Did you want to buy Bitcoin at $3k last year, what about now?

BTCUSD trading at around $17,000, what is the first question you would have asked yourself? Why didn’t I buy at $3,000 just 4 months earlier in August?

A week later as the markets reached there now historical high of over $20,000. Some of those questions would have in many cases hinted at frustration, disappointment and even anger in missing out on what many called “ a once in a generation” opportunity.

Those who did enjoy the notion of triumph, and were beneficiaries of the price rise would have had even greater hopes for future peaks. $50,000, $75,000 and even $100,000 to 1 Bitcoin in the coming year (2018) were forecasted. So now with the market on the edges of $3000 once again. What questions are being asked now? Or better yet what answers are we getting to the questions asked a year ago.

The questions the markets are asking now is where are those who thought they missed out on the opportunity? BTCUSD, and crypto coins in general has been the big bear market story of 2018, many speculators saw the initial rise of crypto’s as the dawn of a new age in finance and civilization, where no one establishment dicated the rules. Many may still believe this to be the case, however after falling $14,000 in value YTD even the biggest optimists are having there views tested. Have traders been scared off? Stopped out of positions, or eagerly awaiting the turnaround of turnarounds before running out of margin?

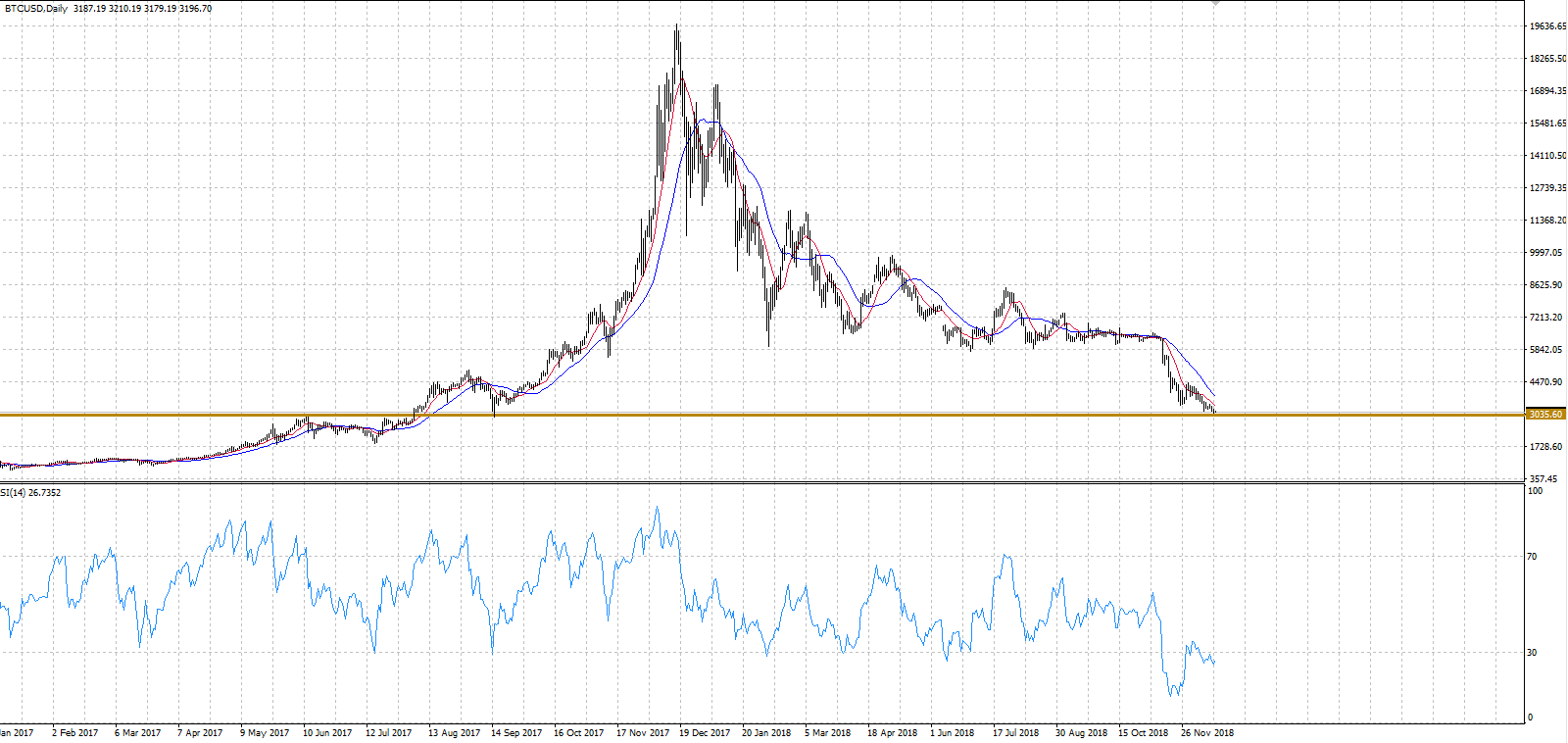

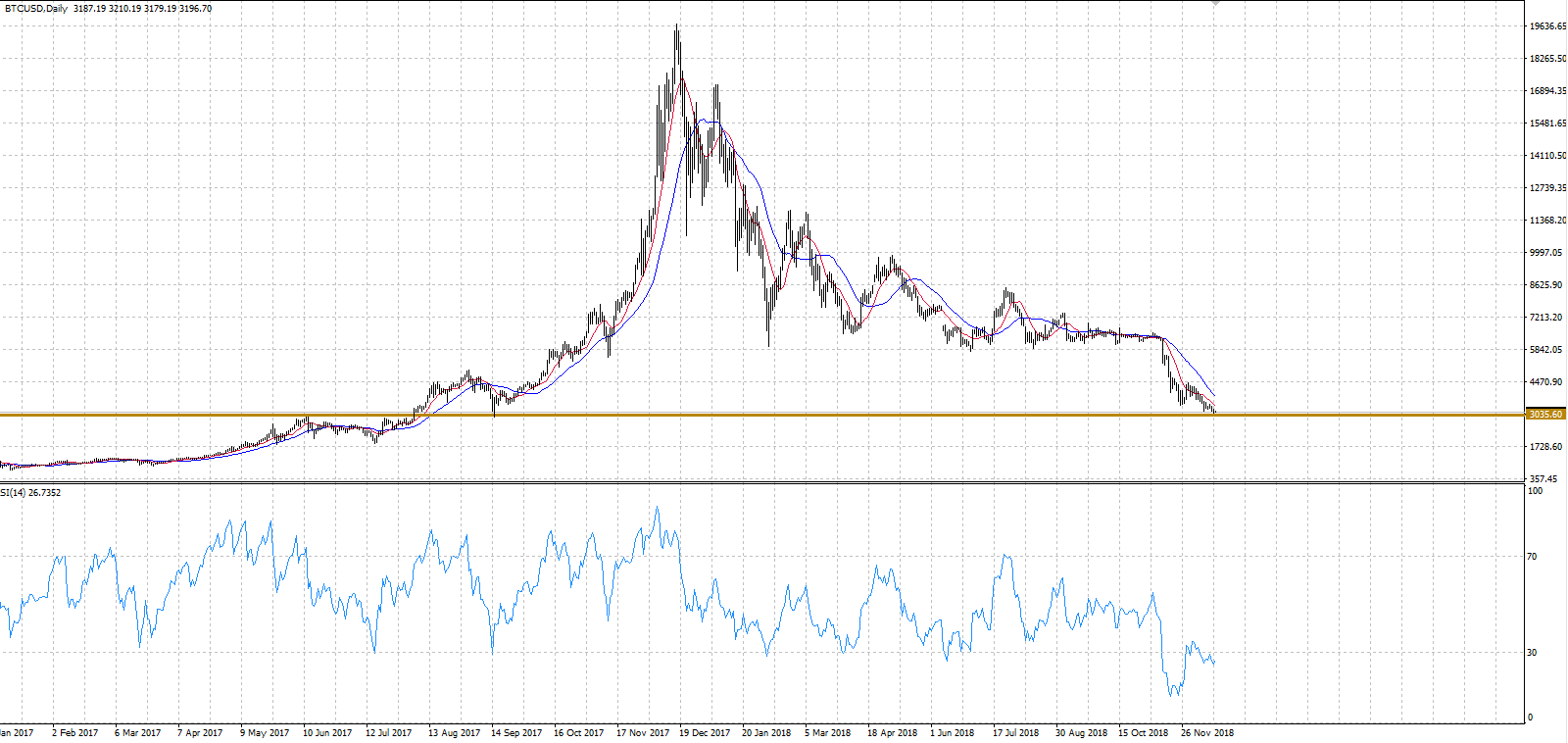

The rally in BTCUSD last year was spurred not by radical innovation, or a regulatory change, but by the herd. A lot of people wanting to believe, and betting on there beliefs. Recently, the belief has seen the volumes of selling reach there lowest since 2015, where BTCUSD traded below $300. However with most markets, the next thought is when will the bleeding stop? “It cannot go down forever”, where is it’s floor? As you can see from the chart above we are current trading at the support $3,035, and using the RSI we see it trading below 30, meaning oversold. Does this mean buyers are nearby? Like a boxing day sale where “70% off” is plastered across displays, and ques outside department stores at 6AM in the morning ready to ransack. On a daily time frame the 10/25 day moving averages show a potential upwards cross, which many see as the potential of a bullish run.

Now as Christmas arrives, and we prepare presents for our loved ones, and tell our children Santa has answered there wish. What about ours? Are we seeing the signs of a future bull run in crypto? With the opportunity at “70% off” its true value? Or will we enter the new year like most kids when they find out Santa doesn’t exist? Like a year ago, although the technicals may point to a pending rally, only the belief of the herd can see this be validated or shutdown. Whatever your view, this could be an interesting one to watch in the next few weeks.

Eliman Dambell

Tradeview Markets

Alan Zibluk Markethive Founding Member