The Draper family is well-known to the Bitcoin community.

Tim Draper is one of the most active investors in the Bitcoin ecosystem: back in 2014, he bought 30,000 BTC as part of the government auction and up until now he is said to keep purchasing Bitcoin and to own Ether. Besides, he used his reserve of Bitcoin to fund the startups of Boost VC (with 300 BTC each), his son Adam Draper’s Virtual Reality, Blockchain and Bitcoin venture capital firm.

However, Tim has recently announced his readiness to take one step further in his relationship with the crypto world and participate in ICO – of a company called Tezos, a “new Blockchain platform launched by a husband and wife team with extensive Wall Street and in hedge fund backgrounds.” Not so long ago Boost VC also followed his footsteps and wrote in a blog post that they were willing to invest directly in ICOs.

In an exclusive interview to the Cointelegraph at Arctic15 in Helsinki, Billy notes that for the Drapers ICO is a new opportunity. “In the last month and a half, we have seen a lot of ICOs,” explains Billy Draper, Tim’s son and currently a Partner at Draper Associates. “Since Gnosis, in the last month we have seen six or seven opportunities either asking us to participate, or to market, or do something, but we’ve been still sorting it out.”

Addressing to the crypto community, Billy notes:

“You have changed the whole dynamic of funding. You have taken the best parts of Kickstarter, the best parts of Venture Capital, the best parts of tech community, and you said: Hey, we are going to release a new token, this token is going to be used specifically for making predictions, and all the engineers who are interested in that come buy those tokens, and then you can increase the value of those tokens by building applications on our token.”

Billy Draper is the one responsible for seed-stage investments in companies such as Robinhood, Laurel & Wolf, Tempo Automation, and LawTrades. He is in charge of sourcing and driving investments across all sectors, with some slant towards financial technologies, marketplaces, and logistics. Prior to DA, he worked in Operations at Facebook and Product Design at ApartmentList. He was named to the 2016 Forbes '30 Under 30' List for Venture Capital. “And because you bought that application, the price or the value of that currency goes up,” he continues. “And there is something so beautiful about that – that is why we are excited about crypto in general and now we are actually starting to think about ICOs.”

Is it going to be Bitcoin and Ethereum forever?

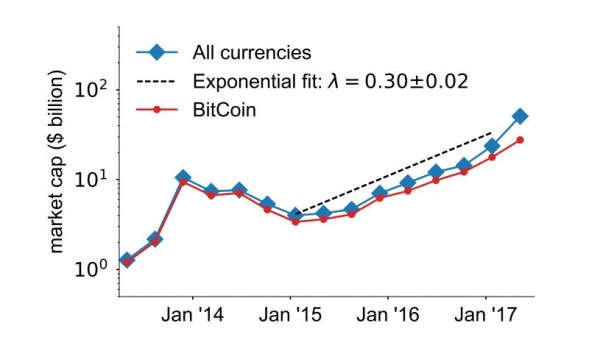

Billy admits that cryptocurrencies are probably relatively small and it’s not the focal point of the fund yet even though they do look for deals in crypto – Bitcoin, Blockchain and ‘whatever the next token is’. “We know that there will be a sort of cryptocurrency revolution, it has already started, this is no longer a science project,” he says. “This is now huge multibillion dollar industry if you take a look at the the market cap of Bitcoin, Ethereum, and now Ethereum is worth a few billion dollars, and people are building token on top of Ethereum.” However, the question that comes – Is this going to be driven, is this sort of the revolution in crypto going to be driven by 25 different cryptocurrencies or a hundred different currencies? Or is it going to be the winner takes it all?

“The reasons why new tokens pop up is because they find problems with the old ones or perhaps not problems, but opportunities to build a currency more focused on solving one problem – governance, or smart contracts, or anonymity,” Billy continues. “Another thing I like about other currencies popping up is that now Bitcoin is the gold standard to buy into the other cryptocurrencies.” The Drapers do believe that there is something behind Bitcoin and Blockchain tech in general. On the one hand, they have inherited connections and wealth from their father and grandfather. But on the other hand, they have been raised with “anything-is-possible” mentality, the Silicon Valley’s spirit of individualism and relentless optimism.

Billy shares his optimism about cryptocurrencies:

“It is not because cryptocurrency is a cool new thing – it is because of there is an incentive structure, it’s because you are taking some of the smartest engineers in the world. The coins that fail are going to be those that don’t have real world applications, the ones that are going to be successful are the ones that fulfill the promise.”

For venture funds, it would be better if cryptocurrencies and ICOs were regulated because that would make investors feel safer. Right now there is no legal ground, so you can’t ask for your money back. “We would definitely be worried about the bubble, but there is also a fear of missing out, and you have to believe in the promise,” Billy notes. “Not necessarily in the whole market of crypto but you have to believe in the promise just like people now believe in the promise of Bitcoin and Ethereum. So yes we would be worried about the bubble but just like everyone. But I don’t think we could live our lives worrying about that.”

How to invest in ICOs and cryptocurrencies, what to consider

In the early 1980s, Tim Draper was exploring the opportunities of Silicon Valley – he had an engineering degree from Stanford and a diploma from Harvard Business School and so he was trying to figure out what to do next. He started his own firm, which later became the founding investor in Baidu and Tesla Motors and backed the likes of Hotmail and Skype. They say it is the ‘Draper luck’. “If you talk to all the great venture capitalists in the history, all of their failures have been failures to act,” explains Billy. “It is not like I invested into something and It went to zero. Because you can invest in something that goes to zero, but then you can invest in something that goes to thousands, so one X downside, thousand X upside.”

He points out that we could always talk ourselves out the investment, just like we are going to talk ourselves out of an ICO, or investing money directly into cryptocurrency, or a platform built around the cryptocurrency, but the potential opportunity we would miss is what would drive us crazy. Right now ICOs are small projects with sometimes not very experienced teams who are doing mostly marketing, raising up millions of dollars without having a product. You can get the interest really high in the ICO: you do the offering, you limit the number of tokens, you create a supply on the marketplace and then you could drive up the price because of who is involved and who is building but eventually the apps have to be built. What is important is that the promise has to be fulfilled.

“When it comes to ICOs, the criteria would be if you are an investor interested it is not hard to reach out to these people, if they have a white paper, they usually have contact, if they want questions, they want to be challenged,” says Billy. “You need to believe in the team and the team should be aware of that and the team shouldn’t try to hide behind wherever and more people do that. This is very encouraging, they publish a whitepaper saying hey contact us, this is how we are going to do this, how we are going to implement this, this is the background that we have.”

Billy also recommends investors to diversify and participate in several ICOs to make sure their crypto portfolio has some exposure to some other currencies. They should understand how the market is going to function, that this crypto could go to zero, it could fail, it could be dead, or there is a bigger risk, which we don’t typically have to deal with which is it could be stolen. “What I would do is probably work with the crypto expert, who I trust and ask him if he would consult me and make sure I do it in the right way,” he says. “You look at what applications could be developed for it, so why does this exist, what is the specific use for this that can’t be done elsewhere and if those applications were to be built, what is the market size of that, based on the market cap, then you would approach it the way we approach startups.”

Billy concludes by saying that team and real world application are the two criteria for a success, the real world applications that people need to connect. Previously, in the Cointelegraph we have covered several examples of how real world economy can benefit from the crypto economy. The latest case of such type of a project is Primalbase, which claims to transform traditional office rental into a new-generation community-based ecosystem where one can share, sell or rent out high-quality office spaces using Ethereum and Waves-based digital tokens. In other words, it’s distributed workspace for the tech community in the manner of WeWork but in crypto tokens.

Billy Draper says about it:

“That’s cool, they found a real world application, and that’s what we want to see – we don’t want to see more coins in the world. That is a game-changing thinking, the same with real estate. Renting out these tokens? That is how you start the real revolution, that’s how things will go from Bitcoin sort of still crypto community which is getting bigger.”

We end our conversation with Billy with asking for a general advice about cryptocurrency investment. And he tells us that the best way to start with is to learn about cryptocurrencies that you think are the most interesting, the specific ones. Then you should start trading them, in some small way – you don’t have to start with a huge million dollar investment in a cryptocurrency. You should start to feel and understand the volatility of the market, to understand what drives the market and how you can play into that.

He concludes:

“I would suggest just like with anything – make sure you know what you are getting into, so there are no surprises, and if the token goes to zero, that’s the risk to take. And on the upside make sure you are investing in a token you believe in. If you are trying to pick winners, make sure you pick winners that you feel very comfortable about what they are going to develop.The key is user education, just make sure you understand what you get into, there is a certain risk.”