The Growth of Gamification at Markethive: Get Ready for Video Flying Ads – The Wheel of Fortune Is Already Turning

The intersection of gamification and digital marketing is growing and evolving at Markethive, offering fresh ways for businesses to connect with their audiences. This expansion brings new opportunities for engaging, interactive marketing strategies that can truly resonate with customers, making the experience more enjoyable and memorable.

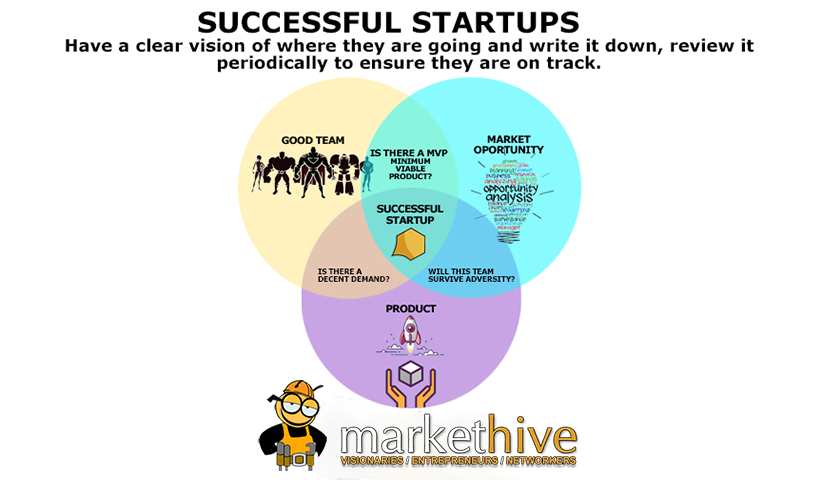

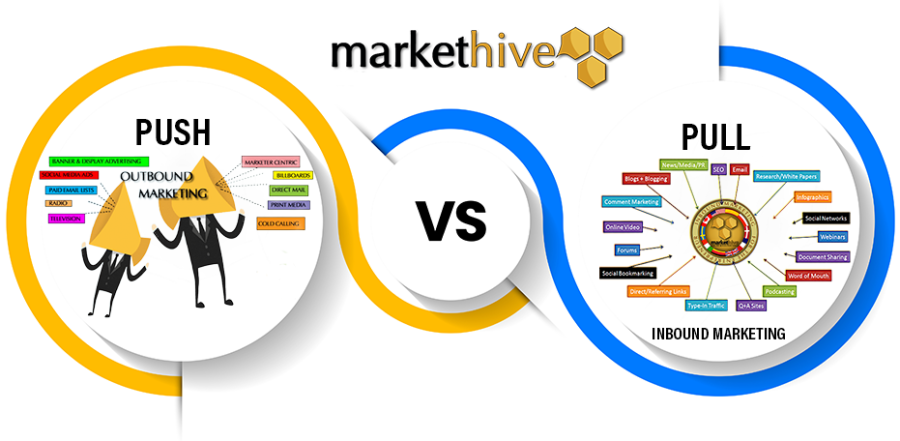

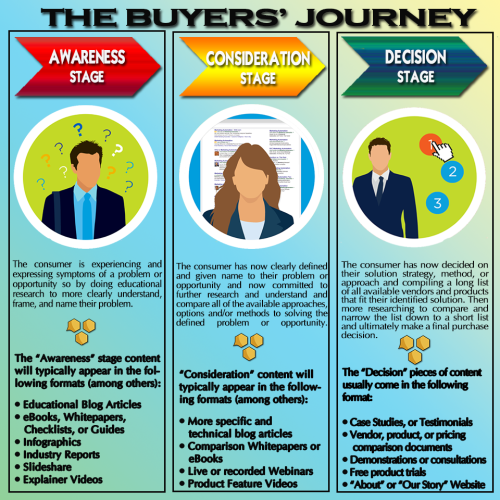

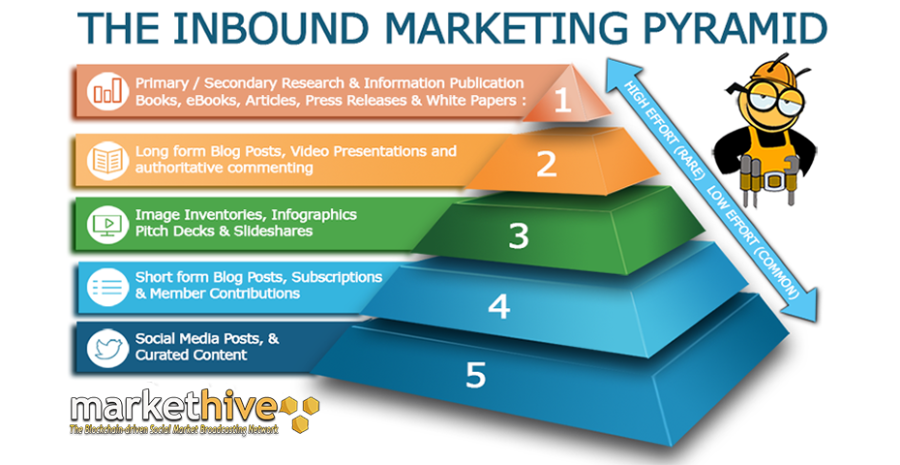

Markethive, explicitly designed for the Entrepreneur, is a friendly, supportive Market Network that prioritizes your privacy and security. It goes beyond a typical social network by serving as a hybrid enhanced social market network. This platform seamlessly integrates the power of Inbound Marketing into the News Feed and infuses the dynamic nature of the social network into its Inbound Marketing capabilities. This makes it a perfect environment for gamification.

Flying Video Ads: Enhancing Member Engagement through Gamified Rewards – in development.

In terms of gamification, Flying Video Ads offers an innovative approach to advertising, transforming passive viewing into an interactive, rewarding experience for members. This concept centers on gamifying video content by incentivizing user engagement with tangible rewards. Unlike traditional advertising models that often interrupt the user experience, Flying Video Ads seamlessly integrates into the platform, making ad consumption a desirable activity rather than an obligation.

The flying video ads will occasionally pop up and run across your screen in the Markethive interface. If you click on them, you will be notified of a contest (a high/low type of contest) and how many Hivecoin (HVC) you will receive for watching the video.

Benefits for Members:

- Monetization of Attention: Members are directly compensated for their time and attention, turning a typically passive activity into a valuable one.

- Enhanced User Experience: The gamified nature makes ad viewing more entertaining and less like a chore.

- Access to Rewards: Members receive desirable rewards, such as Hivecoin, the native cryptocurrency of Markethive, boosting their overall platform portfolio.

- Discovery of Relevant Content: Through personalization, members are exposed to products and services that align with their interests.

Benefits for Advertisers:

- Increased Engagement Rates: The gamified, incentivized model drives significantly higher ad views and interaction rates than traditional advertising.

- Improved Ad Recall and Brand Awareness: Active participation in gamified videos enhances memorability and brand recall.

- Measurable ROI: Detailed analytics provide clear insights into campaign performance and the effectiveness of ad spend.

- Positive Brand Association: By offering a rewarding experience, advertisers can build a more positive association with their brand.

Flying Video Ads signals a paradigm shift in digital advertising, shifting from disruptive methods to a mutually beneficial ecosystem. It incentivizes member participation and makes ad viewing an interactive experience, thereby boosting user satisfaction and yielding better results for advertisers. This forward-thinking strategy builds a stronger, more positive connection between brands and consumers, setting the stage for a more effective and engaging advertising environment.

Markethive's Wheel of Fortune: Spin Your Way to Crypto Wealth and Lifetime Revenue!

Many features of Markethive are still to be released later this year. One that has already launched is Wheel of Fortune, which highlights its gamified element. This interactive, gamified system is designed not just for fun, but to significantly benefit every participating community member by offering a diverse array of Markethive-related prizes. It transforms engagement into tangible rewards, driving activity and value within the platform.

A Spectrum of Valuable Prizes

With every spin, participants have the chance to win a bounty of Markethive assets, directly enhancing their presence and portfolio on the platform. The rewards include:

- Hivecoins (HVC): The core cryptocurrency of the Markethive ecosystem, providing direct financial value and utility.

- Bee Coins (BEEs): A micro-unit of Hivecoin, serving as an easily accessible fractional component. (Note: 100,000,000 BEEs are equivalent to one Hivecoin, much like a Satoshi relates to Bitcoin).

- Ad Impressions: Valuable credits for running marketing campaigns on Markethive's internal Banner Impressions Exchange, (BIX) boosting visibility for businesses and profiles.

- Airdrop Bumps: Multipliers that increase the volume of Hivecoin received during scheduled airdrops, accelerating crypto accumulation.

- Newsfeed Boosts: Enhanced visibility for your content on the Markethive Newsfeed, ensuring your posts reach a wider audience.

- Micropayment Boosts: Multipliers applied to the micropayments you receive within the Markethive system.

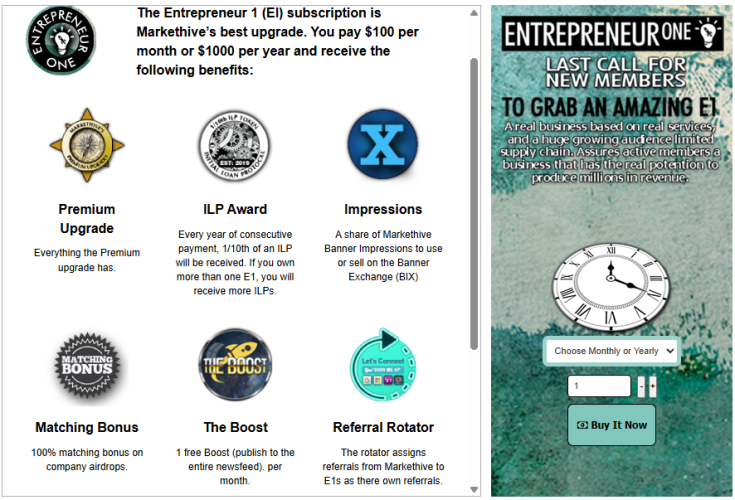

- Initial Loan Protocol (ILP): The most coveted prize, offering a share in the platform's lifetime revenue. Spins can award partial or even a full ILP, opening the door to becoming a Markethive Shareholder.

- Exclusive Top Placement Banner: A temporary, high-visibility advertising spot for a day, offering unmatched promotional value.

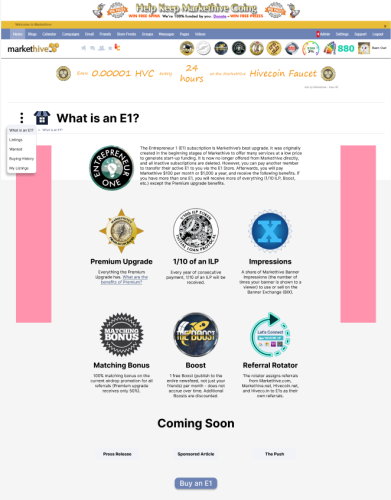

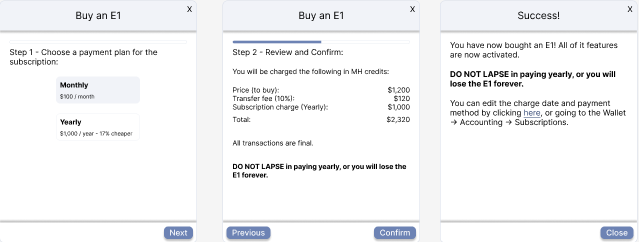

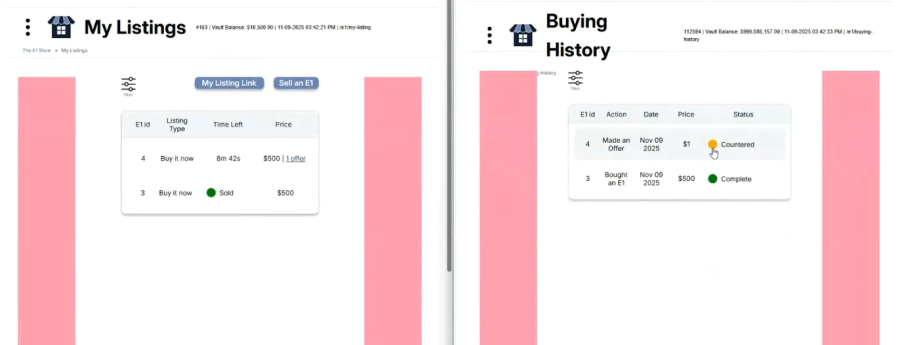

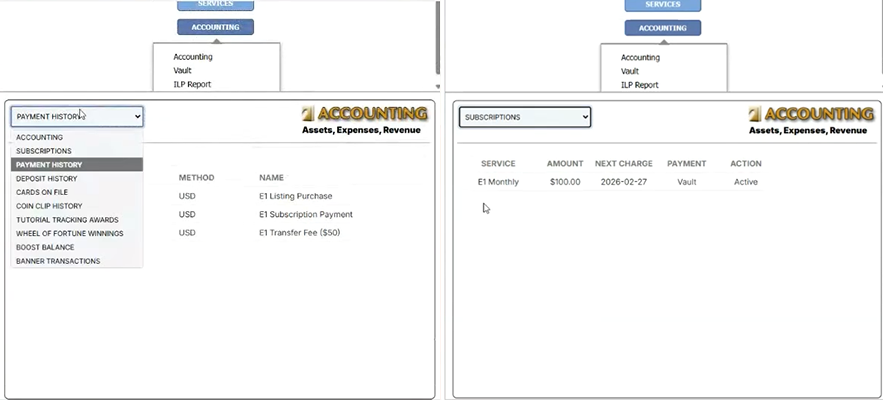

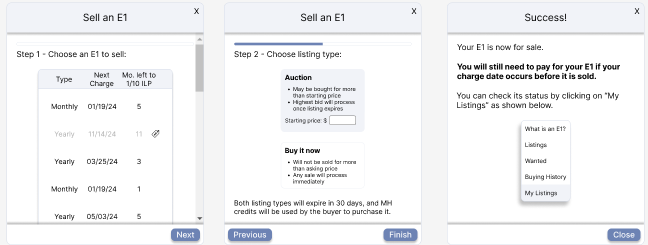

- Entrepreneur One Lifetime Account: Full, premium access to the platform's features for life, including 1/10 ILP every year it’s active.

- Faucet Bounces: Enhanced returns on Markethive's built-in crypto faucet.

The Mechanism: A Donation-Based Win-Win System

The Wheel of Fortune is structured as a transparent, donation-based platform. Community members contribute at levels 1 through 5, ranging from $1 USD to $100 USD.

The fundamental principle governing the system is simple: The number of spins and the potential value of the prizes are directly proportional to the chosen donation level. Higher donations yield more spins and access to larger prize brackets. The system provides a fundamental guarantee: "Every Spin is a Win!" Participants are assured of a benefit for their contribution, as there are no "lose" outcomes or empty slots. At the very least, a participant will win a free spin to try again.

Your Donation Translates to Exponential Returns

In exchange for your support via a donation, you receive immediate chances to win, which often translate into superior returns, including:

- A chance to win substantial HVC amounts.

- Double or Triple Returns on upcoming airdrops.

- Significant boosts to your advertising impressions and newsfeed visibility.

- The life-changing opportunity to win a fractional or full ILP, securing your status as a lifetime revenue-earning Markethive Shareholder.

Exclusive Limited-Time Promotion

To celebrate the launch and encourage broad participation, Markethive is offering an exceptional promotion: Until further notice, the Wheel of Fortune is available at a massive 50% off the published donation rate. This significantly lowers the barrier to entry, making it an ideal time to maximize your spins and potential winnings.

How to Get Started

You will find the Wheel of Fortune by clicking its icon in the tray at the top of the home page. Participating is quick and easy. To begin your journey toward crypto accumulation and potential lifetime revenue:

- Select Your Wheel: Choose the desired donation level (Wheel) you wish to contribute to.

- Choose Your Spins: Determine the number of spins you want to purchase.

- Spin and Win! The system conveniently tracks and stores your purchased spins, which you can use immediately or save for later.

The Wheel of Fortune marries the fun of gamification with the serious opportunity to build wealth. It is a strategic tool for community members seeking to rapidly grow their crypto portfolio while offering the chance to achieve the pinnacle of Markethive membership as a lifetime revenue earner with an ILP.

Your donations also support Markethive’s ongoing iterations, including scaling the infrastructure, expanding the feature set, improving the user experience, and completing the ecosystem’s build-out of the revenue system, which encompasses the retail side of our products and services, ensuring Markethive's continued leadership in the decentralized market network space.

Are you taking advantage of this dynamic feature and the daily opportunities it offers? Why not give it a spin? Not only are you rewarded with assets that will be extremely valuable in the foreseeable future, but you are also helping Markethive continue to build its God-given vision that millions of aspiring entrepreneurs worldwide desperately need.

The Dual Benefit: Building Your Assets While Fueling a Global Vision

The rewards for your engagement are twofold and deeply impactful:

- Gaining Valuable Future Assets: The immediate benefit to you is the accrual of future assets within the Markethive ecosystem. These assets represent a stake in the platform's future growth and prosperity, creating a powerful engine for passive income and appreciation. You are not merely participating; you are actively investing in your own future portfolio with every action you take.

- Actively Supporting Markethive's God-Given Vision: Beyond your personal gains, your participation provides the essential momentum to advance Markethive's larger, profound mission. This vision is desperately needed by millions of aspiring entrepreneurs worldwide; a decentralized, fair, and empowering platform where small businesses, innovators, and creators can thrive without the stifling control or high costs of traditional Silicon Valley giants.

A Movement for Global Entrepreneurial Empowerment

Markethive's core mission is to build an ecosystem grounded in the principles of equitable wealth distribution and true digital ownership. The platform is designed to be the definitive 'entrepreneurial social market network,' a place where genuine economic freedom is possible.

By participating in Wheel of Fortune, you become a critical part of achieving this grand humanitarian goal, ensuring that every entrepreneur, regardless of location or starting capital, has the tools and community needed to turn their aspirations into reality. Your daily engagement is a decisive vote of confidence and a direct contribution to democratizing global entrepreneurial opportunity.

You are invited to join a powerful movement and actively contribute to the unfolding of this transformative vision, while simultaneously positioning yourself to receive substantial incentives for your dedicated support and participation.

This article is designed to provide a comprehensive understanding of Markethive, exploring the profound reasons its foundational principles and ambitious goals are considered a divinely inspired vision – a framework rooted in a higher purpose. It meticulously details the multifaceted steps we can collectively take to nurture and sustain this endeavor.

Furthermore, it establishes a framework for patient anticipation, recognizing that the full and glorious realization of Markethive's immense potential, and with it, the manifestation of your own eventual, well-deserved prosperity, is intrinsically tied to and dependent on God's perfect timing. Our commitment is to work diligently in the present while maintaining faith in the future, understanding that the most significant rewards await those who align their efforts with divine providence.

.png)

%20Reward.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)