Comprehensive Project Update: The E1 Exchange Development

The upcoming launch of Markethive's Entrepreneur One Exchange (E1X), also known as the E1 Store, represents a significant leap forward for the entire ecosystem. This highly anticipated platform is a direct result of the dedicated support and commitment of Markethive's Entrepreneur One members. Their reliable monthly or yearly subscriptions have been crucial, providing the necessary stability and resources to fund the successful development and ongoing innovation across all facets of the Markethive platform.

The E1X platform is the central hub of the entrepreneurial ecosystem, designed to foster a dynamic environment that actively encourages collaboration, resource sharing, and commerce. This strategic initiative gives individual Markethive members unmatched tools and a wider reach, while reinforcing the company's leading and innovative position within the competitive industry landscape. By bringing entrepreneurial activities together into a unified marketplace, the E1X serves as a hub for innovation, partnerships, and economic opportunities, keeping Markethive at the forefront of the digital entrepreneurial revolution.

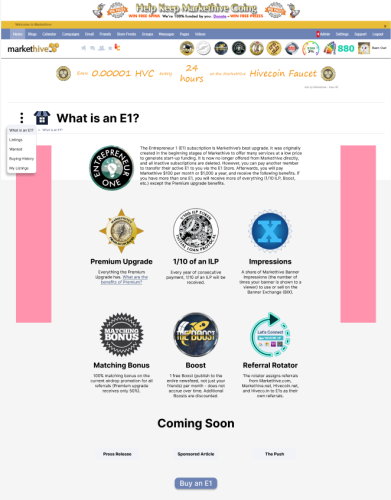

Upon the launch of the E1X, the Entrepreneur One (E1) subscription, known for its ongoing and profitable rewards, will no longer be available for direct purchase through Markethive. Instead, interested parties can acquire it via the exclusive E1 Store. This unique platform is managed by existing E1 members who wish to sell or auction their accounts, providing a valuable opportunity for new members to access the many benefits of the E1 Upgrade.

This article provides a comprehensive overview of E1X's development, intricate mechanics, and anticipated impact as we approach its official launch. The E1X represents a paradigm shift; a calculated, engineering effort that is unprecedented in a newly defined category of commerce and wealth generation.

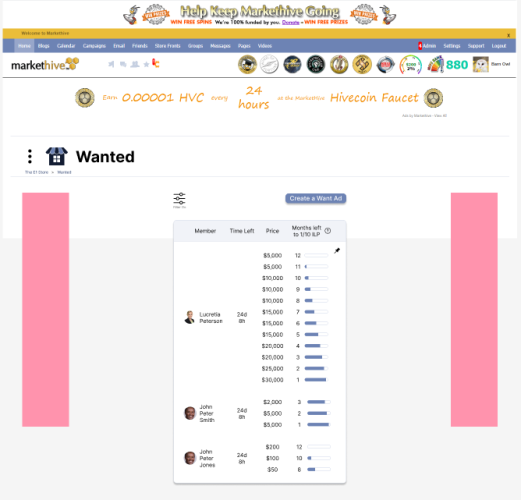

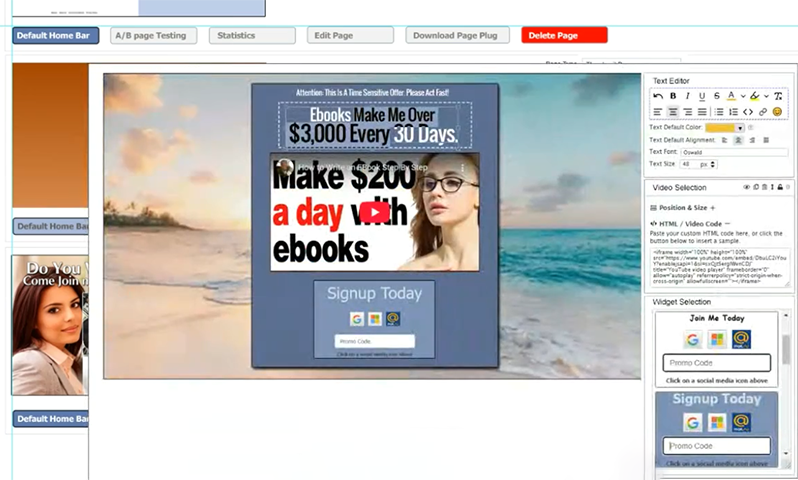

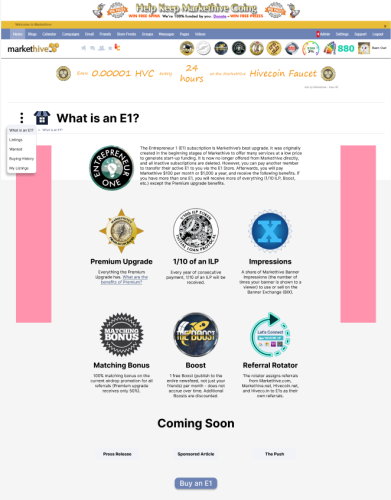

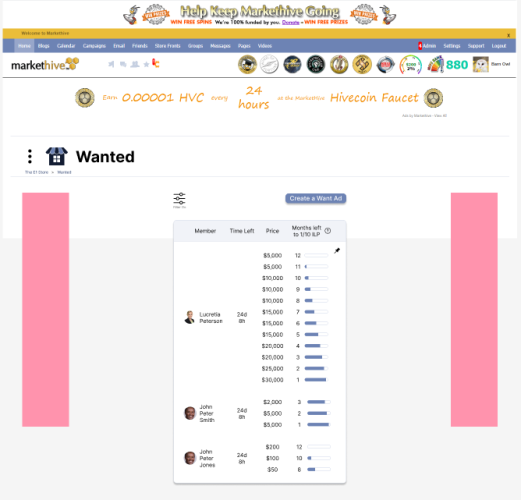

The image below shows the front page of the E1 Exchange platform, providing an overview of E1 and highlighting Markethive’s products, services, and subscriptions. The pink areas are reserved for banner ads.

The home page of the E1 Store

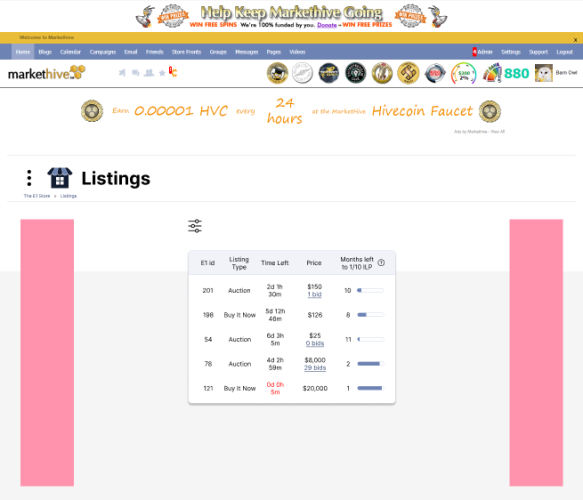

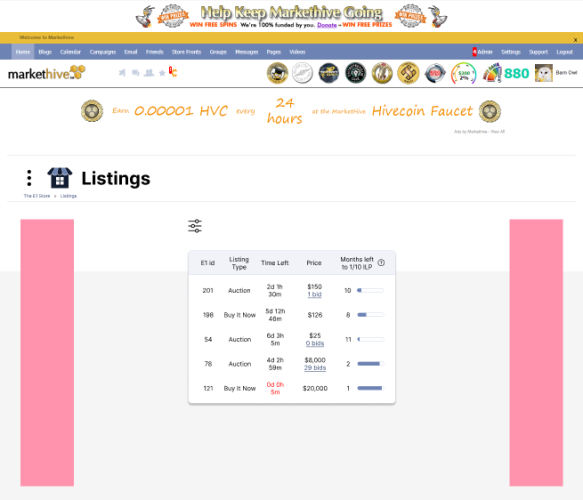

Buying and selling E1s via The Markethive E1 Exchange

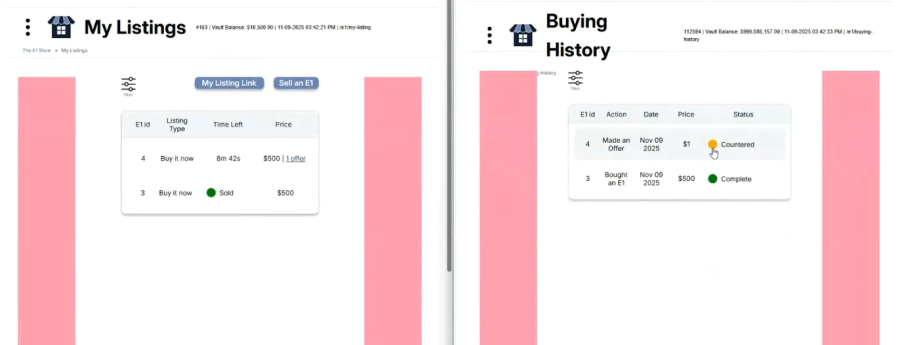

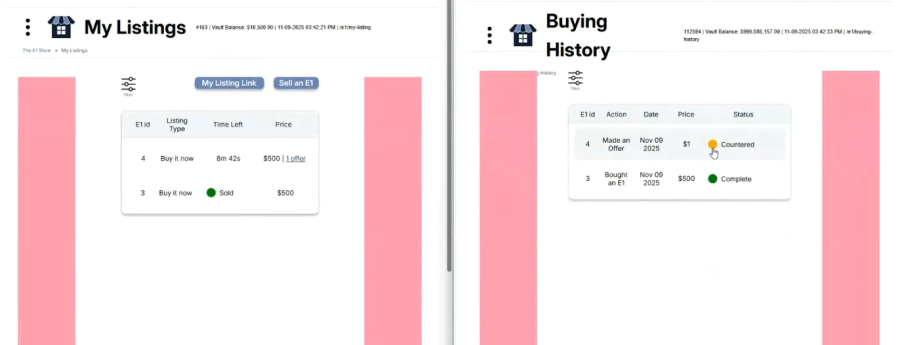

The E1 Store provides a versatile, transparent marketplace for buying and selling E1s, serving both sellers and buyers with flexible options and clear pricing. Designed with an intuitive user interface, the platform features real-time reporting indicators for all auction and "buy-it-now" activities. These instant updates on transaction statuses enhance the user experience, enabling users to make more informed decisions when purchasing or bidding on E1 subscriptions.

Sellers benefit from a choice between two distinct and flexible methodologies when listing their E1s, each designed to cater to different sales goals, market conditions, and desired transaction speeds. This dual-option framework ensures that every seller can select the strategy that best aligns with their individual needs. Both listing types have a maximum duration of 30 days, and all transactions are finalized using Markethive Credits.

Illustration of the Listings page.

Auction

- This dynamic option enables competitive bidding, where the interested buyers determine the final sale price.

- The E1 may sell for more than the starting price.

- The transaction processes upon the listing's expiration, with the E1 going to the highest bidder.

- This can be an effective strategy for potentially maximizing returns, especially for highly sought-after E1s.

Buy it Now

- This offers a more straightforward approach with a fixed, predetermined price.

- The E1 cannot be sold for more than the asking price.

- This method provides predictability and is ideal for sellers who have a specific value in mind for their E1s and prefer a quicker, less volatile transaction.

- The transaction processes immediately upon sale.

By offering both the stable Buy it Now and the potentially lucrative Auction option, the platform provides sellers with the tactical flexibility required to navigate various market conditions and achieve their specific sales objectives.

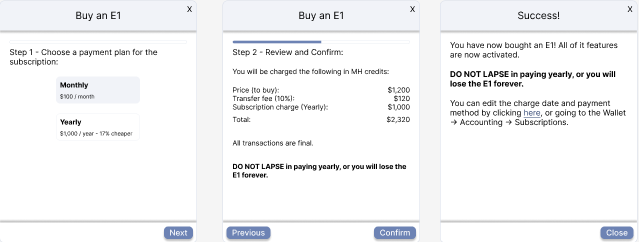

Mechanics of the Buy It Now Process

“Buy It Now” vs. “Make an Offer”

Choosing the 'Make an Offer' option initiates a direct negotiation with the seller, much like traditional bargaining. This indicates your serious interest in purchasing the item (the E1) at a price lower than the seller's original asking price.

Once you submit an offer, the seller has three possible responses:

- Acceptance: The seller agrees to your price, and the transaction proceeds.

- Counteroffer: If your offer is too low but the seller is open to negotiation, they can propose a new, acceptable price.

- Expiration: If the seller does not take action, your offer will eventually expire.

.png)

Mechanics of the Make an Offer process

When a seller sends a counteroffer, the ball is back in your court. You have two options:

- Accept the Offer: If the seller's price is acceptable, you can agree to the counteroffer.

- Submit a New Offer: If the counteroffer still doesn't meet your expectations, you can propose a new price to keep the negotiation alive.

This negotiation process continues until both the buyer and seller agree on a price, or one party chooses to end the discussion. Unlike a "Buy It Now" fixed price, this back-and-forth exchange offers flexibility and the potential to secure a better deal. It requires both patience and a willingness to communicate to achieve a satisfactory result.

Example of a Make an Offer Counteroffer proposal

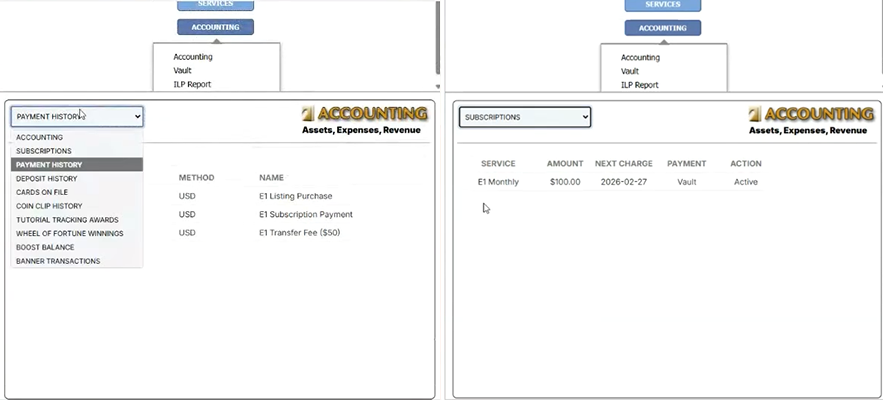

Ensuring Platform Sustainability: The E1 Transfer Fee

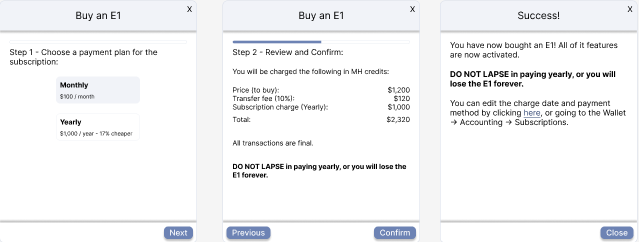

To guarantee the sustained smooth operation, continual development, and maintenance of the robust Markethive marketplace and the E1 Exchange infrastructure, a standard transactional cost is applied. A mandatory 10% transfer fee is applied to the gross value of all E1 sales transactions conducted within the platform.

This fee is a standard industry practice and is crucial to the platform's ongoing sustainability. By factoring this charge into the overall transaction cost, Markethive ensures the resources are available to continually enhance security, improve features, provide customer support, and maintain the high operational standards that users rely upon. This mechanism supports the long-term health and growth of the Markethive ecosystem and the value of the E1 exchange.

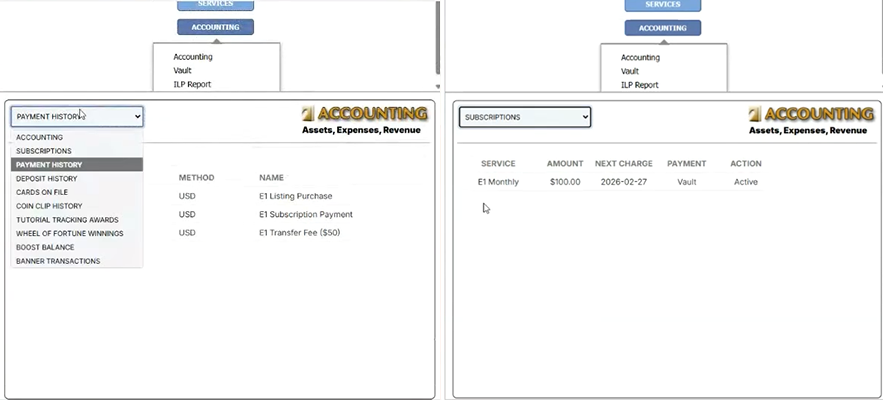

The Vault record of the E1 purchase and subscription

Available Currencies for Transactions

For the initial launch of the E1 Exchange, Markethive Credits (MHC) are the exclusive payment method for all transactions, including dynamic auction-based sales and fixed-price "buy-it-now" or “Make an Offer” options. Each Markethive Credit is consistently valued at one US Dollar (USD 1). As we move forward, other options for direct transactions within the E1X will include cryptocurrencies, payment processors such as PayPal, and credit cards.

Meanwhile, you can fund your vault to acquire Markethive Credits using various accepted payment methods, including credit or debit cards, as well as popular cryptocurrencies like Bitcoin (BTC) and Solana (SOL). You will also be able to use Markethive’s native cryptocurrency, Hivecoin (HVC), to fund your vault once it’s listed on a crypto exchange.

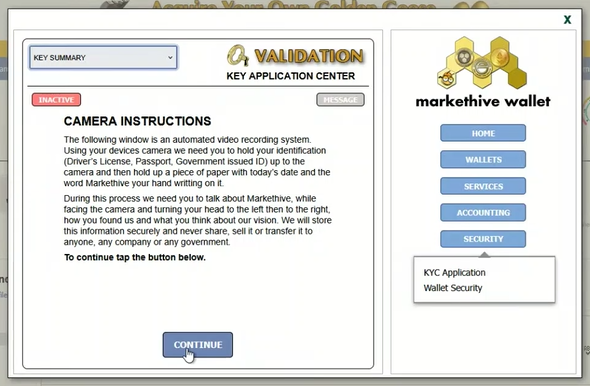

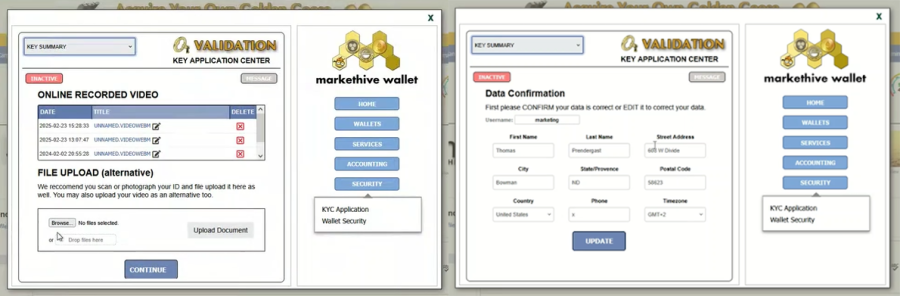

All E1X purchases are processed through your Markethive wallet's vault, with a detailed transaction history available in your payment history. After purchase, the acquired E1 is recorded in the Vault's subscriptions section, where you will be able to edit the charge date if required.

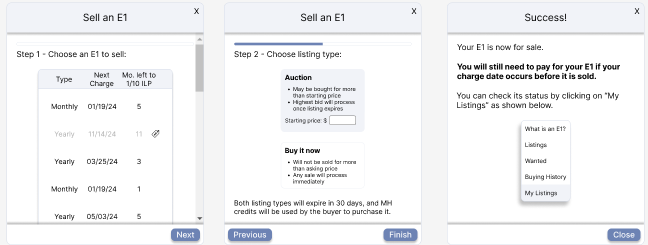

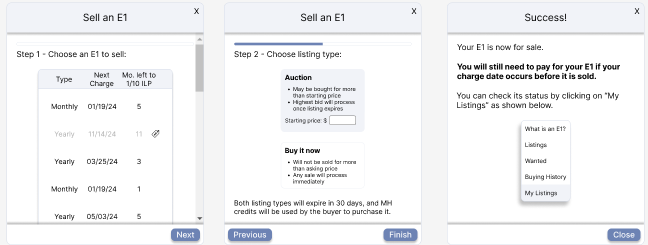

Mechanics of the Sell process

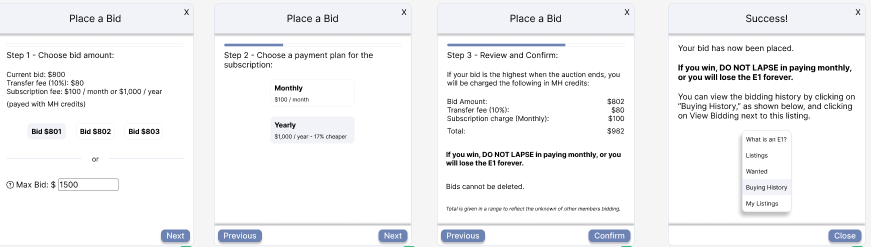

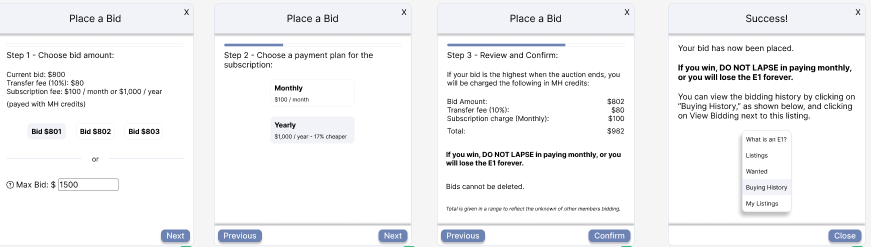

Auction Room Protocol – What is a “Max Bid”?

The "Max Bid" feature is designed to simplify your bidding experience and boost your chance of winning an E1 without requiring constant monitoring. It serves as an automatic bidding mechanism where you set the maximum price you are willing to pay.

By placing a "Max Bid," you authorize the system to automatically bid for you, increasing your bid in $5 increments up to your specified limit. Crucially, the system will bid only the minimum necessary to keep you as the highest bidder.

Example Scenario:

Imagine your maximum bid for the E1 is $500, and the current bid is $100.

- A member bids $105.

- The system automatically counters with a bid of $110 on your behalf, making you the new high bidder.

This automatic process continues, raising your bid by the smallest necessary increment to outbid others, until one of two outcomes occurs:

- You Win: If no one bids higher than your Max Bid, you secure the E1 at the lowest possible price above the second-highest bid.

- You Are Outbid: If another member places a bid that exceeds your Max Bid, the automatic bidding stops, and you are no longer the high bidder. At this point, you can choose to place a new, higher Max Bid to continue pursuing the item.

Comprehensive Auction Rules and Features: Integrity and Fair Play

- Bids are Final (Irrevocable Bids): A core principle of our auction platform is the finality of the Maximum Bid (Max Bid). Once a Max Bid is submitted, it becomes an irrevocable commitment and cannot be retracted, edited, or withdrawn for any reason. This rule is crucial for ensuring fair competition, reliability, and trust in the auction environment for all participants. Before confirming and submitting your bid, we strongly recommend that all bidders carefully review and verify the amount to ensure it aligns with their maximum comfort level and financial situation. A confirmed bid is a binding agreement.

- Preventing Manipulation: To ensure fair auctions and give genuine bidders a final chance, we use a Time Extension feature. If a bid is placed in the last minute, the auction extends by five minutes. This repeats with each new bid within the extension, stopping after 5 minutes without a bid. This prevents manipulation, known as "sniping," and ensures the final price accurately reflects the market's willingness to pay.

- Confidentiality (Privacy): The Maximum Bid you submit is handled with the highest level of security and privacy. The exact value of your Max Bid is never revealed to other bidders or made public. Other participants will only see the current highest bid amount, which the system increases incrementally on your behalf. This ensures that your private financial limit remains hidden, giving you a strategic advantage without exposing your position.

- Strategic Advantage (Strategic Bidding): The Max Bid feature is a crucial tool for online auctions, offering strategic advantage and convenience to bidders who can't be present at the close. Setting Max Bid allows the system to bid automatically in small increments up to your limit, keeping you the highest bidder. This prevents missing out due to timing, technical issues, or being offline, ensuring a strategic, efficient way to secure items.

The Max Bid feature is a cornerstone of an effective auction strategy, designed to simplify your participation and increase your chances of success. By setting your maximum acceptable bid in advance, you enable the system to automatically place competitive bids on your behalf up to your specified limit. This strategic automation helps you stay a strong contender without the need for constant, real-time monitoring of the auction. Ultimately, understanding and using the Max Bid tool is key to an efficient and rewarding auction experience.

Note: Members can list their entire E1 inventory for sale simultaneously through the E1 Exchange. However, it’s important to note a key financial point regarding the monthly subscription fee. If the subscription date falls within the sale listing period, the seller must still pay the subscription fee if the E1 hasn’t sold. Ownership remains with the member who is selling until the sale is complete and the asset is transferred to the buyer. During the listing, since ownership hasn't transferred, the monthly maintenance fee for the E1 remains the seller’s responsibility until the sale is finalized.

Mechanics of the Bidding process for an auction

E1 Acquisition Payment Plans

Markethive is committed to providing a flexible, user-friendly experience for acquiring E1s, recognizing that prospective buyers have diverse financial needs and preferences. To accommodate this, Markethive has established two distinct and convenient payment options for purchasing E1s.

1. Monthly Payment Option: The Flexible Approach

- Cost: Buyers can choose a recurring monthly payment of $100.

- Benefits: This plan is designed for maximum financial flexibility and accessibility. It allows buyers to spread the investment cost of their E1s over time, requiring a lower initial outlay. This makes the E1s readily attainable for individuals who prefer smaller, predictable monthly budget allocations rather than a single lump-sum payment. The monthly option ensures a steady entry point into the Markethive ecosystem.

2. Yearly Payment Option: The Value Maximiser

- Cost: For buyers who prefer efficiency and greater savings, an annual, upfront payment plan is available for $1000.

- Benefits: This option provides a significant financial advantage. Compared to committing to the monthly plan for an entire year (12 months x $100 = $1200), the annual plan offers a 17% discount, saving $200. This pricing structure rewards buyers for their commitment and foresight, positioning the yearly plan as the optimal choice for individuals and businesses aiming to maximize their investment value and achieve the most cost-effective acquisition of E1s.

Notification options in settings

Dedicated Notification System and Unique Listing URLs

Members will be kept fully informed about the status of their listing through a comprehensive notification system. These alerts, which include important incremental updates detailing the progress of the listing process, are delivered promptly to two convenient locations. Firstly, a prominent flag area on the user's home page will display these notifications, providing a quick and centralized view of all recent activity. Secondly, for added convenience and assurance, copies of these notifications will also be dispatched directly to the user's registered email address.

To ensure a personalized user experience, a dedicated settings panel is available. This panel provides granular control over the notification system, allowing users to fully customize which alert and update types they prefer to see displayed in their home page flag area. This ensures that users only receive the information most relevant to their current focus.

Beyond notifications, the system is designed to streamline the management and promotion of individual listings. The platform provides easy access to direct, dedicated links for each listing created by the user. This functionality is crucial for outreach, as it enables users to effortlessly copy and share these unique URLs with any interested parties, potential buyers, or clients, facilitating wider distribution and increasing the visibility of their assets.

The E1 Exchange Wanted Section

The E1 Exchange – Wanted Section

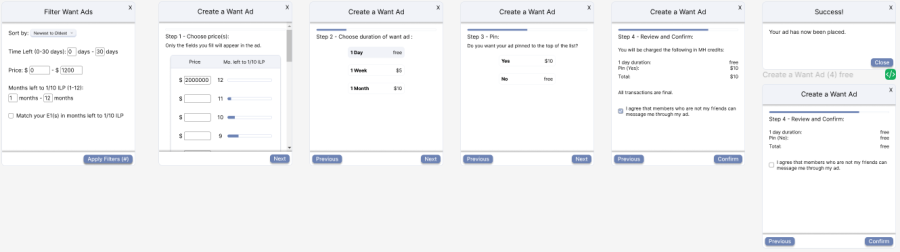

The "Wanted" section within the E1 Store serves as a dynamic marketplace for members seeking to acquire E1 accounts. This dedicated area facilitates connections between prospective buyers and sellers, offering a streamlined process for transactions.

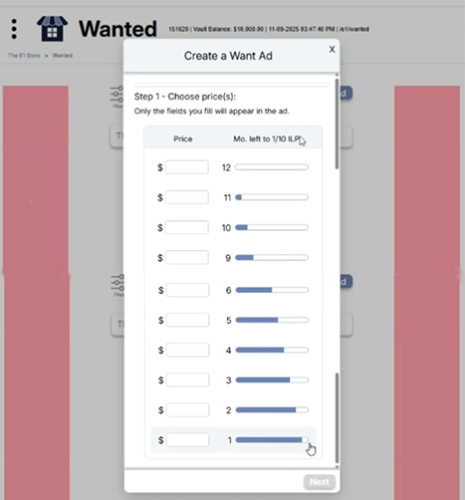

Members interested in purchasing an E1 account can leverage the "Wanted" section to post their specific requirements. When creating an advertisement, buyers are encouraged to clearly state their desired price range, providing transparency and attracting relevant sellers. This proactive approach enables buyers to outline their ideal E1 account specifications, including the number of remaining months in the subscription for that year and any specific features they prioritize.

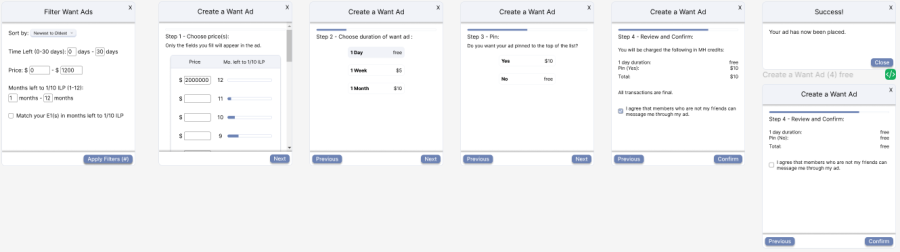

The E1 Store offers flexible ad duration options for "wanted" postings to suit the various needs of its members.

One-Day Advertisement: This is a free option, ideal for members with immediate needs or those wanting to test the marketplace briefly.

Extended Durations: For a longer market presence, extended postings are available for a nominal charge.

- A one-week posting costs $5.

- A one-month posting costs $10.

Details for even more extended periods are outlined in the E1 Store's pricing structure. Increased visibility with extended durations significantly improves the likelihood of finding a suitable E1 account.

Enhanced Visibility – Optional Pinning: For an additional $10 fee, you can pin your ad to the top of the list. Choosing this option places the advertisement at the top of the "wanted" postings, ensuring it stays immediately visible to all members browsing the section and giving you a competitive edge in a busy marketplace.

Mechanics of the E1 Wanted process

A central element of the "Wanted" section is its emphasis on direct and efficient communication. After a want ad is published, interested parties (typically E1 account sellers) can message the ad poster directly. The poster will be required to agree that non-friends can message them regarding the transaction. This direct messaging capability simplifies negotiations, enabling buyers and sellers to privately and effectively discuss terms, ask questions, and arrange the E1 account transfer. Sellers can provide the unique URL for each listing to interested buyers, allowing them to complete the transaction directly through that link.

To enhance the user experience and facilitate efficient browsing, the "Wanted" section offers robust filtering options. These filters enable members to refine their search criteria, ensuring they only view listings that match their specific preferences. For example, a popular filter allows members to search for E1 accounts with the fewest remaining months.

The E1 Store's "Want" section serves as a central hub for the E1 community, providing a transparent, efficient platform for buying and selling E1 accounts. Its user-friendly design, versatile advertisement options, and effective communication tools make it a vital resource for all members.

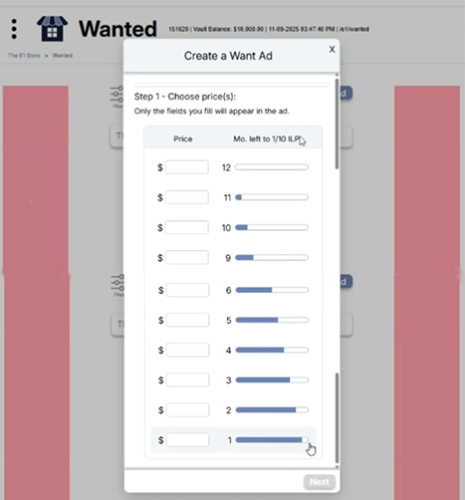

Illustrating the Months left to 1/10 ILP in the Want ad

Understanding "Months Left To 0.1 ILP” Before Rewarding E1 Accounts

The key metric when examining E1 accounts in the store is "Months left to 1/10 ILP." This is a vital detail for potential buyers, showing how close an E1 account is to earning 0.1 of an ILP. Specifically, it indicates the number of remaining monthly payments on the current 12-month subscription required before the 0.1 ILP increment is awarded. Once the remaining monthly subscription payments for that year are completed, the accrued 0.1 ILP is automatically transferred to the new owner and displayed in the wallet.

Here are examples illustrating the payment obligation required to earn the associated 0.1 ILP with an E1 listing fully:

- "Ten Months left to 0.1 ILP": This indicates the buyer must complete ten more monthly subscription payments. The 0.1 ILP linked to the E1 account will be fully earned and transferred to the buyer only after these 10 payments have been successfully made. This provides clear transparency regarding the commitment needed to realize the 0.1 ILP benefit.

- "One month left to 0.1 ILP": In contrast, this listing signifies the E1 account is very close to the end of its ILP accrual period. The buyer's payment obligation is significantly shorter, requiring only one additional month's payment for the 0.1 ILP to be accrued and transferred. Such an account may be highly attractive to buyers seeking a quicker return on their ILP investment.

This "Months left to 0.1 ILP" metric is therefore crucial for buyers to evaluate the value proposition of each E1 account beyond its immediate features. It helps them consider the time and financial commitment required to achieve the ILP increment, which can be a significant incentive for users aiming to maximize their long-term benefits on the platform.

Informed purchasing decisions are supported by understanding this metric, helping buyers align their choices with their preferences for either immediate access to ILPs or a longer-term accumulation strategy. A key benefit to note is that maintaining an active E1 account in subsequent years will increase your interest or dividend income, as it earns an additional 0.01 ILP each year.

The Launch of the E1 Exchange is Imminent

We are on the verge of a major technological breakthrough: the highly awaited launch of the E1X platform. This significant transition aims to usher in a new era of enhanced performance, security, and user experience. E1X will introduce a wide range of new features, improved functionalities, and a simplified interface, providing significant benefits to our entire community.

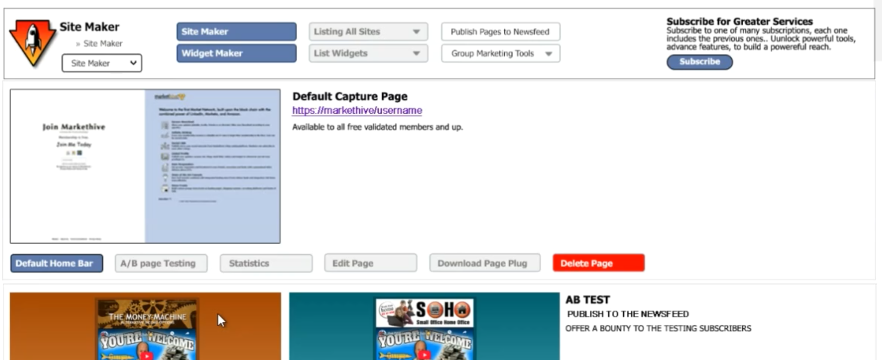

This innovative approach exemplifies the cottage industry concept in action, showcasing one of the many "money machines" Markethive offers to empower its entrepreneurs. Markethive is dedicated to distributing its profits directly to its vibrant community and is committed to helping individuals shape their destiny and strengthen their financial footprint, fostering a shared prosperity model that challenges traditional corporate structures.

Upon the E1 Exchange launch, all individual E1 account holders will receive an email and internal message providing a 30-day notice to reinstate any suspended E1 accounts. If a suspended E1 account is not reinstated within these 30 days, it will be permanently voided and removed.

This article is the latest, in-depth update on the development of the E1 Exchange. Our dedicated engineering team is currently focused on the critical phase of developing, implementing, and thoroughly testing this revolutionary platform. To ensure you stay fully informed and can witness our progress firsthand, we strongly encourage you to join our regular weekly development meetings. These essential sessions are held every Sunday at 8:00 AM MST (Mountain Standard Time). During these meetings, you will:

- Stay Informed: Get the latest news and granular details on the E1 Exchange's progress and development roadmap.

- See Demonstrations: Receive exclusive, live demos of other complementary systems currently under development within the Markethive ecosystem, providing a holistic platform view.

- Witness Innovation: See the cutting-edge designs and proprietary technology being implemented. Markethive aims to be a definitive leader, setting new industry standards for performance and innovation.

Your engagement and feedback are invaluable as we approach the official launch. We look forward to seeing you at our next Sunday meeting as we collectively build the future of Markethive.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)