Here are two reasons to buy Bitcoin right now

-

Bitcoin long-term seller just closed his short position with a profit.

-

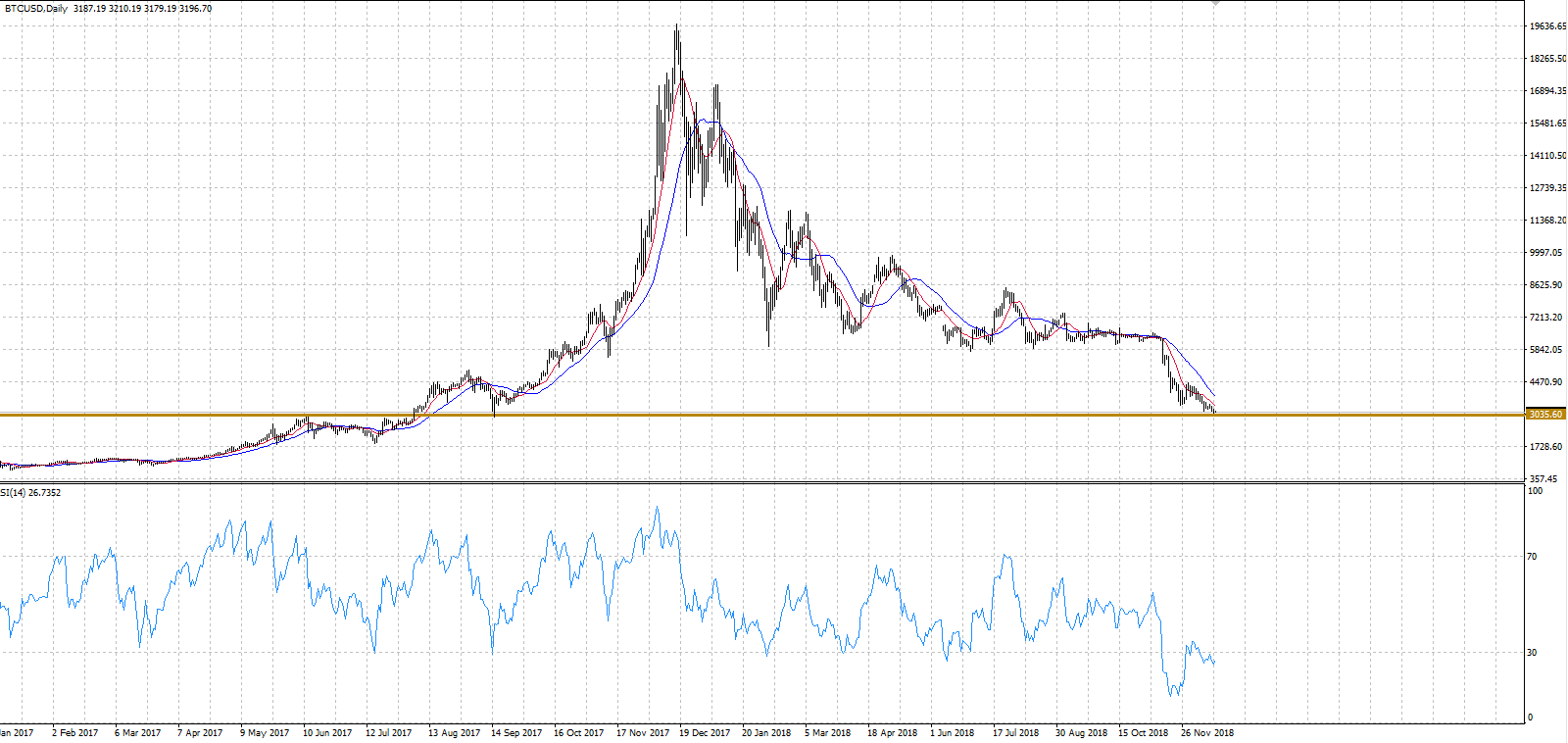

Candlestick pattern on a daily chart hints on a trend reversal.

Bitcoin bulls have another reason to rejoice. Mark Dow, a former International Monetary Fund economist and, more importantly, the guy who entered Bitcoin short right at the top of the last year's rally, just closed his position.

“I’m done. I don’t want to try to ride this thing to zero. I don’t want to try to squeeze more out of the lemon. I don’t want to think about it. It seemed like the right time,” he said in phone interview with Bloomberg.

He explained that he saw some psychological hallmarks during the euphoria that surrounded Bitcoin last December. Those signals told him that the market had reached a breaking point.

"People buy into these assets because they believe the narrative, and you look at the asset prices to see if the narrative is weakening or changing. It’s not easy — you could be wrong, but that’s the sign you look for. But it doesn’t mean you’ll get it right," he added.

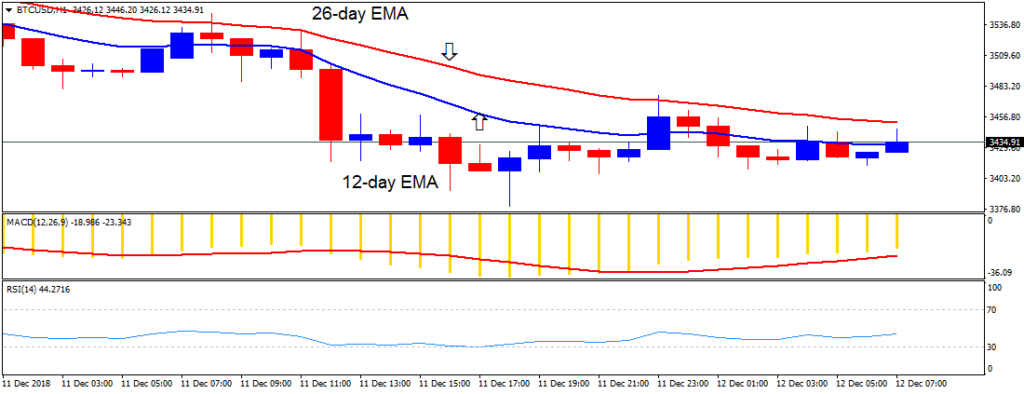

Currently, BTC/USD is changing hands at $3,730, gaining over 6% on a day-to-day basis. The digital coin No. 1 has been growing strongly for the third day in a row, creating an exciting candlestick pattern on a daily chart.

Three White Soldiers are on the assault mission

On the daily chart, a candlestick pattern "Three White Soldiers" is being formed. If Bitcoin manages to maintain the rally during the day, we will have and strong long-term reversal signal. "White Soldiers has come after a short period of indecisive trading that followed a strong bearish trend. Big bullish candles with small shadows imply that bulls are growing stronger and ready to snatch the control over the situation. For the pattern to be confirmed, we will need to see a daily close above $3,800 handle.

Tanya Abrosimova FX Street

Alan Zibluk Markethive Founding Member