The Remarkable Influence of Markethive E1 Subscribers

If you are one of the Markethive E1 subscribers who have been supporting the development of this innovative social network, you deserve a big round of applause. Your monthly contributions have helped build a powerful ecosystem that is transforming the way people communicate, collaborate, and professionally grow online. You are part of a visionary group shaping the internet's future.

Markethive is a social network with a purpose. Its purpose is to empower entrepreneurs, freelancers, artists, activists, and anyone who wants to make a positive impact in the world. The company respects your privacy, rewards your participation, and gives you access to cutting-edge tools and resources to help you achieve your business and personal goals.

Thanks to your support, Markethive stands out as a genuinely unique player in the world of social networking, inbound marketing, and cryptocurrency. It's a unique space where entrepreneurs connect and grow their businesses in a safe and supportive environment. And guess what? It's all made possible by your fantastic contributions, our noble investors.

Your monthly support isn't just about the numbers; it's about fueling the development of new features, improving the user experience, and broadening the platform's reach. This has turned Markethive into a social network that's truly one-of-a-kind. And you know what? It's all thanks to you.

When you invest in Markethive, it's not just about backing a platform; it's about supporting a movement. It is a movement dedicated to empowering entrepreneurs and helping them thrive in today's digital economy and a movement for you to attain financial freedom. Your monthly contributions are the powerhouse behind this incredible social network, and we're here to illuminate the extraordinary journey we've embarked on together. Cheers to building something extraordinary!

A Social Network with Heart

Markethive is a God-given vision that has a vibrant community with a beating heart. What truly makes Markethive stand out goes beyond its features; the authentic sense of community sets it apart. And guess what? You, with your unwavering commitment, are the reason behind this unique environment where members aren't just users but a supportive family.

In this community you've helped create, people don't just navigate through features; they support each other, share valuable knowledge, and cheer for each other's successes. Markethive, in essence, is more than a mere platform; it's a family, and you're the driving force behind the warmth and connection of this company.

Through your dedication, you've carved out a space where individuals from all walks of life can connect and grow together. It doesn't matter where someone comes from, how much experience they have, or what their goals are, Markethive is a place where everyone is welcome. It transcends being just a social network; it's a movement, and you, my friend, are the catalyst for this transformative change.

You have helped build a magnificent sanctuary that isn't just a space to market products or services; it's a place where meaningful relationships are formed, new skills are learned, and contributions to the common good are made. Markethive has evolved into more than just a social network; it's a hub of shared passions, and you are the reason behind that infectious passion. Cheers to creating a space that goes beyond the ordinary, where genuine connections and collective growth flourish!

Markethive: A Unique Competitor

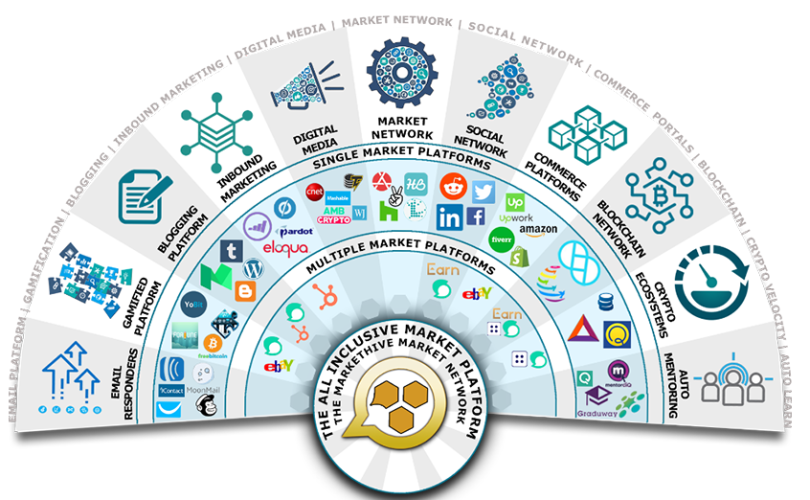

One of the incredible things about Markethive is that it isn't just taking on the local scene; it's gearing up to compete with the heavyweights in the global social network and crypto project arena. What sets Markethive apart? It's not just about the tools and features; it's about the community, the spirit, and the commitment to empowering entrepreneurs.

In the vast landscape of social networks and crypto projects, Markethive stands out as a unique player, driven by a genuine passion for entrepreneurship and innovation. While others may focus solely on functionalities, Markethive places a premium on fostering a community of like-minded individuals who are not just users but active contributors to each other's success. So, as Markethive steps into the ring with other giants, it brings not just a platform but a movement dedicated to the rise of entrepreneurs and reshaping how they connect, collaborate, and thrive.

Your generous contributions have fueled the creation of a versatile space where entrepreneurs can do more than just dip their toes into the business world. Whether crafting a compelling blog, launching a dynamic campaign, connecting with like-minded individuals in a group, or gaining insights from a webinar, Markethive provides the infrastructure for entrepreneurs to expand their businesses.

The Ripple Effect: Your Investment, Our Collective Growth

Your E1 subscription is more than just a tick on your to-do list. It's like throwing a pebble in a pond, and the ripples? They're pretty darn amazing. When you sign up for the E1 subscription, it's not just about you; it's about a shared vision we're all painting together. Your commitment starts a ripple effect, and those ripples? They touch every corner of the Markethive community.

Now, why does this matter? Well, it's like planting a seed. Your investment grows into something much bigger, benefiting not just you but everyone in this dynamic Markethive family. Think about it: by backing our mission, you're not just getting the key to a toolbox; you're also handing out keys to others. Tools, resources, opportunities – it's like a treasure chest, and you're sharing the loot.

But it goes beyond that. Your support is like a booster for our innovation engine. It helps us fine-tune the platform, making it Fort Knox secure, ready to handle growth, and user-friendly for every tech level, from newbie to pro. And here's the cool part: your E1 subscription? It's not just a thumbs-up emoji for our vision. It's the fuel for our collective growth. Picture it as a bunch of friends on a road trip; everyone pitches in for gas, and suddenly, you're cruising farther and faster.

Together, we're not just building a platform but creating a wave of positive change. Your contribution might seem like a drop in the ocean, but guess what? Those drops add up, creating a tide that lifts all boats. So, keep riding this wave with us. Your investment isn't just about today; it's a high-five to the future. Let's keep creating those ripples, one subscription at a time, and watch how we can make a splash in the world. Let’s get ready for the ride.

Why Your Continued Support Matters

♦ Keeping the Innovation Wheel Turning

Keeping the innovation wheel turning is like keeping a good story rolling. It's all about the ongoing journey, not just a single chapter. At Markethive, we're on a mission to provide top-notch solutions for your online marketing adventures. Picture it like constantly adding cool twists and turns to a thrilling plot.

Your support is the fuel that keeps our innovation engine running smoothly. We're always cooking up new and improved tools, like a writer crafting a captivating sequel. Your feedback and suggestions? They're our plot twists, helping us fine-tune the narrative and make Markethive the go-to platform for all the entrepreneurial storytellers out there.

So, here's to you, our loyal readers and contributors. Together, we're shaping the ultimate success story in the ever-changing digital landscape. Cheers to keeping the pages turning and the innovation flowing!

♦ Expanding Reach and Inviting More to Join the Movement

This company is a fantastic ecosystem where dreamers, doers, and change-makers come together to make a positive impact. But guess what? We're not doing the solo journey; we want you on board!

Markethive empowers entrepreneurs, visionaries, and changemakers to pursue their dreams and positively impact the world. But we can't do it alone. We need your support to spread the word and invite more people to join our community.

By contributing to Markethive, you are helping us grow our network, enhance our features, and create more opportunities for everyone. You are also enriching the community with your unique insights, experiences, and skills. Together, we can make Markethive the ultimate hub for innovation, collaboration, and social good.

♦ Leave Your Mark on Markethive's Future

So, when we talk about Markethive, we're not just talking about a regular platform. It's a big project, a legacy in the making. Now, why do I say that? Your support and involvement in Markethive are like planting a tree that will keep growing and making a difference.

Think of it as leaving your mark on this mind-blowing social network. Your actions and your support all add up to something much bigger. It's not just about today; it's about the lasting impact you're making for the future. You're part of something extraordinary, and together, we're creating a story that will be remembered by generations yet unborn.

So, every time you engage with Markethive, you're essentially contributing to this bigger picture, leaving a kind of "indelible mark" – a mark that won't easily fade away. You are part of a journey where your steps matter, shaping what's coming next, which is this year. Markethive is launching from the depths of the oceans to the top of the highest mountains.

Conclusion: Together, We Build the Extraordinary

In wrapping up, we want to express our most profound appreciation for each Markethive E1 subscriber. Your contributions have transformed a vision into reality, creating an extraordinary social network that continues to redefine the landscape. As you consider your monthly E1 subscription, know that it's not just a transaction; it's a continued investment in something exceptional.

Your monthly subscriptions serve as the lifeblood of continuous innovation.

We thank you for your continued support and loyalty. We appreciate your trust and confidence in our vision and mission. We hope that you are happy with the results that we have achieved so far and that you are excited about the future that we are building together.

We also invite you to keep supporting Markethive and to spread the word about it. The more people join Markethive, the more value it will generate for everyone. The more E1 subscribers we have, the more resources we will have to improve and expand Markethive. The more feedback we get, the more we can tailor Markethive to your needs and preferences.

You are the reason why Markethive exists. You are the reason why Markethive is extraordinary. You are the reason why Markethive will succeed. Thank you for being the heart and soul of Markethive. Let's continue this incredible journey together! Remember, your E1 subscription makes Markethive extraordinary.

.png)

.gif)

(38).gif)

.jpg)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

%20ORIGINAL(1).png)

.png)

.png)