John McAfee’s Guide To Help You Get To Your Destination

I personally find John McAfee a fascinating, genuine and humorous character who enjoys life and truly believes at this time in his life, his god-given mission is to do anything it takes to “wake people up”, as he puts it, to the tyranny of governments and miracles of technology – Blockchain and Cryptocurrency which will free the people from the shackles of centralized institutions. I came across a blog written by John McAfee with his attempt to guide you through the checkpoints of Central America. He posted it in 2012 and tweeted it today in the hope it may help anyone traveling to join the protestors in South America. He certainly is a character and I had to have a little chuckle to myself as I read through the following…

The McAfee Central America Travel Guide

As all of my close friends know, I have not always been a teetotalling, drug-fighting citizen. Prior to 1983, I was a synthesis of a corporate manager and drug dealer. The drug dealer eventually won out, and for a period of time, that was my only occupation. Well ….. taking the drugs that I sold also became a principal occupation. This is not a secret, I tell anyone who asks, even the press. Not many in the press reported much about it until Josh Davis’ eBook came out. I am not ashamed of my past. Our collective pasts make us who we are. In 1983 I joined Alcoholics Anonymous and gave up alcohol and drugs entirely. My exceptions are coffee, which some classify as a drug, and, occasionally, cigarettes. Not proud of the cigarettes, I know they are bad.

During my drug-dealing days I became adept at those talents required of a successful drug dealer: clandestine travel through the Third World countries that produce and transport the goods; dealing with corrupt officials; dealing with drug lords and drug traffickers; successfully passing checkpoints; bribery, and in emergencies, the methods of escape.

I am a firm believer that all experience can be a valid teacher if a person listens to experience with unclogged ears. Since it is a Saturday and I’ve had a tiring week, I will take a break from the task at hand and use what little I have learned to assist travelers that might appreciate the rewards of traveling off the beaten path in third world countries. It should also assist anyone engaging in questionable activities. If a person does not directly harm another, then I try not to judge. You might call this McAfee’s Travel Guide:

In order to make the most of your travels, you need to first understand that, throughout much of the Third World, there is a smoothly functioning “system” in place that has evolved over centuries. From the First World perspective, it is a “corrupt” system, and indeed, at the higher levels there is no other word for it, and this blog’s purpose is to remove the brutality and horror of such high-level corruption.

At the lower levels, however, the system contains an element of grace and humanity, and this lower lever is all that most people will ever encounter. You might still call this lower level “corruption”, but that’s not a helpful word if you want to acquire the most effective attitude for dancing with it. I prefer “negotiable”. It focuses the mind on the true task at hand when dealing with officialdom and removes any unpleasant subconscious connotations. So if you can view the following tools and tips as negotiation guidelines it will help bring the necessary smile to your face when the situation requires one.

Press Credentials

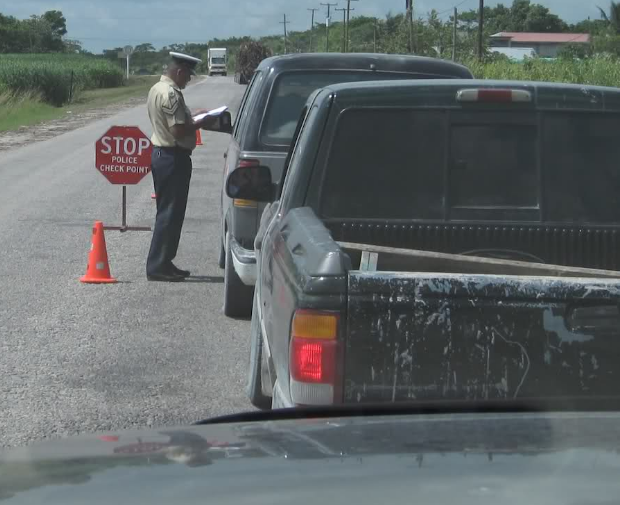

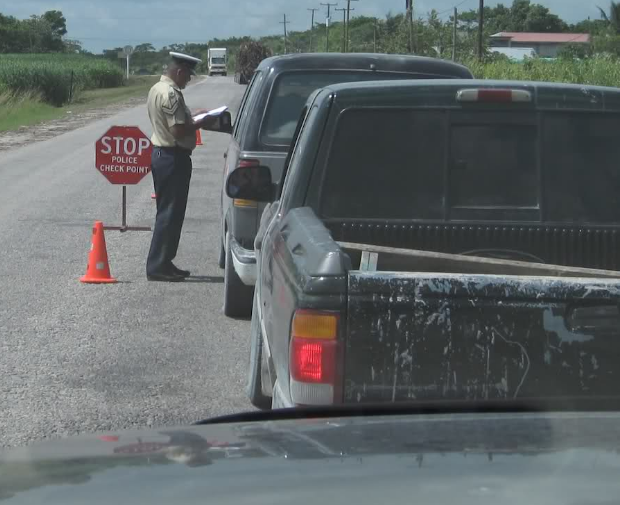

The most powerful tool a traveler can possess is a Press card. It will allow you to completely bypass the “documentation” process if you have limited time or limited funds and don’t want to deal with it. I have dozens stashed in all my vehicles, in my wallet, in my pockets, in my boats. You might ask since I claim to be an upstanding citizen, why I would need such deception. It is because I am one of the few white men who chose to live part-time in the interior of the country. I was one of only three white guys living in the district of Orange Walk, for example. I have cars and enjoy driving and I travel frequently. Not a day went by without having to go through a “checkpoint” of some kind.

I am paranoid about being caught without one when I need one. They have magical properties if the correct incantations are spoken while producing them. A sample incantation at a police checkpoint (this will work in any Central American country):

(Spoken before the officer has a chance to say anything) – “Hi, I’m really glad to see you.” (produce the press card at this point). I’m doing a story on Police corruption in (fill in country name) and I would love to get a statement from an honest police officer for the story. It’s for a newspaper in the U.S. Would you be willing to go on record for the piece?” You can add or subtract magic words according to the situation.

Don’t worry about having to actually interview the officer. No sane police person would talk to a reporter about perceived corruption while at the task of being perceived to be corrupt. He will politely decline and quickly wave you through. If you do find the rare idiot officer who wants to talk, ask a few pointed questions about his superiors and it will quickly awaken his sensibilities. He will send you on your way.

The press card is powerful but has risks and limitations. Do not attempt this magic, for example, at a Federale checkpoint in Mexico on a desolate road late at night. You will merely create additional, and unpleasant work for the person assigned to dig the hole where they intend to place you.

Documentation

Documentation is the polite word for “cash”.

The real art of producing documentation is the subtle play of how much to produce. In some countries, a policeman makes less than a dollar an hour. At a checkpoint, a policeman will usually share his proceeds with the other officers lounging by the side of the road and with the police Chief. The Chief will get about 25% in countries like Colombia and Panama, so if there are three officers total, then a ten-dollar contribution will end up with about $2.50 in each person’s pocket – a good take for someone making about a dollar an hour in legitimate salary.

Nothing irks locals more than someone who produces documentation in excess of what is expected. It ruins the system for the rest of the population. The Police begin to expect more from everyone, and the populace is then burdened beyond any sense of reasonableness. I might mention that checkpoints for any given location in most countries are set up no more than once a week, and frequent travelers reach accommodations with the authorities so that they are not unnecessarily burdened to the point that they are single-handedly putting the policeman’s children through school. The police are, by and large, honest people with hearts, and few truly abuse the system.

So to give more than is reasonable is a crime against humanity. The following are some hard and fast formulas that I have learned from trial and error over the years:

Documentation is inversely proportional to traffic density – the higher the traffic, the less you pay, the lower the traffic the more you pay. This is simple economics: The police must make their personal quota from whatever traffic there is.

If you stop at a checkpoint and there are four or five cars in line, you can be assured that less than a couple of dollars will be expected from a Gringo. Smart folks carry a half dozen cold cokes and beers in a cooler in the backseat and simply reach around, grab one or the other and hand it out the window with a smile. In the late afternoon on a hot day, this will be received with far more appreciation than a few small coins. If you hand a cold drink to all of the officers, you could easily talk them into giving you a protective escort to the next town.

In low traffic areas, in addition to having to pay more, you will also entail more risk. It’s never good to travel lonely roads in Central America unless you are very experienced or closely wired into the authorities. However, if you’ve come down to do a dope score or are determined to visit sweet Crucita in some remote village and have no other choice, then strictly adhere to the following:

Do not get out of the car, even if ordered to do so. Your car is your only avenue of escape. It’s a ton or more of steel capable of doing serious harm to anyone foolish enough to stand in front of it, and once underway is difficult to stop. The checkpoint police in Central America never chase anyone down, in spite of years of watching U.S. Television and action movies. It’s too much work, plus they could have an accident. It’s not worth it for an unknown quantity. And they won’t shoot unless you’ve run over one of them while driving off. It makes noise and wastes a Round that they must account for when they return to the station – creating potential problems with the higher-ups. Not that I recommend running. It’s just that outside of the car you have lost the only advantage you have.

Smile and, if possible, joke. Say something like: “I’d like to stay and chat but I’m in a hurry to meet a girl. Her husband will be back soon.” This will go a long way toward creating a shared communion with the officers and will elicit a shared-experience type of sympathy.

Don’t wait for them to talk. Take the initiative. Have your documentation ready as you pull up and simply present it to the nice policeman while beginning your patter similar to the above, or whatever patter is comfortable for you. Never hand cash directly. Slip it in inside your insurance papers, or some other paperwork relating to your car or your journey, with about an inch of the banknote discretely sticking out. I use a Cannon Ixus 530 setup manual with the front and back cover removed. It’s small, light, and looks like it could be important paperwork for almost anything.

Remember: 50% of the police who stop you in some countries can’t read. This is a powerful piece of information for the wise.

Once the officer has removed the banknote, which will be immediate, reach out and retrieve your laptop manual (or whatever you choose to use), smile, wave and drive off immediately without asking permission, but slowly, without looking back. Doing the job and leaving quickly without appearing to hurry off is the key here. Don’t give them enough time to assess you.

The above is a failsafe formula for back roads of Central America if adhered to explicitly. Expect to part with at least 20 bucks. If, on approaching the checkpoint, you judge the police body language to be insolent or agitated, change the twenty for a fifty.

If something goes awry and the above, for some reason, has not worked, then pretend stupidity. Ask them to repeat everything they say and act bewildered. If ordered to get out of the car, smile broadly and simply drive off. Again – slowly.

If drugs or other contraband are planted in your vehicle by one of the police while another has your attention (a very common occurrence), understand, above all, that there is a zero probability that you will be arrested, unless you add to the “offense” by pissing someone off or otherwise acting unwisely. The intent is to scare. Under no circumstances deny that it is yours. Say something like “Damn, I thought I left that at home”, or “That’s the second time I’ve been caught this week.” This will show them that you are a good-natured player and will probably negotiate. Denying ownership of the contraband will be seen as confrontational – an attitude that brings high risk when dealing with Third World authorities. The “documentation”, however, need not be much.

They have chosen an approach to make a living that is universally considered by the locals as “not fair play”, and they should not be unjustly rewarded for it. Sure, they did go to the effort of distracting you, and someone had to go to the trouble to plant the dope, so they deserve something, but $5 is the maximum you need to pay. If they ask for more, then you can safely become indignant. They will shut up. The locals won’t tolerate police that takes too much unfair advantage of the system, and your obvious awareness of the correct protocols will alert them to potential trouble if they push things.

If you actually are carrying contraband, of any kind – drugs, guns, Taiwanese sex slaves – whatever, and are caught, then the actions that you take within the first few seconds of discovery will have a profound impact on the rest of your life. The reality is: You have been caught. The officers have options:

1. Arrest you and charge you, where you are likely to confess to other people about exactly what you were carrying and how much – thereby limiting the policemen’s ability to make off with much of the cache. Or:

2. Come to some arrangement with you that is mutually beneficial and that does not include your demise or create any undue risks to the officers’ jobs or safety.

Option 2 is obviously preferable. To anyone not fond of prisons, that is.

Your first order of business is to assess your situation. If you are in a town or even near one with reasonable traffic driving by, then the chances of your demise, or incurring harm to yourself, are virtually nil if you keep your wits about you. If you are on a lonely country road, and there is only one officer, or even two, your risks could be high, so you will be handicapped in your negotiations.

On your side, you have the option to go to jail and tell your story to lots of people, which generally restricts the officers’ abilities to make money on the encounter. The higher-ups will take it. On their side, they have guns and threats. Ignore the threats. You are fully cognizant of the fact that their sincere hope is that some accommodation can be reached that enriches their pockets and allows you to leave the area without compromising them.

So — first things first. Smile. There is no circumstance under which a smile will handicap you when dealing with authorities.

Be friendly in your speech and immediately and fully acknowledge your situation, and theirs. This puts them at ease and sets the framework for negotiation. Be polite but firm. Let them know that they will not be able to walk off with your entire stash, and do this early on. It creates more reasonable expectations in their minds. If your contraband is drugs, offer them a small hit while talking. It re-enforces, subconsciously, the idea that the dope is your possession and that they are partaking due entirely to your goodwill. If you are transporting sex slaves, then I must say first that I cannot possibly condone your chosen occupation, but offering each one of the policemen a taste of the goods may well seal the deal without any additional cash thrown in.

It’s important to be firm without any semblance of hostility. If the policemen tell you, for example, that they are going to confiscate all of the goods, then, with an apologetic manner that implies an unfortunate certainty, say “I’m sorry, but that won’t be possible”. Shake your head sadly as if you had divulged: “My mom just died”. And this is the point to present them with an absurdly low offer. If you are carrying 20 keys of cocaine or a half-ton of marijuana, then offer them $50. Alternatively, you could offer them a one-ounce bag of the weed or a gram or so of the coke. If it’s sex slaves, tell them they can look at the bare breasts of one of the least attractive women (in parts of Southern Mexico, this might actually be sufficient).

They will be taken aback at your offer, but it will place any unreasonable expectations they may have in a stark perspective. As a rule of thumb, if you are near a populated place, you will ultimately settle by parting with an amount of cash equal to about 10% of the wholesale value of the goods. On a road with infrequent and unpredictable traffic, maybe 20%. If you are on a desolate road, especially if the body language is not comforting, you may have to bite the bullet, give them the entire wad, plus your car, and ask for a ride to the bus station. Don’t expect the police to accept the drugs or contraband as payment if you are near a populated area. They would obviously be seen transferring the goods to their vehicles. If you are not carrying sufficient cash, then you are unprepared, and shouldn’t be doing shady deals in Central America.

Never display fear or hostility. Smile throughout, and crack what jokes you can.

Name Dropping

Knowing the name of the country’s Police Commissioner and Armed Forces Chief, and the Chief of Police for each county or town you will be driving through can be very helpful. Knowing all the mayor’s names will not hurt any either. Name-dropping is a powerful tool in the Third World, especially for gringos, if used appropriately. Telling a cop in America that you are friends with the mayor or the police chief will seldom help you avoid a traffic ticket, and may even increase the charges.

In Belize, offending the Police Commissioner will immediately get a policeman fired, with no repercussions to the Commissioner, and, depending on the offense, may even get the officer “erased”. So it gives an officer serious pause when you say: “The drugs belong to Commissioner (insert name). I am delivering them to a friend for him”.

If spoken with authority and condescension, they can have a dramatic effect. No policeman in his right mind would try to validate the story. Resident Gringos, for odd reasons, are prized as friends by wealthy and prominent locals, so it would not be out of the question to be close with the Country’s Police Commissioner. If the cop asks any specifics, like, how you know the Commissioner, pull out your cell phone and say: “I have the commissioner’s number, why don’t we call him and you can ask him yourself.” You need to have solid self-assurance, or at least some large cojones, to pull this off, but in a tough situation, this can work miracles.

A small amount of research is necessary before using this approach. You need to know, for example, whether the police commissioner is really dealing drugs (almost all are). Every local inhabitant in the country will know this information (there are no secrets in the Third World). The policeman will certainly know.

You don’t have to be doing something illegal in order to use the name-dropping approach. When a friend of mine first moved to Belize, two policemen stopped him late in the evening while he was driving a golf cart across the bridge to San Pedro’s North Island. Before he could provide the proper “documentation” for a bridge checkpoint, one officer harshly demanded his drivers’ license, which he provided and then shut up. The officer’s attitude was not in harmony with a normal checkpoint situation. While he stared at my friend’s license, the other dropped a bag of weed on the back floor of the cart. (he didn’t smoke weed by the way.) When the first officer “discovered” the bag my friend said: “I hope you won’t tell the Commissioner about this. He’s a very close friend of mine and I wouldn’t want him to think anything bad about me.” The first officer divulged that they were only joking by planting the weed. He apologized and waved my friend through.

Generally, the tactic of planting drugs on people is only practiced in heavily trafficked tourist areas. The police in tourist areas are handicapped because tourists generally don’t “pay their due” to the police, or to any other functionary. Tourists consider it “corrupt” to have to pay policemen to do their jobs or to pay them in order to have the freedom to drive down the street on checkpoint day. The police, therefore, are forced to resort to unethical means in order to make a living in these places. I understand this well, yet some character flaw in myself won’t allow me to reward someone who plants drugs on me. My friend feels the same.

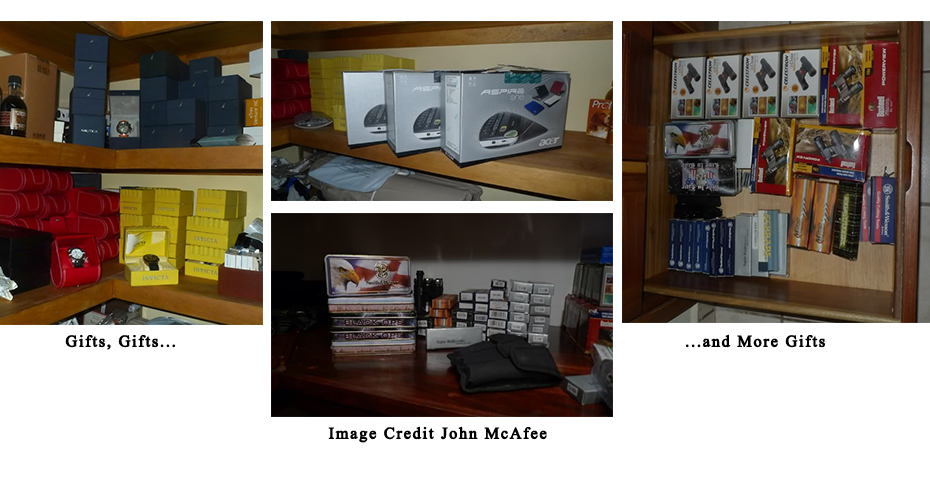

Gifts

Gifts occupy different strata in the system of negotiation. They are used when some future consideration is required, or after an official favor has been provided. Gifts can be small or large, depending on the circumstances and the wise person will have an ample supply ready for any event. I operate seven small businesses in Belize. When I first opened them I refused to acquiesce to my business manager’s advice about gifts. I naively assumed I could skate by without them. I was wrong, I finally allowed the guy to stock up on resources so that he could do the job I was paying him to do:

Now… to be fair to the authorities ….. I have no way of knowing whether these “gifts” were actually given to the authorities. For all I know the business manager that I hired started his own retail outlet somewhere and is still living off of the proceeds. It’s difficult under certain circumstances to get at the facts.

Favors, likewise, are part of the system. They have no negative connotation, and they require gifts whose magnitude reflects the magnitude of the favor.

One common “favor” that is considered questionable is to gift an officer in the armed forces to provide armed support for a drug deal, a revenge raid, an armored car heist, or any similar function. It’s a very common occurrence but it’s deemed to be morally sketchy by most of the populace. The reason for this, I believe, is the sense of unease created by the image of highly organized, insolent, largely illiterate men with fully automatic weapons catering to the whims of anyone with spare change.

The general consensus is that the system of “negotiation” should stop at the gates of the military. The military should uphold the system, not practice it, as my friend and philosopher Paz once said. This is no more illogical than policemen as “officers of the peace”. The fact that SWAT teams exist and every policeman carries a gun and is trained in violent tactics, should alert us to the fact that practicing peace is not the means of choice for maintaining peace.

Written and Posted by John McAfee, November 24, 2012

Deb Williams

A Crypto/Blockchain enthusiast and a strong advocate for technology, progress, and freedom of speech. I embrace "change" with a passion and my purpose in life is to help people understand, accept and move forward with enthusiasm to achieve their goals.