Bitcoin's Rally Forgets These Asia Crypto Shares

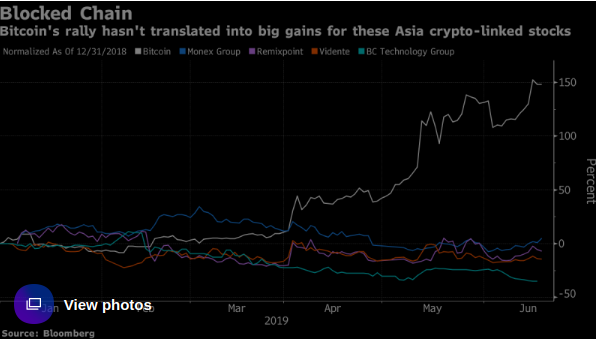

(Bloomberg) — This year’s resurgence of Bitcoin and other cryptocurrencies has yet to translate into the same kind of gains for some of Asia’s more prominent crypto-linked stocks.

The largest digital coin is up about 150% in 2019, surging past the $9,000 level earlier this week ahead of Facebook Inc.’s announcement for a cryptocurrency called Libra, that will be governed by a group of almost 30 companies including Visa Inc., Mastercard Inc. and PayPal Holdings Inc. Facebook shares slipped 0.3% in New York after the announcement Tuesday.

The prospect of Facebook and other mainstream institutions such as JPMorgan Chase & Co. entering the space has been one of the main drivers of the so-called thaw in the “crypto winter” since April. U.S. bitcoin-exposed assets have rallied: Grayscale Bitcoin Trust soared 189% this year, Riot Blockchain Inc. rose 78%, Marathon Patent Group Inc. climbed 50% and Parateum Inc. surged 67%.

But there has been little follow through in Asia.

Monex Group Inc., which owns the Japanese exchange and former hacking victim Coincheck Inc., is down more than 2% this year in Tokyo. The brokerage is counting on its investment in Coincheck to help its securities arm make up lost territory against its competitors.

Others include Remixpoint Inc., operator of crypto exchange BITPoint, which has lost 10% so far in 2019. Vidente Co., a shareholder of South Korean exchange Bithumb, is down 14% this year, while BC Technology Group Ltd., which launched new crypto exchange ANXONE earlier this year is also down 35% amid a wider selloff among Hong Kong-listed stocks.

“Companies that have invested in exchanges, I do think they will lag price appreciation in terms of the stock,” said Vijay Ayyar, Singapore-based head of business development at Luno, a crypto exchange. Companies need to “report at some point and actually show some guidance in terms of how they are able to convert their crypto revenue into fiat dollars.”

While it can be difficult to determine a company’s exposure to crypto relative to its other operations, Ayyar sees three levels by which investors can roughly gauge how closely a stock may move in line with the price of Bitcoin, with the first the most strongly correlated:

Outright ownership of digital assets;Investment in a crypto exchange;Investment in a blockchain project.

“I do think that in crypto, the general consensus seems to be that you are basically better off owning crypto rather than trying to invest in the peripheral stocks,” Ayyar added. “Owning crypto-linked stocks is lesser risk and potentially lesser reward because it’s not going to directly be as lucrative.”

Stock-Market Summary

MSCI Asia Pacific Index ex-Japan up 1.5%MSCI Asia Pacific Index up 1.5%Japan’s Topix index up 1.5%; Nikkei 225 up 1.6%Hong Kong’s Hang Seng Index up 2.2%; Hang Seng China Enterprises up 2.2%; Shanghai Composite up 1.4%; CSI 300 up 1.9%Taiwan’s Taiex index up 1.3%South Korea’s Kospi index up 1%; Kospi 200 up 1.1%Australia’s S&P/ASX 200 up 1%; New Zealand’s S&P/NZX 50 up 1.1%Singapore’s Straits Times Index up 1.3%; Malaysia’s KLCI up 0.3%; Philippine Stock Exchange Index up 0.3%; Jakarta Composite up 0.8%; Vietnam’s VN Index down 0.3%S&P 500 e-mini futures little changed after index closed up 1% in last session

Bloomberg Eric Lam

Alan Zibluk Markethive Founding Member