Bitcoin (BTC) Bear Market Isn’t Over? Industry Analysts Duke It Out

Bitcoin Could See Another Drop

With Bitcoin (BTC) recently surmounting $5,000 in a move that came straight out of left field, some are sure that bears are done. Jonathan, a forex and cryptocurrency trader, however, recently explained that it would be unfair to assume that the bear market is over. In fact, in a recent Twitter post, he seemed to hint that proclaiming a bear trend over is irresponsible.

He recently explained that this same cycle of optimists calling for an end to the bear after a short-term, emotion-inducing spike always ended in disaster, looking to Bitcoin’s bear market rallies throughout 2018. Past performance isn’t indicative of future action, but considering the reliability of short-term upticks resulting in an eventual move to fresh lows, Johnathan might have a point. Certain technical indicators, too, could also be hinting that a move lower is inbound.

Nunya Bizniz recently wrote on Twitter that the last time Bitcoin’s one-week Guppy, a technical indicator that weighs moving averages to predict price trends, looked as it is now, BTC rallied into the top of its range, before a final capitulation event, which brought the cryptocurrency lower than the seeming bottom. Thus, if history repeats, BTC will move to as high as $5,600 in the coming weeks, before a rapid sell-off that brings the asset under $3,000 for mere days.

Even if there are unlikely to be fresh lows, many analysts are adamant that a return to all-time highs won’t occur until 2020 at the earliest. Dave The Wave, an analyst who favors the MACD indicator, recently posted the chart below on Twitter. While little was divulged, other than “2019 — a year of accumulation and consolidation,” the chart implies that if history repeats itself, Bitcoin could trade relatively flat over much of 2019, eventually rallying into 2020’s block reward reduction.

Magic Poop Cannon, a technical analyst that has been tacitly endorsed by Tom Lee, recently made a similar comment. Per previous reports from this outlet, the trader believes that Bitcoin will trade between $3,200 and the “low 4,000s” for much of the year.

Maybe “Crypto Winter” Is Over

The aforementioned sure seem to be making the case that the cryptocurrency downturn isn’t over yet, but some analysts have begged to differ. As reported by Ethereum World News earlier today, Tom Lee, revealed that he thinks the worse may be over for BTC.

Fundstrat’s in-house crypto bull remarked that Bitcoin’s sudden spike last Monday was based on “true buying,” making it not an act of manipulation as some postulated. This is likely in reference to a Reuters report, which claimed that a single group or entity managed to purchase $100 million worth of Bitcoin across three exchanges, creating a short-term influx of FOMO that pushed BTC higher.

Furthering the bullish narrative, Lee looks to the 200-day moving average, which has acted as an overarching level of resistance for BTC since early-2018. The Fundstrat co-founder explains that while many proclaimed cryptocurrencies dead as a result of their -85% performance from top to bottom, BTC closing and holding above the aforementioned level confirms that it is “back in a bull trend.”

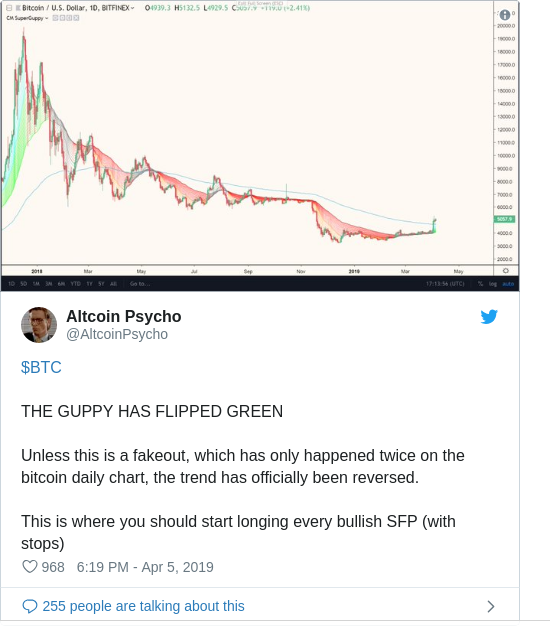

Technicals, too, could also show that Bitcoin’s downturn has likely bitten the dust. According to analyst Altcoin Pyscho, the Guppy has “flipped green” on the one-day Bitcoin chart on BitMEX.

While there’s a fleeting chance that this shift in the Guppy is a bull trap or “fakeout,” which has purportedly only occurred twice in BTC’s history, Pyscho asserts that the bear trend has likely been reversed. He adds:

“This is where you start longing every bullish swing failure pattern (with stops).”

By Nick Chong April 7, 2019

Alan Zibluk Markethive Founding Member