Redefining Marketing: Markethive Leads in the Inbound Marketing Era

Staying ahead of the curve is crucial in the dynamic and ever-changing business world. In the modern business landscape, innovation and technology act as guiding forces, shaping how companies engage with their audiences and forge connections. In this era of constant evolution, a powerful synergy has emerged between two groundbreaking concepts: inbound marketing and blockchain technology. This convergence is rewriting the rules of engagement and presenting companies with unprecedented opportunities to carve out a competitive edge.

Gone are the days when traditional marketing methodologies ruled the roost. The one-size-fits-all approach of old-school marketing campaigns is gradually being replaced by a more interactive, personalized, and customer-centric approach. Inbound marketing is not just a strategy; it's a philosophy that revolves around attracting, engaging, and delighting customers by delivering valuable and relevant content. It's about creating a genuine connection with your audience, addressing their pain points, and offering solutions that resonate personally.

Amidst this transformative landscape, a standout player emerges: Markethive. This innovative ecosystem stands at the crossroads of the inbound marketing revolution and the blockchain evolution. Markethive's unique proposition lies in its ability to seamlessly fuse the principles of inbound marketing with the cutting-edge potential of blockchain. By doing so, it offers a comprehensive system that empowers businesses to connect with their target audience and build lasting relationships based on trust and transparency.

As we embark on this journey through the eras of marketing, from the traditional approaches of yesteryear to the revolutionary paradigm of today, we'll delve deeper into the facets that make Markethive a trailblazer in this space. We'll explore how its state-of-the-art technology and commitment to blockchain integration position it as a force to be reckoned with in the marketing world. So, fasten your seatbelts as we navigate through the intricacies of modern marketing evolution and the exciting possibilities that lie ahead, with Markethive leading the way.

The Dynamic Evolution of Marketing Strategies

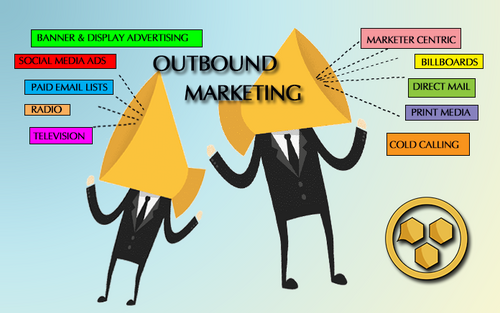

Delving into the ancient history of marketing unveils a fascinating narrative of transformation and adaptation. From the early days of universal billboards and broadcast commercials to the sophisticated era of inbound marketing, marketing strategies have been a journey of innovation, trial, and refinement. What began as a shotgun approach, characterized by mass advertising and outbound messages, has now matured into a nuanced dance of personalized engagement and interactive storytelling.

Cast your mind back to the days when marketing was synonymous with loud, one-sided conversations. Brands would deliver their messages from billboards, TV screens, and radio waves, hoping to capture the attention of a broad audience. This hit-or-miss approach often left consumers feeling like passive recipients of information rather than active participants in a meaningful dialogue. These tactics' lack of customization and relevance underscored a glaring disconnect between brands and their increasingly savvy and selective audience.

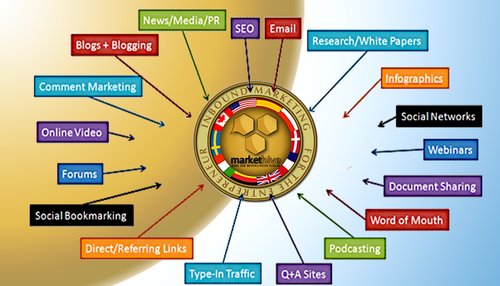

But then, the winds of change swept through the marketing landscape. Inbound marketing emerged as a beacon of customer-centricity, altering the course of how businesses connect with their potential customers. This paradigm shift responded to the changing dynamics of consumer behavior and preferences. Modern consumers no longer want to be bombarded with messages; they crave valuable insights, personalized experiences, and genuine connections.

Inbound marketing is a philosophy that turns the tables on traditional approaches. Instead of flooding the masses with messages, inbound marketing seeks to attract, engage, and delight potential customers through meaningful interactions. It's a strategy rooted in empathy, understanding, and value creation. By delivering content that addresses their target audience's specific pain points and interests, brands can establish themselves as trusted advisors rather than mere promoters.

The beauty of inbound marketing lies in its ability to align seamlessly with the evolving preferences of modern consumers. It's not about pushing products; it's about forging connections. It's not about one-size-fits-all; it's about tailoring experiences. In an age where consumers have the power to filter out unwanted noise, inbound marketing opens the door to authentic conversations and valuable exchanges.

As we navigate through this dynamic evolution of marketing strategies, it's clear that the journey is far from over. The landscape continues to shift, driven by technological advancements, changing consumer behaviors, and societal trends. But one thing remains certain: the heart of effective marketing beats to the rhythm of connection, relevance, and engagement. As we embrace this new era of marketing, one thing is for sure: the consumer is at the center, and the businesses that listen, adapt, and engage are the ones that will thrive.

The Power of Inbound Marketing

Imagine a world where businesses aren't just vying for attention with flashy ads and intrusive pop-ups, but rather, they're earning attention by offering solutions to real problems. That's the essence of inbound marketing. By crafting content that addresses pain points, answers questions, and gives insights, businesses become more than just sellers; they become trusted sources of information and assistance.

The transformative power of inbound marketing becomes even more pronounced in today's digital age. Thanks to the rise of social media, businesses now have direct access to their audience, enabling authentic interactions and meaningful conversations. No longer are companies limited to a one-way communication channel. Instead, they can engage, listen, and adapt in real-time. This has ushered in a new era of marketing where feedback isn't just welcomed; it's actively sought after.

But the impact of inbound marketing isn't solely about engagement; it's about building relationships. When content resonates with the audience, it sparks a connection beyond transactional exchanges. It establishes a bond based on shared values, common interests, and a genuine understanding of the audience's needs. This connection drives customer loyalty and advocacy, turning satisfied customers into brand ambassadors.

Consider the scenario where a fitness enthusiast comes across a series of blog posts from a sportswear brand. These posts provide workout tips, nutritional advice, and success stories from fellow enthusiasts. By offering this valuable content, the brand positions itself as more than just a seller of athletic wear; it becomes a partner in the journey towards a healthier lifestyle. This emotional resonance is what sets inbound marketing apart. It creates a narrative that customers want to be a part of.

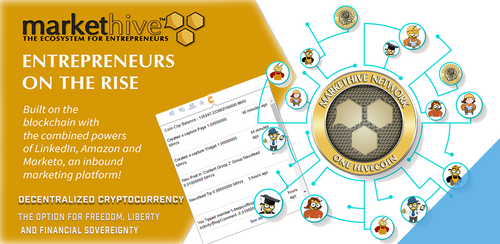

Markethive's Innovative Approach

At the crossroads of innovation, where the worlds of inbound marketing and blockchain technology converge, lies Markethive, a platform that is rewriting the rules of engagement. It's not just a platform; it's a visionary approach that melds the power of inbound marketing, the potential of blockchain technology, and the strength of a vibrant community, all fueled by its very own cryptocurrency, ‘Hivecoin.’ This cryptocurrency isn't just a digital token; it's a symbol of collaboration and a medium of exchange for ideas, services, and value.

Visualize a terrain where traditional marketing techniques are no longer sufficient, customer relationships are not just transactions but genuine connections, and security and transparency are paramount. This is the landscape that Markethive is helping to shape, offering a fresh perspective on how businesses can interact with their audiences.

Inbound marketing, the heartbeat of Markethive's strategy, is all about creating meaningful interactions. It's a departure from the one-way communication of old marketing methods. Instead, it's a conversation, a dialogue, and a relationship-building endeavor. Markethive recognizes the power of this approach and has harnessed it to its fullest potential. Through the platform's array of tools and features, content creation becomes an art, and engagement transforms into a science.

But Markethive doesn't stop there. It goes further, embracing blockchain technology and redefining the foundations of trust and security. Blockchain, often associated with cryptocurrencies, is more than that; it's a technology that brings accountability and immutability to the digital world. Markethive seamlessly integrates blockchain's capabilities, ensuring that data remains private, transactions are tamper-proof, and interactions are verifiable.

What sets Markethive apart is its community-driven ethos. It's not just a platform for marketers; it's a living, breathing ecosystem where individuals with diverse talents and goals come together to thrive.

So, when you look at Markethive, you're not merely seeing a platform; you're witnessing a paradigm shift in how marketing, technology, and community intersect. It's a place where creativity meets security, transactions are infused with trust, and a global community comes together to shape the future of engagement. This is Markethive, an innovative fusion of ideas, technology, and humanity, redefining how we approach marketing and community collaboration.

The Multifaceted Advantages of Markethive

When exploring the advantages that Markethive brings, one quickly realizes that this platform is a true game-changer in more ways than one. Beyond its surface appeal, Markethive's multifaceted benefits resound through the core of modern marketing and networking dynamics. In this era where data is as precious as gold, Markethive harnesses the power of blockchain technology to provide a level of assurance and security that is nothing short of revolutionary.

In a world with its fair share of data breaches and privacy concerns, Markethive stands tall as a fortress of data security. The seamless integration of blockchain technology within the platform serves as a reassuring shield, safeguarding user information against the prying eyes of malicious actors. The inherent transparency and immutability of blockchain deter unauthorized access and offer users the peace of mind they deserve. This is more than just a feature; it's a testament to Markethive's commitment to building a haven for its users.

Beyond data protection, Markethive takes decentralization to a whole new level. In an age where governments use businesses to dictate the rules of engagement and achieve their control agenda by proxy, Markethive flips the script. The decentralized structure of the platform puts the reins back in the hands of the users themselves. No longer confined to the dictates of third parties, users are empowered to direct their interactions, forging connections on their terms. This enhances user autonomy and ushers in an era of authentic engagement.

One of the most intriguing facets of Markethive's approach is its ingenious way of turning content creation and sharing into a rewarding endeavor. In a landscape where attention is a currency, Markethive elevates this concept by enabling users to monetize their contributions. Imagine earning tangible rewards for sharing your insights, creating content, and engaging with a community that values your input. Markethive transforms your actions into currency, making every interaction a step towards potential earnings.

Markethive is a game-changer because it's powered by the strength of people coming together. The company is on a mission to give you an edge that's seriously unfair in the best way possible. Imagine being part of a movement that reaches billions through social networks and gets you top-notch SEO results in a snap. That's the kind of power we're talking about.

The system is jam-packed with features that are designed to help you succeed. The autoresponders here are even better than what you'd find in popular services like Aweber, and the capture page technology is out of this world, ensuring you capture leads like a pro. And speaking of leads, there are widgets that make subscription a breeze for your capture pages and WordPress sites.

The blogging systems are designed for massive reach. Your visitors can easily subscribe and spread the word through their social networks. And there’s an auto-posting feature; we're talking about reaching millions, even billions, on platforms like Facebook, LinkedIn, Instagram, and more. Results? Yep, you're gonna see them with mind-blowing ROI.

Inbound marketing is the way to go. More than 90% of your potential customers search the web, and a whopping 80% of their purchasing journey happens before they even contact you. That's where Markethive comes in, helping you understand your customers and guiding them straight to your website. Attract leads, nurture them, and turn them into loyal customers. That's the power of inbound marketing. And with Markethive, you're not just getting a platform but becoming part of a movement. Several other services are in the works, so whether you're starting or ready to take your business to the next level, Markethive is here to support you. Your success is our success, and with Markethive, you've got a partner who's got your back every step of the way.

It's worth noting that the extensive censorship on various social media platforms and the concerning actions of governments that seem to limit people's freedoms, Markethive provides an exciting solution. Markethive creates an environment where people can truly express themselves without fearing censorship or suppression. This merging of ideas and technology promises to allow individuals to communicate, connect, and collaborate without facing the hurdles often accompanying the virtual landscape.

Markethive aims to establish a space where creativity and dialogue can flourish unhindered, promoting an atmosphere of openness and unrestricted exchange of thoughts and ideas. By acknowledging the concerns surrounding censorship and the desire for personal freedoms, Markethive is positioning itself as a potential solution, offering a platform that aspires to preserve the essence of free expression in an ever-evolving digital world.

Navigating the Future

As digital marketing has become essential in today's business environment, businesses constantly seek efficient ways to reach their target audiences—Markethive steps in by offering a suite of inbound marketing tools designed to address these challenges head-on. Unlike traditional outbound marketing, where messages are pushed to consumers, inbound marketing focuses on attracting potential customers through valuable content and experiences.

Markethive's arsenal includes systems and tools like blogs, email autoresponders, e-commerce stores, banner advertising, press releases, boost, video advertising, broadcasting, franchised news sites, and analytics that empower businesses to craft engaging content and strategically share it across various platforms.

Businesses can streamline their marketing efforts and achieve a more significant ROI by offering a comprehensive toolkit that covers content creation, social media management, analytics, and community engagement. This approach aligns well with consumers' evolving preferences, who value authenticity and personalized interactions.

One of Markethive's standout features is its emphasis on community building. Businesses can thrive by connecting with like-minded individuals, networking within their industry, and fostering meaningful relationships. This communal approach enables trust and credibility, which are crucial components of successful marketing campaigns.

Markethive's potential to surpass the tech giants lies in its commitment to addressing the pain points of modern marketing. Markethive's innovative solutions have the potential to propel it beyond Facebook, Twitter, and LinkedIn. Its focus on inbound marketing, community building, and blockchain technology sets it apart as a platform that understands and addresses the evolving needs of businesses in the digital age. As we navigate the future, it's exciting to witness how Markethive could reshape the landscape of social media and marketing.

Final Thoughts

Markethive is like a fresh breeze in the world of marketing. It's an ecosystem that mixes modern marketing ideas with the power of blockchain technology. This lets marketers do their thing, keep their data safe, and make real connections. Markethive is all about changing how we do marketing, and it's a sign of how new and exciting ideas can shape industries for the better.

The company's unique positioning as a pioneer in this space underscores the platform's commitment to reshaping marketing practices for the better. As we look ahead, it's clear that the fusion of these dynamic forces will define the trajectory of marketing in the digital age, and Markethive is the pioneering force.

.png)

(32).gif)

(31).gif)

.png)

.png)

.png)