Unleashing the Power of Force Multipliers: How Markethive Amplifies Your Business Success

Entrepreneurs encounter many challenges that can impede their businesses' progress and prosperity. However, force multipliers such as technology, tactics, resources, software, and partnerships can enhance effectiveness and achieve significant results even with limited resources. Markethive, a social neural network, provides a range of force multipliers, including information and content sharing, user-generated content, blockchain technology, storefronts, campaigns, brand ambassadors, awareness of the market, and network connectivity. These force multipliers can expand a business's reach, influence, and development, making Markethive an invaluable asset for entrepreneurs.

The challenges that entrepreneurs encounter can hinder their businesses' long-term success and growth. One common obstacle is figuring out how to effectively utilize the limited resources at their disposal, whether time or money, to achieve the most significant impact and profitability. This is where force multipliers come into play. It is essential to understand what force multipliers are and how powerful they are in addressing these challenges.

The armed forces have long understood the importance of force multipliers. A troop multiplier, for instance, enhances an existing military capability by either increasing its size or utilizing machine guns as force multipliers for rifles. The military would integrate sniper training into various subjects to enhance the value of snipers as a force multiplier and ensure their survival in combat.

Force multipliers are a means to accomplish more remarkable results with the same or reduced amount of effort, similar to how using a drill instead of a screwdriver can make tasks more manageable. These force multipliers can be vital in ensuring the business's survival.

What Are Force Multipliers In The Online World?

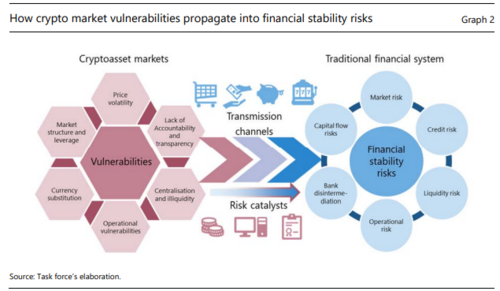

In the digital realm, force multipliers refer to the various methods, techniques, technologies, and resources that can significantly enhance your business's competitiveness and give you an edge over your rivals. These force multipliers can help amplify your online presence, streamline operations, and ultimately drive success in the digital marketplace.

Utilizing force multipliers has enabled many entrepreneurs to experience rapid and substantial growth, leading to outcomes that would have been unattainable through other means. By leveraging these tools, you can rapidly scale your efforts and unlock opportunities that otherwise remain out of reach.

Combining these elements creates a powerful effect and dramatically enhances the outcomes for the company, its clients, and the overall economy. By leveraging its strengths, a smaller entity can gain an unfair advantage over a larger, more established competitor with a similar business model, creating a force multiplier effect.

The military interpretation mentioned earlier emphasizes the importance of enhancing capability. Markethive, on the other hand, prioritizes the addition of processes as we aim for the combined marketing elements to unite and surpass the overall marketing endeavor synergistically. Unlike in many other institutions, force multipliers typically serve to optimize store operations or manufacturing productivity.

Marketing force multipliers stem from strategic and procedural innovations that enable businesses to adapt to the rapidly transforming landscape. Outdated linear approaches are no longer practical in today's dynamic market, where retailers and brands must respond to changing consumer behaviors and technological advancements. By embracing new strategies, marketing teams can capitalize on the explosive potential of force multipliers, allowing them to stay ahead of the curve and achieve tremendous success.

Any company seeking expansion must discover its unique Force Multiplier. The hurdle is determining which specific factors will boost your business's growth.

The marketplace is in a state of constant flux, with no shortage of influences impacting it. This highlights the importance of recognizing the factors that can amplify the growth of your brands. These factors must be identified and nurtured. Listed below are Markethive’s force multipliers, which are crucial for online businesses.

Image: Markethive.com

Force Multipliers In The Digital Realm

Sharing Info And Content On Social Networks

The speed and interactivity of sharing information and content on social networks is an essential tool for Markethive entrepreneurs. The diverse range of social media platforms available allows for extensive reach and connectivity. These platforms work harmoniously with the Markethive social media platform, enabling a tailored, individualized, interactive collaboration experience.

User-generated Content Attracting Feedback and Reviews

Entrepreneurs can benefit from the immediate sharing of user-generated content, but they must also be prepared to handle feedback and ratings from online users. While this can be a powerful tool for growth, it can also be detrimental if the entrepreneur is not receptive or dismissive of their customers' opinions. To effectively manage online feedback, being attentive and understanding of one's audience is crucial.

Fostering Advocacy: A Key to Success

Advocates should be nurtured. It is vital to cultivate advocates as they serve as an invaluable asset. They are passionate supporters and allies who strongly believe in your brand, cause, or product. These individuals willingly put in the effort without compensation. They become influential figures who can sway the opinions of undecided individuals. They engage in conversations with others and act as a catalyst in building customer loyalty and involvement.

Real-time Situational Awareness and Strategic Network Connectivity

By leveraging a robust network of connected individuals and groups, your business can stay ahead of the curve and respond promptly to evolving market trends. With the right people and information in place, you'll be empowered to make informed decisions quickly, giving you a competitive edge.

This proactive approach is a potent force multiplier that enhances your company's situation awareness in real-time, allowing you to stay adaptable and responsive in an ever-changing landscape. This strategic networking capability is an indispensable component of your marketing strategy, enabling you to stay ahead of the competition and achieve long-term success.

Harnessing the Power of Predictive Insights

The ability to forecast forthcoming changes holds immense potential, yet many organizations still need to catch up to adopt data-driven strategies. While some industries, such as law enforcement and healthcare, have embraced predictive analytics to anticipate security concerns and resource needs, many companies still need to utilize this powerful tool. By harnessing the capabilities of predictive intelligence, organizations can gain invaluable insights to preempt changes and stay ahead of the curve.

A network must capitalize on emerging trends and directions. Predictive analytics, such as analytics for anticipating short-term and long-term change, is a powerful tool to recognize trends and requirements at all times. It embodies a culture of innovation.

Storefronts and Campaigns

At Markethive, we offer powerful tools to help entrepreneurs amplify their reach and impact. Our storefronts and associated marketing campaigns are designed to work together seamlessly, providing a force multiplier effect that helps businesses grow and thrive. Additionally, we have integrated broadcasting capabilities that allow group administrators to easily share information with the entire group's social network, further expanding the reach of your message.

The blogging platform is designed to streamline team collaboration and provide comprehensive management reports for administrators. These reports offer visibility into individual team members' activities, including blog posting, autoresponder creation, capture page development, news feed posting, ad management, and new member sponsorship. Additionally, the system features a group rotator that showcases the collective traffic generated by the team and a cooperative mechanism for raising funds and shares to support group advertising campaigns.

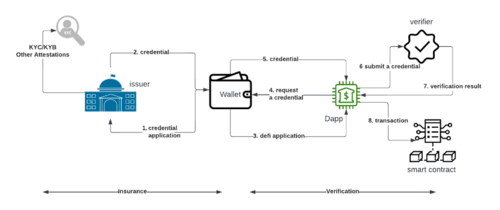

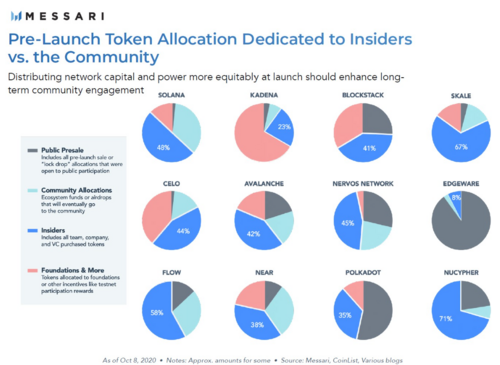

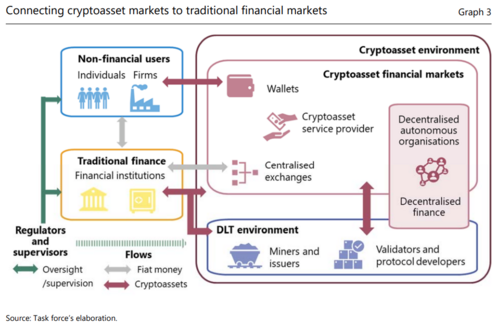

Blockchain Technology

Blockchain and smart contracts offer a pivotal advantage by amplifying the impact of crowdsourcing. These innovative methods provide a cost-effective way to incentivize and reward individuals contributing to crowdsourcing initiatives. Entrepreneurs can bypass traditional sources such as professional investors and venture capitalists by obtaining funding directly from the crowd. This enables them to finance the development of new platforms that cater to users' requirements. The Incentivized Loan Program (ILP) serves as a prime illustration of this concept.

Image source: Gotco.in

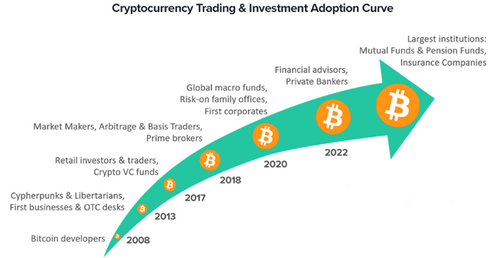

Cryptocurrency

Users are rewarded with cryptocurrency micropayments for participating in various activities just using the systems on the platform. It creates a fun, engaging, rewarding, and profitable experience. This approach also utilizes gamification elements, with loyalty and bounty programs, to incentivize users and make their engagement even more valuable. The result is a dynamic that amplifies the impact of users' efforts and transforms how they interact with the platform.

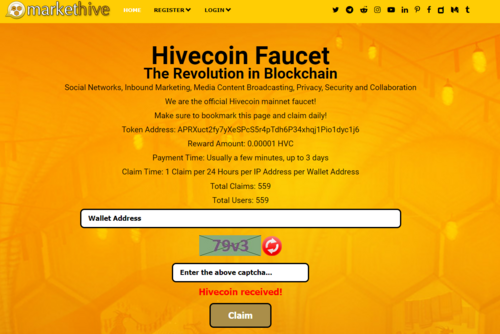

Markethive’s Hivecoin (HVC) is alive and well on the official Hivecoin mainnet faucet. Increase your HVC portfolio by visiting the Hivecoin Faucet website daily to receive your free crypto. You just need to paste your Markethive wallet address in the bar, fill in the capture, and claim. You’ll receive 0.00001 HVC in usually a few minutes, up to 3 days. Also, be sure to bookmark the site and visit it daily to accumulate your HVC. This is a powerful force multiplier that increases the transactional activity required to meet exchange protocols.

Amplify Your Reach with Force Multipliers

It is essential to utilize force multipliers to achieve expansion. Suppose you solely focus on targeting one customer, market, or partnership at a time. In that case, your growth will be limited, and you won't be able to compete effectively, especially against larger competitors with a well-established market presence. By employing force multipliers, you can accelerate your growth, increase scalability, and capitalize on opportunities that would otherwise be out of reach.

Constantly seeking ways to enhance productivity is crucial for businesses and marketers. Given our limited resources and time, it's essential to identify the most effective multipliers for each element to optimize results.

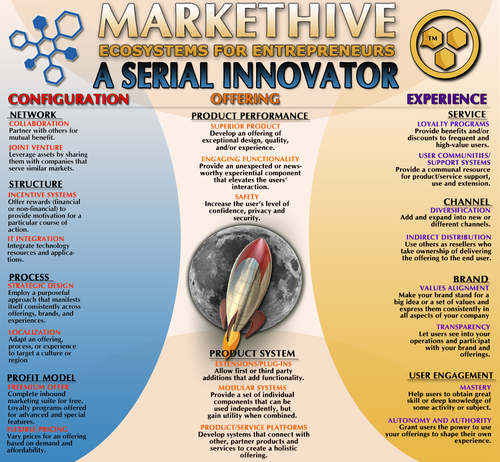

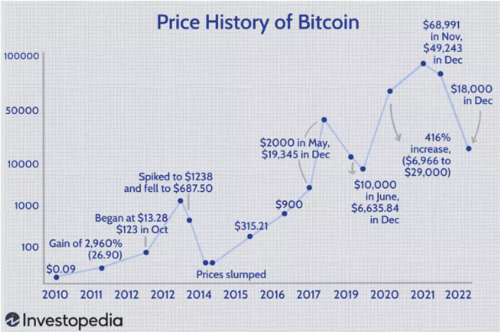

Infographic: Markethive.com

Markethive: What’s In A Name?

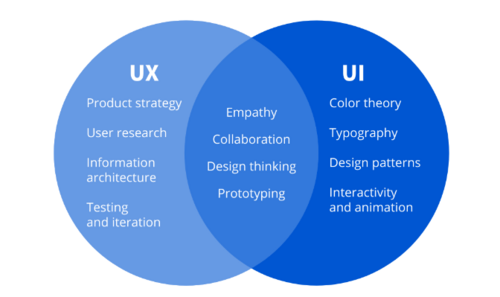

The term "market" encompasses a comprehensive collection of effective inbound marketing resources, such as automated email responders, social media broadcasting tools, landing pages, blogging platforms, search engine optimization tools, lead management systems, and analytics.

The term "hive" refers to the social network present in the system. It is an innovative form of social network known as a Social Neural Network. This concept of a "Hive" offers unparalleled potential for campaigns to capitalize on the network effect, with effortless management and unbridled impact.

Irrespective of your motivation level, Markethive will enhance your schedule, expand your outreach, and create a larger and more impactful sphere of influence than any other platform has ever tried to achieve.

Markethive is an innovative platform that fuses the features of LinkedIn, Facebook, Marketo, and Fiverr, all while utilizing the cutting-edge technology of Blockchain. By doing so, it offers a comprehensive set of Inbound Marketing tools seamlessly integrated into a user-friendly social network. And the best part? It's free to join and even rewards you for participating!

Within Markethive, a thriving cottage industry has given rise to numerous independent businesses as the Markethive entrepreneurs capitalize on the opportunities presented by the platform. Markethive's money machines, such as the Banner Impressions Exchange (BIX), empower associates to harness the system's potential and achieve financial success.

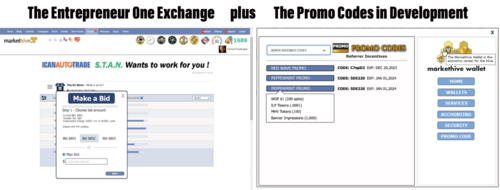

Markethive is in the throes of incorporating more revenue-generating components, such as the E1 Exchange and Promocode. Additional components, referred to as hubs and portals, will be integrated in due course. They are diverse in nature and can also be considered force multipliers, amplifying earning potential.

Just like any other platform, upgrades offer additional features, such as the Entrepreneur One Upgrade, with more entry-level upgrades coming, like the Premium Upgrade launching soon. As a free member, you'll have access to various essential tools for inbound marketing. Plus, you'll be in our thriving social network and even earn crypto rewards, such as micropayments in Hivecoin for your activity on the platform, once you refer three friends or colleagues to join markethive. This article explains more about the referral program.

We have here the world's first entrepreneur business person's social network, with the entire system offered predominantly for free to the worldwide entrepreneurs market. With the integration of the new streamlined dashboard and various newsfeeds currently in development, the complete system is next-level, clean, and intuitive, delivering every function and aspect available, fitting for the entrepreneur, business, and corporation.

It encompasses a diverse range of entities, from small, local businesses to global corporations, including cottage industries, real estate and mortgage agencies, insurance providers, affiliate marketers, software developers, musicians, religious organizations, political parties and candidates, distributors, network marketers, innovators, and visionaries.

Cut expenses, boost profits, and expand your online presence with Markethive. This powerful platform allows you to amplify your reach, grow your audience, and increase your revenue stream without breaking the bank. There is no need for expensive internet marketing costs but an increasing need for a more efficient and effective way to achieve brand and financial success and sovereignty in the parallel economy. Markethive is the ultimate Social Market Broadcasting Network and the home of technology-driven Force Multipliers.

May the force be with you.

.png)

(1).gif)

(34).gif)