The Latest Report On CBDCs. A Dystopian Nightmare!

Cryptocurrencies’ continued adoption puts pressure on governments worldwide, and their reckless money printing has only added fuel to the fire. Now they're rushing to develop their Central Bank Digital Currencies before it's too late. In a previous article, I explained how the implementation of CBDCs could well be part of the great reset plan. Today, we’ll explore a recent report, revealing what features CBDCs will have, how governments plan on rolling them out, and what implications this could have for cryptocurrency.

The report was composed by the Bank for International Settlements or BIS, which is fundamentally the bank for central banks. Its primary role is to facilitate coordination between central banks around the world. Over the last few years, the BIS has been devising a template for Central Bank Digital Currencies or CBDCs to be issued by their respective central banks.

It must be stated that CBDCs are not cryptocurrencies by any standards. This is because CBDCs are centralized, permissioned, and offer very little or no privacy. They are entirely controlled by central banks and the governments to which they are accountable. Almost every Central Bank is working on a CBDC of its own, and seven of these central banks have been actively helping the BIS construct a CBDC template.

These are the United States Federal Reserve, the European Central Bank, the Bank of England, the Bank of Japan, the Swiss National Bank, the Bank of Canada, and the Swedish Central Bank. In October 2020, these seven central banks and the BIS published the first of many reports about what and how CBDCs will look. The second CBDC report came out on September 30th, 2021, and contains even more details about what CBDCs will look like.

It's divided into a three-part system;

The authors provided a short six-page summary.pdf of their three-part CBDC report, and there are a few interesting points in the summary, which were seemingly not mentioned in the three sections of the report.

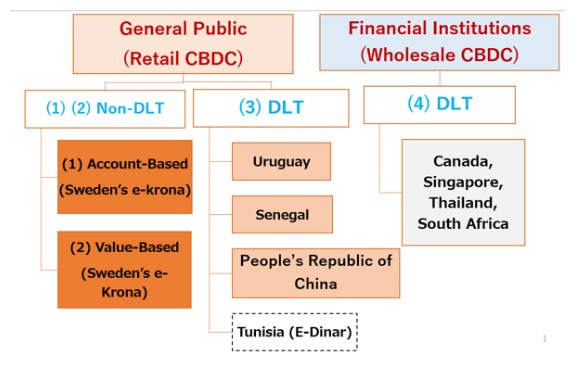

The very first thing worth pointing out is the most important, and that's everything you read here applies to a public or retail CBDC. Now, this is a small but insanely significant detail because central banks, governments, and select institutions will use their own so-called wholesale CBDCs. A wholesale CBDC template is also being worked on, but one blatantly obvious thing is that regular folks like us will use a completely different digital currency to the people in power.

Source: https://voxeu.org/article/central-bank-digital-currency-concepts-and-trends

Another concerning detail quoted at the end of the first page of the report summary is, “CBDCs would be likely to have wide-ranging impacts on public policy issues beyond a central bank's traditional remit.”

This seems to imply that CBDCs will be used to enforce public policy mandates in all other areas of our lives, not just the financial aspect.

Adding to that, as quoted in the screenshots below, “different users and needs would need to be defined and addressed in the system’s design.”

And also, “Central banks might consider measures to influence or control CBDC adoption or use. This could include measures such as access criteria for permitted users,” …]

This suggests that even retail CBDCs will have different rules for different groups of people.

How Will CBDCs Be Designed?

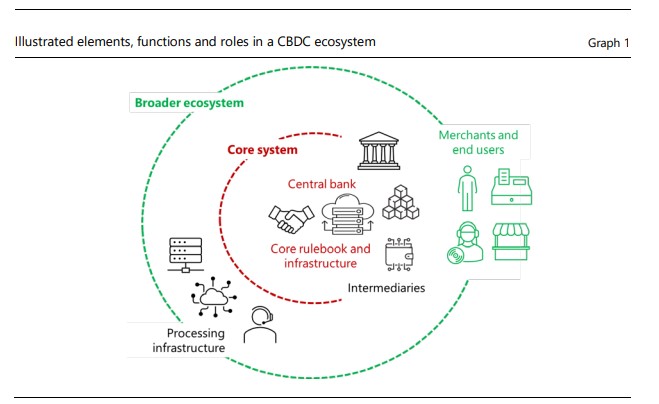

Much of how CBDCs will be designed has to do with the current financial intermediaries’ roles in such a system. For starters, the report states, “Central banks would be the only entities entitled to issue and redeem a CBDC and would bear the ultimate responsibility for the design of the CBDC system and the operation/oversight of the core Ledger.”

Although central banks could theoretically cut out all existing financial intermediaries, the report stresses the importance of partnering with the private sector simply because the central bank can't possibly recreate, much less maintain the same infrastructure on its own.

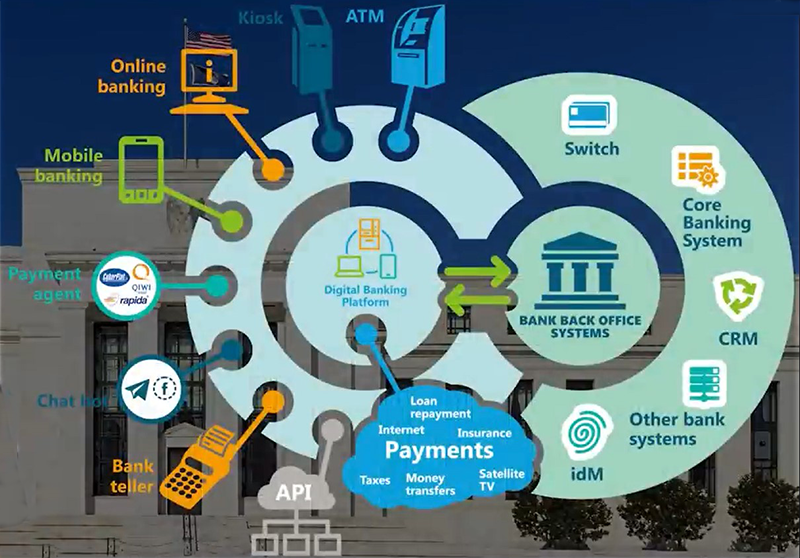

Below is an image of what the financial system looks like now in most countries,

Source: Coin Bureau

And the image below is what a CBDC-based financial system would look like, according to the report. As you can see, the exact role each party plays here is not entirely clear. Still, the report notes that “if the central bank were to play a too operational or dominant a role in the ecosystem, private intermediary participation could be curtailed with a reduction in the diversity, innovation, and efficiency of the system.”

Given that private financial intermediaries will be a part of the picture, CBDCs will need to be interoperable internationally and domestically with their existing infrastructure. But, because this will likely cause many technical issues, the report recommends limiting the number of financial intermediaries that are allowed to operate.

Also, the report states approval processes for new intermediaries or specific services and strong oversight could help mitigate technical issues. Meaning, the central bank will decide exactly which financial intermediaries are allowed to operate.

Privacy Issues

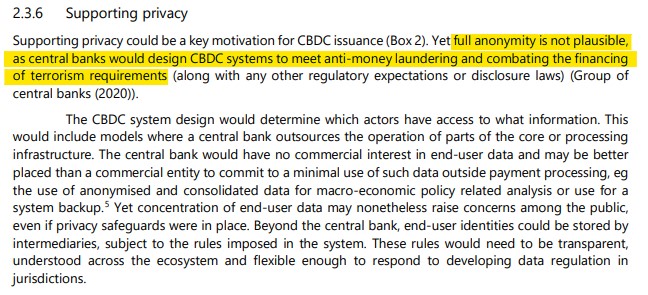

When it comes to privacy, it states total anonymity is not possible as central banks would design CBDC Systems to meet anti-money laundering and combat the financing of terrorism requirements.

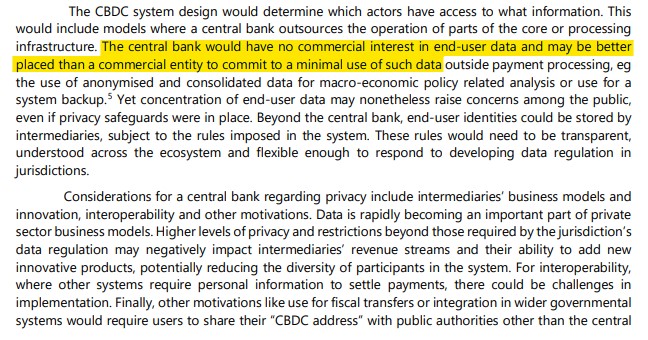

Supposedly, our data will be safe because the central bank would have no commercial interest in end-user data and may be better placed than a commercial entity to commit to a minimal use of such data.

The report also brings up the infamous travel rule put in place by the FATF, which means that every CBDC transaction above a certain amount would be automatically tracked.

Interoperability

The next part of the report briefly touches on the interoperability requirement for CBDCs and notes that the essential foundation of interoperability would be standardization, which would allow compatibility.

The report’s last mention of interoperability is that a CBDC could be introduced with an explicit policy goal to catalyze a migration of national standards to an internationally promoted standard. In other words, CBDC standards will be Global.

What Is Their Strategy For Global Acceptance?

The BIS and central banks know that the public may have trouble understanding or accepting their new monetary system, as mentioned below, but they have a plan on helping us “ordinary people” understand.

It starts by outrightly admitting that the main reason why central banks are developing CBDCs is because of cryptocurrency adoption, stating that, “without continued innovation and competition to drive efficiency in a jurisdictions payment system, users may adopt other less safe instruments or currencies potentially leading to economic and consumer harm.”

Ironically the report acknowledges that “technological innovation has been transforming the markets for retail payments at pace over recent years, with many new payment methods platforms and interfaces evolving to become faster, cheaper, and safer.”

The logical conclusion of this kind of statement would be to allow this kind of payment innovation to continue, but apparently, the BIS and its banker cohorts believe this is better done differently.

In this section of the report.pdf, it outlines the three ways by which CBDC adoption can be achieved by;

- Fulfilling unmet user needs

- Achieving network effects

- Not requiring everyone to buy a new computer or phone

The report detailed how CBDCs exactly fulfill unmet user needs, and according to the BIS, the main selling points are security, low cost, high liquidity, programmability, and privacy. The report then starts to detail some more manipulative ways of achieving CBDC adoption. Namely, “incentivize consumer use of CBDC by dispersing, social benefits and transfers to individuals in CBDC” and “allowing consumers to pay their taxes in CBDC.”

The report also provides a formula for various CBDC marketing campaigns targeting consumers with different pain points and needs. The funny thing is that one of these consumer archetypes in their category is a person “who does not want commercial banks to know his or her Identity or track his or her spending.” So naturally, the best solution to this issue is to give all that information directly to the central bank instead.

What Are The Financial Stability Implications?

The next section of the report is the financial stability implications of a CBCD and is where cryptocurrency is first acknowledged. The report notes that “stablecoins are only just starting to be developed, and will need to satisfy regulators that they are safe.” It would seem they missed the memo that stablecoins have been around for years and their users know which ones are safe and which ones are less safe.

Then the report goes on and makes a ridiculous claim which is believed to be categorically false by the crypto savvy, “Unlike central banks, issuers of stablecoins are not bound by principles to design products that would coexist and interoperate with other forms of money or to promote ongoing innovation and efficiency.”

In the crypto space, it’s common knowledge that stablecoins like USDT and USDC are available on more than a dozen different blockchains. It's in the BIS and central banks’ economic interest to be as interoperable as possible. Stablecoins are literally leagues ahead in interoperability terms of any CBDC. Even Visa has managed to test USDC as part of its payment infrastructure.

Source: Techcrunch

Then, the truth is revealed when the report states, “Significant stablecoin adoption and the potential consequent fragmentation could result in excessive market power and the type of deposit disintermediation described as a risk for CBDC issuance.”

This statement officially confirms that central banks see stablecoins as a risk to a central bank digital currency rollout. They're also hyper-aware that “the actual introduction of CBDCs could be some years away. In the interim, providers of private money and tokens are expected to continue developing and expanding their service offerings.”

Because the central banks can't possibly catch up, they can only slow stablecoins down through regulation, and we see more news of crackdowns and reviews in recent headlines.

Although the next part of the report is quite technical, many astute crypto enthusiasts’ interpretation is that central banks know that CBDCs can't compete with stablecoins because they can't offer the same yields on savings found in Defi. Yields are something that wealthy investors and institutional investors crave, and their influence could protect stablecoins from harsh regulations.

The third section of the BIS report is where things get really interesting. Besides the fact that the projected adoption of CBDCs in G20 countries is between 4% and 12%, CBDCs could pose a considerable threat to the financial system via the banks.

To understand why we must go back to when the stock market started crashing in the lead up to the Great Depression. People scrambled to withdraw all their money from their bank accounts, only to find that their banks didn't have their money because it had all been lent out.

The bank runs caused the banking sector to collapse, which ultimately caused the Great Depression. The FDIC was created shortly afterward to ensure that banks always had enough cash on hand to ensure bank runs could never happen again.

However, the BIS report highlights that a CBDC would be seen as a safe haven by many investors during a crisis. It is suggesting that investors would move their money out of the banking system and into the central bank.

This would lead to a collapse of the banking system like it did a hundred years ago. Even if this collapse doesn't happen, the report admits that in a CBDC system, “a common theme is that maintaining bank profitability levels could be challenging.”

The report gives a series of recommendations for how private banks could mitigate the loss and risk of potential collapse, and some consider them laughable, at the very least.

One aspect particularly stands out of all the report’s side effects a CBDC could have on the banking system. It states, “the introduction of a CBDC by the central bank could cause a reduction in commercial bank deposits, which would consequently translate into more expensive credit lines.”

In other words, CBDCs could make loans more expensive, which means it could become next to impossible for the average person to buy a house or other valuable assets. You could say it's almost like "you’ll own nothing, and you’ll be happy."

Notably, the same run on the bank risk exists with stablecoins, and you could argue that it's already begun as the $130+ billion in the stablecoin market cap came from bank balance sheets.

After highlighting these risks and others, such as CBDCs potentially replacing government bonds, as the primary safe-haven asset among investors, the report explains how central banks can use their omnipotence to prevent these scenarios from playing out.

Quote, “quantity-based safeguards would restrict the use of CBDC, through imposing hard limits on the transfers and or holdings of CBDC.” It also states, “Limits could also be applied varyingly for different CBDC account holders.” Better yet, quote, “Such limits could be imposed on a permanent basis or on a transitional basis.”

In other words, if the economy starts crashing and everyone runs to CBDCs to protect their wealth, the central bank will prevent them from doing that to prevent the crash, with no regard for investors.

The BIS report concludes that a material shift from bank deposits to CBDC if the holdings of CBDCs by individual users were left unconstrained, could have a non-trivial long-term impact on bank lending and intermediation.

What Is The Likely Outcome?

As terrifying as this BIS report is, it reveals just how difficult it will be to roll out such a dystopian system and arguably next to impossible. This is simply because there's no way to introduce a CBDC without eating into the bottom line of the banks and financial intermediaries. They would sooner side with crypto than let that happen, and some would suggest that this could be the outcome of introducing a CBDC.

There is also no way on God’s earth that the average person would adopt a CBDC without being forced, and the moment someone starts to use force to mandate something and claim it is good, it becomes clear that it's not. This begs the question of why central banks would go through all this trouble to create what is likely to be an abysmal payment method.

Many would argue the answer is that this isn't their actual goal, and the evidence is easily found in the design of what they're building. CBDCs are nothing short of a tool for total control, and every single stated benefit and feature only exists to entice people into this totalitarian scheme.

As the report admitted, there are already numerous financial technologies that can do everything CBDCs can and more. Most of these financial technologies have come from cryptocurrency, and it’s odd that the report didn't mention any cryptocurrencies besides stablecoins.

It also didn't mention the word blockchain either. It may be that the BIS doesn't want to draw any more attention to cryptocurrencies. What is the likelihood of any of the governments that read the report getting the idea of adopting Bitcoin as El Salvador did? Other countries are likely to follow suit, especially since it's much easier to plug into a financial system that's been proven to be secure and reliable rather than build a new one from the ground up.

It looks like they won't have any other choice either because fiat currencies are losing value and credibility by the minute. However, this might actually be what the central banks want though. After all, the only way they could possibly convince anyone to adopt their CBDCs is if their existing fiat currencies are worthless. Even then, the crash could happen much quicker than they anticipated, and their CBDCs are far from being ready to fill that void.

It may sound a little crazy, but we could end up with a scenario where the only kind of money left with any value is select cryptocurrencies and China's digital yuan (e-CNY). I think we all know which one the global majority would choose.

So while politicians and bankers “fluff around,” trying to implement their new financial system, we can do our part in adopting credible cryptocurrencies and emerging projects that tower over any technology the central banks come up with, especially in the case of decentralization autonomy and privacy. Systems that will have a positive impact on “We the people” not only financially, but also socially and professionally.

A special thank you for valuable insights and research performed by Coin Bureau

Also published on Before It’s News – https://beforeitsnews.com/economy/2021/10/the-latest-report-on-cbdcs-a-dystopian-nightmare-3044898.html