Bitcoin to rise to $333,333, following a $2,500 imminent bottom: Bobby Lee

Bobby Lee, the co-founder of the Hong-Kong based cryptocurrency exchange BTCC and a board member of the Bitcoin Foundation, has predicted that Bitcoin [BTC] could skyrocket to $333,333, after it plummets to a bottom of $2,500.

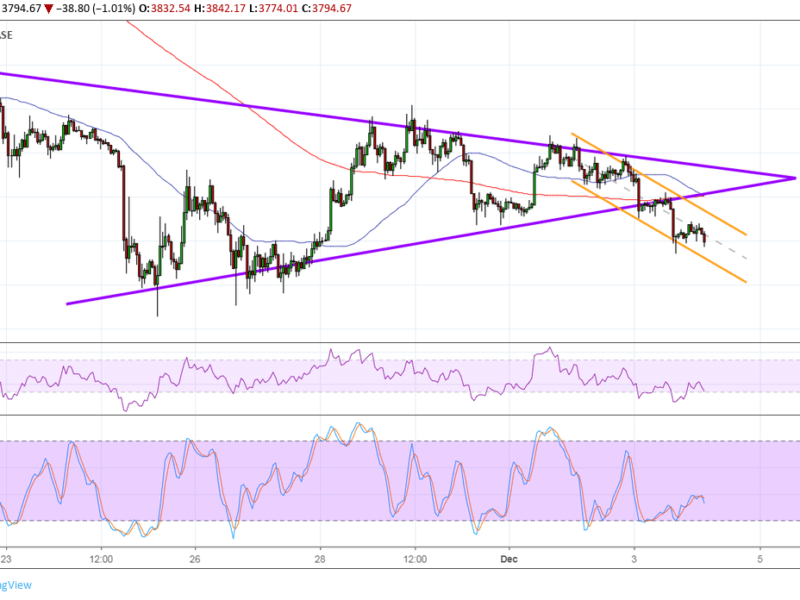

Lee expects the bears to continue to torment the cryptocurrency market, leading to a fall of 27.4 percent against the current BTC price, dropping down to $2,500 by January 2019, its lowest point since July 2017.

He further stated that the next upswing would begin in late 2020, achieving an unprecedented high of $333,333 by December 2021 following another market crash to $41,000 by January 2023.

If history repeats perfectly, then the current bear market for #Bitcoin would bottom out at $2,500 next month, in Jan 2019.

And then the next rally would start in late 2020, peak out in Dec 2021 at $333,000, and then crash back down to $41,000 in Jan 2023.

Something like that????? https://t.co/M8ljIVnt73

— Bobby Lee (@bobbyclee) December 7, 2018

Basing his chronological prediction on the market trends, as far back as December 2013, when Bitcoin reached an all-time high of close to $1,200, before settling back down to under $300 by 2015. As Bitcoin approached 2017, the top crypto held well over 80 percent of the entire virtual currency market.

Investors began to notice the dominance of cryptocurrency in early 2017, when the coin’s price broke the $1,000 mark in January and the $3,000 in the next eight months, following which it soared to as high as $19,000 during the infamous December 2017 bull-run.

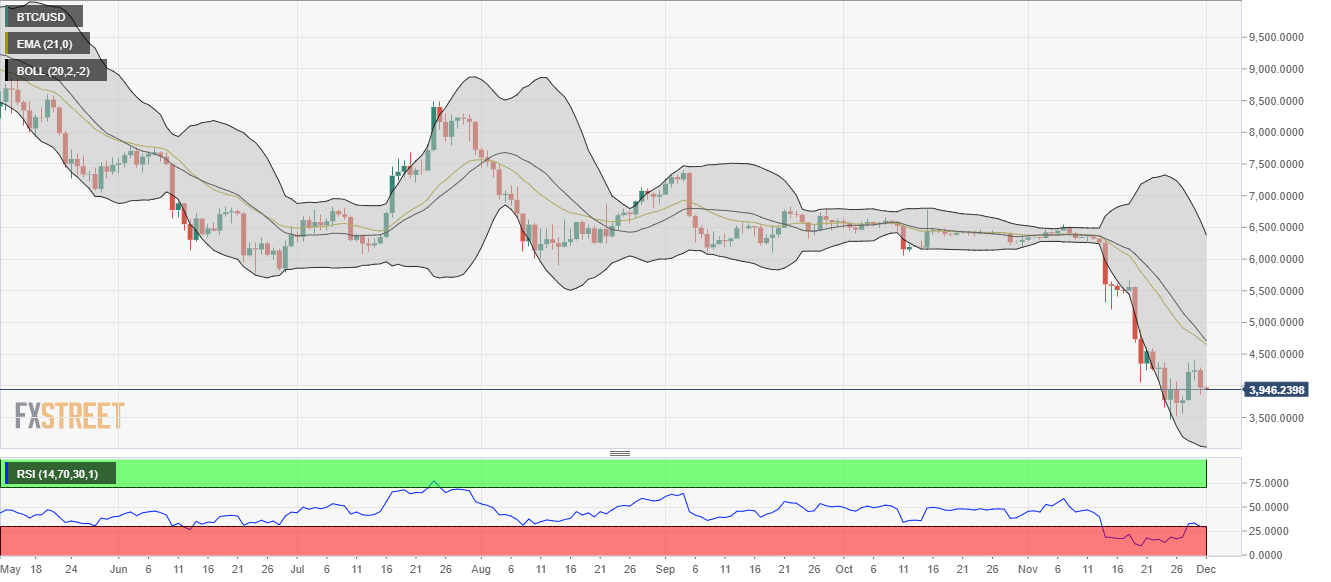

On a year-to-year basis, Bitcoin has dropped by 82.57 percent from its highest valuation of $19,783 in December to its current price of $3,447. The cryptocurrency markets, which has a 54 percent Bitcoin stake currently, has felt the brunt of the Bitcoin collapse, falling by over $100 billion in a month since the beginning of November.

Crypto-proponents were gunning for a December 2018 bull run mimicking the previous year, but were taken aback by the November meltdown, triggered by Bitcoin Cash. Mike Novogratz of Galaxy Investment Partners predicted a rally at the end of 2018, pushing Bitcoin up to $8,700. At press time, the coin has fallen by 60.3 percent from the aforementioned prediction to the current price $3,447.

Tom Lee, the head of research at Fundstrat Global Advisors in mid-November during the peak of the crash, affirmed his earlier prediction that Bitcoin would reach $15,000 by the year’s end. Lee pegged his hopes on investors viewing the virtual currency, not as a “commodity,” but as an “emerging asset class.”

By aakash

Dec 08?2018 11:17 AM

Alan Zibluk Markethive Founding Member