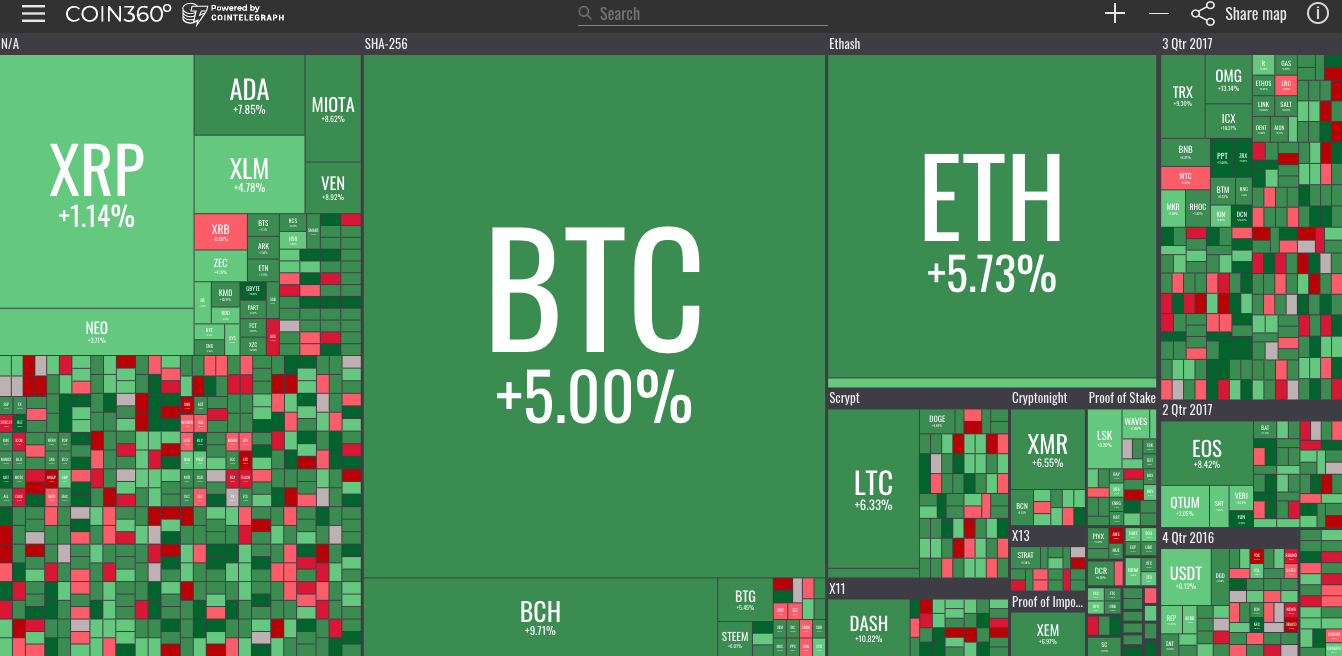

Bitcoin, Ethereum, Bitcoin Cash, Ripple, Stellar, Litecoin, Cardano, NEO, EOS – Price Analysis, March 16

Fundstrat's Thomas Lee believes that Bitcoin mining is an unprofitable venture at current prices. A model developed by his data science team has pegged the breakeven price at $8,038.

If prices fall further, the miners will start to lose money on their operations. Shone Anstey, co-founder and president of Blockchain Intelligence Group opines that this may force a few miners to stop their operations.

Technical analysts watch the 50-day MA and the 200-day MA closely to forecast the path of least resistance. A death cross, a situation where the short-term moving average falls below the long-term moving average, indicates weakness. Paul Day, a technical analyst and head of futures and options at Market Securities Dubai Ltd believes that if the cross occurs, Bitcoin can sink to $2,800.

It is common to see wild price forecasts on the downside when Bitcoin is falling. We saw similar outrageous forecasts on the upside when the cryptocurrency was rising.

Though we do keep those factors in mind, we should not be worried much by them. Let’s see what our analysis forecasts.

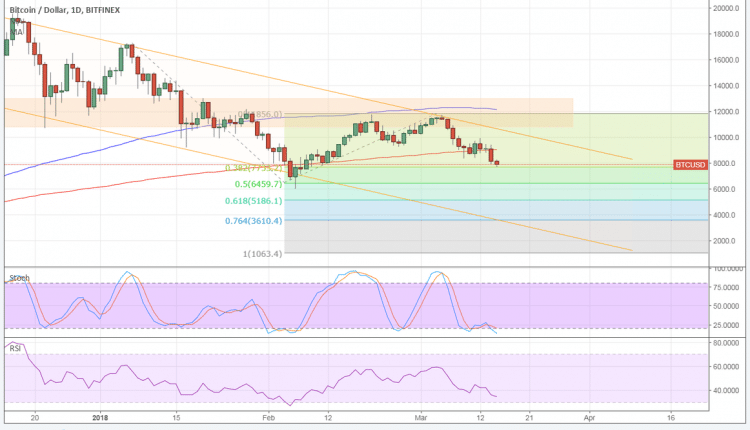

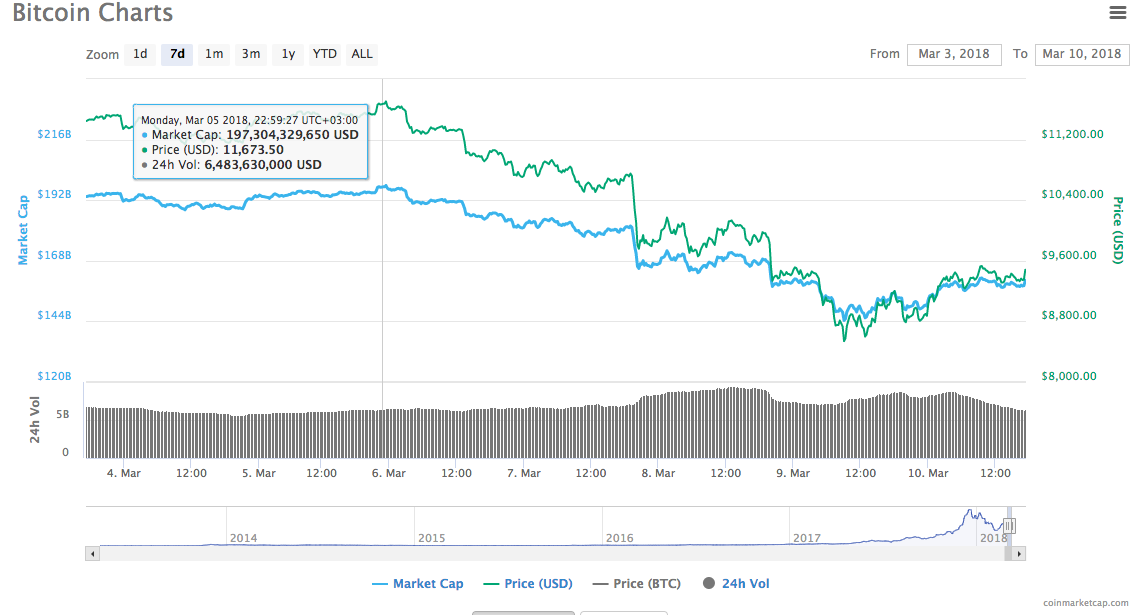

BTC/USD

Bitcoin fell to $8,066.61 levels on March 15. The bulls are trying to defend the $8,000 levels and pullback towards the $9,500 levels.

The BTC/USD pair remains in a downtrend as prices are trading inside the descending channel and below both moving averages. The 20-day EMA has broken below the 50-day SMA, which is another bearish move.

If prices fail to sustain above the overhead resistance zone of $9,500 to $10,000, the cryptocurrency can fall to $7,850 and after that to the February 06 lows of $6,075.04.

Our bearish view will be invalidated if the bulls manage to sustain above the $10,000 levels.

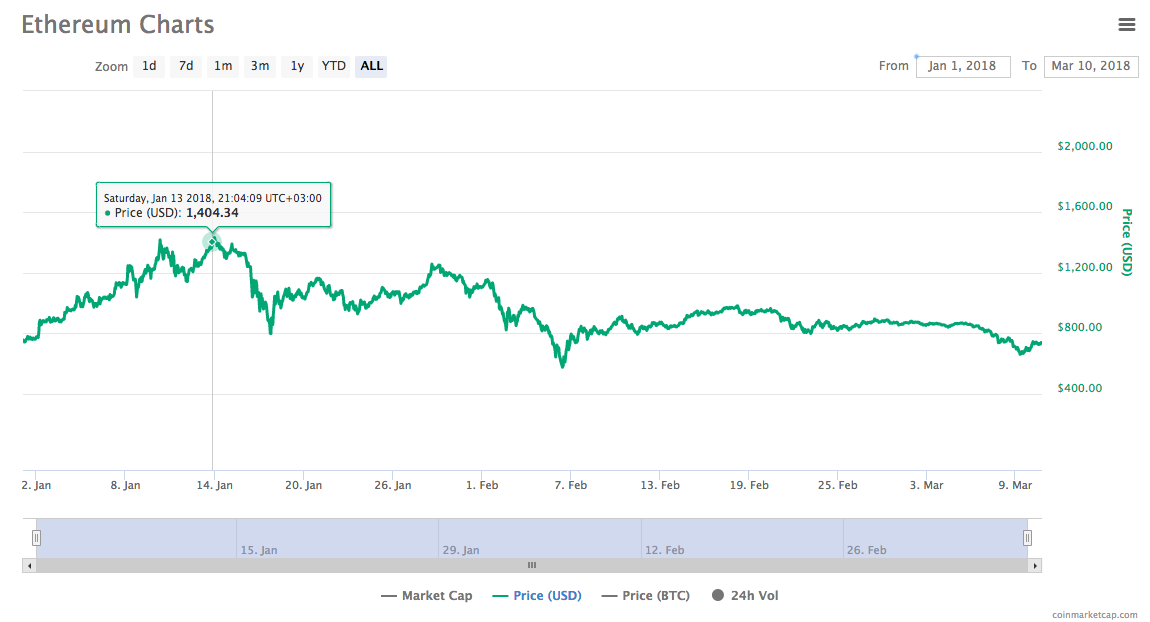

ETH/USD

Ethereum extended its downtrend as it fell to $568.29 on March 15, close to the February 06 lows of $565.54. This is major support.

We expect the bulls to attempt a bounce from these levels. The pullback will face selling pressure at the 20-day EMA and the resistance line of the descending channel.

If the bounce fails to gain strength, the next down leg in the ETH/USD pair will break below the $565.54 support and move lower to $500 and then to $430 levels.

Aggressive traders can buy a very small position, about 30 percent of the usual position size at $630, if the level sustains for about four hours. The stop loss can be kept at $560. If the price fails to break out of $700, positions can be closed, else please trail the stops higher.

BCH/USD

Bitcoin Cash fell to $910.6798 levels on March 15. Currently, the bulls are attempting a pullback from the supports.

The downtrend line should act as the first level of resistance. Above this, the 20-day EMA and $1,150 will act as resistance. If the cryptocurrency turns down from these levels and breaks below $900, it can slide to $778.2021.

The BCH/USD pair will become positive in the short term once the price sustains above $1,150.

XRP/USD

Ripple found support at the $0.62681 levels on March 15. We believe that the support zone between $0.695 and $0.5627 will hold.

The bulls are attempting to pull back above the March 15 high of $0.72685. Once this level is crossed, a move to the 20-day EMA is possible where the cryptocurrency will face strong selling pressure.

During the next decline, if the XRP/USD pair does not break below $0.695, we can expect it to trade in a large range. We may try to trade this, but as we don’t see any buy setup, hence, we don’t recommend any trade on it at the moment.

XLM/USD

Stellar remains in a downtrend, and it continues to decline gradually. It is close to our first lower target of $0.22.

If the bulls fail to defend these levels, the XLM/USD pair can slide towards the support line of the descending channel.

We remain bearish on the cryptocurrency until it stays below the 20-day EMA, the downtrend line and $0.32.

LTC/USD

Litecoin is trying to pull back towards $186.823 levels, where we expect another bout of selling by the bears.

Both moving averages, the downtrend line and the horizontal line, all converge around $187 levels making it important resistance. If prices turn down from the resistance and break below $157.236, it might fall to $141.

The LTC/USD pair will indicate strength if it can sustain above $187 levels for a day.

ADA/BTC

We expected Cardano to trade in a range, but prices turned down from 0.00002482 levels on March 14 and are now on its way towards the next lower target of 0.00001690.

It continues to be in a strong bear grip as the cryptocurrency has not even touched the 20-day EMA for more than a month.

The ADA/BTC pair will become positive once prices break out of the downtrend line and the 20-day EMA. Until then, all attempts to recover will face selling at the resistance.

NEO/USD

The bulls are trying to hold the critical support level of $63.62 on NEO. We can expect a retest of the breakdown level at $86. If the bulls succeed in sustaining above this overhead resistance, it will indicate that the bears are losing strength.

If prices turn down from $86 levels, we anticipate the next down move to a breakdown of $63.62 and move towards the lower target objective of $49.

We should wait for a confirmed buy setup to initiate a long position on the NEO/USD pair.

EOS/USD

EOS has been declining gradually for the past few days. It fell to a low of $4.7484 on March 15. We can expect the bulls to attempt a pullback from the current levels, but the 20-day EMA has been acting as strong resistance since end-January of this year. If prices turn down once again from there, a fall to $3.26 is likely.

If the EOS/USD pair sustains above the $7 levels, we can expect it to rally to the 50-day SMA and then to $10 levels.

Currently, we don’t find any buy setups on the cryptocurrency.

Author: Rakesh Upadhyay

Posted by David Ogden Entrepreneur

Alan Zibluk – Markethive Founding Member