take control of everything before the purchasing power of their fiat currencies goes entirely to zero. They will fail because people will opt out of the current system when they see it closing in on them.

They’ll opt out by participating and supporting parallel ecosystems and adopting alternative technologies like cryptocurrency, which have been in development for years in preparation for this exact transition. As fiat currencies implode, the current system will collapse, and an alternative system will emerge.

Restoring Humanity – From Mass Psychosis to Mass Awakening

Restoring Humanity – From Mass Psychosis to Mass Awakening

The global events of the last three years have presented extreme economic, health, and freedom challenges while raising questions about the emerging dystopian nightmare.

Why is it that a minority of people can see through the crumbling official narrative imposed on the people while, by contrast, many seem so blissfully asleep in continuing to accept and defend a narrative that does not add up?

In order to answer this, it may be helpful to look at the relationship between perception and mind control and how this contributes to mass psychosis, which refers to a collective lack of insight where current reality is concerned. Even more important than insight is how to break the spell of harmful and destructive conditioning.

I start with a personal example. I was walking through our local hospital many years ago wearing a white jacket and skirt cotton suit. As I walked through the local hospital, it seemed that everybody I passed nodded at me respectfully; initially, I couldn't figure out why. After all, I didn't know them.

It took a minute to dawn on me that my presence was being acknowledged this way because most doctors wear white uniforms. They thought I was a doctor and, therefore, worthy of such respectful acknowledgment due to my perceived status and authority.

In another incident in 2020, an elderly gentleman in town gave me expletives due to my opposing views over a specific health matter. He abruptly stopped when I told him I was a former nurse, and his demeanor changed entirely to a more passive and accepting stance. Again, in his eyes, I represented authority.

Image source: Bgfons.com

MASS PSYCHOSIS

In the above examples, the keyword was authority, demonstrating the behavioral trend to accept what those in charge say without question. In an ideal world, that should not cause an issue, and there is merit in taking advice from those in authority who have the relevant expertise and a desire to help those they serve genuinely.

However, if you primarily serve your ego, then authority and status can lead to misuse and abuse of power if left unchecked. Money and status are aphrodisiacs to these types of individuals. With this in mind, Thomas Jefferson warned Americans about the need to be vigilant.

‘Freedom is not free; the price you must pay for freedom is eternal vigilance.’

So why do individuals accept authority blindly when a destructive use of power is in play? The clues lie in mind control.

MIND CONTROL

Mind control is the ability to influence the mind towards a specific objective. It can be positive when focussing on how to achieve a dream goal, for example. This is a constructive use of the mind, which impacts emotions and behavior too. When used for harmful or nefarious purposes, this becomes destructive.

Most, if not all of us, have been born into a time when such corruption is well established. This means that these practices have an air of normality about it. Normal becomes so through a process of conditioning over time. If you look at it from the angle of the law of cause and effect, these nefarious outcomes are the effects of things being created to cause them to happen.

So if the effect is that you wish people en masse to believe a lie, then certain ingredients would need to combine to cause that to happen. For example, combine authority with media, education, and health control, and you can control the message that will be delivered consistently to the people.

After a certain time, that message will get accepted to the point where it will remain unchallenged without question, even when it makes no sense. Mass conditioning becomes possible when you expose the public to specific information with frequency and intensity through commonly held technology devices such as the television.

George Orwell once said, “Who controls the past controls the future.”

Ask yourself the following question. Who controls the media, who owns education, and who owns the pharmaceutical industries? See if you can name them without research.

If you struggled with the answer, that is great feedback because it lets you know what you do and don’t know. It's on the basis of such ignorance that many make uninformed comments and decisions about things like health, education, and money.

To help advance your knowledge in this area, the documentary below called "MONOPOLY" is well worth watching as it shows you how to find the answer rather than just telling you who controls the world. It’s about one hour long and addresses the issue of who owns what when it comes to the primary industries in the world. It also develops your research ability in the process.

This pattern of control highlighted in the documentary is the creation of those with high status, money, presumed authority, and disdain for humanity. Once you determine who controls what, you can examine their connections regarding who they associate and with whom they merge their objectives. You can then more accurately predict the narrative that will come through the media channels.

So in the case of the Monopoly documentary, all roads lead to Blackrock and even more so to one in particular – Vanguard. The agenda with Blackrock and Vanguard has been addressed in previous articles from the team.

Since they have a monopoly on every major industry, it stands to reason that it is not in their interest to allow an even playing field for all. They do not believe in meritocracy. Hence they will use everything in their arsenal to remove the competition.

Does the trail stop with Vanguard, or is there another type of hierarchy with controlling influence?

Well, depending on how far you want to take your research, there is consistent commentary from various ex-government officials turned whistleblowers to suggest there are individuals in the shadows hiding behind these corporations pulling the strings.

Some talk in terms of thirteen ruling families. Others talk of the Club of Rome or The Committee of 300. The theme of Masonic Orders and The Illuminati are other names. They are collectively referred to as The Cabal or Deep State.

Where this trail ends is hard to say, but a common theme is this hatred for humanity, reflected in destructive rituals and behaviors. This theme of unjust enrichment for the few by those in authority and enslavement of the masses is an enduring theme, irrespective of the exploration angle.

So how does that corporate control relate to you? It goes beyond you buying their stuff. Let’s loop back on the subject of mind control and see if we can get nearer to the roots of this.

MK Ultra

MK Ultra was a collaboration between the government and approximately 80 institutions in the 1950s, a central point of which was the Tavistock Institute. Certain people were selected to be experimented on regarding mind and behavior control. It was brought into being off the back of the war as a strategic initiative for defense purposes. For more background, look up Project Blue Beam, Operation Paperclip, and P20 CointelPro.

Image Source: All That’s Interesting

Director Sidney Gottlieb, an integral figure in that program, joined the CIA in the early 1950s. He was an expert in poisons and devised many projects to remove the enemy. This program became controversial because such experiments were used more widely to experiment on the public without their knowledge. The nature of the experiments was barbaric in that they were designed to break the human will and spirit.

The mind would become fragmented as the conditioning process of subliminal messages, drugs, alcohol, mental disruption, fear, blackmail, hypnosis, and sensory deprivation kicked in to induce specific behavior. The subject would automatically and unconsciously respond to a pre-programmed objective once triggered by a stimulus or command at the required time.

MK Ultra is deemed to be behind certain assassinations where the assassin has no knowledge of performing the act. It protects the real killer, and hence these subjects become proxy killing machines, weaponized to do the bidding of those that control them.

Once this program became known in the public domain in the early 1970s, the program was supposed to be terminated. However, it got morphed into Project Monarch, and many believe the project continues in some way, with the use of subtle tactics.

Strategies and Tactics

To bring it forward to the present day, the use of artificial intelligence for population surveillance and the internet of things is deemed to be the medium through which the public is being spied on. Here are a few tactics employed in the process.

Plausible Deniability

Plausible deniability is about insulating yourself from blame based on the fact that someone else performed the misdeed without your knowledge, coupled with the fact that there is no clear trail of evidence that links you directly with the act in question.

The following testimony from a whistleblower from a private security firm in Seattle demonstrates this and how far these global powers are willing to go to control the masses for their own agenda. What he shows undoubtedly aligns with the attempted removal of law enforcement and the introduction of robots.

It enters the realms of direct energy weapons, which lays the groundwork for plausible deniability because, in this scenario, you can harm someone without touching them and distance yourself through a lack of evidence.

As much as what he shares is not for the faint of heart, it does prove that these things did not happen overnight, and the view that the so-called virus was created for a global reset rather than the other way around is gaining momentum by the day.

Distraction

Consider this from Aldous Huxley back in the 1930s:

“As for the manual workers, they will be discouraged from serious thought: They will be made as comfortable as possible…; As soon as working hours are over, amusements will be provided, of a sort calculated to cause wholesome mirth and to prevent any thoughts of discontent which otherwise might cloud their happiness.”

Distraction is a tactic that keeps a person from realizing what is actually happening. A typical vehicle for this is the television.

Entertainment

Look up the film ‘White Noise’ and compare it to what happened in Ohio recently with the train incident. Many reported that the so-called virus reminded them of the film ‘Contagion.’ Most recently, there was talk of another virus called the Marburg virus.

Coincidentally Stanley Johnson, the father of former UK Prime Minister Boris Johnson, released a fiction book in 2020 called ‘The Virus,’ featuring the Marburg Virus. It was previously published in 1982 as The Marburg Virus.

A variation of these fiction movies and books is the simulated tabletop exercises facilitated by Bill Gates back in 2019 and written into the WHO papers. (World Health Organization)

Are these fictionalized movies, books, and simulations a tactic to get the mind to associate these things with fiction prematurely or to confuse the mind about what is real and fiction?

Could it be that when the real event happens, it has already been seeded in the collective mind? And any attempts to suggest this is premeditated get seen in a fictitious light as disinformation?

Or are we being told the agenda ahead of time, albeit presented as mere fiction, so we won’t take it seriously until it catches up with us in an unguarded moment? You decide.

The Trojan Horse

If you look up what a trojan virus is, it is a play of the trojan horse theme. In this scenario, some sort of malware disguises itself as legitimate code. Once it enters your computer, it wreaks havoc in a destructive manner.

Apply this to 9/11, where there was a supposed foreign terrorist attack. Through the back door came The Patriot Act, allowing for citizen surveillance.

In the case of the so-called virus Co-vid 19 [look up its patent]. The virus supposedly allowed the public to be inoculated through experimental jabs, which has given way to track and trace technology for our protection.

It was, in fact, the other way around. The problem was created in the form of a virus with a 99.9% recovery rate, yet, by sleight of hand, by solely focussing on cases, it was presented as a killer pandemic, suggesting a significant percentage of the population would be wiped out.

This, in turn, would provide a context and compelling case for mass injections and then, then morph into an emergency climate agenda based on reducing carbon emissions.

Now the proposal of a digitized CBDC becomes a controlling pinnacle mechanism for approved social behaviors in the form of social credits within smart cities. Spot the trojan horse. Welcome to the new world order.

.jpg)

Image Source: Stop World Control

In their new online playground, the lines between reality and virtual reality get consumed in the metaverse, ‘et voila’ we have the internet of things, where you now become a thing that can be switched on or off at the press of a button – the ultimate control.

A way to further verify these events is to look at where big money has been directed. For example, look up the list of US patents, and you will find related patents going back many years ago that laid the ground for what we are now seeing.

Duplicity

This is where you appear to be on one side while really serving the other. An example of this is when the government sugarcoats its lies with the truth to bait the people or keep them hooked.

Deception – The Overarching Theme

Deception is a theme that runs through all the tactics mentioned above, and the most dangerous kind is the duplicitous narrative that has a bit of truth sprinkled in to keep the masses onside and to mute any objections.

Robin de Ruiter sums it up in his book The Satanic Bloodlines,

“There is only one truth which has been purposely covered up and re-branded to ensure that those who dare to seek and question are unsuspectingly led into a dangerous cocktail of truth mixed with error.”

This can pave the way for things such as battered wife syndrome and Stockholm Syndrome. The latter is a term often used in psychiatry, where the subject perceives her abuser as more of a friend than a foe to the point where the abused will defend the abuser in the face of threat.

This is an example of codependency, where the abuser controls a vulnerable subject and where she is dependent on the abuser in some way for her survival.

In the book Fruits From A Poisonous Tree, Mel Stamper describes the other common form of deception, which is the use of language to deceive.

Nowhere is this more prominent than in the laws that were changed over time to create things like the birth certificate fraud and the debt economy fraud. This was done to enslave the masses and make it so difficult for them to recover, let alone have the strength to make those responsible accountable for their fraudulent and criminal actions.

If you accept that the very things that would bring charges of fraud and crime against us are things that the government seems to be immune to, then at some level, you have to accept that we are being ruled through organized crime by the very people we pay to serve us.

When errors are not corrected, this leads to incompetence. When incompetence is repeatedly ignored, this leads to corruption. That makes them criminals and fraudsters acting as a government.

The above construction of a mass psychosis through mind control and fear would suggest that certain globalists have succeeded in their orchestrated plan to numb, dumb, and stupefy the public into going along with their behavior. Authority has combined with force in the present day to keep it this way. Yet all is not as it seems, and truth has a way of coming to the fore in time.

MASS AWAKENING

This begs the question of how it is possible to go from mass psychosis, where there is no insight into current reality, to a mass awakening, where there is clarity of insight.

Thomas Jefferson reminded us of the important quality of vigilance; “Freedom is not free; the price you must pay for freedom is eternal vigilance.”

Vigilance is a form of being alert to guard against deception and lies, but it needs to feed off the clarity of insight. Here are three tips for facilitating awakening and anchoring it in vigilance.

1. Perhaps a starting point is to recognize what does not work so well, which has been attempted by many who have tried to wake people up. Many have tried to use reasoning in conversation, which has led to much angst and frustration. The key learning point here is that the act of reasoning with a conditioned mind is nigh impossible.

When faced with something new, the mind will tend to roam its inner filing cabinet, and if it cannot find a supporting experience in its memory bank, it will likely dismiss your reasoning. This is a description of conflict often referred to as cognitive dissonance.

Reasoning only works where there is an open mind and heart. An awakening usually bypasses the intellect and happens through the heart. So the first step is to open the heart and desire to seek truth in all things.

If you are a person that is trying to help someone wake up, the best way to help them open their heart is to simply show them what a better world looks like in thought, word, and deed through things like empathy, compassion, and presence.

This becomes like a contrasting mirror to the type of world that ruling authorities are ushering us into. This also provides a safety net in which the person you are helping can genuinely open up over time without fear and entertain something different from what they have held onto for so long.

2. Recognize the opportunity in adversity. There is something about the nature of adversity that causes individuals to evaluate life with greater depth compared to when things are going well.

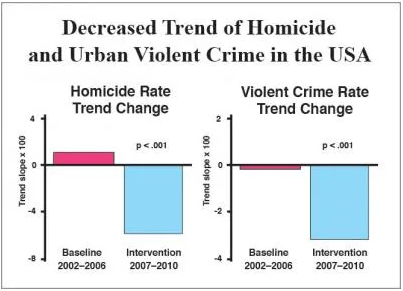

There is an opportunity to change the trajectory of life as more awaken to what is going on. That makes this a perfect storm if that opportunity is taken. Consider the example of Transcendental Meditation and the research conducted over four years, demonstrating its powerful ability to reduce crime and increase peace.

Image source: Meditation Lifestyle