Bitcoin Price Storms 151% YTD as Facebook’s Libra Boosts 2019 Rally

By CCN Markets: Bitcoin is up more than 151 percent against the U.S. dollar year-to-date at $9,300, surpassing most assets and stock indices in the likes of Nasdaq 100 and S&P 500 with ease in six-month performance.

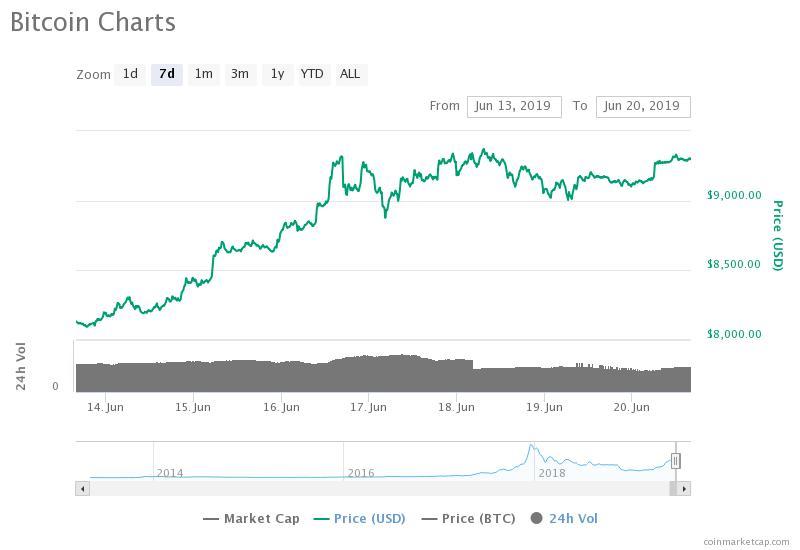

The bitcoin price is up nearly $1,200 in the past week (source: coinmarketcap.com)

With the block reward halving of bitcoin on the horizon and the inflow of institutional capital consistently on the rise, the sentiment around the crypto market remains positive.

Why this trader says Libra will not negatively affect bitcoin

Libra, a crypto asset developed by the Libra Association, a consortium based in Switzerland founded by major conglomerates including Facebook, Visa, Mastercard, Lyft, Uber, Booking Holdings, and more, dominated the headlines in the financial sector in the past two days.

Some analysts have suggested that the release of Libra, planned for 2020, may lead to the decline in demand for existing crypto assets such as bitcoin and ether, the native cryptocurrency of Ethereum.

However, industry executives and traders within the crypto sector believe Libra would only act as a catalyst for existing crypto assets and boost mainstream interest towards the asset class.

DCG CEO Barry Silbert said:

“The launch of Facebook’s cryptocurrency will go down in history as the catalyst that propelled digital assets (including bitcoin) to mass global consumer adoption. Will be remembered as just as important — and transformative — as the launch of the Netscape browser. Buckle up.”

A crypto trader and real estate developer known as Satoshi Flipper noted that Libra, which will operate as a stablecoin backed by the Libra Reserve according to its whitepaper, will not replace bitcoin nor compete against it in the same market.

Rather, it would operate in a centralized ecosystem with regulations and oversight, bringing more awareness to bitcoin and the rest of the crypto market.

He said:

Once Libra goes live, nobody outside of the Facebook platform will care much for it. It’s another stable coin and it’s not replacing BTC. It will work in a centralized ecosystem. But it will bring awareness to BTC and altcoins. And I’m excited about the network effect it will have.

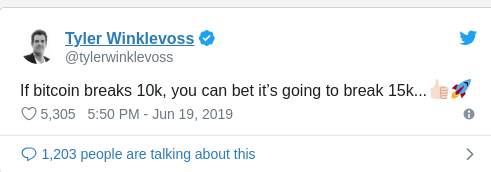

The Winklevoss twins, billionaire bitcoin investors and the founders of the Gemini exchange, also expressed their optimistic stance on the near to medium term performance of bitcoin.

Tyler Winklevoss said that if the bitcoin price breaks above $10,000, it is highly likely to surge above $15,000 based on the historical performance of the asset.

Similarly, Fundstrat co-founder Thomas Lee stated that if the bitcoin price surpasses the $10,000 mark, a 200 to 400 percent increase in value is expected based on the performance of bitcoin throughout the past several years.

Lee said:

“Well, you know I think bitcoin ultimately becomes a reserve currency in crypto, bitcoin at $9,000 has only been at this level in four percent of its history. We’re deep into a bull market and people are pretty silent about it. I think bitcoin is easily going to take out its all-time high.”

Will alternative crypto assets see light?

From record highs, alternative crypto assets remain down by more than 80 percent against the U.S. dollar on average.

Ether and XRP, for instance, are down 81 percent and 87 percent respectively from their all-time highs while bitcoin is down about 52 percent from its record high at above $20,000.

Based on the strong performance of bitcoin since January and the struggle of alternative crypto assets to match the performance of bitcoin in the last six months, traders see potential in major assets to rebound strongly shall bitcoin maintain its momentum throughout 2019.

Published: 20/06/2019 04:47 ET. Journalist:

Joseph Young @iamjosephyoung

Alan Zibluk Markethive Founding Member