The Markethive Wallet: A Pathway to Financial Freedom for Entrepreneurs

.png)

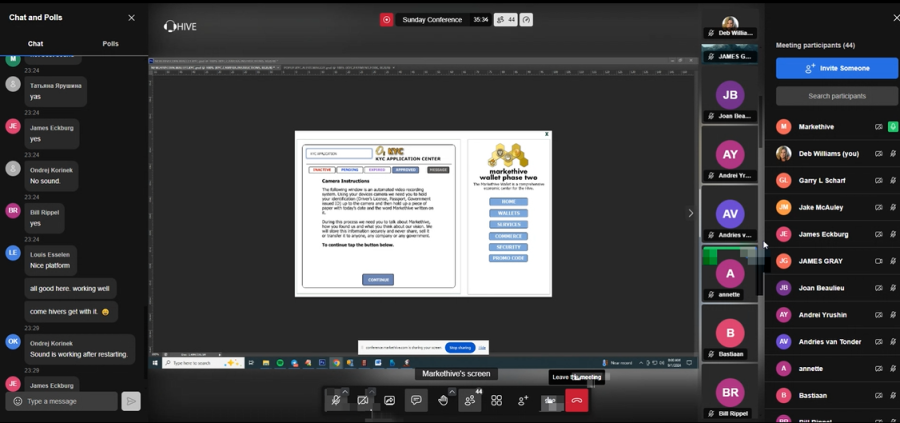

The Markethive internal wallet is an innovative financial management solution created to optimize and secure your business operations. Its user-friendly interface guarantees ease of use, while its robust security features protect your assets and transactions. Acting as a complete financial hub within the Markethive ecosystem, the wallet effectively tracks and records all economic activities.

This includes a wide range of transactions, such as micropayments for various services, subscription fees for premium features, staking rewards gained through participation in network activities and income generated from the sale of retail products and services. Moreover, the wallet oversees the distribution and redemption of Promo Codes, which can be used to encourage purchases or reward customer loyalty.

Furthermore, the wallet plays a crucial role in facilitating loan transactions, including those tied to E1 Upgrade investments. It carefully tracks fund disbursements, logs interest payments through the ILP (Incentivized Loan Program), and ensures accurate and transparent accounting of all loan-related activities. By providing a secure hub for managing these diverse financial interactions, the Markethive internal wallet empowers users to optimize their business operations and capitalize on the opportunities offered within the Markethive ecosystem.

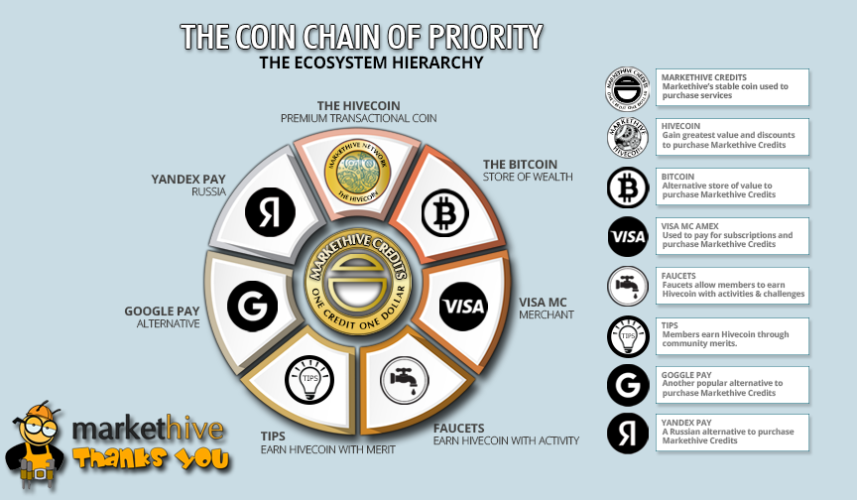

Markethive has created a complete financial infrastructure, going beyond the concept of a traditional exchange. The core of this infrastructure is a diverse ecosystem that utilizes a range of digital assets. These assets include Markethive Credits, ILP founders tokens, and Markethive Tokens (MHVs), used for platform micropayments. Additionally, the ecosystem features Hivecoin (HVC), Markethive's native token, which has a maximum supply of 100 million units.

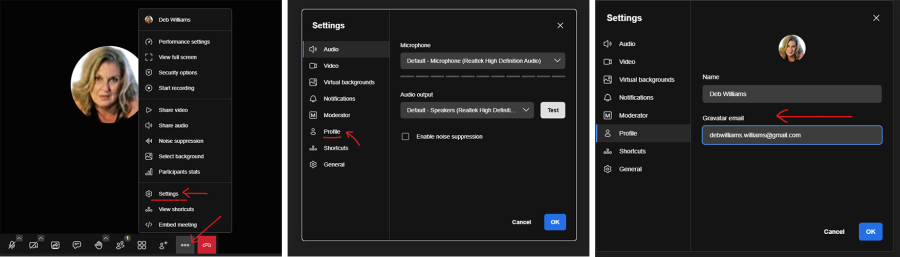

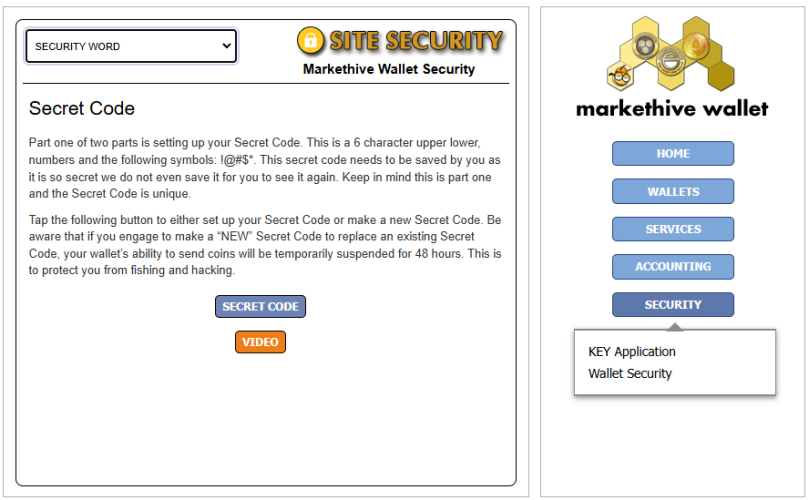

Markethive prioritizes security as a core value, recognizing that every component of the platform plays a vital role in its overall functionality. The infrastructure has been meticulously designed to foster a secure financial ecosystem where users can confidently engage in various activities.

This comprehensive security framework incorporates various measures, including advanced encryption protocols, multi-factor authentication, and regular security audits. These measures work in tandem to protect user data, prevent unauthorized access, and mitigate potential threats. By implementing stringent security practices and adhering to industry best standards, Markethive aims to provide a secure and reliable environment for users to conduct their financial transactions confidently.

In a world where authoritarianism and corruption increasingly threaten personal freedom and financial security, the Markethive wallet offers a robust and user-friendly solution. Its intuitive design and clear instructions make it easy for anyone to manage their finances securely and independently.

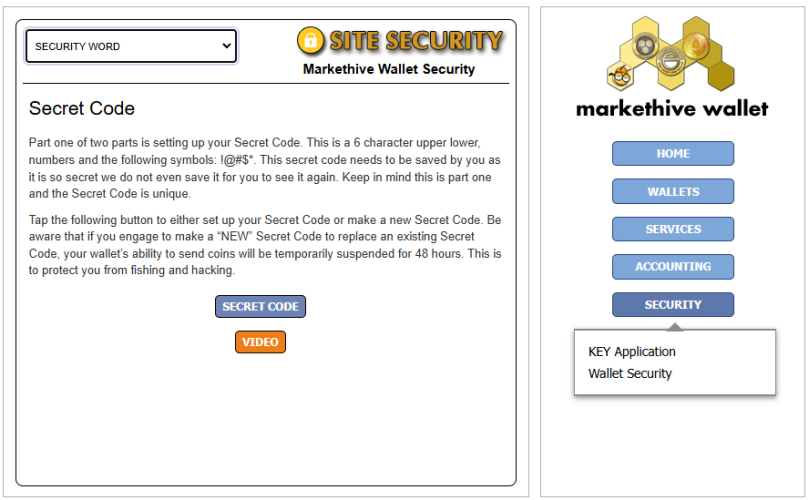

Markethive Wallet Security

Markethive has implemented extraordinary measures to establish an unparalleled security system. Our advanced protocols and encryption methods redefine the concept of protection, making your Markethive wallet virtually impenetrable to unauthorized access and potential threats. This steadfast commitment to exceptional security ensures the safety and integrity of your digital assets, enabling you to conduct transactions and store funds with complete peace of mind.

Beyond its robust security features, Markethive also functions as a comprehensive financial accounting hub, similar to a traditional bank but enhanced by blockchain technology and decentralization benefits. Your Markethive wallet serves as a central repository for your digital assets and transactions, offering a clear and organized overview of your financial activities within the Markethive ecosystem. For many users, the Markethive wallet has become an essential source of income, and our platform is carefully designed to build trust and confidence in the security and reliability of the Markethive wallet system.

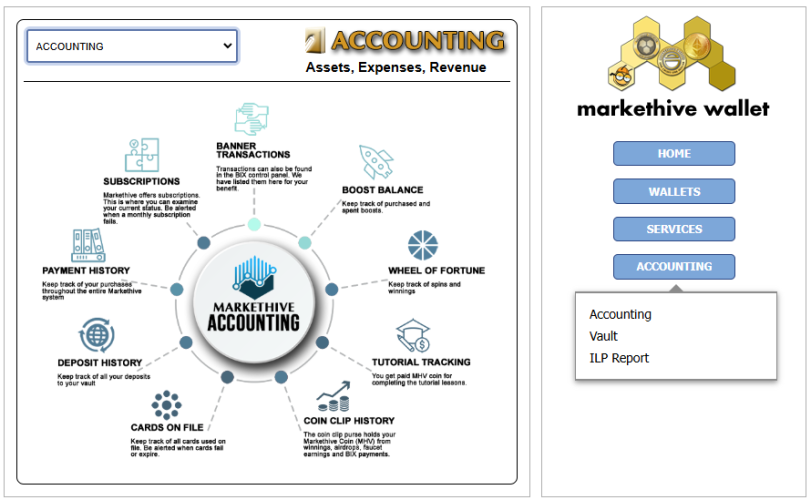

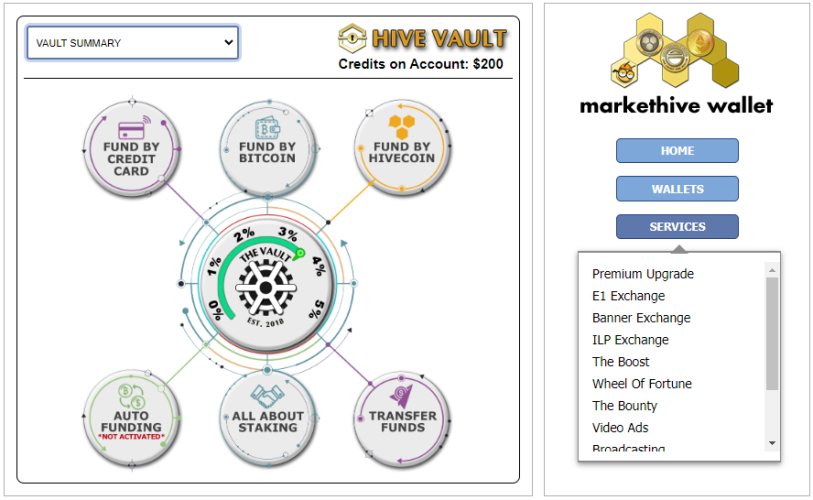

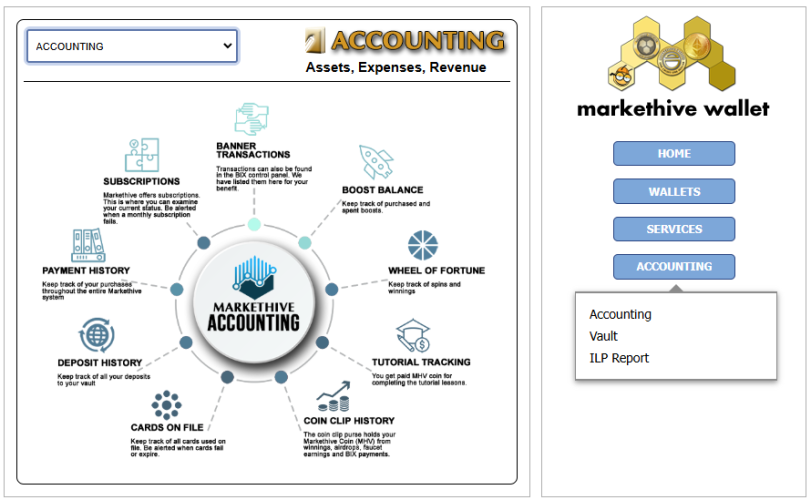

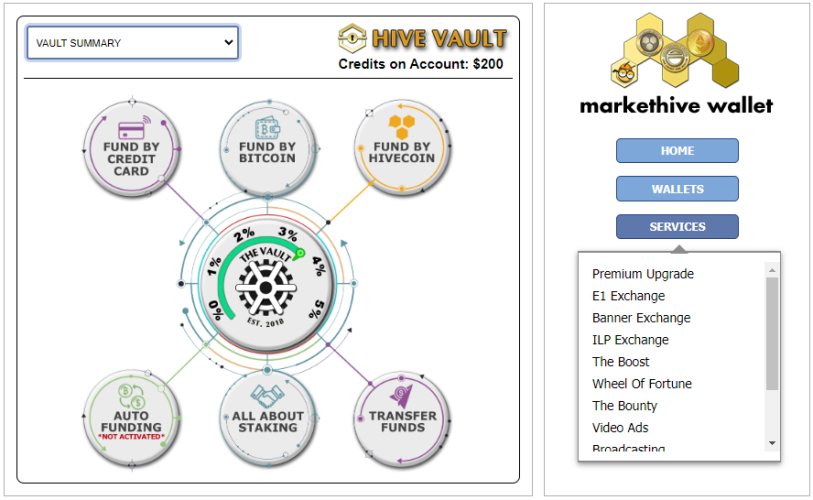

Accounting: The Vault and Markethive Credits

The vault lies at the heart of your wallet, serving as a centralized hub for managing your financial activities within the Markethive platform. It seamlessly integrates essential features such as your ILP Report, a comprehensive record of your transactions, real-time account balances, and convenient subscription management tools. The vault is designed to provide users with a clear and organized overview of their financial activities, enhancing their financial management experience within the Markethive ecosystem.

Through the vault, you can acquire Markethive Credits, which function as the internal currency of the Markethive platform and are essential to the ecosystem. These credits are designed to support commerce for various businesses. They can be used to set up and fund your subscription thresholds, granting you access to various premium services and features. Additionally, you can transfer credits to other members, fostering a sense of community, making you feel connected and part of a more extensive network, and enabling peer-to-peer transactions.

Markethive Credits can be purchased directly through the vault using various payment methods. These credits can then be redeemed for a wide range of services that Markethive offers, including advertising, marketing tools, and educational resources. The credits can also be used to facilitate trades with other members on the platform, creating a marketplace for exchanging goods and services. The exchange rate for Markethive Credits is fixed at a 1:1 ratio with the US dollar, ensuring transparency and stability in transactions.

Cryptocurrency Sub-Wallets

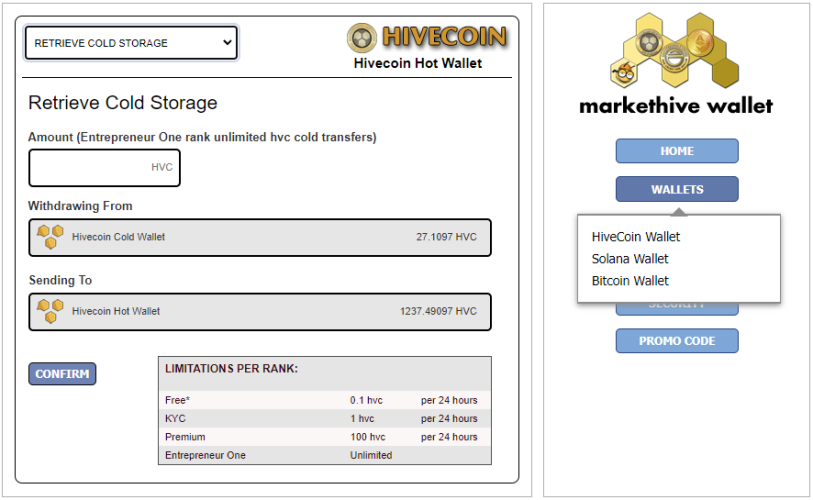

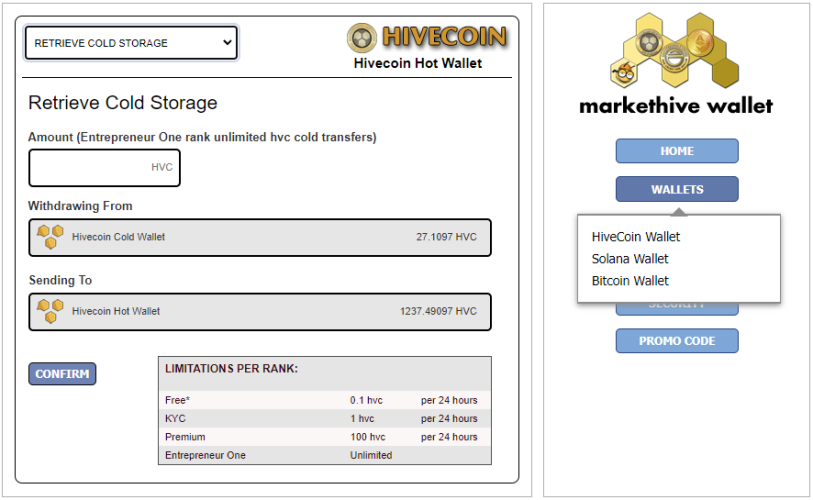

Hivecoin Report

Markethive provides two secure wallet options for storing your coins:

- Hot Wallet Balance: This online wallet allows you to efficiently conduct transactions with other Markethive users and external digital wallets and exchanges.

- Cold Storage Balance: This offline wallet provides enhanced security by storing your coins offline, protecting them from unauthorized access. This safeguards both your assets and Markethive's interests.

The Markethive wallet uses a highly secure one-way transfer mechanism between its cold and hot storage components. Coins can only be moved from cold storage to your available hot wallet balance after stringent verification. However, please note that any coins transferred to the hot wallet cannot be returned to the Markethive cold storage system.

A minimum balance of Solana (SOL) cryptocurrency must be maintained in your Markethive wallet to facilitate transactions within the Markethive platform and to external destinations. This requirement arises because the platform is currently built on the Solana blockchain.

Solana Coin Report

Markethive has developed Hivecoin as a crypto asset on the Solana blockchain, offering fast transactions, enhanced security, and cost-efficient transactions. Solana is a high-performance blockchain platform that facilitates fast, secure, cost-effective transactions. Its native cryptocurrency, SOL, is used to pay transaction fees and interact with decentralized applications (dApps) built on the network.

One of Solana's key advantages is its low transaction fees compared to other blockchain platforms like Ethereum. While Ethereum transaction fees range from $50 to $150, Solana transactions typically cost around $0.01 or 0.002 SOL. This significant difference in cost is due to Solana's innovative architecture and consensus mechanism, which enable it to process transactions more efficiently. As of November 20, 2024, Solana's average transaction fee was approximately $0.036, starkly contrasting Ethereum's gas fee of $18.17.

Another notable feature of Solana is its high throughput capacity. The platform can handle approximately 50,000 transactions per second (TPS), making it significantly faster than other major blockchain platforms like Bitcoin (0.07 TPS), Ethereum (15-30 TPS), Ripple (1,500 TPS), and even traditional payment processors like Visa (2,000 TPS). This high throughput is achieved through advanced technologies, including a unique proof-of-history (PoH) consensus mechanism, a pipeline architecture for transaction processing, and a tower Byzantine fault tolerance (BFT) algorithm for network security.

Bitcoin Report

Markethive has implemented the Vault Funding Threshold feature, which is designed to streamline the process of using Bitcoin within the platform. This innovative tool allows users to establish a predetermined Bitcoin amount in a designated sub-wallet. Once this threshold is reached, the system automatically converts the Bitcoin into Markethive Credits. This automated system ensures that users retain complete control and ownership over their Bitcoin until they actively initiate a conversion, providing a balance between convenience and autonomy.

The integration of Bitcoin into the Markethive ecosystem offers numerous advantages due to the inherent characteristics of this crypto. One of the primary benefits is the irreversibility of Bitcoin transactions. Once a transaction is confirmed on the blockchain, it cannot be reversed or altered, eliminating the potential for disputes and chargebacks. This feature provides both buyers and sellers with a high degree of certainty and security.

Moreover, Bitcoin's pseudonymity has demonstrated its effectiveness as a powerful tool for promoting freedom and democracy. In nations with oppressive regimes or limited financial infrastructure, Bitcoin enables activists and individuals to secure funding and support without relying on traditional banking systems that may be vulnerable to censorship or control. By facilitating the movement of funds even in restrictive environments, Bitcoin empowers individuals and strengthens democratic movements.

In addition to these benefits, Bitcoin's decentralized nature and resistance to censorship make it a robust and dependable store of value. Unlike traditional fiat currencies that central banks and governments control, Bitcoin operates on a distributed network that is not prone to manipulation or interference. This decentralized framework ensures that users have total control over their funds and are not at the mercy of external authorities.

Markethive Wallet: Your Gateway to a Suite of Products and Services

Beyond its primary function as a secure repository for your funds, the Markethive wallet acts as a centralized hub, streamlining your access to many of Markethive's products and services. Through the wallet, you can conveniently purchase or upgrade your membership to gain access to the following offerings:

Premium Upgrade: Unlock a higher membership tier, granting enhanced features, benefits, and privileges within the Markethive ecosystem.

- E1 Exchange: Take part in the E1 Exchange to buy, sell, or bid on E1 Upgrades.

- Banner Exchange: Utilize the Banner Exchange to promote your brand or message through targeted banner advertising across the Markethive network.

- ILP Exchange: Investigate the ILP Exchange for trading opportunities with the Incentivized Loan Protocol.

- The Boost: Leverage "The Boost" to amplify your visibility and reach within the Markethive community.

- Wheel of Fortune: Try your luck with the "Wheel of Fortune," potentially earning rewards and prizes.

- The Bounty: Participate in "The Bounty," completing tasks or challenges in exchange for compensation.

- Video Ads: Advertise your products or services through engaging video ads displayed across the Markethive platform.

- Broadcasting: Broadcast your message or content to a broader audience within the Markethive network, external social media, and digital sites.

- Sponsored Articles: Promote your brand or cause through sponsored articles published through Markethive.

- Press Releases: Announce your news or developments through professionally crafted press releases distributed through Markethive's channels.

- Franchised News Sites: Establish a presence on franchised news sites within the Markethive network, potentially expanding your brand's reach and authority.

The Markethive wallet not only simplifies the management of your funds but also acts as a portal to a comprehensive suite of tools and services designed to enhance your experience and success within the Markethive ecosystem.

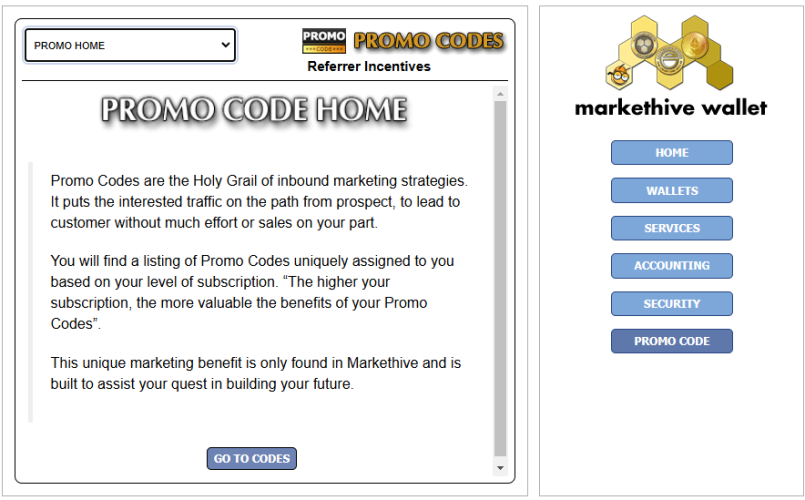

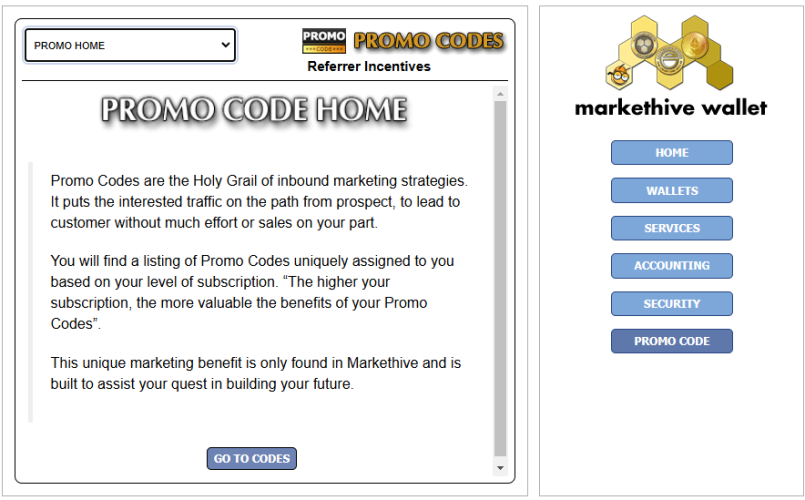

Promo Codes

The Markethive wallet is a central hub for managing Promo Codes, each offering unique rewards that correspond to your subscription level and are included in your subscription. This tiered reward system incentivizes users to upgrade their subscriptions, as higher subscription levels unlock progressively more valuable rewards that can significantly enhance their marketing initiatives.

One unique and powerful feature of this system is the Vanity Promo Codes. This subscription-based service empowers users to create personalized and memorable code names, serving as a strong inbound marketing tool. These custom codes can effectively attract potential customers, spark their interest, and cultivate a sense of connection and exclusivity, turning them into loyal customers with minimal effort. This personalization feature can greatly enhance a user's brand identity and recognition.

Moreover, Markethive acknowledges the leadership role of Entrepreneur One members who manage Supergroups. These members have the privilege of assigning a unique Promo Code specifically to their group. This serves as an extra incentive for new members to join, symbolizing exclusive benefits and a sense of community linked to that particular Supergroup.

The Markethive Promo Code system, featuring its tiered rewards, Vanity Promo Codes, and Supergroup-specific codes, represents a comprehensive and innovative approach to marketing on the platform. It offers users a wide array of tools and incentives to attract new customers, build their brand, and foster a sense of community, ultimately leading to increased success and profitability for everyone involved.

To Sum Up…

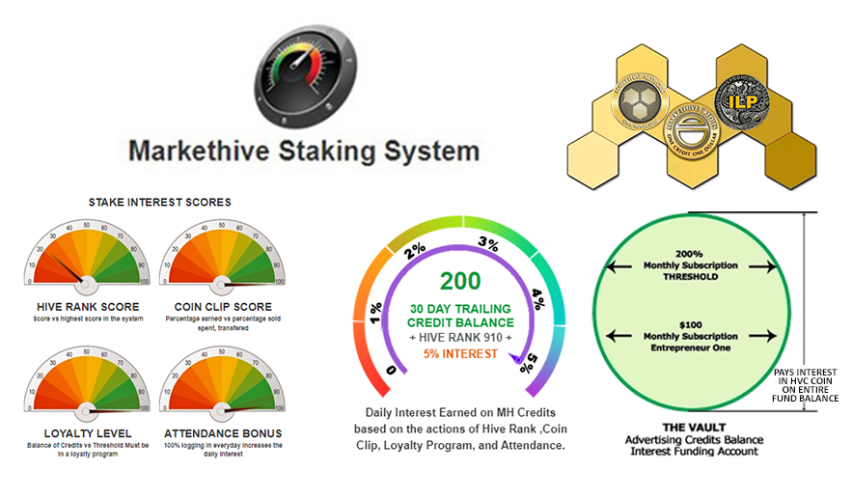

The Markethive wallet, an integral component of the Markethive ecosystem, functions as a multifaceted financial instrument that offers its users a broad spectrum of capabilities. At its core, it provides a comprehensive accounting system that meticulously tracks all financial transactions within the ecosystem. Furthermore, it facilitates seamless payments and rewards distribution, ensuring members are duly compensated for their contributions and participation. The wallet also houses the secure Vault and Staking system, allowing users to safeguard and grow their digital assets.

In addition to its core functionalities, the Markethive wallet incorporates Bitcoin, Solana, and Hivecoin wallets, allowing users to manage multiple cryptocurrencies within a single platform. Moreover, it offers a gateway to various crypto exchanges and third-party wallets, enabling users to interact with the broader cryptocurrency landscape seamlessly. Markethive members can also access a variety of Markethive services, such as the Promo Code, directly through the wallet, streamlining their overall experience.

Security is a paramount concern within the Markethive ecosystem, and the wallet is designed to provide unprecedented protection for users' digital assets. The wallet minimizes the risk of unauthorized access and fraud by ensuring that only the user can access their self-contained financial framework.

With the platform's native cryptocurrency, Hivecoin, members can earn and accumulate value within the ecosystem by actively participating in various activities and contributing to the community. This decentralized financial infrastructure and robust security measures give users complete control and autonomy over their intellectual property and financial assets, fostering a thriving and sustainable economic ecosystem where innovation and entrepreneurship can flourish.

.png)

Editor and Chief Markethive:

Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my

Markethive Profile Page | My

Twitter Account | and my

LinkedIn Profile.

.png)

.png)

.png)

.png)

.png)

%20copy(1).png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

%20copy.png)

.png)