Solana Gains Momentum Defying All Odds. SOL Set For Serious Gains

Many altcoins have experienced significant declines exceeding 40% since March, yet a few have shown remarkable strength. Solana stands out as one of these resilient altcoins, prompting speculation about its potential for a bullish surge once the cryptocurrency market reaches a parabolic phase. In this article, we will explore Solana's recent developments and discuss the possibility of SOL reaching new heights in the upcoming months. Whether you are already invested in SOL or contemplating adding it to your portfolio, this information is essential reading.

Significant developments have unfolded in the brief span of three months since the last Solana update. Notably, Solana surpassed Ethereum regarding stablecoin trading volumes, a milestone achieved during a mini-surge in altcoins in March, and Solana was a vital driver of this trend. Notably, SOL’s value peaked just before the FTX estate revealed its plan to offer 41 million SOL tokens to investors at a substantial 68% discount, amounting to approximately $7.6 billion.

FTX completed its over-the-counter (OTC) sales in May, but a crucial aspect to consider is that these deals are tied to a four-year vesting period. This means that when the buyers eventually sell their SOL, they will likely face minimal albeit steady selling pressure.

Solana Memecoins, Payments

Solana's surge in popularity can be attributed to the numerous memecoins created on its platform, particularly after the launch of Pump.fun memecoin generator in March. This memecoin hype caused a significant increase in transaction fees, which led to Solana surpassing Ethereum in terms of fees generated. However, the high volume of memecoin transactions caused congestion issues on Solana's blockchain, and despite not experiencing any actual outages, it was severely impacted, rendering the network nearly unusable.

Congestion problems first appeared in April and have since been a significant factor in the fear, uncertainty, and doubt (FUD) surrounding SOL’s price. Solana's validators then implemented a technical upgrade to address the congestion problems, yet they continue to affect some users. Despite this, institutional investors remain unfazed and continue to include SOL in their crypto portfolios.

According to a report by CoinShares, 15% of institutional investors surveyed have raised their investments in SOL since the beginning of the year. Some of these investors likely obtained their exposure through FTX OTC sales. Another positive development for Solana occurred in April when it was announced that Stripe, a major payment processor, would enable USDC payments on multiple blockchains, including Solana.

The importance of Solana's self-positioning as a blockchain for crypto payments cannot be overstated. The announcement in May that PayPal had introduced its PYUSD stablecoin on Solana's platform is particularly noteworthy. In an open letter, PayPal explained its decision to build on Solana, highlighting the network's rapid finality and low fees. Additionally, they emphasized their intention to utilize PYUSD on Solana for commerce and payment purposes, citing its confidential transfer feature. This development could catapult Solana's value to unprecedented heights, with stablecoin payments emerging as a game-changing use case.

June was a whirlwind of activity for Solana. Following the news of its collaboration with PayPal, institutional investors significantly increased their investment in SOL. But they weren't the only ones eager to get in on the action—Circle, the issuer of USDC, also revealed plans to introduce enhanced stablecoin features on the Solana platform.

It’s worth mentioning that Solana is identified as the designated blockchain platform for USDC, as stated in a blog post by Circle. The current status of this arrangement is uncertain following the dissolution of the Center Consortium in August 2023, which was composed of Coinbase and Circle.

Solana Enhancements, ETFs, Regulations

Solana has made significant iterations, including introducing Solana Actions and blockchain links (Blinks). These innovative tools enable seamless integration of blockchain transactions into various platforms, providing a user-friendly Web3 experience. With Solana Actions, users can efficiently execute on-chain transactions across different platforms, including websites, social media, and physical QR codes, allowing for enhanced flexibility and convenience.

With Solana Blinks, any action can be converted into a shareable link, enabling any website or platform that supports URLs to initiate a Solana transaction using a Solana wallet. This innovative feature seamlessly integrates on-chain transactions into various online platforms, including websites and social media, eliminating the need for users to navigate away from their current page. Thus, decentralized apps become more accessible, intuitive, and user-centric. Most would say that’s pretty remarkable!

However, what’s not so remarkable is the concerning development of the CFTC, which is investigating Jump Crypto, a crucial entity within the Solana network. Jump Crypto has played a vital role in shaping Solana's infrastructure, having contributed to the creation of the Pith Network Oracle and the Wormhole bridge and collaborating on the development of Solana's Fire Dancer client. The potential implications of this investigation on Solana's growth are uncertain. They may hinge on the extent to which other companies within the ecosystem are involved in developing Fire Dancer.

Thankfully, the attention Solana received regarding the Jump Crypto CFTC investigation has been overshadowed by the announcement that VanEck had applied for a Solana ETF in June. Nevertheless, despite the recent greenlighting of similar ETFs for Ethereum, industry insiders believe it's unlikely that Solana will receive ETF approval anytime soon.

However, several analysts have pointed out that the approval of a SOL ETF may become more feasible if there is a change in the presidential administration following the November elections, as this could lead to a shift in leadership of the SEC. Despite being a challenging prospect, a growing consensus across party lines in Congress supports cryptocurrency. Bloomberg ETF analyst Eric Balchunas emphasized that the deadline for the SOL ETF approval is expected to be around March next year. Additionally, 21Shares submitted an ETF application after VanEck, and it is anticipated that other asset managers may also pursue similar ETF offerings, opening up exciting possibilities for SOL's future.

Predictions regarding the impact of a potential SOL ETF on the price of SOL vary widely, similar to the discussions around Bitcoin and Ethereum ETFs. While some forecasts suggest that the ETF may have minimal influence on SOL's price, others anticipate a significant surge, possibly exceeding its current value by nine times. One piece of evidence supporting the bullish outlook is the substantial premium at which Grayscale’s Solana Trust (GSOL) is trading in comparison to its net asset value, indicating institutional optimism.

According to CoinBureau's crypto specialists, SOL's optimal price ceiling during a strong market surge is estimated to be around $1200. Notably, this forecast aligns with the 9x growth predictions made by other industry experts, and those ETFs will likely launch when the crypto bull market reaches its most enthusiastic and optimistic peak, potentially leading to a significant surge in SOL's price.

SOL Price Outlook

SOL has been an outlier among altcoins, bucking the trend of recent price crashes. Instead, it has been trading within a tight range of $130 to $200 since late February. It is essential to highlight that a similar scenario is observed with Bitcoin, Ethereum, and other major altcoins. Typically, periods of consolidation are followed by significant breakouts either above or below the established range.

The chart above indicates that SOL could reach $300 if it breaks out upwards in the upcoming weeks or drop to $90 if it breaks out downwards in the same period. However, predicting the direction SOL will take is not determined by knowing its potential high or low points. To resolve this, we need to examine the factors influencing the new supply, such as selling pressure, and the factors driving demand, known as buying pressure.

The price is influenced by supply and demand dynamics. SOL's supply has reportedly risen by approximately 20 million units over the past three months. If all the newly supplied tokens were sold, SOL trading at an average price of $150 could have resulted in up to $3 billion worth of selling pressure in under four months. However, despite this significant supply increase, the demand for SOL seems even more extraordinary.

A few key statistics to consider:

- Notably, the Phantom wallet has surpassed 4 million downloads, marking a significant milestone. It was reported to have reached 3 million downloads just a few months prior, as highlighted in a recent Solana updates article, showcasing its rapid growth.

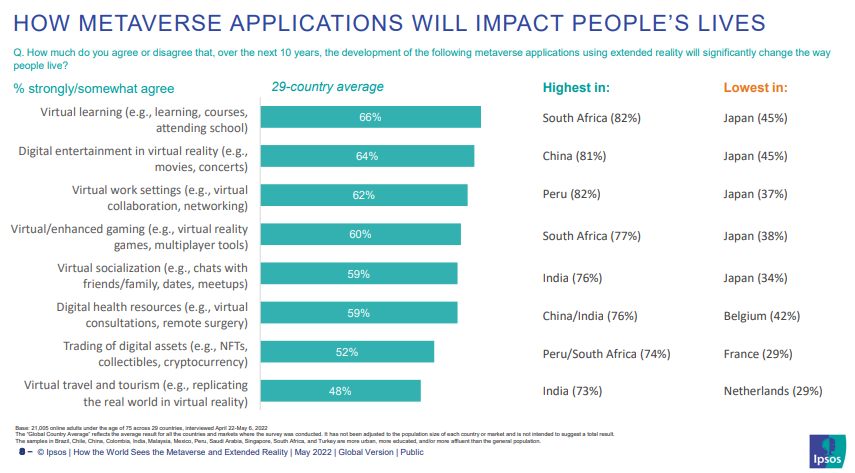

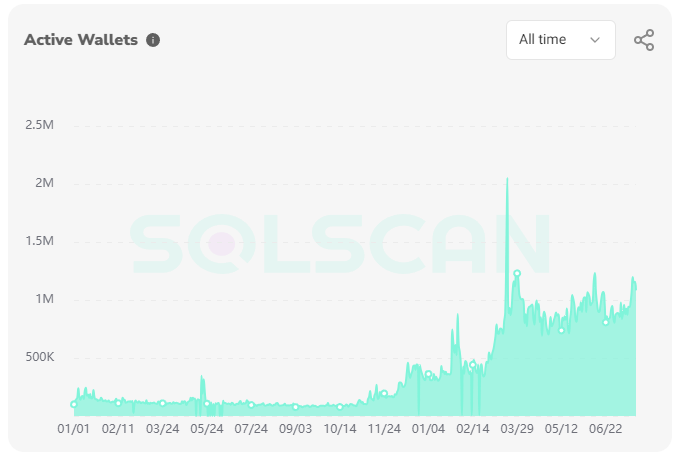

- DAP radar indicates that Solana has recorded over 5.5 million unique active wallets in just three days. This figure represents four times the 1.4 million wallets recorded in March. Additionally, DApp Radar has observed a 50% rise in active wallets within the past month.

- Solana's DeFi protocols have maintained a total value locked of approximately $4.7 billion, even as the price of SOL has dropped by 20 – 30% from its recent peaks. This is noteworthy as it indicates that fresh funds are flowing into Solana's DeFi protocols despite the decrease in price and the overall negative market sentiment.

- Furthermore, this trend is supported by data from Solscan's analytics page, which shows that the daily number of active Solana wallets has remained stable, hovering around the 900,000 mark.

Solana’s Roadmap And Catalysts That Could Boost SOL

Returning to SOL's current and future price action, its resilience can be attributed to the strong demand aspect of the supply-demand dynamic. The ongoing uptrend in the factors driving demand indicates a greater likelihood of SOL breaking higher. Put simply, there is a higher probability of SOL surging to $300 in the coming weeks than plummeting to $90, representing a significant 50% increase from its current value. However, it's important to note that a break above $200 is required for this scenario to play out, and that would need a catalyst to trigger it.

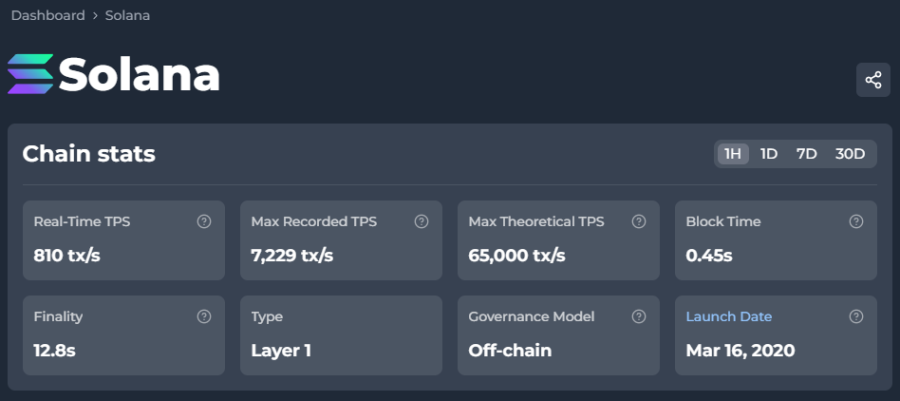

It just so happens that Solana has a slew of forthcoming milestones that could act as a growth catalyst. One of the most significant is Fire Dancer, a cutting-edge validator client generating much buzz. To provide a quick update, Fire Dancer is a game-changer because it has the potential to enhance Solana's speed significantly. A member of the Fire Dancer team shared that it will initially boost Solana's transaction capacity to 20,000 transactions per second (TPS) with plans to increase that number to a whopping 1 million TPS gradually.

Solana has achieved a peak speed of approximately 7,000 TPS to date. However, its maximum potential TPS is believed to be around 65,000. A Fire Dancer team member disclosed that the actual figure is nearer to 200,000 TPS. Nevertheless, exceeding the indicated TPS level brings about significant challenges, implying that scaling up to 1 million will necessitate additional modifications.

Concerning the project schedule, Anatoly Yakovenko, the founder of Solana, has repeatedly stated in interviews that his team aims to launch the initial version before the September Breakpoint conference. The recent announcement of a bug bounty program for Fire Dancer suggests that the release will likely happen sooner rather than later. However, it’s worth noting that Jump Crypto, a company assisting with the development of Fire Dancer, is currently under investigation by the CFTC, which may impact the project's timeline.

Additionally, Solana has experienced a string of technical problems in the past. A team member from Solana's Jito validator client recently shared in an interview that Fire Dancer may also face some challenges. If Fire Dancer propels SOL above the $200 mark, the driving force behind its surge past $300 will likely be unveiled at Breakpoint.

Notably, previous conference announcements have significantly impacted the price. In addition to Fire Dancer and any other announcements to be made at the conference, Solana has two other important events coming up that could increase the value of SOL. One of these is creating a formal on-chain governance structure, a topic discussed in Solana’s forums.

A well-defined governance framework can help Solana shift towards a more decentralized model, which may alleviate the regulatory pressure the SEC has exerted on it. In case you missed it, the SEC has identified SOL as an unregistered security in its legal actions against major cryptocurrency exchanges Binance and Coinbase.

A crucial upcoming development that could propel SOL's growth is the potential passage of stablecoin-related legislation in the US, although its timing is uncertain. Austin Federa, Solana Foundation's strategy head, recently asked crypto-friendly politician Bill Haggerty in an interview about this matter. Unfortunately, Haggerty's response suggested that the regulatory approval process would be prolonged due to ongoing Democratic opposition in the Senate despite widespread bipartisan support. This delay may be why major SOL stakeholders have been increasing their financial backing of Republican candidates.

The outlook for Solana over the next eight months is quite eventful. With Fire Dancer on the horizon, followed by the pivotal Breakpoint event, upcoming stablecoin regulatory developments (should the Republicans prevail in the November elections), and a potential ETF launch early next year (again, contingent on a Republican win), the path is paved for SOL to potentially reach the $1000 mark before the crypto market's bull run concludes. However, achieving this feat will hinge on various external factors beyond Solana's control falling into place.

Solana Challenges

One of the primary obstacles facing Solana is regulatory issues. Despite the optimism around stablecoin payments, the negative impact of the Jump Crypto CFTC investigation cannot be ignored. If the legal proceedings escalate to the point where Jump is forced to reduce its involvement in the cryptocurrency sector, it could have significant consequences. This scenario is not merely a matter of speculation.

The leader of Jump's crypto business resigned recently. If a major company within the Solana network reduces its operations, it could considerably delay the progress of Fire Dancer and similar projects. The Securities and Exchange Commission's (SEC) continued examination of Solana as a financial asset is expected to persist for the foreseeable future. Moreover, if the Democratic party gains control of Congress in the upcoming election, Solana can likely expect even more rigorous oversight.

Solana faces a second hurdle: stiff competition. With its impressive speed, it's easy to overlook that it's not the only high-performance Layer 1 blockchain on the scene. Rivals like Aptos and Sui, dubbed "Solana killers," are rapidly gaining traction in the Layer 1 space. Anatoly has publicly expressed concerns about these projects' threats, and for good reason. The technology behind Aptos and Sui has been years in the making, originating from Facebook's Libra project, underscoring the significant resources and expertise behind these emerging competitors.

In any case, Aptos and Sui possess a dual advantage, boasting cutting-edge technology and established connections. Furthermore, developers have found the Move programming language highly accessible and easy to work with. Although Aptos and Sui have not yet reached the same level of adoption as Solana, any technical glitches experienced by Solana could prompt a mass exodus, similar to how alternative platforms gained traction when Ethereum's high gas fees became prohibitively expensive.

This leads to the third hurdle, namely development complexity. Solana's developers, including Anatoly, often joke that building on Solana is as painful as "chewing on glass," making it precarious when rival platforms offer seemingly effortless coding experiences. A notable example is Soulend, formerly one of Solana's most prominent DeFi protocols, which has opted to deploy on Sui as Suilend. While this doesn't imply that Solend has completely abandoned Solana, it does suggest that developers and projects within the Solana ecosystem are actively exploring alternative blockchain options.

The Bottom Line

Despite everything mentioned, Solana stands out as a leading cryptocurrency project, and its native coin, SOL, is expected to achieve significant growth in the near future. If Solana successfully tackles its obstacles and achieves its milestones, SOL could pleasantly surprise investors. Many experts in the crypto space share this sentiment, predicting that Solana will be among the top-performing large-cap cryptocurrencies.

Some believe that SOL may even lead the pack regarding percentage gains, which could positively impact the altcoins within the Solana ecosystem. They may also witness substantial gains compared to their counterparts, potentially leading to impressive growth.

Many will know that Markethive’s token, Hivecoin (HVC), has been successfully integrated into the Solana blockchain. Solana stands out as the only blockchain capable of meeting the massive demands of Markethive's decentralized social market broadcasting network, which generates ever-increasing amounts of data and content. Other blockchains lack the technological capabilities to support an application of this scale and complexity.

Projects like Markethive that have pioneered a specific field and offer genuine utility to the broader community possess a unique advantage. Markethive belongs to the category of first movers and provides a wide range of practical applications, enabling it to gain a significant portion of the market.

Leveraging Solana's technology, Markethive is well-positioned to become the premier choice for a decentralized, uncensored platform that integrates all aspects of social media, marketing, broadcasting, publishing, eCommerce, and business facilitation thereby creating a thriving entrepreneurial ecosystem for individuals from all backgrounds.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

.png)