Bitcoin Price Starting to Reverse, 2 Catalysts Will Drive it Higher in 2018

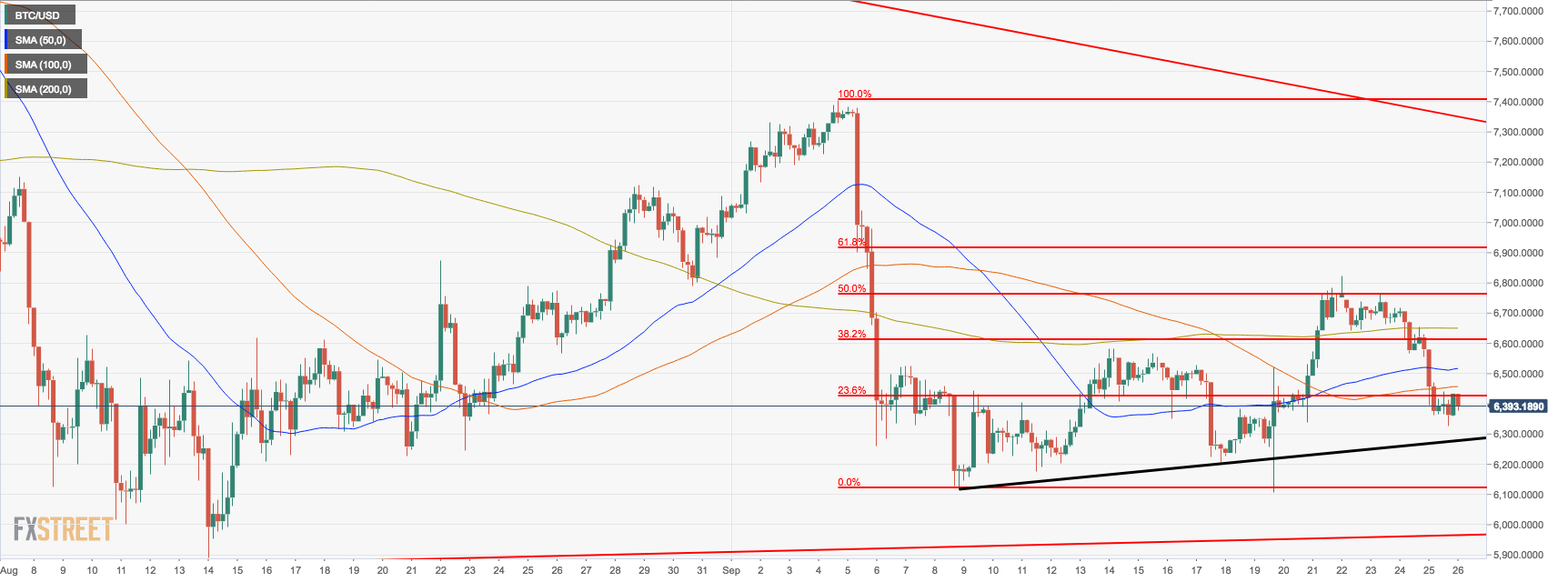

Throughout 2018, Bitcoin has continued to record lower highs, testing major resistance levels at $10,000, $8,000 and $7,000. According to Fundstrat’s Tom Lee, the stability of Bitcoin at $6,000 regardless of its lower highs is optimistic.

In early 2018, Fundstrat emphasized in a report that the $6,000 level will likely be held by Bitcoin in the mid-term because it is the breakeven point for miners. That means, miners that utilize electricity and mining equipment to verify transactions on the Bitcoin network can still generate some profit if the price of Bitcoin stays above the $6,000 level.

Lee explained on Bloomberg that the stability of BTC at the $6,000 mark and two major catalysts awaiting BTC in the year end could push the price of BTC up substantially within the next two months.

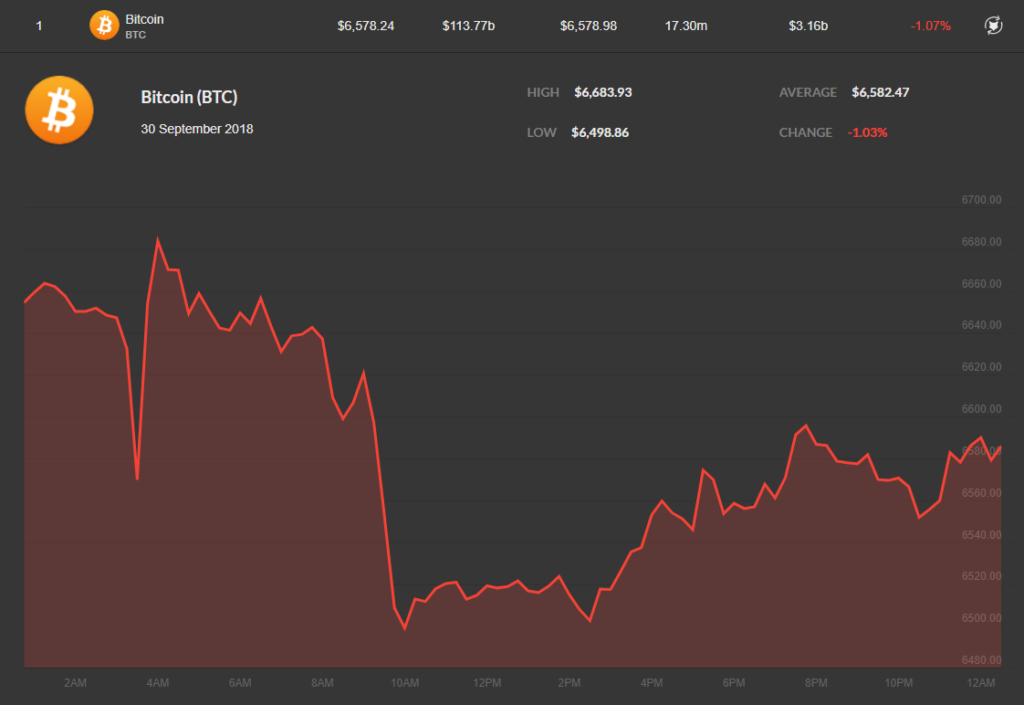

Bitcoin daily price chart on September 30, provided by Coincap.io

Bitcoin daily price chart on September 30, provided by Coincap.io

“$6,000 is a level that is more important than we realized. Earlier this year, we were pointing $6,000 as breakeven for Bitcoin mining so that level should hold. The fact Bitcoin is holding here is very good news. I think there are catalysts in the year end so I think despite the lower highs we’ve seen I think we’re starting to reverse,” Lee said.

What are the Two Catalysts?

According to Lee, two major factors will contribute to the increase in the price of BTC by the end of the year: strengthening infrastructure of the cryptocurrency exchange market and fear of missing out (FOMO) amongst institutional investors.

Over the past few months, Bakkt, a cryptocurrency exchange created by ICE, Starbucks, and Microsoft, has been building the first regulation-focused platform that primarily aims to operate as a trusted custodian and brokerage for large-scale investors.

Eventually, with the entrance of major investment banks and solid products offered by Bakkt, Lee stated that institutions will have the ability to enter the market.

But, echoing the sentiment of billionaire investor Mike Novogratz who previously stated that institutions will likely not commit to the crypto market until Bitcoin surpasses major resistance levels at $8,800 and $10,000, Lee emphasized that Bitcoin will have to show some recovery in its price before it appeals to many institutions.

“I think there is a few. One, this new exchange called ICE Bakkt will be launched. It is going to be really one of the first regulated exchanges. I think around that, there is working being done by these major investment banks to build products to support it or work with it. I think institutions are waiting to be involved,” he said.

How Will Bitcoin End 2018?

In early 2018, Lee reaffirmed his price target of $25,000 per BTC. The cryptocurrency market is quickly approaching the end of 2018 and it is becoming increasing unlikely for the dominant cryptocurrency to reach an all-time high by the end of the year.

Still, given the stability of BTC at $6,000 since late July, it is possible for the asset to show strength and momentum by November and December, a period in which the cryptocurrency market historically tend to record large gains.

Alan Zibluk Markethive Founding Member