The Great Disconnect: Exploring the Global De-banking of Crypto Businesses.

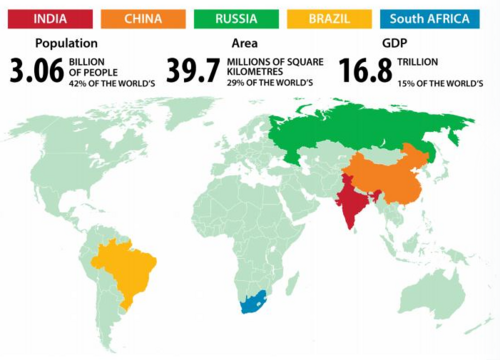

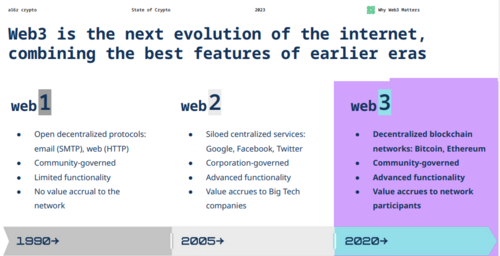

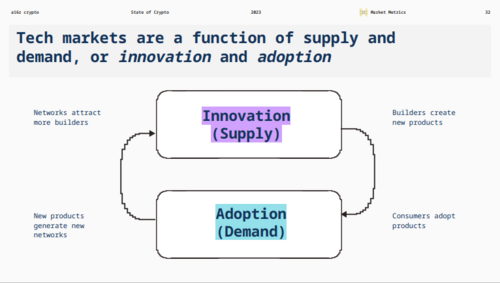

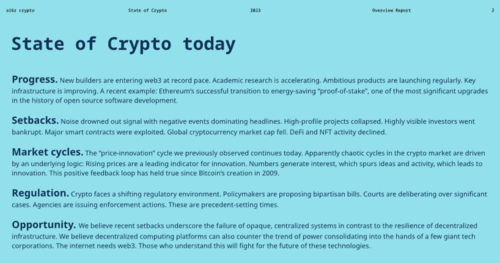

Cryptocurrencies emerged as a disruptive force, challenging the traditional financial system and centralized control. With their potential to revolutionize cross-border transactions, enhance financial inclusion, and provide secure and transparent transactions, cryptocurrencies gained momentum among investors, businesses, and individuals seeking alternative financial solutions. However, traditional financial institutions have not met this radical shift towards decentralized finance with open arms.

In recent years, a concerning trend known as de-banking has emerged, where banks and other financial institutions systematically sever ties with crypto-related businesses. This process entails closing accounts, denying services, and declining partnerships with companies involved in cryptocurrency-related activities. While financial institutions cite concerns over regulatory compliance, money laundering risks, and reputational damage, critics argue that de-banking stifles innovation and hampers the growth of the burgeoning crypto industry.

This article aims to provide a comprehensive analysis of the global de-banking phenomenon, shedding light on its underlying causes, consequences, and potential implications for the future of cryptocurrencies. By examining real-world examples from various countries and industries, we will delve into the factors contributing to this widespread debanking trend. Additionally, we will explore crypto-related businesses' legal and regulatory challenges, often prompting financial institutions to distance themselves from this sector.

Furthermore, this article will explore the immediate and long-term consequences of de-banking on the affected businesses and the broader cryptocurrency ecosystem. We will delve into the difficulties crypto entrepreneurs encounter in accessing banking services, obtaining loans, and establishing partnerships, as well as the potential implications for financial stability and the overall adoption of cryptocurrencies.

Image credit: Markethive.com

De-banking Phenomenon

De-banking refers to the systematic severance of ties between financial institutions and businesses whose operations are perceived not to be in line with legal and governmental regulations. This process involves banks closing accounts, denying services, and declining partnerships with companies engaged in such activities. While financial institutions often cite concerns over regulatory compliance, money laundering risks, and reputational damage as reasons for de-banking, critics argue that this approach stifles innovation and hampers the growth of the burgeoning crypto industry.

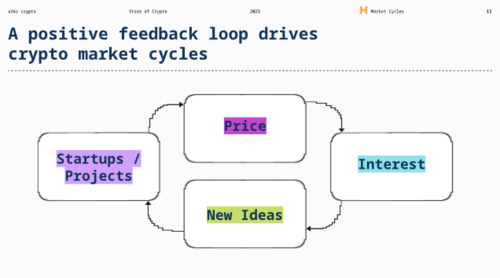

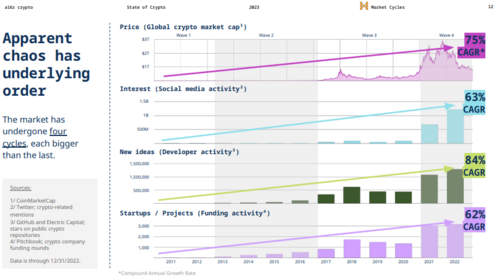

To truly understand the de-banking trend, we must explore the underlying causes. One of the primary factors is the regulatory landscape surrounding cryptocurrencies. Governments and regulatory bodies worldwide have struggled to keep up with the rapid development of this new technology. The lack of clear and comprehensive regulations has created an uncertain environment for financial institutions, leading them to adopt a cautious approach.

The anonymity and pseudo-anonymity offered by some cryptocurrencies have raised concerns about potential money laundering and illicit activities. While the blockchain technology behind cryptocurrencies provides transparency, it can also be exploited by individuals seeking to conceal their identities and engage in unlawful practices. Although wary of potential legal and reputational risks, many financial institutions have chosen to distance themselves from the crypto industry.

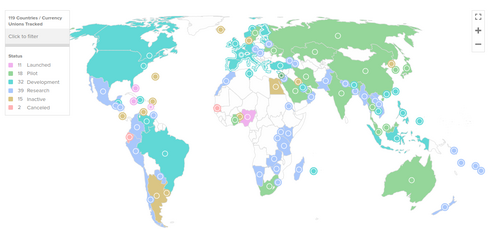

The debanking phenomenon is not limited to a specific country or region; it is a global trend affecting businesses operating in the cryptocurrency space worldwide. For example, many crypto-related startups have struggled to establish banking relationships in the United States. Banks often view these businesses as high-risk due to regulatory uncertainties and the perceived association with illicit activities.

As a result, companies have faced difficulties accessing basic banking services, such as opening business accounts and obtaining loans. Europe has also witnessed a similar debanking trend. Several major European banks have halted services to crypto-related businesses or imposed severe restrictions, hindering their ability to operate smoothly. The situation in Asia is no different, with countries like Iraq imposing a de facto ban on cryptocurrencies and financial institutions wary of engaging with crypto-related entities.

Traditional lenders are reluctant to extend credit to companies operating in the cryptocurrency space due to perceived risks and uncertainties. Access to capital is needed to improve the growth and expansion of these businesses, limiting their potential for innovation and development. These entrepreneurs face significant challenges in accessing banking services, which are vital for day-to-day operations. Without a bank account, businesses struggle to receive and manage funds, pay employees, and transact with suppliers. This creates a substantial operational burden, forcing companies to rely on alternative and often less efficient solutions.

The impact of de-banking extends beyond individual businesses to the broader adoption of cryptocurrencies. The inability to establish partnerships with financial institutions inhibits the integration of cryptocurrencies into the mainstream financial system. It hinders the ability of consumers to use cryptocurrencies for everyday transactions, limiting their utility and slowing down the overall adoption process.

However, it is crucial to consider the perspectives of all stakeholders involved in the de-banking debate. Financial institutions are tasked with ensuring regulatory compliance and managing risks associated with the cryptocurrency industry. With increasing regulatory scrutiny, banks face immense pressure to prevent money laundering, fraud, and other illicit activities. By distancing themselves from crypto-related businesses, they aim to protect their reputation and avoid potential legal repercussions.

Regulators, however, grapple with the challenge of striking a balance between fostering innovation and safeguarding financial stability. Developing clear and effective regulatory frameworks for cryptocurrencies is a complex task that requires careful consideration of the unique characteristics of this digital asset class.

Crypto enthusiasts advocate for a more collaborative approach, where financial institutions work with the crypto industry to address concerns and find mutually beneficial solutions. This includes implementing robust know-your-customer (KYC) and anti-money laundering (AML) measures and enhancing transparency and cooperation between regulators and industry participants.

Moreover, de-banking crypto-related businesses can have significant implications for financial inclusion. Cryptocurrencies have the potential to provide financial services to individuals and companies that are underserved by the traditional financial system. For example, in many developing countries, traditional banking services are limited, and many individuals and businesses rely on mobile money services to manage their finances.

Cryptocurrencies have the potential to provide an alternative to these services, offering faster, cheaper, and more secure transactions. However, the de-banking of crypto-related businesses can limit the ability of these individuals and companies to access these services, further limiting their financial inclusion.

The Impact of De-banking on the Crypto Industry

Lack of access to traditional banking services can create significant operational challenges for crypto-related businesses. Moreover, the lack of access to conventional banking services can also limit the ability of crypto-related businesses to establish partnerships with other companies and organizations. This can limit the potential for collaboration and innovation in the industry, further limiting the growth potential of cryptocurrencies.

The potential implications of these challenges for financial stability and the overall adoption of cryptocurrencies are significant. Without access to traditional banking services, crypto-related businesses may be forced to rely on alternative banking relationships or operate entirely outside the conventional financial system.

This can create significant risks for financial stability, as these businesses may be more vulnerable to fraud, money laundering, and other forms of financial crime. Without the ability to easily convert cryptocurrencies into fiat currency, many consumers and companies may hesitate to adopt these assets as a form of payment or investment.

There are several reasons why some banks and financial institutions decide to de-bank crypto businesses. Some of them are:

• Regulatory uncertainty: Cryptocurrencies' legal status and regulation vary across jurisdictions and are often unclear or inconsistent. This challenges banks and financial institutions to comply with anti-money laundering (AML), counter-terrorism financing (CTF), and other rules and regulations. Some banks and financial institutions may prefer to avoid dealing with crypto businesses altogether rather than risk facing fines, sanctions, or legal actions.

• Compliance risks: Even if the regulation of cryptocurrencies is clear and consistent, banks and financial institutions still face compliance risks when dealing with crypto businesses. For example, they may have difficulty verifying their crypto customers' identity and source of funds or have to deal with complex and costly reporting requirements. Some banks and financial institutions may also be concerned about the reputation risk of being associated with crypto businesses involved in illicit activities or scams.

• Volatility: Cryptocurrencies are known for their high price volatility, which can pose risks for banks and financial institutions that provide services to crypto businesses. For example, if a bank offers a loan to a crypto company that uses cryptocurrencies as collateral, the value of the collateral may fluctuate significantly and affect the repayment ability of the borrower. Similarly, suppose a bank provides a payment service to a crypto business that accepts cryptocurrencies as payment. In that case, the value of the payment may change drastically between the time of the transaction and settlement.

• Competition: Cryptocurrencies are also seen as a potential threat to the traditional financial system, as they offer alternative ways of storing and transferring value that may challenge the dominance and profitability of banks and financial institutions. Some banks and financial institutions may view crypto businesses as competitors rather than customers or partners and seek to limit their growth or market share by debanking them.

Operation Chokepoint

Operation Chokepoint, introduced in 2013 by the United States Department of Justice (DOJ) under the Obama administration, primarily focused on combating fraud in high-risk industries by pressuring financial institutions to sever ties with specific businesses. The operation targeted sectors such as payday lending, firearms, ammunition sales, online gambling, and debt collection. The strategy involved pressure on banks and payment processors to cut off services to these industries, effectively choking off their access to the financial system.

The primary concern driving Operation Chokepoint 1.0 was to curtail fraudulent activities in industries that posed higher risks. The DOJ expressed concerns that some businesses in these sectors were engaged in deceptive practices, leading to consumer harm and financial losses. By leveraging its authority and coordinating with other regulatory agencies, the DOJ sought to disrupt the economic infrastructure supporting these industries and minimize their ability to carry out activities.

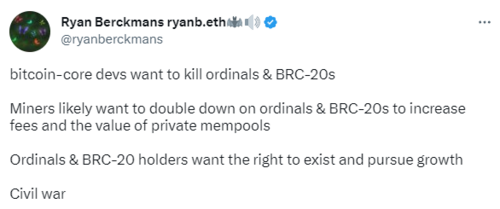

Screenshot: Twitter

The connection between Operation Chokepoint 1.0 and Operation Chokepoint 2.0 lies in extending the original concept to the crypto industry. Operation Chokepoint 2.0 indicates the application of similar tactics employed in the initial operation to the crypto industry. Just as Operation Chokepoint 1.0 sought to target high-risk sectors by pressuring financial institutions, Operation Chokepoint 2.0 involves exerting pressure on banks, payment processors, and other financial service providers to sever ties with cryptocurrency-related businesses.

The victims of Operation Choke Point 1.0 are thus all too familiar with what the participants in the crypto economy are now experiencing. The campaign begins with a series of vague policy pronouncements and ominous warnings issued as informal guidance to the banks. Then there is a flurry of decisions by banks to terminate their banking relationships with the targeted industry, of accounts closed either without any explanation or with the decision being attributed to “compliance requirements,” to “your business being outside of our risk tolerances,” or to “risks associated with your business.” All these are gimmicks to destroy the crypto industry.

Examples of De-banking in the Crypto Industry

It has been a common practice for banks to distance themselves from companies they perceive as high-risk for many years. However, the de-banking of crypto-related businesses has become increasingly prevalent in recent years as the industry has grown and regulators have struggled to keep up with the pace of innovation.

Binance US is halting US dollar deposits and withdrawals from its platform as of June 13, 2023. This comes after the US Securities and Exchange Commission (SEC) filed a lawsuit against Binance and its CEO, Changpeng Zhao, for allegedly violating securities laws and operating an unregistered exchange. The SEC also asked a federal court to freeze Binance US assets.

The de-banking of Binance US could be a concern for the crypto community because it could affect the liquidity and accessibility of the crypto market in the U.S. Binance US is one of the largest crypto exchanges in the country, with over 2 million users and more than $1 billion in daily trading volume.

If Binance US users cannot deposit or withdraw fiat currency, they may have to resort to other platforms or methods that could be more costly, risky, or inconvenient. Moreover, the SEC's crackdown on Binance could signal a more aggressive and hostile stance towards the crypto industry, which could discourage innovation, investment, and adoption of digital assets.

On May 18th, 2023, Binance Australia announced that it had suspended Australian dollar (AUD) PayID deposits "with immediate effect" due to a decision made by its third-party payment service provider. It also said that bank transfer withdrawals would also be impacted. According to Binance Australia's statement, its payment processor's partner bank Cuscal had decided to end AUD deposit services for Binance Australia without providing any specific reason.

In July 2022, FTX, another major crypto exchange, lost its banking partner Signature Bank after the SEC filed a lawsuit against the company for allegedly operating as an unregistered securities exchange. FTX had to suspend its U.S. operations and refund its customers. Signature Bank said it ended its relationship with FTX due to “regulatory concerns” and “reputational risk.”

One of the most high-profile examples of de-banking in the crypto industry is the case of Bitfinex. In 2017, Wells Fargo, one of Bitfinex's banking partners, announced that it would no longer process wire transfers for the exchange. This move left Bitfinex unable to process withdrawals for its users, leading to a significant drop in trading volume and a loss of trust among its user base.

Another example of de-banking in the crypto industry is the case of Coinbase. In 2017, the US-based exchange was forced to suspend trading in Hawaii after failing to secure a banking relationship in the state. This move left Coinbase unable to serve its Hawaiian customers, highlighting the challenges crypto-related businesses face in obtaining banking relationships.

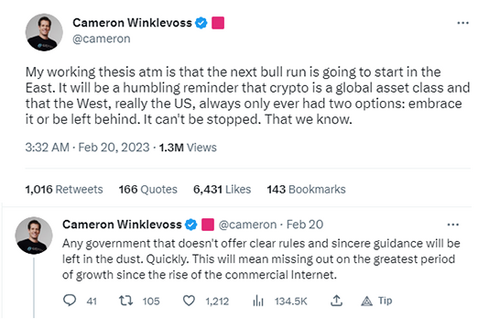

These debanking cases illustrate some of the challenges and uncertainties that crypto businesses face in the U.S. and Europe, significantly as regulators increase their scrutiny and enforcement actions against the industry. In contrast, regulators and policymakers postulate that debanking is necessary to protect consumers and investors from fraud and risk, but is that their true intention for doing that? If the government had full control over Bitcoin and other altcoins, which gives them enormous control over your financial freedom, would they have aggressively fought against the industry? Think about that.

The Future of De-banking in the Crypto Industry

The future of de-banking in the crypto industry is a topic of much debate and speculation. While it is likely that the de-banking of crypto-related businesses will continue in the coming years, there are also signs that the industry is beginning to adapt to these challenges.

One of how the industry is adapting is by exploring alternative banking relationships. Some of these businesses are beginning to work with smaller banks or payment processors that are more willing to work with them. These alternative banking relationships can help these businesses access the traditional financial system while mitigating cryptocurrency risks.

Some countries are beginning to develop more supportive regulatory frameworks for cryptocurrencies. For example, in the United States, the Securities and Exchange Commission (SEC) has started to provide more guidance on the regulatory status of cryptocurrencies, which has helped to clarify the legal landscape for crypto-related businesses.

Similarly, the European Union has developed a comprehensive regulatory framework for cryptocurrencies, known as the Fifth Anti-Money Laundering Directive (5AMLD). This framework requires crypto-related businesses to register with national authorities and comply with anti-money laundering and counter-terrorism financing regulations.

These more supportive regulatory frameworks can mitigate the perceived risks associated with cryptocurrencies, making it easier for banks and other financial institutions to work with crypto-related businesses. These frameworks can build trust in the crypto ecosystem, making it more attractive to mainstream investors and companies.

As the industry continues to evolve, regulators, banks, and crypto businesses must work together to build a more inclusive and supportive financial ecosystem that embraces the potential of digital assets while mitigating the associated risks. By working together, these stakeholders can help to build a more resilient and sustainable financial system that benefits businesses, individuals, and the global economy.

.png)

.png)

.png)

.png)

(27).gif)

.png)

.png)

.png)

(5).gif)