Bitcoin Breaking Past $9,000 And $11,700 Would Confirm Bull Rally

Bitcoin Not Decidedly Bullish Yet

The Bitcoin (BTC) price action on the weekend shocked investors across the board. Some, however, aren’t sure that BTC is in the clear just yet, choosing to be skeptical instead of adopting the “Fear of Missing Out” that many cryptocurrency investors have surging through their veins. What will convince these cynics that this market is in a solid uptrend, and is ready to establish new all-time highs?

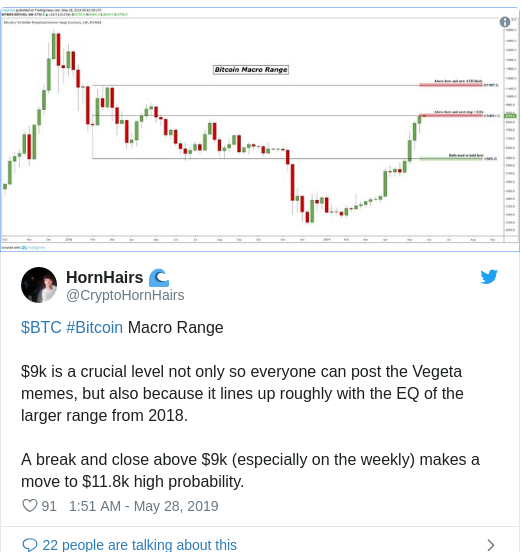

According to HornHairs, a cryptocurrency trader, a key price point that BTC needs to surmount in the near-term is $9,000. Earlier this week, we saw the digital asset run to just short of that level, flirting with $8,970. HornHairs opines that $9,000 is key, as that was the equilibrium of Bitcoin’s range from late-2017 to late-2018, suggesting that it will act as resistance.

Once Bitcoin closes above that level on the daily and weekly chart, just as BTC did with the $8,400 level, the analyst believes that a move to $11,800 has a “high probability of breaking out.” And according to analyst Teddy Cleps, a break and close above $11,700, in his eyes, would confirm the bull market, as Bitcoin’s collapse below this level is “what made the bear market official.” As seen below, BTC touched that level three times in early-2018, accentuating that it is a level of importance.

Can This Happen?

Sure, the technicals show that Bitcoin needs to surmount the aforementioned price levels to enter a full-fledged rally. But, are the technicals and fundamentals there to back such a move? Let’s take a look.

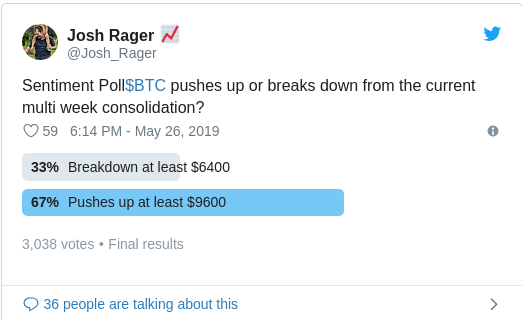

In a recent poll, analyst Josh Rager asked his followers where Bitcoin could head next. Surprisingly, 67% of 3,000-odd respondents picked the option that read “pushes up to at least $9,600”, while the remaining chose “breakdown to at least $6,400.” This would suggest that the sentiment of most cryptocurrency investors is clearly bullish.

Fundamentally, BTC and its respective market still look strong. In fact, Binance, one of the largest digital asset exchanges, purportedly — according to CEO Changpeng Zhao — saw a system traffic all-time high “by far” on Monday. Considering that the cryptocurrency industry is barely out of a “crypto winter”, and the market is still 70% down from its all-time highs, this fact is jaw-dropping.

More broadly, the underlying infrastructure of the industry is nothing like it was in previous cycles, even at the peak of 2017’s rally. In 2014, were Fidelity Investments, E*Trade, Microsoft, TD Ameritrade, Nasdaq, and their Wall Street and Silicon Valley brethren involved in cryptocurrency and related technologies? No.

By Nick Chong May 29, 2019

Alan Zibluk Markethive Founding Member