The crypto-verse is truly holding its breath as Gary Gensler of the SEC shifts his gaze towards the challenges presented by artificial intelligence. In the whirlwind domain of cryptocurrencies, where values swing wildly in the blink of an eye, it's rare for a single person's actions to stir up so much speculation and excitement across the entire industry.

Yet, that's exactly what's happening with Gary Gensler, the Chair of the U.S. Securities and Exchange Commission (SEC), as he zeroes in on the hurdles posed by AI. It's like a sudden plot twist in a gripping movie, keeping everyone on the edge of their seats. But the stakes are much higher this time, and the outcome could determine the destiny of an entire economic sector.

Gensler's tenure as the SEC Chair has been all about taking the reins in cryptocurrency regulation. He's brought lawsuits and investigations against significant players in the crypto field, aiming to establish more explicit guidelines and clamp down on possible fraud or deceptive practices. This bold approach marks a clear departure from the more hands-off attitudes of the past. However, just when everyone thought they had the storyline figured out, the narrative took an unforeseen twist.

Gensler, recognized for his deep understanding of financial regulation and emerging technologies, has made a surprising choice to shift the SEC's focus toward the challenges posed by artificial intelligence. This unexpected move has raised eyebrows among those in the industry and those observing from the sidelines. With the crypto market booming and regulations still a work in progress, the question arises: Why would Gensler shift his attention to a whole new frontier?

The crypto sector now stands at a crossroads, uncertain about the path ahead. With Gensler's attention toward AI, those invested in cryptocurrencies can't help but wonder how this chapter will unfold. Will it be a story of collaboration and forward movement or a tale filled with suspense and hurdles? Only time holds the key to revealing the upcoming exciting chapter in this ongoing saga.

Regulatory Concerns and the SEC

The SEC wears the hat of a regulatory guardian, ensuring that securities are handled fairly, and markets run smoothly. When it comes to the realm of cryptocurrencies, their mission extends to safeguarding investors against fraud and unethical practices. They meticulously monitor Initial Coin Offerings (ICOs) to guarantee compliance with securities laws. Think of them as the lawmen of the digital Wild West, where crypto-cowboys roam.

But the plot has taken an interesting twist. The SEC's head honcho, Gary Gensler, has unveiled a change of focus. Instead of exclusively zeroing in on cryptocurrencies, he's turning his attention to the hurdles posed by artificial intelligence (AI) in the financial arena. The US watchful regulators are now keeping tabs on the potential influence of our future robot overlords.

This shift has thrown the crypto industry into a state of suspense. What does this mean for the fate of cryptocurrencies? Will they finally break free from the chains of regulatory uncertainty, or could they find themselves overshadowed as AI takes center stage? The answer is yet to be unveiled.

But one thing is sure: Gary's shift might divert attention and resources from overseeing cryptocurrencies. This could bring a sigh of relief to those yearning for less interference or raise eyebrows among those advocating for stricter control. The industry is undoubtedly in for some turbulence as this transformation unfolds. It's akin to riding a rollercoaster with no map of its twists and turns.

The crypto industry has weathered many ups and downs before and is well-equipped to navigate this latest twist. It's all part of the wild and unpredictable nature that makes this industry so intriguing. Moreover, who knows the ways in which AI could revolutionize the cryptocurrency landscape? Picture self-trading coins or wallets that seem to possess a mind of their own. The potential seems boundless!

So, as we await the SEC's strategies to tackle AI challenges, let's keep our gaze fixed on the ultimate goal. Cryptocurrencies have come a long way, and their journey is far from over. As the industry matures and adapts, we'll continue to rise above whatever hurdles come our way. After all, these very challenges shape us and fuel the evolution of this exciting sector.

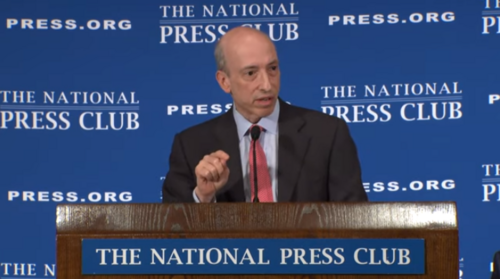

SEC Chair Gensler speaking before the National Press Club on July 17. Source: SEC

In his speech at the National Press Club, Gary Gensler underlined a significant truth: While the cryptocurrency arena has its fair share of issues like scams, hacks, and money laundering, the realm of artificial intelligence (AI) poses even more significant financial hazards for folks in the US and other nations. As he delved into the topic, Gary spotlighted various risks tied to the ongoing AI surge, which could shake up trillions of dollars worth of assets traded on markets overseen by the SEC.

Looking closely, Gary explains that amidst this AI boom, there's a flip side to the coin. On one hand, AI-generated investment suggestions could revolutionize the customer experience within financial institutions. Sounds promising, right?

However, he doesn't shy away from pointing out a potential drawback. This emerging technology could also be used to blur the lines of accountability when things go wrong. If errors or failures occur, AI could be exploited to shroud responsibility. AI-driven trading bots can potentially manipulate financial markets, particularly in unregulated sectors like cryptocurrency. This manipulation can deceive investors into buying assets at inflated prices, resulting in financial losses.

Phishing scams used to stand out due to their misspellings or grammar mistakes, but with the advent of generative AI, creating well-written emails in any language has become effortless. This technology can craft convincing messages that mimic native speakers. In simpler terms, Gary is raising a flag on the potential upsides and downsides of AI's influence on the financial world. It's like navigating a brand-new terrain where incredible opportunities and unforeseen pitfalls are equally likely. As he steers this conversation, Gary is essentially shining a light on the unknown pathways that lie ahead in the realm of AI.

Phishing scams used to stand out due to their misspellings or grammar mistakes, but with the advent of generative AI, creating well-written emails in any language has become effortless. This technology can craft convincing messages that mimic native speakers. In simpler terms, Gary is raising a flag on the potential upsides and downsides of AI's influence on the financial world. It's like navigating a brand-new terrain where incredible opportunities and unforeseen pitfalls are equally likely. As he steers this conversation, Gary is essentially shining a light on the unknown pathways that lie ahead in the realm of AI.

Image source: X [Twitter]

The Waiting Game

Gary Gensler has been quite vocal about his criticisms of the crypto world, accusing it of being filled with hackers, fraudsters, and scams. He's been attacking the industry with full force, making us all wonder what his next move would be. But then, out of nowhere, BlackRock, the giant investment firm, steps in and expresses its interest in crypto.

They see the value and potential in Bitcoin and other cryptocurrencies. And just like that, Gary's tone changes. He suddenly shifts his focus to AI and suggests we can address the crypto world later. It's almost like that schoolyard bully who picks on a kid, only to back off when he realizes the kid has a strong older sibling to protect them. BlackRock is that older sibling defending crypto against Gary's attacks.

This turn of events is quite amusing to watch. With Gary's attention focused on AI startups, it's safe to say that those in the AI industry need to brace themselves. It seems like Gary is excited about this new direction and wants to regulate AI. As for crypto, there's a sense of relief that his aggressive attacks might lessen.

However, remember the importance of clarity and resolution for ongoing cases. The SEC seems to be strategizing by prioritizing the current cases before moving on to new ones. After all, a win in these high-profile cases could set a legal precedent that affects the entire industry.

It is essential for the crypto community to come together and support each other in these cases. The industry can't afford to have a fragmented stance where some projects are supported while others aren't. The outcome of the SEC’s regulation against AI will impact the entire crypto industry, and it's crucial for crypto to have a strong track record.

All the players need to understand that it's not just about supporting one project over another but rather about advocating for a fair and just resolution for all cases involving crypto. So, amid all this, we continue to watch the developments unfold. The shift from attacking crypto to focusing on AI is quite the twist, and it'll be interesting to see how it all plays out.

The Bottom Line

AI is making leaps and bounds in technology, with blessings and concerns in store for the cryptocurrency industry. The fusion of AI and various aspects of cryptocurrencies can make things smoother, more accurate, and super secure. Picture this: Trading strategies are automated, and fraudulent activities are identified in a snap. That's the kind of potential AI brings to the table.

But of course, there's the flip side. Cryptocurrencies' unique, decentralized, and roller-coaster nature poses a challenge for AI algorithms. Making sure these systems can keep up with the ever-shifting crypto landscape is no cakewalk. And let's not forget about the worries around privacy, data security, and biases sneaking into AI decisions. All these are real concerns that are keeping industry regulators awake at night.

Now, while the SEC's AI focus might momentarily shift away from cryptocurrency regulation, folks in the know are pretty sure it's just a temporary shift. The waiting game has begun, and everyone's busy speculating. Will we see more regulations? Will the cryptocurrency ecosystem become even more robust and secure? It's like making guesses about what's in the next plot twist.

As for how the industry is reacting to Gensler's AI interest, it's a mixed bag. Some see it as a thumbs-up, a sign that the SEC is on track with keeping up with the times and potential risks. Others have their brows furrowed, worried that too much regulation might stifle the creative spark of innovation. But no matter which side you're on, one thing's for sure: AI and cryptocurrencies are about to collide in ways that could blow our minds.

In a world that's moving faster than ever, the way to win is adaptability. As we all eagerly await the SEC's next moves, folks in the industry should gear up to be informed, ready to act, and quick on their feet. Embracing innovation while addressing valid concerns is going to be the way forward. This fusion of AI challenges and regulations promises a truly exciting future where finance and technology intertwine to change how we perceive and handle money. Get ready because it's bound to be a thrilling ride!

.png)