A New Crypto Category Has Emerged. What Impact Will it Have…Will It Evolve Into A Significant Narrative?

US-based cryptocurrency initiatives have historically been reticent about their origins. However, during Gary Gensler's tenure, they became vulnerable to aggressive scrutiny from the SEC, and numerous projects found themselves in the regulatory crossfire. Being a US-based project has often been a liability rather than a benefit in recent years.

The cryptocurrency industry has been electrified by the outcome of the U.S. Presidential election, with Donald J. Trump's victory sparking widespread anticipation. The regulatory shifts expected under Trump's leadership are poised to grant the crypto sector unprecedented freedom in the United States.

A new cryptocurrency category has surfaced amid this enthusiasm: "Made in the USA." This category includes cryptocurrencies that are closely linked to the United States, whether through headquarters located in the US or ties to notable American personalities. With Trump backing crypto, this category could see substantial growth, likely surpassing many others.

This has the potential to evolve into a significant narrative; thus, this article explicitly addresses cryptocurrencies based in the United States, the reasons this narrative could gain prominence, and the cryptocurrencies that may benefit from a Trump administration. To commemorate President Trump's inauguration, a newly established cryptocurrency category titled 'Made in USA' has been incorporated into price tracking platforms, including CoinMarketCap and CoinGecko.

What Qualifies A Crypto As Made In The US?

What exactly qualifies a crypto project as US-made? It refers to cryptocurrencies with significant connections to the United States through their founding team or company headquarters or if the project is tied to a high-profile American personality. These tokens include XRP, SOL, USDC, AVAX, SUI, and LTC, with a total market cap of $453 billion.

When CoinGecko first announced a new category had been added, there were just 18 projects, including the Official Trump and Melania memecoins, as well as the yet-to-launch WLFI token, which is for President Trump's very own protocol, World Liberty Financial. The list has been growing ever since, displaying 248 tokens, including Cardano’s ADA and Algorand.

This new category sparked conversations about the advantages of US-based cryptocurrencies, with excitement growing when rumors surfaced that Ripple’s CEO, Brad Garlinghouse, had discussed with Trump the creation of a crypto Reserve that would diversify its holdings beyond Bitcoin. This naturally positioned XRP as a key player in potentially contributing to such a reserve. Consequently, XRP emerged as one of the top traded coins on Coinbase and Binance, second only to BTC, and soared to a new all-time high.

Nevertheless, the excitement proved fleeting; a report from Unchained revealed that three sources claimed the rumors about an altcoin reserve comprised of US-made cryptocurrencies were merely unsubstantiated claims reportedly initiated by unnamed Ripple Labs employees. Following Unchained's publication of this article, Ripple Labs spokesperson Susan Hendrick refuted these allegations, yet she did not clarify which specific allegations she was addressing.

The same report shed light on a conversation that Trump had with Ripple, citing that Trump said, “You guys made this amount of money last year, and you’re gonna make so much more now because of me…But when I needed you, where the f**k were you? You weren’t with me, and maybe you were with [Kamala Harris].”

For context, Ripple’s co-founder, Chris Larson, has reportedly donated $millions to support Kamala Harris’s presidential campaign. Many political analysts believe revenge will be a key theme in Trump's second term. This could foreshadow issues for XRP despite it being a “Made in America” crypto, purely due to the actions of one of Ripple's Executives.

What Makes The "Made In USA" Category So Significant?

This raises the question of why the Made in USA designation is crucial. The answer lies in regulation. Previously, the US was considered a challenging environment for the crypto industry. However, the US could soon transform into a favorable space as the regulatory landscape evolves positively. This change notably lowers the chances of American crypto projects encountering unnecessary scrutiny from organizations like the SEC.

As policies improve, projects based in the US are expected to experience significant growth. These policy changes, which began when Trump signed several executive orders, including one that established the Presidential Working Group on Digital Asset Markets, are a hopeful sign for the future of US-based cryptocurrencies.

This working group will focus on creating clear federal regulations that benefit digital assets and “will evaluate the creation of a strategic national digital assets stockpile” to bolster US competitiveness in this rapidly growing sector.

Concurrently, other executive orders pertaining to cryptocurrency include identifying existing legislation that requires changes, reversing policies that hinder cryptocurrency innovation, and prohibiting the establishment or promotion of central bank digital currencies (CBDCs).

Significant Capital Entering The US Crypto Market

A considerable amount of investment is currently entering the crypto market from the United States, surpassing other countries. According to a report by Chainalysis in 2023, approximately a quarter of all cryptocurrency transactions originate from the US. Nevertheless, the recent fervor sparked by Trump's presidency and the emergence of associated meme coins has altered the dynamics of this market.

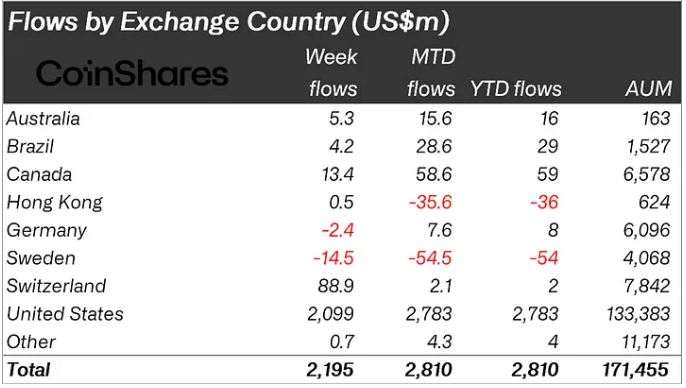

A recent CoinShares report reveals that investor enthusiasm in the week leading up to Trump's inauguration sparked a surge in US capital inflows. During that week, a staggering 90% of investments were directed towards the US, totaling $2.2 billion. Not surprisingly, Bitcoin was the primary recipient of this fervor, with Bitcoin-related funds accounting for 86% of total inflows, amounting to $1.9 billion. This trend aligns with BTC's potential as a national reserve asset and the growing institutional interest in the cryptocurrency.

The Top Cryptos Under The Made In USA Umbrella

Solana Labs, headquartered in San Francisco, is the driving force behind the Solana platform. The recent surge in popularity of Trump and Melania-themed meme coins, predominantly launched on Solana, has significantly contributed to its growing reputation. Notably, Eric Trump is said to be a holder of SOL, and David Sacks, a prominent cryptocurrency advisor to Trump, has publicly expressed his support for the Solana blockchain. As a result, any favorable policies introduced would positively impact Solana, potentially leading to an increase in the value of SOL.

The list includes SUI, regarded as a key competitor of Solana and managed by Mysten Labs based in California. It's interesting to note that Eric has invested in SUI, which has caught many off guard. Although SUI is well-known within the crypto world, it has not yet achieved widespread recognition outside this area. Eric's strong connections to World Liberty Financial might shed light on his investments in both SUI and SOL.

Cardano is another cryptocurrency project that may reap the rewards of a shift in Trump's policies. Although the Cardano Foundation is headquartered in Switzerland, its co-founder Charles Hoskinson has strong ties to the US, having been born in Hawaii and residing in Colorado. Notably, Hoskinson has already engaged with Trump's team in 2024 to explore cryptocurrency policy, potentially positioning him as an influential voice in shaping its future direction.

Chain Link, a cryptocurrency headquartered in New York, is poised to benefit from its association with Trump's positive stance on cryptocurrency and his efforts in the industry. LINK could potentially see significant gains since it serves as a protocol for World Liberty Financial, which holds a substantial amount of LINK.

No Tax On Crypto Created In The US?

The crypto market anticipates potential advantages from Trump's policy changes. Speculation suggests that cryptocurrencies minted in the United States might be exempt from taxes. These claims stem from remarks made by Eric Trump in his December speech in Abu Dhabi.

For context, Eric proposed that cryptocurrencies based in the US might gain from an absence of capital gains tax. Conversely, he noted that crypto initiatives outside the US would face higher capital gains taxes, approximately 30%. Should this occur, there may be a surge of crypto projects established within the US. However, if political resistance arises due to concerns about potential tax revenue losses, alternative strategies remain available.

A potential approach is to create a de minimis exemption that frees minor, everyday transactions from taxation. This would enable individuals to make small purchases, like a cup of coffee, without tax liabilities. Another strategy might be for the United States to implement holding period exemptions akin to those in Germany or Portugal, where cryptocurrencies held for more than 12 months are tax-exempt.

Another approach is for the United States to implement tax policies that are more advantageous for cryptocurrency mining and staking rewards. Such measures would benefit investors and bolster the security of cryptocurrency projects linked to proof-of-stake or proof-of-work networks within the country.

The US Strategic Bitcoin Reserve

Bitcoin and other cryptocurrencies have reached all-time highs partly because of the Trump administration's supportive stance on crypto. Nevertheless, the wording in Trump's executive order indicates that the government's plans regarding crypto may not align with public expectations. One segment of the executive order contains the following passage,

“The working group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the federal government through its enforcement efforts.”

This statement implies that the US government has the authority to retain its existing cryptocurrency holdings and any additional assets that may be confiscated by law enforcement in the future. Still, it does not grant permission for the government to acquire new bitcoin.

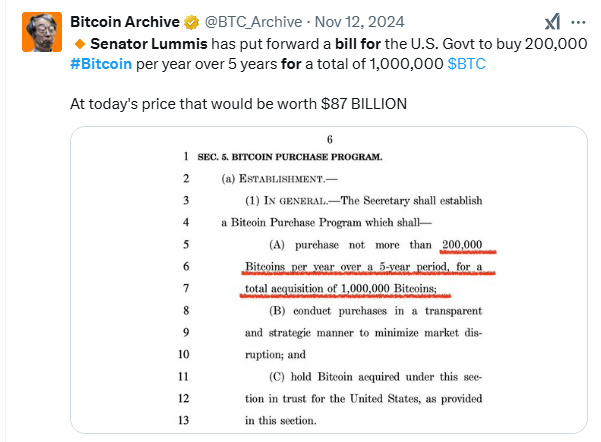

In light of recent developments, Congress is working on a plan to create a cryptocurrency reserve. Under the leadership of Senator Cynthia Lummis, the Senate Banking Committee is preparing to start developing a law allowing the U.S. government to obtain additional Bitcoin (BTC). Senator Lummis had suggested this idea during the Trump election campaign, and it is expected to involve acquiring one million BTC over five years, as outlined in the Bitcoin Act 2024.

Could the Made In The USA Category Gather Momentum

There is widespread optimism regarding the potential of this sector driven by regulation changes. Trump's favorable stance on cryptocurrencies and the supportive teams he is assembling are expected to propel the crypto market to record highs. The positive momentum may be further boosted by the appointment of pro-crypto figures like SEC Commissioner Hester Pierce to head a new crypto task force or through collaborations with the Department of Government Efficiency. (DOGE)

In a notable change, the Trump Administration has recently overturned the SAB 121 rule, allowing banks to offer cryptocurrency custody services. This action is anticipated to enhance confidence among institutional investors, encouraging them to explore cryptocurrency investments. It will also enable publicly traded companies to consider adding Bitcoin to their portfolios without reservations. As the regulatory landscape for cryptocurrency in the US becomes increasingly favorable, we may witness a resurgence of crypto projects returning to the country, potentially involving hundreds of initiatives making the transition.

It is well-recognized among cryptocurrency enthusiasts that the United States has not provided a favorable environment for cryptocurrency projects and enterprises in recent years. Consequently, numerous companies have relocated offshore to countries with a more welcoming atmosphere.

Given the positive developments in the regulatory landscape, the current situation may significantly evolve. Furthermore, there is a perspective that the "Made In The USA" narrative could motivate other jurisdictions to adopt a more favorable stance towards cryptocurrencies to remain competitive, potentially influencing jurisdictions that have historically opposed cryptocurrencies, such as China.

Interestingly, CoinGecko has launched a new classification titled "Made In China. " It currently features a more condensed list of 15 entries, including notable names such as TRON, OKB, VeChain, and NEO. As revealed on the social media platform X, the creation of this category coincides with the celebration of the Chinese New Year.

What Type Of Cryptos Will Benefit

The shift in Trump's policies may benefit numerous US-based cryptocurrencies, offering various research options. However, the question remains: Which type of crypto will demonstrate long-term viability? Historically, cryptocurrencies with practical applications have shown greater promise than those lacking utility. These utility-focused tokens enable specific functions within a blockchain network and are more likely to appreciate and gain widespread acceptance. Several key factors are worth considering when evaluating their potential.

Practical Applications: Utility tokens unlock exclusive benefits and functionalities within a blockchain network. Take Solana (SOL), for instance, which empowers users to engage with DeFi platforms, acquire NFTs, and utilize dApps. Additionally, its Saga phone initiative extends the token's utility to the mobile realm, granting access to bespoke apps fueled by the Solana blockchain. This tangible value proposition can draw in more users and developers, ultimately driving up the token's worth and long-term viability.

Hivecoin (HVC) fits into this category as a utility token for Markethive’s various products and services in online marketing and digital broadcasting. Markethive is distinguished by its utility token, Hivecoin (HVC), which powers a range of online marketing and digital broadcasting tools. This platform allows users to generate income through engagement, leveraging a user-friendly social media interface. Users can also amplify their earnings through staking, engage in gamification activities, and even receive a share of the company's net revenue.

Market Demand: The worth of utility tokens is influenced by the level of interest and adoption within the market. When a token gains widespread acceptance and usage among individuals and organizations, its value tends to appreciate. A notable example is Binance Coin (BNB), which has become a sought-after utility token due to its versatility in facilitating payments for trading fees, transaction fees on the Binance Smart Chain, and other services.

Long-Term Potential: Investors generally see utility tokens as having more attractive long-term potential because of their inherent value. Field experts argue that cryptocurrencies with real-world applications tend to endure market downturns better and maintain their relevance over time. This resilience is linked to their capacity to provide tangible benefits and meet actual needs, distinguishing them from speculative or novelty tokens that do not have a defined purpose.

Ecosystem Development: A thriving ecosystem is a key indicator of a token's prospects for success. Projects with dedicated development teams, consistent progress, and a well-defined strategic plan are generally better positioned for long-term growth and achievement.

The Connection Between Utility and Valuation

Consider the potential increase in utility companies' value if they capture a small portion of the economic activity generated by their essential services. For instance, consider the possibility of water companies profiting from the monetary value generated by individuals using water or electric utility companies obtaining a fraction of the economic value generated by using electricity in various parts of their homes. That's precisely what happens with utility cryptos.

For example, SOL's price is closely tied to the level of economic activity within the Solana blockchain ecosystem. Similarly, as the value of the decentralized social market broadcasting network Markethive increases, its native currency, Hivecoin, is expected to rise accordingly. This is due to its ability to provide essential products and services with HVC as the primary transactional coin that facilitates various applications, including exchange transactions, payment processing, smart contract execution, and tokenization within the Markethive ecosystem.

Generally, a cryptocurrency's value is directly correlated with its utility. The greater a cryptocurrency's versatility and functionality, the more extensive and diverse its network of users and developers will likely be. This correlation can subsequently lead to increased potential for expansion and development, fostering growth and further adoption.

In essence, cryptocurrencies that serve a purpose are more likely to succeed because of their practical applications, user adoption, market demand, long-term potential, regulatory compliance, and ecosystem development. Investing in such tokens can be a strategic choice for those looking to capitalize on the growing blockchain and cryptocurrency landscape.

In conclusion, while the broader market is anticipated to gain from a Trump administration, specific U.S.-based cryptocurrencies may be exceptionally well-placed to take advantage of the evolving regulatory conditions. The Trump administration marks a possible turning point for the U.S. cryptocurrency sector. Although the specific policies are yet to be determined, the prevailing sentiment appears optimistic. U.S.-based cryptocurrencies that can adjust to the shifting regulatory landscape and seize emerging opportunities will likely thrive in the years ahead.

This article is provided for informational purposes only and should not be relied upon as legal, business, investment, or tax advice. Furthermore, however plausible, the contents of this article may include speculative opinions. Of course, there is nothing wrong with speculation as long as its premises are made clear. Speculation is the customary way to begin the exploration of uncharted territory as it stimulates a search for evidence that will support or refute it.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)