Three Wise Investing Principles For The Current Times

.jpg)

This article explores the importance of an investment portfolio and the process of setting it up.

Why Consider an Investment Portfolio?

Perhaps one of the hardest lessons of these last two years is the realization that you can be great at what you do, and yet see all your efforts go up in smoke during economic turmoil. We live in a rapidly changing world and no industry is immune from the potential fallout of economic events.

Certainly the case for having more than one income stream has been underlined in these last two years, and being able to work online from home has taken on a new advantage. For many the idea of having an online business from home solves a lot of issues and generates money in the short term. At the same time it can be overwhelming to be wearing many hats in business without an established team around you. It is important to take a step back and put all of these things in a bigger context in terms of your life aspirations and how money plays its part in that scenario.

The Benefits of An Investment Portfolio?

There are several good reasons to consider an investment portfolio. This is not the same as portfolio income. When approached properly it helps you become proficient in financial literacy which you can pass on to your children.

Financial investments give you financial assets which can produce cash flow in the medium to long term income. Central to the theme of investments is that money is working for you rather than the other way round. It is a smart move to work in partnership with money, as opposed to simply working for it.

The key is to have a diverse portfolio across several sectors to spread the risk and create good upside potential for profits. This is what Warren Buffet reportedly did so successfully. For many the word investment may sound a bit daunting, and too long term to be a serious consideration.

Image Source: Investment Portfolio

This gives clues as to where to start. Many people are caught up with the immediate short term things, only to regret not taking a more holistic long term view. Here are three wise principles to apply to investing.

The First Investment

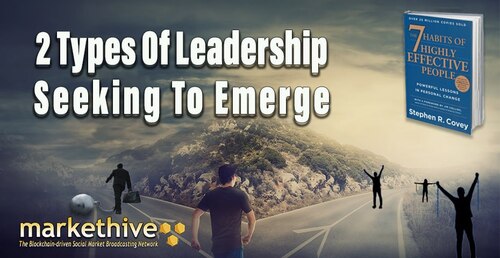

Steven Covey, author of ‘The 7 Principles of Highly Effective People’, advocates where life decisions are concerned, that you start with the end in mind and use that as a main reference point. This is all about the context in which all decisions play out.

So you need to start with yourself, and decide what you want your life to be about moving forward and build accordingly. ‘Know thyself’ is a phrase often read, but how well do you really know yourself? Take the time to do this and you will reap dividends, pun intended!!

The Second Investment

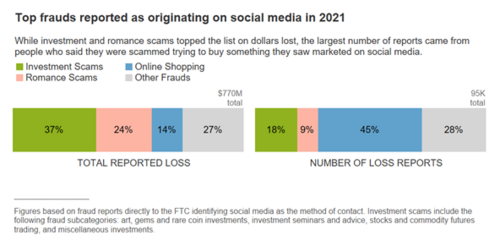

Once you have done so take the time to invest in your financial education. Financial literacy worldwide is very low, and yet significant money decisions are made everyday. This means there are likely to be far more speculators than investors involved in investing.

Teach a Man to Fish

There are many experts in investing with free videos on youtube to get you off the mark. Robert Kiyosaki is a well known expert who talks in terms of six basic rules. He uses debt to invest and get rich while reducing or avoiding taxes with this strategy. He walks through the use of other people’s money, the three types of income, financial education, investing for cashflow, risk and raising capital.

On the other hand the investment community I joined teaches the opposite in advocating not to use loans to invest. Only you can decide which path you will take, but know the ‘why’ and the consequence of each decision. Weigh up the pros and cons. This is why it is important to become educated, so you can make informed decisions.

Give A Man A Fish | Teach A Man To Fish

In the community I joined they allow you to partake in their portfolio. At the same time they encourage you to learn how to create your own portfolio, which I have since been doing. It’s a combination of two strategic approaches – ‘teach a man to fish’ and ‘give a man a fish’.

I learned about 8 Rules to govern my investment practice. I share them here in slightly paraphrased fashion so you can use these as guidance by way of developing your own portfolio.

- Know what financial independence and financial freedom specifically mean to you. In other words what figures would equate to financial independence and freedom from your perspective.

- The second rule references 5 commandments to follow. Firstly put 10% of your income aside for the purposes of investing. Always control revenue and expenditures. Protect your money from losses. Learn to invest. Learn to earn more.

- Choose your financial plan and stick to it.

- Don’t put all your eggs in one basket so to speak. Learn to diversify.

- Always keep investment discipline.

- Greed and laziness leads to bankruptcy and ruin.

- Always study investing.

- Always increase your investment deductions.

By having the above structure I was able to start developing my own portfolio. One of the key things in addition is to know your risk profile. In other words, how much are you prepared to risk when investing in something?

A positive way to rephrase this would be the price you are willing to pay for your education and research concerning that investment. For example I decided to do a certificate of deposit strategy on a new project, but since this was new, I was very risk averse, and took a conservative approach.

I put $16 in and was able to 10x it into $160 in 1.5years. I was happy because the key objective was to get some wins from sound practice rather than simply hope I would rake in a lot of money. I was able to add to this after.

One of the first things taught in investment is not to put in anything you are not prepared to lose, and yet you see many doing the opposite. For example the enticement of short term and lucrative income pulls many a speculator in, only to see a rug pull happen quite suddenly. One thing the above two approaches agree on is the importance of financial education and investing for the long-term, not just the short-term.

The Third Investment

Source Image: Wisdom

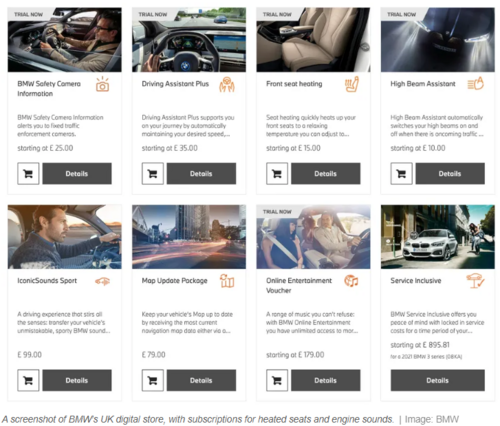

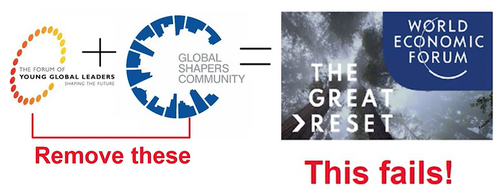

This may present controversy for some but warrants serious consideration, and that is the wisdom of ethical investing. With everything that is currently going on in the world, what principles drive your investment strategy.?

I for one will not invest in Big Pharma because their profits depend on people being sick and therefore there is both an orchestration and a monopoly to dominate the markets so that people buy their stuff. There are people whose mindset is solely on what will make them money regardless of consequences. That may be driven by a survival mentality, impatience, greed or lack of education regarding alternative and lucrative choices.

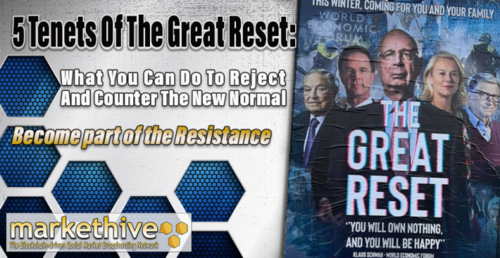

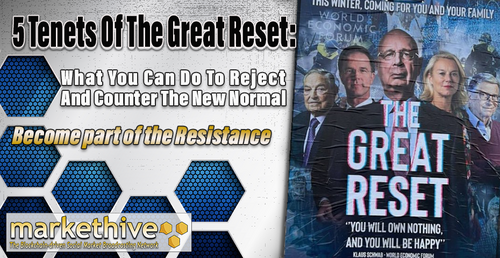

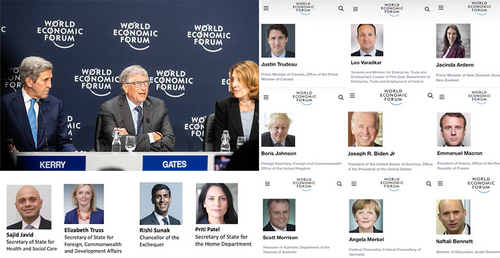

Catherine Austin Fitts is an investment banker and former US Secretary of Housing during the Bush Administration. She is the creator of the Solari Report, which is an advisory publication for investors. In many of her talks she puts investment within the context of what has been going on in the world from a political and economic standpoint. She gives a comprehensive educational assessment from an aerial viewpoint with regards the plan of the globalists and its relationship to investing.

While she is not a fan of cryptocurrency for valid reasons, her core message is an important consideration in choosing investments, because what you invest in does not just shape your life, but also impacts the political and economic landscape. The bottom line of her message is that since the globalists such as the W.E.F. and their associates are wanting to enslave us, it is incumbent that we do not ‘build their prisons for them’ because they intend to put us in them!

You don’t have to invest in the Monsanto’s of this world for example. You can invest ethically and profit while changing the structures of society for the better. In doing so you stop feeding the beast so to speak.

Types of Investment

With the above three investment tips in mind, when it comes to what to invest in, that depends on you, your educational assessment and your life governing ethical principles, as to what you choose and prioritize.

Traditionally there are different sectors such as technology, advertising, property, money, real estate to name a few. You can invest in property, technology, media, precious metals, restaurants, start up companies or already established companies. Basically any financial vehicle which creates cash flow can be considered an asset for the purpose of investing. Make sure to create your own investment criteria, by which you select or deselect investments.

As far as company investments are concerned, look at the company's vision, community, financial assets and projections, along with market statistics when assessing viability. Is it a liquid or illiquid asset? Who are the owners? Is there an advisory board? What is the benefit to society?

Maybe you decide to do a safe haven play and invest in gold as an inflation hedge. Now it is easier to liquidate gold too. Study the precious metals and decide what best fits your needs. There may be certain companies you like which you could invest in. Maybe you choose to invest in projects that you are interested in such as cryptocurrency. Currently this is like the wild west and a very volatile market. So you need to have a firm sense of how risk averse you are, while keeping a very disciplined mindset. Maybe you go for projects that have real utility or are tied to real world assets.

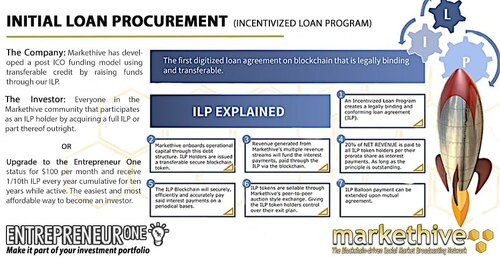

Exploration of Investments

You might wish to look into legacy projects that are trying to improve the world we live in. Markethive is an obvious example of investing in a company that is building an ecosystem for the entrepreneur to thrive. Constellation DAG is an example of a blockchain that is fast and feeless in response to the issues with other blockchains such as ethereum etc.

Image Source: Constellation DAG

Qortal is a project that is building a new internet built around privacy and accessibility. Debtbox on the other hand is a project tied to real world investments using innovative scanning technology, for example. Bobcoin is tackling unemployment in Africa and pollution with its cryptocurrency based project.

None of the above are recommendations, but hopefully will stimulate critical thinking. Know your values, develop an investment mindset, otherwise you are effectively gambling. Also think about the world you wish to create through your investment choices.

For me I am looking to bring balance to my investments to include those I wish to see become part of our future such as Markethive, and technologies that allow me to create my own banking system as part of a parallel society to the one we are currently living in.

Image Source: Markethive

Words of Wisdom

The Chinese bamboo tree has much to teach us about abundance in the long term. In the first four years there is no visible sign of growth. Yet in the 5th year when it breaks through the surface of the ground, it grows significantly to 90 feet tall within 5 weeks. So the question is posed – did it take 5 weeks or 5 years to grow 90 feet tall?

The answer is the latter because had it not been consistently watered and nurtured on a daily basis the growth spurt could not have happened. So be encouraged even if you have yet to start an investment portfolio. It is never too late to do the right thing by you, especially if it creates a legacy that will inspire others beyond your life.

Can you imagine the world we would live in if more did that, and what would happen if we started to thrive through making wise, ethical investments? This is how you change the world, one step at a time. Hold that thought, and live it out.

.png)

.png)

(10).gif)