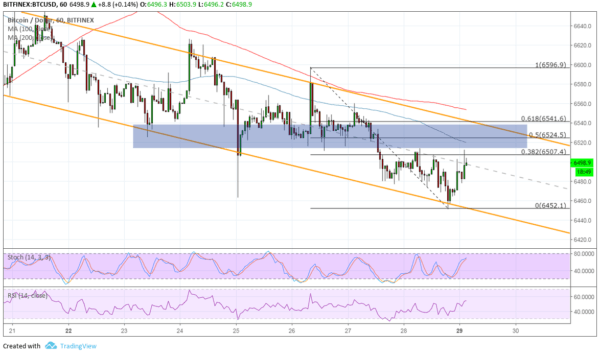

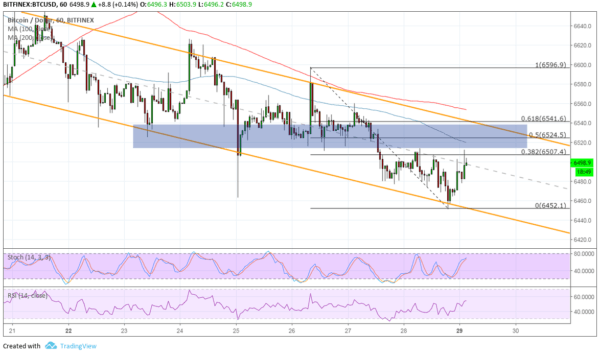

Bitcoin Price – BTC/USD Approaching Area of Interest

Bitcoin is still trending lower inside its short-term descending channel but might be due for a bounce to the top. Support held and a correction to the Fibonacci retracement levels is underway.

Price is testing the 38.2% Fib currently, and this happens to line up with the mid-channel area of interest. Holding as resistance could send Bitcoin back to the swing low around $6,450 or the channel support closer to $6,425. A larger correction could test the 50% Fib that lines up with a former support area that might now hold as resistance, as well as the 100 SMA dynamic inflection point.

The 61.8% Fib is just below the 200 SMA dynamic inflection point and close to the channel resistance, which might be the line in the sand for a correction. The 100 SMA is below the longer-term 200 SMA to indicate that the path of least resistance is to the downside. In other words, the downtrend is more likely to resume than to reverse. The gap between the moving averages has been widening to signal strengthening bearish momentum.

Stochastic is heading higher to signal that bulls still have some energy left, and the oscillator has some room to climb before hitting overbought conditions. RSI also has some ground to cover before bulls are exhausted, which suggests that the correction could go on for a bit longer before sellers return.

Pic

Bitcoin might even have enough momentum to break past the channel top, provided market updates also turn out positive. As it is, investors still seem to be holding out for more directional clues and hoping to get confirmation that the earlier rallies might be sustained.

Institutional investment could be a strong factor, but that might have to wait until early next year. The near-term catalyst would likely be the bitcoin futures on ICE Bakkt and it appears that traders are waiting to see how this might impact prices first.

SARA JENN · OCTOBER 29, 2018 · 1:30 AM

Alan Zibluk Markethive Founding Member