New Use Cases For Bitcoin. Ordinal Theory Disturbs Bitcoin Purists. Competition For Ethereum?

Bitcoin is evolving with the introduction of inscriptions, which has caused an explosion in innovation, creating new use cases for Bitcoin that many thought it would never advocate. Some believe these use cases are inappropriate for Bitcoin's primary mission of decentralizing money and being a store of value. These use cases include BRC-20 tokens, and Ordinal Inscriptions likened to an NFT called Digital Artifacts, and many are wondering whether they will compete with NFTs and ERC-20 tokens on Ethereum.

This article illustrates what Inscriptions, Ordinals, and BRC-20 tokens are, how they work, and evaluates what impact the Ordinal theory could have on BTC. Also, how will these protocols impact Ethereum? Could ETH lose NFT market dominance as a result?

When Did It All Start

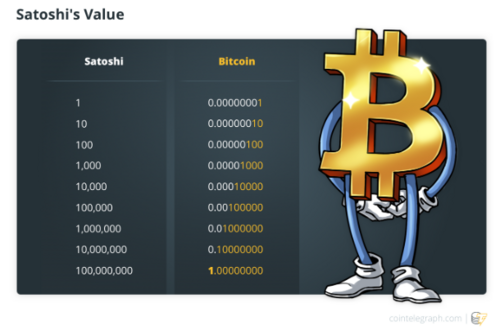

The history of Bitcoin's recent innovations begins with the Taproot upgrade, which went live in November 2021. Essentially, Taproot removed limits on how much data each BTC transaction can use, allowing a single transaction to fill an entire Bitcoin block. This opened the door to attaching additional data to BTC transactions, including individual Satoshis. (Sats). For context, each BTC comprises 100 million Sats, like cents to a dollar.

Image Source: Cointelegraph

As the name suggests, inscriptions make it possible to attach data to individual Sats, including audio, video, and text. Bitcoin Ordinal inscriptions can be fungible or non-fungible, depending on who owns the Ordinal and whether they wish to preserve the individual Satoshi.

The concept of adding data to individual Sats isn't necessarily new. In fact, Bitcoin creator Satoshi Nakamoto and early Bitcoin developer Gavin Andresen discussed creating a domain name system on Bitcoin in 2010. This eventually led to the creation of Namecoin, one of the first Bitcoin forks. In 2012, the CEO of eToro proposed the concept of colored coins, which involves attaching data to BTC transactions to tokenize real-world assets effectively.

The main reason why these concepts failed to reach mass adoption was because of data limits on BTC transactions, which Taproot has since removed. Another reason why these inscriptions failed to reach mass adoption was because it was challenging to create or keep track of them. This is what the Ordinals protocol does. It allows anyone to inscribe individual Sats with additional data and keep track of where they are.

Ordinal Protocol and Inscriptions

As stated on the Ordinal website, a Sat inscription is an NFT; however, "digital artifact" is used instead because it's simple and familiar to artists, collectors, and traders. The phrase "digital artifact" is highly suggestive, even to someone who has never heard the term before. In comparison, NFT is an acronym that feels like financial terminology and doesn't indicate what it means if you haven't heard it before.

Bitcoin developer Casey Rodarmor created the Ordinal protocol in late January 2023. In an interview, Casey explained that he'd been considering making the protocol since he saw generative art NFTs on Ethereum in early 2022. Casey wanted to bring similar kinds of NFTs to Bitcoin. However, Casey stepped down as the lead developer of Ordinals in late May and announced a pseudonymous developer named Raph Japh would be taking his place as he couldn't give the protocol the attention it deserves.

Interestingly, Ordinals only need two things to run the protocol: a full Bitcoin node and a Bitcoin wallet that can read and write Ordinal inscriptions. Casey explained in an interview that the Ordinal protocol was designed to require no extra infrastructure; it exists entirely on Bitcoin. Even more interesting about Ordinals is that the inscriptions apparently can't be searched using a browser, at least for now.

Casey explained that this is because of “instability.” This means that you must search for inscriptions manually on Ordinals.com, which isn't easy because there are many. For reference, there were more than 10 million inscriptions when Casey stepped down from the protocol in late May. It’s not surprising considering that multiple NFT marketplaces had started supporting Ordinals inscriptions, and a new type of inscription was also invented, the BRC-20 token.

Image source: X [Twitter] Ordinals Wallet

What Is A BRC-20 Token?

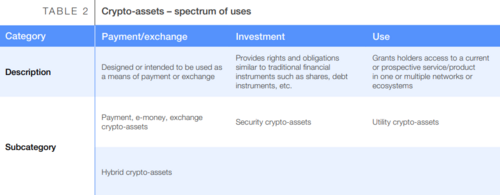

The BRC-20 token experiment was introduced by a pseudonymous on-chain analyst named Domo in early March 2023; that enables users to create fungible tokens natively on Bitcoin. However, before launching BRC-20, Domo stressed that the token is “simply a fun experiment.”

The BRC-20 token standard is similar to the ERC-20 token standard commonly used on the Ethereum blockchain. However, unlike the popular token standards on Ethereum, BRC-20 tokens do not use smart contracts. Instead, users store a script file on Bitcoin and use that to attribute tokens to individual satoshis. BRC-20s embed JSON data into ordinal inscriptions to enable users to deploy, mint, and transfer tokens. BRC-20s are considered “semi-fungible” since users can only exchange BRC-20 tokens in set increments.

BRC-20 tokens have limited functionality compared to their ERC-20 counterparts on Ethereum. Unlike ERC-20s, which can be used as collateral in various dApps, BRC-20s are restricted to minting and moving fungible tokens on the Bitcoin blockchain. This is why there were over 10 million Ordinals but only around 40,000 BRC-20 tokens. Each Sat inscribed with an Ordinal Digital Artifact only contains one image, video, or text, whereas each Sat inscribed with a BRC-20 can have millions of units of a single token.

BRC-20 Memecoin Craze Causes Fees To Skyrocket

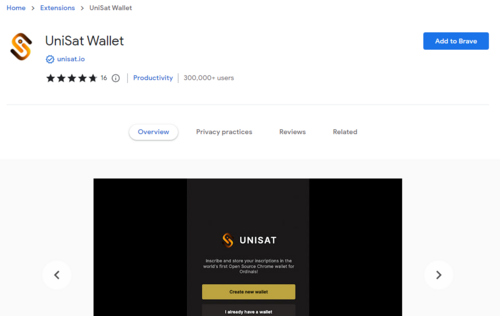

Naturally, BRC-20 tokens caused the number of inscriptions to surge, and the subsequent BRC-20 memecoin craze caused transaction fees on Bitcoin to spike. By May, the market cap of BRC-20 tokens had passed $1 billion, with crypto wallets adding support and exchanges listing the biggest ones. The most popular crypto wallet for BRC-20s and Ordinal Digital Artifacts is the UniSat browser extension. The browser wallet has been downloaded over 300,000 times so far. To put things into perspective, the wallet only had 100K downloads in mid-May – a 3X increase in a month.

Screenshot: Chrome Web Store

Meanwhile, the number of non-zero Bitcoin addresses, i.e., the number of Bitcoin wallets holding more than 0 BTC, has gone parabolic over the same period. Bitcoin miners have also been raking it in from the transaction fees. The fees actually surpassed the block rewards for the first time since 2017. At the same time, innovation around both Ordinals NFTs and BRC-20s had increased.

More Innovations Ensued

One of the most famous innovations happened in February 2023, when a crafty hacker found a way to upload a cloned version of the 30-year-old video game classic DOOM to the Bitcoin blockchain as an inscription on the network’s Ordinal protocol. You can literally play a simplified version of Doom on Bitcoin.

More recently, another pseudonymous Ordinal developer named Leonidas introduced recursive inscriptions, making it possible for inscriptions to interact. This, in turn, makes it possible to upload playable video games larger than one Bitcoin block and unlocks other new use cases.

In May 2023, Milady’s NFT enthusiasts launched a new Ordinals NFT standard with the help of an Ordinal Digital Artifact marketplace that makes it possible to bridge NFTs from Ethereum to Bitcoin. The catch is that the conversion is currently a one-way trip, but it foreshadows more interoperability for Ordinal Digital Artifacts and BRC-20s.

On that note, the first BRC-20 stablecoin was launched in late May. The caveat is that the issuer of this stablecoin appears to be somewhat sketchy. Even so, it foreshadows the launch of more reputable stablecoins directly on the Bitcoin blockchain, likely resulting in even more Bitcoin adoption.

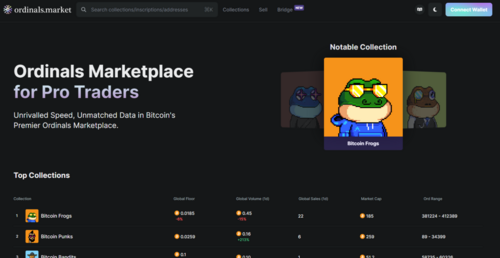

Image source: BRC-20.io

Bitcoin Maxis Pushing Back

Not everyone is applauding Bitcoin's recent innovation, however. Many have argued that Ordinals are useless. This argument has some merit, considering that some of the earliest Ordinal inscriptions contained unsavory types of content that have since been hidden. Still, as it’s been inscribed into the blockchain, the image itself is immutable.

Some have also argued that BRC-20 tokens are harmful. This is also understandable, considering that they caused transaction fees on the Bitcoin blockchain to spike. It’s made it more expensive for people in developing countries to send BTC transactions, all because some degens wanted to trade memecoins.

Others have argued that Bitcoin shouldn't be used for anything other than regular peer-to-peer BTC transactions. This is reasonable, considering the Bitcoin white paper says peer-to-peer electronic cash. Never mind that the more complexity you add, the more vulnerabilities you create.

Crypto analyst Eric Wall explained in an interview that the way the ordinals protocol was coded is akin to an exploit. Crypto VC partner Nick Carter also pointed out in an interview that this unforeseen use of the Taproot upgrade could make the Bitcoin community more hesitant to approve future upgrades. Nick believes that Bitcoin won't be seeing another upgrade for a long time because of the unforeseen risks it will create.

On the other hand, many, including Nick, have argued that the objectively useless Ordinal Digital Artifacts will be priced out due to the increased transaction fees. It makes sense because whoever pays the highest price has their transaction processed first. People won't continue to pay a high price to inscribe useless data.

Progressive Bitcoiners Counter

Some have argued that Layer 2s will solve the blockchain bloats supposedly caused by BRC-20s like the Lightning Network. This also makes sense because higher transaction fees on the base chain create an incentive to generate scaling solutions, an incentive lacking in Bitcoin.

Others have argued that the fees from peer-to-peer BTC transactions alone may not be enough to secure the Bitcoin blockchain as time passes, so additional use cases should be allowed. This makes sense because Bitcoin isn't just a crypto; it's the most secure network in the world, the ideal base layer. It's not just the progressive Bitcoiners saying this, either. Bitcoin OGs like Blockstream CEO Adam Back have acknowledged that Bitcoin can be used for whatever people want.

Many Ordinal supporters have also noted the technology’s contribution to the freedom of speech. One Bitcoin observer posted on X stating, “I know everyone hates Ordinals, but whether it’s text or images, the ability to publish uncensorable information on the Bitcoin time chain effectively makes speech uncensorable worldwide forever.”

What matters at the end of the day is the demand for block space and BTC, ideally from objectively valuable use cases. F2Pool CMO Li Qingfei underscored that Ordinals and BRC-20 tokens will eventually give rise to these objectively valuable use cases once all the hype is gone. The consensus is that both innovations are a net benefit and clear advantage to Bitcoin, but it's still too soon to say what's hype and what's here to stay.

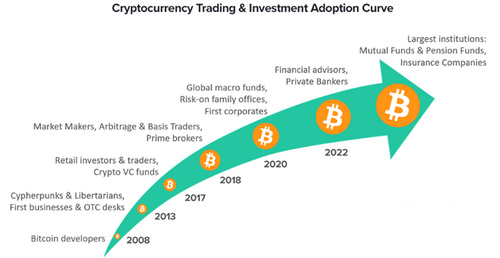

Ethereum Gearing Up for Competition

Many people have pointed out that conversations around Ordinal Digital Artifacts and BRC-20 tokens sound eerily similar to those around the first NFT craze and the ICO boom on Ethereum in 2017. At the time, people were also arguing about Ethereum’s future in light of these disruptive innovations. Some of you will recall how pictures of cartoon cats once caused massive congestion, jamming up the Ethereum network.

You may also know that most crypto projects launched on Ethereum were utterly worthless. Notably, all will appreciate that many of the NFTs and ERC-20s that survived are valuable and useful. Chances are that we will see the same thing happen with Ordinal Digital Artifacts and BRC-20 tokens. This means that Bitcoin could become more akin to Ethereum; if it does, it will make BTC a more direct competitor to ETH, and it appears that ETH has already been gearing up for this direct competition.

To explain, BTC is considered to be digital gold. This is primarily because BTC's tokenomics make it an ideal hedge against currency debasement and, arguably, inflation – It is “Sound money.” Conversely, ETH is considered to be digital oil. This is primarily because ETH is the fuel that runs Ethereum, which hosts most dApps and tokens. The narrative around ETH started to change in mid-2021 with the EIP1559 upgrade.

EIP1559 burns a portion of all transaction fees on Ethereum to refresh your memory. With enough activity, this makes ETH deflationary. Hence, the new narrative of ETH is “Ultrasound money.” Obviously, the term is meant to imply that ETH is a superior store of value to BTC due to its deflationary nature.

Image source: X [Twitter]

Ethereum’s transition from Proof-of-Work to Proof-of-Stake also made ETH more appealing to institutional investors because they can stake it to earn a yield, and we know institutions love earning yield. Regarding the environmental aspects of Proof-of-Work versus Proof-of-Stake, you should know that ESG-obsessed institutional investors aren't really concerned about the E part. They're worried about the G, the Governance, i.e., the control. Bitcoin can't be controlled, and ESG investors don't like that.

What Makes BTC More Appealing

Given that ETH can be deflationary and earn a yield via staking, it begs the question of what makes BTC more appealing than ETH to investors, particularly institutional investors. Many people have been asking this question lately, especially as ETH continues to change and BTC stays relatively static. The answer to the question is “security.”

The Bitcoin blockchain is the most secure network in the world, mainly because it is static compared with all the others, which change constantly. It is the ideal base layer on which additional innovations can be built. The only thing missing was the incentives to create them. Ordinal Digital Artifacts and BRC-20s have introduced these incentives and prepared Bitcoin’s ecosystem to see the same explosive growth Ethereum did after NFTs and ERC-20s saw genuine adoption.

The difference is that Bitcoin’s ecosystem will be much more secure due to its base layer. This is significant because security is the only thing institutional investors love more than token burns and yield. They want to be sure that the tokens they mint on a cryptocurrency blockchain will stay there forever, and Bitcoin arguably provides more certainty than Ethereum here.

This is for many reasons, including that Proof-of-Work is more secure than Proof-of-Stake. The infrastructure used to interact with Ordinal Digital Artifacts and BRC-20 tokens exists on Bitcoin itself—the fact that Bitcoin doesn't change, and it's been around for much longer than Ethereum. Never mind that BTC is the only crypto the SEC has said is not a security.

Bitcoin Innovation Risks

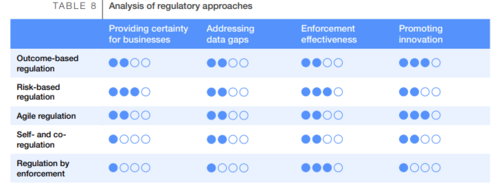

As bullish as Ordinal Digital Artifacts, BRC-20 tokens, and other Bitcoin innovations will be for BTC, there will also be risks. This is one undeniable advantage that Ethereum has: it has moved fast, broken things, and fixed them. Bitcoin hasn't broken anything yet, but unlike Ethereum, it can't afford to.

Many argue that the most significant risks associated with Bitcoin innovation appear to be regulatory. Bitcoin evangelist Michael Saylor believes there could be regulatory risks, mainly for BRC-20 tokens. Like the ERC-20 tokens on Ethereum, Michael thinks that some BRC-20 tokens could be classified as securities by the SEC. It's ironic, considering that BTC itself is supposedly immune from scrutiny.

Definitively, the most considerable risk associated with innovation on Bitcoin is one that's been overlooked, and that's centralization. As transaction fees on the Bitcoin blockchain rise because of the innovation, more people, mainly those who don't have much money, will switch to using Layer 2 protocols.

The Lightning Network is Bitcoin’s Layer 2 solution for its renowned slow transaction speed. It consists of payment channels that contain large amounts of BTC. Individual payment channels between various parties combine to form a network of Lightning Network nodes that can route transactions among themselves. The interconnections between different payment channels result in the Lightning Network.

Unless you have enough BTC and technical know-how to open your own payment channel, you must use a payment channel that a third party of some kind operates. The harsh reality is that sending BTC transactions on the lightning network using a payment channel run by a third party is no different from using a bank to send fiat transactions.

That's because every BTC transaction is tracked, and you technically don't own your BTC, meaning it can be frozen or stolen. Because of this protocol’s current vulnerabilities, third parties must run on nodes to prevent fraud within the Lightning Network, called a watchtower, which monitors transactions.

Today's gas fees on Ethereum transactions are unaffordable for most people, forcing them to use Layer 2s, which are centralized and controlled by VC investors. It’s fair to say that's not what crypto is about and what anyone wants for Bitcoin, Ethereum, or other cryptocurrencies. All being well, Bitcoin will take a different approach to growing and scaling its ecosystem than other Layer 1s. All it takes is the right incentives.

Image source: Ordinals Marketplace

In Closing

The developers of the Ordinal theory have expressed that the most essential thing the Bitcoin network does is decentralize money. They acknowledge all other use cases are secondary, including Ordinals. However, they believe that Ordinal theory helps Bitcoin's primary mission, at least in a small way.

Suppose inscriptions prove to be highly sought-after digital artifacts with a rich history. In that case, they will serve as a powerful hook for Bitcoin adoption: Come for the fun, rich art, and stay for the decentralized digital money.

Ordinals and inscriptions increase demand for Bitcoin block space, which increases Bitcoin's security budget. This is vital for safeguarding Bitcoin's transition to a fee-dependent security model, as the block subsidy is halved into insignificance and ensures that Bitcoin remains secure.

Many hope that the Ordinal theory strengthens and enriches Bitcoin and gives it another dimension of appeal and functionality, enabling it to serve its primary use case more effectively as humanity's decentralized store of value.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

.png)

.png)

.png)

(30).gif)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

(28).gif)

%20copy.png)

.png)

.png)