United Nations' Insane Attempt At Global Digitization: A Plan To Control And Profit

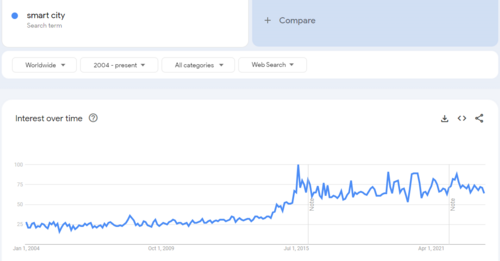

For most of us, it feels like digitization has already permeated every aspect of our lives, whether we like it or not. Some, most notably UN Secretary-General António Guterres, believe digitization is nowhere near the worldwide goals needed. The world must be digitized as quickly as possible, ideally no later than 2030.

As we didn’t vote for this, all we can do as citizens is forward petitions to governments opposing this invasion of privacy and top-down control. More often than not, it seems to fall on deaf ears as the politicians supposedly working for the people are getting orders from corporate lobbyists or unaccountable and unelected international organizations, not their citizens.

The United Nations is one of the most influential of these organizations, and it recently released a plan for a “Global Digital Compact” that governments will soon agree to. This article summarizes these digital plans, when they’re expected to be finalized, and what we can do to stop them.

The report is titled “A Global Digital Compact – an Open, Free and Secure Digital Future for All.” It was published by the United Nations (UN) in May 2023 after almost four years of work.

Source: A Global Digital Compact.pdf.

Incidentally, in a speech that António gave at the World Economic Forum’s (WEF) Davos meeting in January 2023, he confirmed that the WEF and its affiliates have been forcing the UN's Sustainable Development Goals or SDGs using the Environmental, Social, and Governance or ESG investment trend. In other words, the WEF is effectively the arm of the United Nations.

The good news is that the private sector isn't too keen to go along with the UN these days, per António's admission. The bad news is that the public sector is still very much on board, and António instructed the politicians at the WEF to ignore the opinions of their populations when implementing the UN's policies.

The fact that the public sector is still on board means that some of the UN's policies could still be implemented. If you want a sense of what these policies will look like, consider that the UN recently took over the EU's pandemic passport to develop what is essentially going to be a global digital ID. The continued influence of the UN in the public sector is why it's prudent to summarize its recent report. It's necessary to know what they're planning and when they want to implement it if you want to sidestep or even stop it.

Report’s Brief Introduction

António himself apparently wrote the report; however, given the detail and scope of these initiatives and reports, many would find that very hard to believe. It's more than likely that someone is advising António, and it's possible he didn’t write these reports at all.

Speculation aside, the report begins with a brief introduction. In the first few sentences, António reveals that the proposals in this report are expected to be approved and adopted by global governments at the Summit of the Future in September 2024. He also reveals that he is behind the broader UN initiative this report is related to.

Antonio underscores that all the policies in this report are intended to help achieve the UN's SDGs. For context, the SDGs are a set of 17 milestones that every country is supposed to meet by 2030. The SDGs are the origin of digital IDs, CBDCs, and that 2030 date you see everywhere.

António explains that these policies can only be achieved with the help of so-called stakeholders. A word that effectively refers to the world's most powerful individuals and institutions. Note that private sector stakeholders want profits, and public sector stakeholders want to control. This is why both parties are obsessed with digitization. Plugging everyone into the system increases profits and makes it easier to control them.

António laments that some people aren't as plugged in as others and implies that this is why inequality is growing around the world. Some would say that inequality is increasing because central banks and governments are lining their pockets and the pockets of their cronies using money printed out of thin air or taken from the average person via taxation, but that's a topic for another time.

António also laments the fact that new and innovative technologies such as AI and crypto are not being sufficiently governed, that is, controlled. He applauds the digitization that resulted from the pandemic and implies that this is the direction the world should go in. António ends the introduction by saying, "Global digital compact is necessary to achieve the governance required for a sustainable digital future.”

By now, you'll know that governance means control, and you'll also notice that António threw the word ‘sustainable’ in there out of nowhere. This could be a subtle reference to the individual carbon credit score system the UN is trying to set up.

Requirements For Global Digital Cooperation

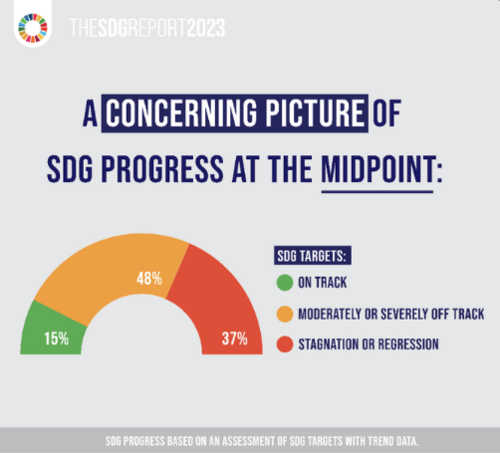

The first part of the report is about the requirements for global digital cooperation. António explains that it requires having a set of shared goals, and wouldn’t you know it, the SDGs are highlighted in blue.

Source: A Global Digital Compact.pdf.

António stresses that we must fully digitize the remaining 2.7 billion people ASAP. Notably, more than 1 billion are children. He acknowledges that not everyone wants to be part of the system and says that a “demand pull” is also needed and that this is where the public sector can play a role. He explains that they can do this by making things like digital ID mandatory to access Public Health Services. António includes schools and cultural services, which begs the question of whether we’ll eventually need to show a digital ID to get an education or practice religion.

António calls on both the public and private sectors to make all their data accessible so that the UN can keep track of how close countries are to meeting the SDGs. He admits that the UN’s progress towards achieving 41% of the 92 environmental SDGs indicators cannot be globally measured due to a lack of interoperable data and standardized reporting. In other words, the UN has struggled to assess whether countries have achieved 41% of the SDGs by 2030.

Image source: UNStats.com

He then pivots to a topic he's been passionate about on X lately: Online Safety, AKA censorship. He says, “Open, safe, and secure use of the internet is slipping away from us, potentially, permanently.” He blames this on disinformation, hate speech, and the like. Antonio acknowledges that some countries have taken steps to censor the internet but says this isn't enough. He says the governments need to get more involved, both online and in the real world, and that they should crack down on hate speech. He also says that the “Global nature and infrastructure of the internet needs to be protected.”

This is reminiscent of something António said in his speech at the WEF. He fears that the internet is splitting in two: A censored internet in the West and a censored internet in the East. Meanwhile, regarding AI, António says that the rapid advancement of technology is making governance, AKA control, very hard for the UN and its affiliates and that AI has put this on full display.

Naturally, António is upset that AI is making it possible to generate so much content. “Imagine the disinformation”, he says. António does acknowledge that AI can be beneficial, but only if it is sufficiently controlled. He reveals that the UN has already been working with AI experts to assess how it can be controlled and how to make sure that it can always be shut down.

Lastly, António says that the “Arc of Innovation” needs to be bent toward solving societal problems and global challenges. Translation: AI needs to be used to manage the peasants. He says that governments need to be involved because businesses won't do this on their behalf. Some would say that some companies are doing the bidding of UN-controlled governments already, but let's not go there.

Digitization Approach Similar To Climate Crisis?

The second part of the report is about the Global Digital Compact António is obsessed with. He starts by saying that digitization should be addressed in a manner similar to the climate crisis. This is quite concerning as it implies lots of regulation, intervention, and restriction of the internet. It would be ludicrous if they swapped out the climate crisis with some sort of AI-driven digitization crisis, but that would never happen, would it?

Speculation aside, António explains that the global digital compact he envisions adheres to the UN's SDGs, and the purpose of the compact would be to ensure that the SDGs are met. He hints that this will require “New governance arrangements.” In other words, more shady organizations.

On a curious note, throughout the report, António refers to countries as “states,” presumably a term in the global government structure the UN is apparently trying to create. Antonio reveals that the UN is already actively discussing digitization with the states.

The Global Digital Compact Objectives

António then lists the global digital compact's objectives and the actions stakeholders should take to ensure these objectives are met. The first objective is to plug everyone into the matrix, and António provides a long list of measures, including subsidies and $100 billion of funding to this end.

The above ties into the second objective: to invest heavily in digitization and “develop environmental sustainability by design and globally, harmonized digital sustainability standards, and safeguards to protect the planet.” It's a word salad that sounds like total control of digital technologies.

The actions António recommends include money, money, and more money. They also encompass sharing data so the UN can finally start tracking how far along countries are in meeting the SDGs. For reference, there are only seven years left. It's safe to say that it's not looking good. Maybe they'll just rebrand like they did when their Millennium Development Goals failed due to the 2008 GFC.

The third objective is to end the “gender digital divide” and to ensure that labor rights are adhered to online. Like all vague and ambiguous objectives, the actions required to meet them include some seriously dystopian stuff, including creating a dedicated UN government body in every country.

The fourth objective is to ensure the internet remains open, secure, and shared. António's actions include avoiding blanket internet shutdowns but managing dissent or opposition. He suggests that governments use “targeted measures” instead.

This relates to the fifth objective: to address disinformation, hate speech, and the like to develop “trust labels and certification schemes” and to ensure that gender is included as a part of every digital policy to ensure absolute equality. Antonio proposes a long list of actions here, the most important of which is establishing a global code of conduct to ensure that the internet is policed correctly in every corner of the planet. After all, if there is a place where free speech still exists, opposition to the UN and its allies could start to spread. We can't have that, can we?

The sixth objective is to ensure adequate data governance, i.e., control. Actions include ensuring that all data is interoperable because nothing says privacy, like sharing your most sensitive data with every corporation, government, and organization on the face of the Earth.

The seventh objective is to ensure adequate control of AI. Actions include “Urgently launching a global body that will regulate all of the AI in existence and any new AI that emerges.” António mentioned the UN half a dozen times, at least in this section. It sounds like they bought into the AI boom.

The final objective is to ensure all other targets are met under the UN's SDGs. If you read through the report, you’ll see that António used “I” rather than “we” when recommending what action stakeholders should take to ensure these objectives are met. Those who often read reports may know this is rare in accounts by any organization. Some would say it speaks to the size of António's ego.

Implementation Of Global Digital Compact

In any case, in the next part of the report, António discusses the actual implementation of the global digital compact. He starts by saying that various stakeholders will be responsible for different tasks. He then provides a long list of UN entities to assist with implementation. Oddly enough, António doesn't believe these existing UN entities are sufficient. He reveals that he wants to establish an annual digital corporation forum after all the world's governments agree to the global digital compact at the Summit of the Future in September 2024.

What's hilarious is that he doesn't even ask for feedback about this idea. He literally says that he's just going to go ahead and start planning the agenda for this new forum. Would-be members of the forum already have homework. Every year, they will write an extensive report about digitization for the UN.

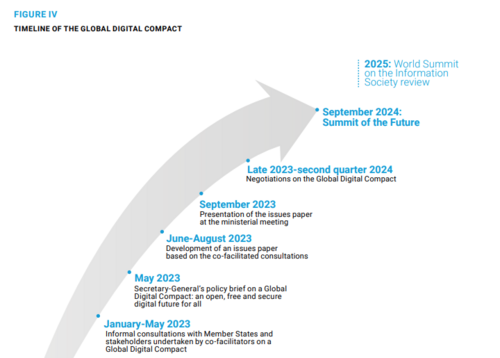

António concludes the report by recounting how the UN began this digitization initiative four years ago and how he released an initial roadmap for it two years ago. A partial timeline is illustrated in the image below. Note that it doesn't end with that event in 2024. It ends with the World Summit on the Information Society review in 2025 instead.

Source: A Global Digital Compact.pdf.

António then declares,

“The time for talking about the need for digital cooperation has long passed. We need to focus on how we make this a reality. We need to act now, and with speed, if we are to recover the potential of digital technologies for the equitable and sustainable development that is slipping away from us and the planetary crisis that confronts us.”

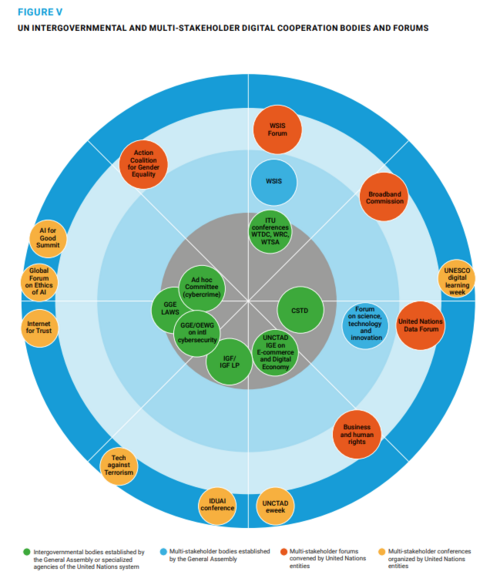

The remainder of the document provides a list of all the different UN entities and stakeholders involved in this particular initiative. Most people, including me, do not recognize any of the key players in the infographic (shown below), and many critical thinkers opine that the rabbit hole runs right to the center of the earth with each one.

Source: A Global Digital Compact.pdf.

How Do We Stop This Global Takeover?

So the big question is how to stop this Global Digital Compact. The answer could be as simple as letting history run its course or as complex as convincing public institutions to steer clear of it. The simple answer is to reference all the countless UN initiatives that never came to pass. As you can imagine, coordinating hundreds of institutions and thousands of individuals can be challenging. Everyone must be on the same page, or they won’t meet their international goals. After all, the world is pretty fragmented right now, and that's why António is so frustrated.

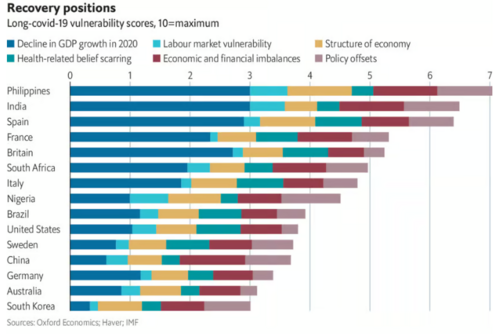

Internationally, the global South is slowly cutting itself off from the global North. Domestically, political tensions are rising fast, and UN-affiliated ideologies are quickly becoming unpopular. In this climate, it's impossible to achieve widespread consensus. The fact that some of the UN's initiatives are bad for the average person makes the presence of countries not conforming to an agreement a problem. That's because regular folks will be able to compare outcomes and see what effects the UN has. And if we end up with some kind of financial crisis, it's guaranteed that the UN's Global Digital Compact or the SDGs will be of insignificant value.

Consider that the 2008 financial crisis stopped the MDGs dead in their tracks. They were also on year eight of a 15-year journey. It would be uncanny if history repeated itself this year. But let’s play out a scenario for the sake of entertainment. Let's assume the UN somehow gets all its ducks in a row. In this case, convincing public institutions to defect from its digitization agenda will be extremely difficult.

The UN can pressure them to comply using other public and private institutions. Some of the UN's digital initiatives, such as CBDCs, may appear appealing to the average person initially, which means there's likely to be lots of voluntary adoption at the outset. It's not until later that the populace will realize that they've sleepwalked into digital slavery.

As such, the only solution would be to create an alternative system or help existing alternative systems grow. This is what the UN fears the most, especially when this alternative system consists of rapidly evolving technologies, such as ethical AI and cryptocurrency.

Indeed, the fact that the UN fears these kinds of technologies proves that these technologies are a part of the solution. If the UN gets its way, it could also become a part of the problem. Thankfully, technology evolves much faster than the United Nations and is also much humbler than the UN's head honcho, so it's implausible that the stratagems of these self-serving globalists will reign.

The great reset/agenda 2030 is falling apart, so always seek the truth and share it. The elites will try and take control by putting us in de facto digital prisons with CBDCs and digital IDs, but alternatives exist and are evolving. They will prevail if they're promoted, adopted, and crowdfunded.

Cryptocurrency will play a critical role in this decoupling between the average person and the corrupt institutions that rule them. Success is not guaranteed, but the pendulum is swinging toward freedom. The UN/WEF's self-confidence is waning as its stakeholders and countries realize how out of touch they are with ordinary people like us, so let's keep that momentum going.

(31).gif)

.png)

.png)

.png)

.png)

(30).gif)

.png)

.png)

.png)

.png)

.png)

.png)

(29).gif)

.png)