BREAK THE CRYPTO LANGUAGE BARRIER – Crypto Lingo Defined

How familiar are you with the ever-evolving crypto phraseology?

Have you ever come across a crypto meme but have no idea what it means? We also see crypto-related news dominating just about every medium on the internet, with cryptocurrency and the technology behind it becoming more prevalent in our global society. But there’s a bit of a language barrier regarding the terms used, and it’s growing as new terminology is invented.

Considering the Markethive social market network has its Hivecoin as an integral factor at the core of its ecosystem and a source of income for its community, understanding the crypto-specific terms when introducing your referrals to your crypto interests is a good idea and a sign of your expertise, especially to those who haven't dipped their toe into the crypto world as yet. These people are called “no-coiners.”

So let's define some of the more popular terms, what they mean, and where they originated. Many of you may already know the crypto vernacular, but as I found while researching, there is much more to them.

Hold On For Dear Life – HODL

I’ll start with the most common cryptocurrency term, HODL, which is considered the acronym for “Hold On For Dear Life” and has become one of the core philosophies of cryptocurrency investing. HODL means holding on to your cryptocurrency for the long term and paying no attention to the short-term price action.

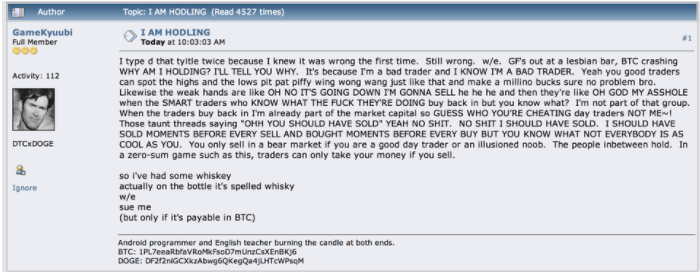

The truth is HODL was first introduced on the Bitcointalk forum in December 2013, when user GameKyuubi, with a few whiskeys under his belt, posted about missing the top of Bitcoin’s first bull run. He misspelled the word “holding,” so the post titled “I AM HODLING” quickly became a meme with respondents saying that they too would be HODLing their Bitcoin instead of actively trading it.

The people that HODL are called HODlers, and some intend to hold on to their Bitcoin until a single BTC is worth millions of dollars. Other HODlers intend to HODL until cryptocurrency becomes the new financial standard with Bitcoin as a global store of value. Therefore, see the fiat exchange rate of cryptocurrencies as irrelevant.

By contrast, people who can't handle huge swings to the upside or downside and sell instead are referred to as “weak hands.” Most of the weak hands are retail investors who are new to cryptocurrency.

Hodlers have no interest in the volatility and prognostication of pundits. They simply hodl, which helps them to counteract two common destructive tendencies: FOMO (fear of missing out), which can lead to buying high, and FUD (fear, uncertainty, and doubt), which can lead to selling low, which is occasionally referred to as SODLing.

HODL is most often used when the price of Bitcoin or another cryptocurrency suddenly drops or spikes. So when someone asks if you are selling your crypto when it reaches all-time highs, politely but firmly say that you are hodling. This may leave that person feeling some FOMO.

Fear Of Missing Out – FOMO

FOMO is short for “Fear Of Missing Out,” and in the context of crypto, FOMO is what you feel when you see the price of a coin or token that you don’t have in your portfolio reaching new ATH, which is an acronym for all-time highs.

Interestingly, FOMO is technically classed as social anxiety identified in 1996 by marketing strategist Dr. Dan Herman. It wasn't until 2004 that FOMO was coined by venture capitalist and author Patrick J. McGinnis, who subsequently popularized it in an op-ed he published while studying at the Harvard Kennedy business school.

If you've ever seen those Facebook ads that tell you there's a limited time to buy any given product, that's FOMO marketing. According to McGinnis, the only thing worse than FOMO is FOBO, or “Fear Of a Better Option.” FOBO is more relevant to no-coiners as it refers to waiting for something better to come along.

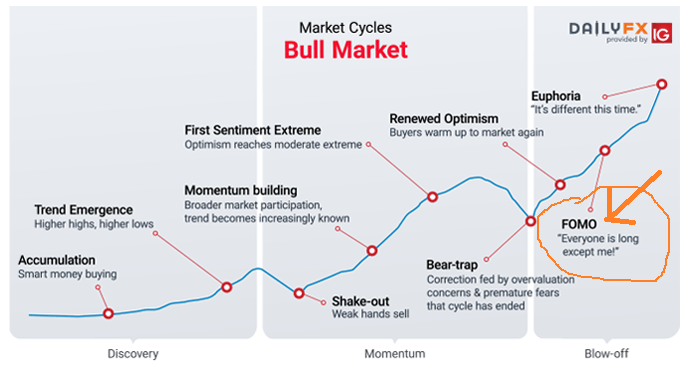

Widespread FOMO is also considered by many to be the second last stage of a bull market cycle which is why you see a lot of discussion around retail and institutional FOMO when talking about what's going to drive Bitcoin to its all-time highs. Some believe that measuring this FOMO is how you can time the top of a bull market.

Fear Doubt And Uncertainty – FUD

The opposite of FOMO is FUD which is the abbreviation of Fear, Uncertainty, and Doubt. FUD is pretty self-explanatory; it's what you feel when you see the crypto market crashing or see a viral news article about how Bitcoin is dead. People who spread FUD are referred to as fraudsters and of which the corporate media has been guilty.

In contrast to FOMO, FUD is not social anxiety but a propaganda tactic used exclusively in sales and marketing. Wikipedia notes that FUD is used most in “disinformation related to software, hardware, and technology industries.”

It was popularized in the 1970s and first used in its common current technology-related meaning by the prominent computer architect Gene Amdahl in 1975 after he left IBM to found his own company, Amdahl Corp.

“FUD is the fear, uncertainty, and doubt that IBM sales people instill in the minds of potential customers who might be considering Amdahl products.”

It makes you wonder what IBM is saying about crypto behind closed doors while shilling their centralized blockchains to hypnotized investors. Some people believe that big banks and tech giants sponsor a fair chunk of the cryptocurrency FUD you see in the news.

So the next time your no-coiner friend sends you another mainstream article talking about how cryptocurrency is going to be banned by U.S. Regulators, you can tell them that it's nothing more than FUD. A good indicator of this is that if whales and institutions are still buying despite the news, there's no real cause for concern. There are also many free online trading indicators to use to follow the trends.

Hopium

It’s essential to back up your beliefs about a cryptocurrency using solid facts and statistics; otherwise, you may be at risk of becoming a hopium addict. Hopium is an addiction to false hopes and is a blend of the two words “hope” and “opium.” It’s used to describe a fictional drug to help one stay hopeful in times of stress.

The term has been used among stock market investors to describe market investors who hold on to failing investments out of false hope, and more recently by Bitcoin investors in a similar way. Hopium was first used in December of 2010 by Zero Hedge’s Tyler Durden, who published an article criticizing Goldman Sachs for an opinion on the economy. In the piece, Durden uses the term "hopium" to describe Goldman's outlook as one based on false hope.

It has since been used in many investment articles and became a viral meme of Pepe the frog hooked to an oxygen tank labeled “hopium.” Hopium memes grew in popularity due to the 2020 US Election alongside another closely related portmanteau, “copium.”

Copium

Copium is a blend of the words “cope” and “opium.” A user of the Urban Dictionary defined copium as “a metaphorical opiate inhaled when faced with loss, failure or defeat, especially in sports, politics and other tribal settings.

Although the earliest known use of the word was by rap artist Keak Da Sneak in his 2003 album titled Copium, in 2019, it has become a popular meme with Pepe, the frog and used in various instances as a reaction to any given situation.

Shitcoin

Co-host of Unhashed Podcast, Ruben Somsen, is credited with defining what a shitcoin tweeting a shitcoin is “a coin that can be predicted to go to zero because of its flawed fundamentals, its creators and adopters deny all criticism and focus heavily on misleading marketing in order to extract maximum value from new “investors,” saddling them with the inevitable losses.”

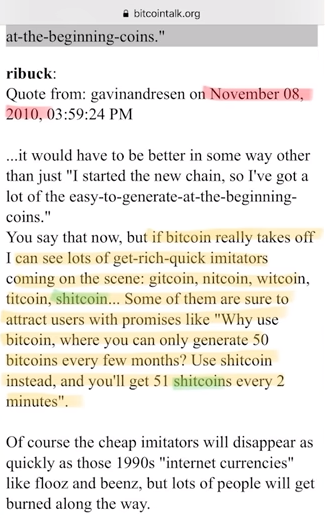

Shitcoin was first used in November 2010 by Bitcoin talk user Gavin Andresen. He predicted and quoted that “if Bitcoin really takes off, I can see a lot of get-rich-quick imitators coming on the scene” and notes that shitcoin as being one of these imitator coins.

There are actually two literal shitcoins listed on Etherscan as ERC 20 tokens. Also, the FTX cryptocurrency exchange offers numerous shitcoin index tokens that allow you to “long” or “short” a basket of 58 altcoins. However, some may not agree with all the tokens listed.

According to the Shitcoin Graveyard, all shit coins are destined to become either dead coins or zombie coins. A dead coin is defined as a cryptocurrency project that its team has abandoned, has less than $100 of trading volume per day, and no longer has a functioning website.

Zombie coins are basically dead coins with relatively high trading volume. Keep in mind that the trading volume you see on many zombie coins is probably fake, especially if it's happening on lesser-known exchanges. It's also worth noting that a cryptocurrency can still be profitable even if it is a shitcoin; just be wary of the risks of investing in these sorts of projects.

Image source 99bitcoins

REKT

REKT (or rekt) is internet slang for “wrecked,” meaning severely damaged or utterly destroyed and ruined. The term is usually used among the online gaming community describing a player (or team) that was defeated in an embarrassing or silly way.

Specifically, when used in the crypto community, rekt often refers to a person who has experienced heavy financial loss due to a wrong trade investment. The term can also refer to the cryptocurrency itself that nosedived in price or a market that dropped significantly, e.g., “the market is rekt.”

It is, however, worth noting that being REKT and truly losing money are quite different since rekt assets can bounce back. For example, back in early 2018, Bitcoin was rekt, yet it bounced back by year's end in 2020, reaching a new all-time high.

Image source 99bitcoins

Shill

Shill has become a popular term in the crypto space and refers to a person who will promote a particular cryptocurrency, typically using baseless information, for their personal gain. Many crypto projects assign bounties for influencers who “shill” their crypto. A “Shiller” encourages others to invest in a cryptocurrency so that the interest grows, and people buy it, and the price of the coin or token increases.

The word “shill” didn’t originate in the crypto world. It is commonly used by casinos where collaborators (shillers) are given a stack of chips to play so that the other gamblers don’t have to feel alone in losing.

Shillers are often seen as fraudsters; however, what constitutes a shill is of personal opinion. Sometimes, we can see the use of shilling when a person makes damaging, occasionally false accusations about a specific cryptocurrency. A Shiller may want a competing crypto to fail so that theirs becomes more valuable.

Pump And Dump

A “pump-and-dump” strategy is a form of market manipulation that has been around long before cryptocurrencies existed. “Pump” happens when a coin or token’s attention and demand in the market goes up, leading to a price increase. Then, everyone “dumps” the cryptocurrency and sells, coupled with a spread of negative emotions towards it. This will result in big waves in the crypto’s value.

Like FUD, pump and dump is another tactic they use to manipulate the sentiments of the crypto market. In many cases, traders artificially inflate the price of cryptocurrencies with the hope of making a quick profit at the expense of other investors.

A simple rule of thumb to avoid pump-and-dump schemes is that you should never listen to one particular influencer’s opinions about investment decisions or price predictions. Instead, take in as many different views as you can, do your own research (DYOR). Always verify and validate market news and information.

Airdrops

Airdrop has become a central feature of the cryptocurrency space. It refers to the practice of crypto projects giving away free tokens to the public. This can lead to an increase in the project’s publicity and token circulation. It then gets more people trading it when it lists on an exchange.

As a marketing strategy, it raises awareness for their offering among the crypto community and generates initial buzz around a crypto project. This creates a win-win scenario because the crypto project gets low-cost (or free) marketing about their project, and you get free crypto tokens.

An example of a crypto project doing airdrops is Markethive, the next generation social market network, with its infinity airdrops and micropayments. As a member of the Markethive community, whenever you refer someone, you currently receive 500 Hivecoin.

Also, your referral receives an equal amount upon joining. Once qualified, a member continues to receive micropayments allowing the ability to accumulate coins. Among many other of Markethive’s initiatives, this ultimately creates an entire ecosystem.

In Closing

There you have it. Just some of the key crypto slang terms, and you’re likely to come across many more, along with new words and acronyms that will find their way into the crypto world as the industry evolves. To check out a few more, visit cryptocurrencyfacts.com. Cryptocurrency slang is a handy thing to know, and knowing where all these terms came from really highlights just how far the crypto asset class has come.

HODL is really much more than some whacky acronym that is bandied about. It's symbolic of the sort of mindset and grit you need to have to brave the volatile crypto market. I’m sure we’ve all had weak hands at some point, nor are we immune to FOMO or FUD, but if we keep our head down and focus on the fundamentals, we’ll rise above it.

There is a saying that goes:

"Where focus goes, energy flows."

If you are focusing on the "crazy" daily fall in your portfolio, it will throw you off and consume you.

If you decide to focus on the fantastic ways cryptocurrency is transforming our world, you will be content in your investment decisions.

I hope that being familiar with these terms will help you educate others about cryptocurrency. Of course, knowing the history and law behind them will make the explanation of these terms that much more interesting to your no-coiner friends.

Resources: Coin Bureau, Genesis Block

Written by Deb Williams

Chief Editor and writer for Markethive.com, the social, market, broadcasting network. An avid supporter of blockchain technology and cryptocurrency. I thrive on progress and champion freedom of speech and sovereignty. I embrace "Change" with a passion, and my purpose in life is to enlighten people en masse, accept and move forward with enthusiasm.

The information contained in this article is for informational purposes only and not to be construed to be financial, legal, or investment advice.