Bitfinex Alleged Missing $850 Million Puts Pressure on Crypto Markets

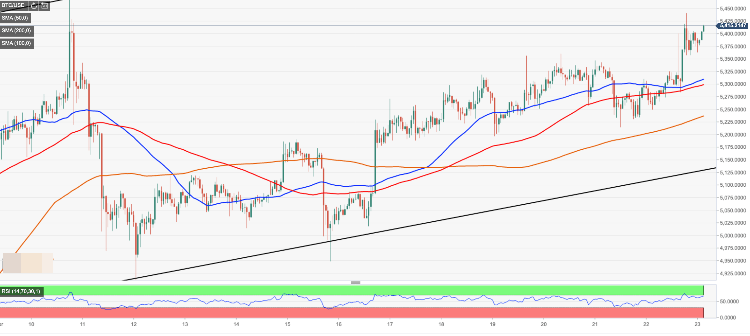

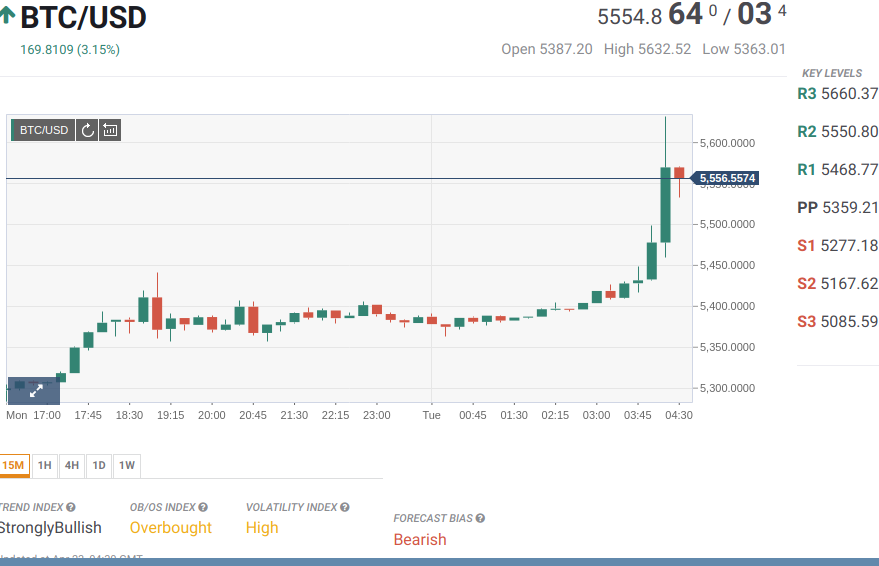

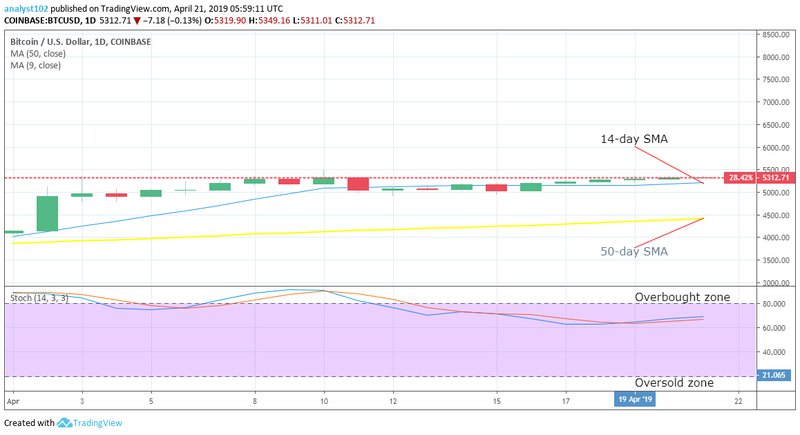

Bitcoin took an unexpected dive on markets overnight with pundits pointing at the New York State Attorney General’s investigations into a Bitfinex cover-up of missing Tether.

Major exchange Bitfinex allegedly attempted to cover missing funds totaling USD 850 million by raiding its Tether reserves in order to pay out customers. Between May 2015 and August 2016, Bitfinex was reportedly attacked by hackers who stole BTC 1,500 in 2015 and USD 72 million worth of Bitcoin in 2016.

The dent in the Tether cap was no mean figure according to stablecoins producer Paxos, suggesting that the dip into the funds would account for at least 27% in Tether’s dollar reserves. The news was not lost on the market causing a significant dip which is still trying to recover with Bitcoin dropping 6% at one stage.

The lawsuit refers back to previous messages from Bitfinex which indicates that all was not well as far back as August of 2018. The following message from a Panamanian payment processor to which it had transferred funds indicates the degree to which the exchange has found itself in deep water:

“THE SITUATION LOOKS BAD. WE HAVE MORE THAN 500 WITHDRAWALS PENDING AND THEY KEEP COMING IN … [T]OO MUCH MONEY IS PARKED WITH YOU AND WE ARE CURRENTLY WALKING ON A VERY THIN CRUST OF ICE.”

Further, the attorney general suggested that Bitfinex uses a network of money agents including “human being friends of Bitfinex employees that were willing to use their bank accounts to transfer money to Bitfinex clients”.

The actual investigation into Bitfinex has been ongoing over a period of months in its attempts to uncover if Bitfinex and Tether have impacted customers through fraudulent activity; an operation which involves the FBI and other US federal agencies.

By Harold Vandelay Posted on 27/04/2019

Alan Zibluk Markethive Founding Member

Bitcoin Displacing Gold Entirely Would Value BTC At $350,000 – Is It Possible?

Bitcoin Displacing Gold Entirely Would Value BTC At $350,000 – Is It Possible?