If you are new to business and online marketing, welcome! I know from experience that it can feel both exciting, yet overwhelming to know where to start. This article shows you how to get off the mark with the customer journey to your first few clients. It will address three core reasons why businesses fail as it relates to the customer journey. The three areas are, no product to market match, no compelling offer, and lack of funding. It will also cover some free and low cost assistive tools for online deployment.

Business Failure: No Market to Product Match

Before looking at all the bells and whistles that might comprise your marketing resources and essential toolkit, it's important to take inventory of what you are looking to bring to the table through your gifts and talents by way of a product or service. Having determined that, who is your target avatar and how does your product or service fit with the market?

Research

Since a no product to market match is one of the cited reasons a business fails in the first few years, it is important to avoid the temptation to second guess the market. Let the market give you the feedback.

Step 1 – Collate

Compile research on your topic area from both a market data and educational perspective. Look at opposing viewpoints too. A simple free tool to start is to use your google browser to type in a buyer keyword to see what people are predisposed to buying in your category. Artificial Intelligence has also developed free tools such as SIRI and Google Voice. Google Keep and Evernote are valuable tools for capturing information.

You could also use social media sites such as facebook, linked in and google ads, or you could use special interest forums. Alternatively you can use sites like Fiverr or Upwork as a low cost way to get your research off the mark.

Step 2 – Engage

It's important to speak to your target market, in order to further test how your product or service will meet their needs. This will help you develop and refine your offer as you customize for an optimal fit. You can use typeform or google forms as a free tool to compile a brief survey. You could also print your form off and do this informally in your community or at your local business event. If you want to gather survey data on a more global basis, you might want to consider survey monkey as a more specific alternative to social media ads. This is a paid service.

Bear in mind that any data and research will form part of your marketing collateral later. Here is a free guide on how to create a lean canvas, which is a streamlined one page diagrammatic layout for your business model with research tips, by Ash Maurya. Keep it simple.

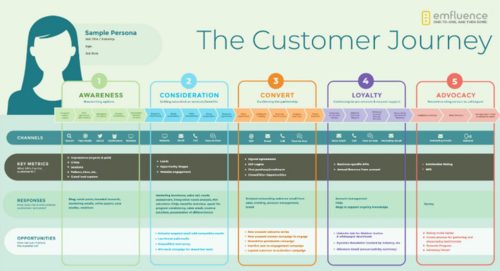

The Customer Journey

The whole process of sales and profits is not simply about how good your product is but also about the prospect you foresee becoming your customer. So it pays to understand the journey of sales from their perspective, not just yours.

.jpg)

Source Image: Customer Journey

For example there are various models which give out a structural formula from your perspective, and the most common one I see is the AIDA formula, which stands for Awareness or Attention, Interest, Desire and Action. That is client acquisition from your perspective, so you may wish to consider a more expansive process that covers the relationship from initial awareness to what it would be like to have a long term customer who is happy to espouse your services to others.

It is worth taking the time to profile your client as that will give you a depth of understanding which will enable effective communication as you create touch points. Psychographics is the term often used to describe this activity, where you examine attitudes, buying behaviours, desires etc.

Touchpoints

Touch points are the various ways in which you will communicate and educate your prospect throughout the customer journey. This may include email, direct messaging, business events and phone conversations. They will take on board the demographic profile of your prospective customer too. Demographics are to do with location, job, income for example.

If your solution is solving a problem a potential client does not even know they have, education is going to be a key part of your communication process. Bear this in mind as you move forward. Touchpoints should be a secondary consideration to building on the foundation of understanding your customer, as Mckinsey & Company conclude.

“We found that a company’s performance on journeys is 35 percent more predictive of customer satisfaction and 32 percent more predictive of customer churn than performance on individual touchpoints. Since a customer journey often touches different parts of the organization, companies need to rewire themselves to create teams that are responsible for the end-to-end customer journey across functions.”

McKinsey & Company

You can create a visual template that maps out the customer journey using free tools such as mural. Or you could use microsoft dynamics. Here is an example of a simple design overview.

Source Image: Customer Journey Template

Education

This is an important factor and needs to be done in a way that rather than simply persuade, will help your prospect make an informed decision. This means including the benefits but also the downsides, or who this is not for. This approach helps to build trust, which is at an all time low in general. So be willing to take the time to build trust. An automated way to educate your prospects in a drip feed manner is by the use of an autoresponder. This way you can pre-sequence and deliver content at a reasonable pace.

Autoresponders do not come cheap and increase as your audience grows. The only exception to that which I found is trafficwave.net which keeps a consistent low price regardless of audience size. Better still is Markethive’s free autoresponder which has a one click sign up facility and great deliverability. For a walk through on the setup of this autoresponder watch this video tutorial.

You can combine that with a medium to educate your prospects such as live events or video. You can use audio too if you are camera shy but video is best in a world where trust is at an all time low. Education is where you get to showcase your expertise as to how your offer will significantly benefit your prospect. This may happen in an experiential online or offline event.

The more you can show rather than just tell, the better. You want your prospect to be able to experience a different future as a result of purchasing from you. Assistive free tools you can use are zoom’s video conferencing tool to interact, which is free to use for 40 minutes for a maximum of 100. You can also record videos too. OBS is a free video and live broadcasting tool which you can download to your computer and create educational content too. Markethive will shortly be coming out with its own inbuilt video conferencing in due course as it comes out of beta. So watch this space.

Business Failure: No Compelling Offer

When you offer your product it is important that it is a compelling offer, otherwise you will fail on execution. This is where proof of concept comes in.

Proof of Concept

Proof of concept is where you get to test the viability of your product or service through confirmed sales, prior to a full launch. This may come in a break even or beta form, where you give a discount in return for your prospects trial of your offer, and their video feedback for example.

The results can become part of your marketing on a bigger scale later. In the meantime, it is important to bring clarity and confidence to the prospect if they are to buy from you. While it is possible to conduct sales manually, you will also need to consider an online website and payment structure.

When it comes to websites, your choice will depend on your business model. You could use a simple lead capture page to start with, which will allow you to integrate your chosen autoresponder. Markethive also offers free capture pages. WordPress is a popular free drag and drop website platform with free themes which shape the look and feel of your site.

You will need a domain name and hosting for your website if you choose this route. You also may need to acquire a bit of technical knowledge to put it together. Here’s a tutorial. A less usual but cheaper and faster alternative is amazon S3 web buckets. Canva is also a great free resource where you can use templates to build websites and create graphics to get started.

For a cottage industry, you might prefer to start with a low key way to test the water and build community so one option might be Buy Me A Coffee, which has less of a corporate feel, and where you can connect to a payment provider called Stripe. For payments in general, you can always use paypal, stripe or wise, both of which have an invoice feature, and are global providers.

Business Failure: Insufficient Funding or Lack of Capital

This is a common reason for business failure and many funding attempts fail and are unable to compete with global corporations. However, If you construct your business plan in the manner described in this article, you will stand a better chance because you will have demonstrated a compelling offer to market match.

New funding sources are emerging all the time yet many of the conventional ways still are not working for entrepreneurs. Creativity is needed and it may be that you start simple with a self-liquidating approach where you use a skill as a side hustle to acquire cashflow for your business.

Another consideration that has serious merit is Markethive. Markethive is an example of an innovative ecosystem which has overcome the product to market match, has a compelling offer and a funding solution for the new and existing entrepreneur, in action.

Firstly, Markethive is meeting a demand in the markethive place with a compelling suite of offers in both free and paid membership. Built from the ground up, it is now powered by the blockchain as a social network and inbound marketing ecosystem combined, with free and cost-effective tools to help level the playing field for the entrepreneur just starting out.

If you need to acquire marketing tools to reduce costs, you get at least $2000 worth of that in the free membership alone, including an autoresponder and lead capture pages to name a couple. You also get rewarded for contribution to the platform. When it comes to cash flow its unique ILP offer [initial loan procurement] provides a paid subscription which gives you even more tools while sharing in the profits of the company as the company grows.

This unique offer is shortly to expire, so check out all this ecosystem has to offer and see where it might fit your needs. It was built for you. Consider how it will help you future proof your business.

Launch Party

When you finally launch your offer, celebrate! Consider having a launch party where you create a special offer for first time customers. It is no mean feat to have created an offer to market match and one that is compelling. You have set your business up for success! Although this article has addressed how to get off the mark, the sale is just the start, and it will bode well to remember that.

How you nurture your client, so that they become a returning customer, where appropriate, is going to be down to how you nurture and support that relationship, as well as the value-added improvements you make to your offer. You will also need to consider how to scale and automate key parts of your business, such as social media content sharing so you can focus on your expertise.

Also remember to continue to communicate with those who did not purchase. Many buy later in time. Lack of follow through is also responsible for lost sales. According to one report 60% of customers reject offers four times prior to an eventual purchase.

On a final note, the beauty of surveying prospects is that they too can become a part of the journey of your compelling offer, helping you to craft the perfect offer through their feedback. This makes them more than a purchaser, someone who has become part of the creative journey and solution. They are your community, the ones that are likely to act like your marketing arm or ambassador in the future. Look after them and your business success will increase.

(7).gif)