Bitcoin will reach $8500 by end of year, says Trefis; predicts ETF approval will cause bull run

Trefis Team, a firm offering software that predicts market movements, recently offered their opinion on the price of Bitcoin [BTC]. While the cryptocurrency market has been seeing bullish news lately, the price continues to exhibit sluggish movement.

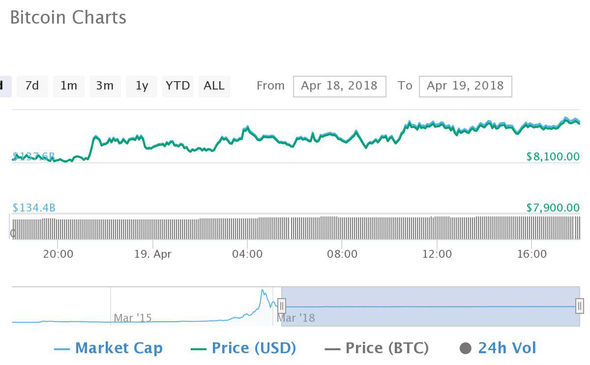

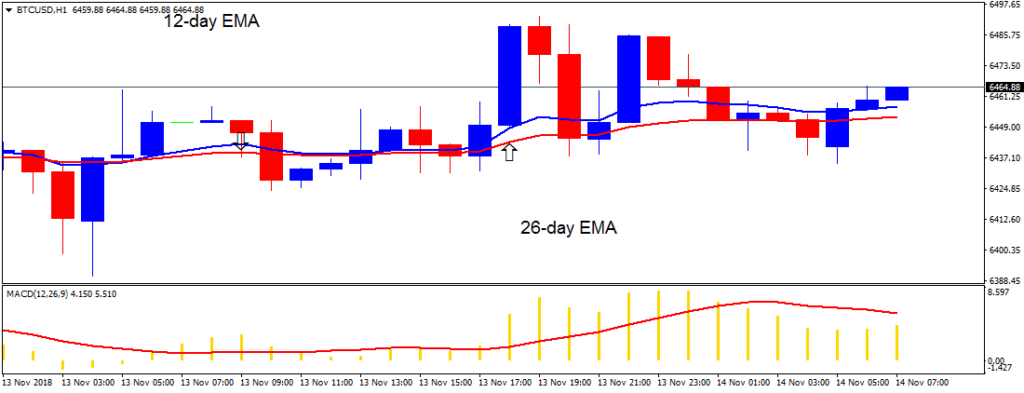

Bitcoin, the top cryptocurrency, is currently trading at the $6500 mark after a series of sharp drops last week. Goldman Sachs stated that they would delay the plans of its cryptocurrency trading desk, leading to a widespread selloff due to FUD.

However, Trefis claims to have predicted the price of Bitcoin by the end of 2018, putting it around $8500 around the timeframe. Their predictions are based on the overall transaction volume for Bitcoin and the total number of users on the blockchain. Moreover, their predictions, when backtested, are reportedly 94% accurate as stated on their website.

They utilize the principles of supply and demand to fundamentally determine the price of Bitcoin. The cryptocurrency, with its capped supply and deflationary system of bringing new coins into existence, has a supply system that would help the case of its price rising. The two variables that Trefis has considered to calculate the demand is the number of active users and the amount they transact.

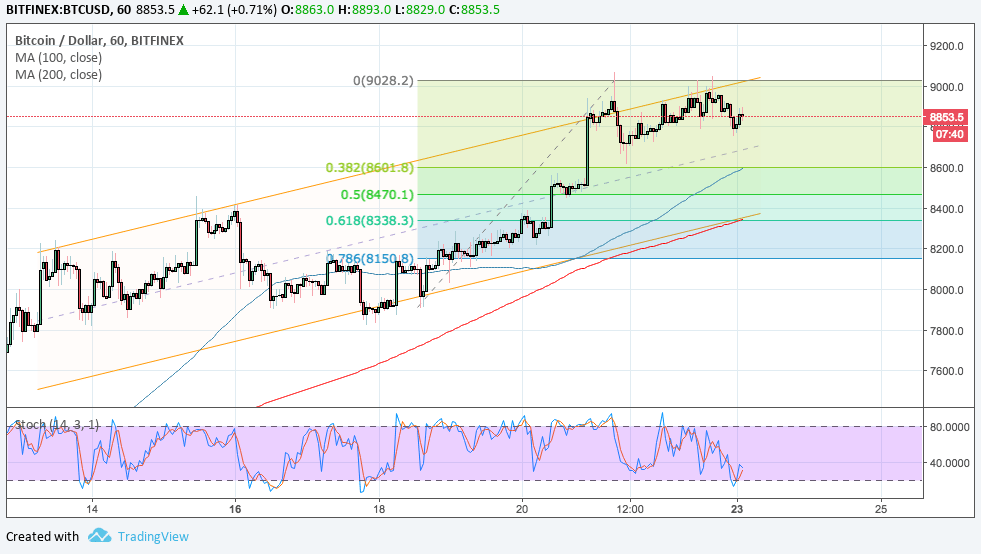

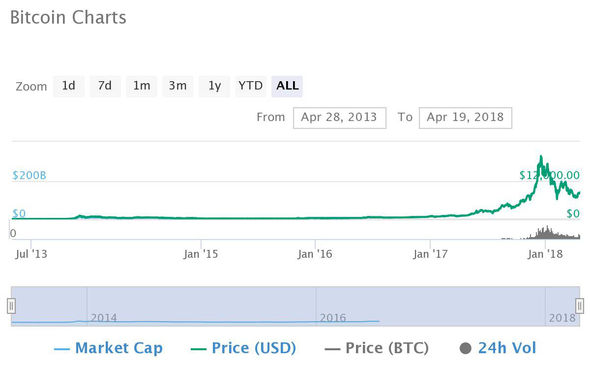

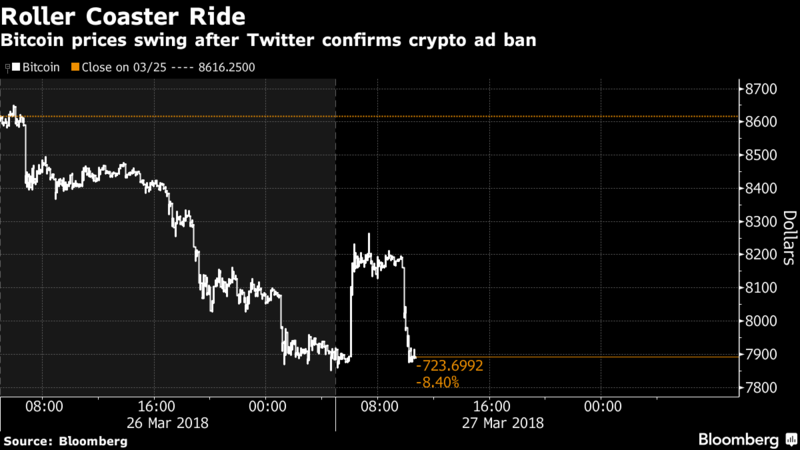

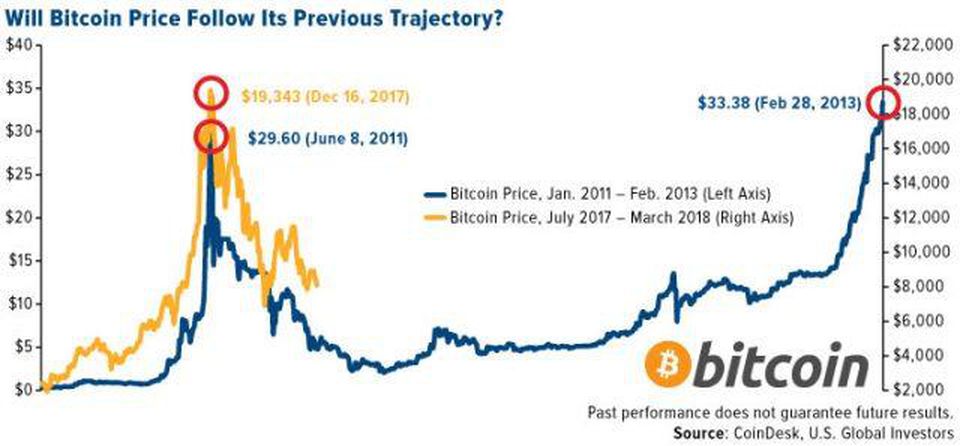

According to these calculations, they expect the price of Bitcoin to undergo a 30% increase over the year, quoting reasons such as the general sentiment dictated by the news. This, according to them, was the reason for the price to go up to $20,000 late last year. They also stated that the price has moved in tandem with news, with dips being observed when exchanges were hacked and when the United States Securities and Exchanges Commission [SEC] denied applications for an exchange-traded fund [ETF].

According to Trefis, the creation and general lobbying of the Blockchain Association will also create a more positive view for regulators. They stated that the approval of the ETF by the SEC is one of the biggest catalysts for the growth of Bitcoin. It represents a “huge potential upside” to the price of Bitcoin.

Iarius Germund, a market analyst, stated:

“While the market still responds sluggishly to a lot of the news coming out right now, the base is gradually being built. At the same time last year, the cryptocurrency market did not have many of the things it required for mainstream adoption as an asset class. We have made considerable progress on that end, but the price is only likely to move when actual changes occur in the market with respect to adoption.”

Anirudh VK

Published 29 mins ago on September 15, 2018

Alan Zibluk Markethive Founding Member