Bitcoin Passes $11,000 Mark, Nears 15-Month High on Facebook Libra, Other News

Bitcoin is back, doubling in value in just two months time and raising the prospect of another speculative bubble.

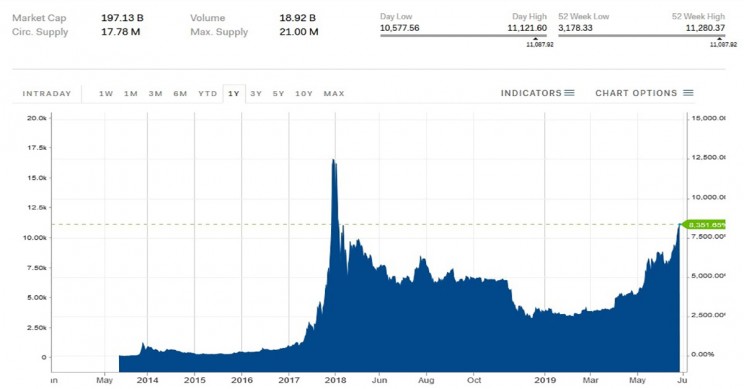

Bitcoin is in the news again, jumping passing the $11,000 mark this weekend and approaching the highest value the cryptocurrency has seen in 15-months after the announcement of Facebook's Libra quasi-cryptocurrency and other market forces.

Cryptocurrencies Bounce Back After Initial Post-Bubble Drop

Bitcoin hit a high of $11,307.69 Sunday evening, posting a more than 20% gain in just one week, according to a new report by CNBC. Prices drew back a bit on Monday, wavering above and below the $11,000 mark all afternoon, priced around $11,070 as of Monday evening.

RELATED: PEOPLE ARE MORTGAGING THEIR HOMES TO GET IN ON BITCOIN ACTION

The sudden jump for the world's first and largest cryptocurrency has a lot to do with the announcement last week of Facebook's 'Libra' digital currency, which reintroduced cryptocurrencies to public consciousness a year and a half after they burst onto the scene with reports of wild, 1000% gains and overnight Bitcoin millionaires. Those reports, in turn, drove further speculation in the cryptocurrency markets, creating a bubble that popped soon after as sell-offs at the height of the craze drove prices into a tailspin as speculators rushed to realize gains they had made on Bitcoin's rise.

After a year and a half hovering in the three-to-five-thousand range, Bitcoin's price is seeing some real action again, doubling in value in just under two months and nearly quadrupling in value just this last year.

There are several reasons for the rise in value, according to analysts. Some say that the rise is due to Bitcoin being seen more as a "safe-haven" asset, rather than a speculative investment.

"There’s a broader understanding of crypto as an asset class,” Circle CEO Jeremy Allaire told CNBC's “Squawk Box” program on Monday. “Anticipation that next generation of blockchains, including what we heard about last week with Libra Association, really indicates what is ultimately going to be a massive mainstream phenomenon touching billions of people."

Forbes points out that much of the current rise in Bitcoin's value may be tied to events in India. Prime Minister Narendra Modi's monetary policy was criticized for appearing to cause chaos in the country in 2016 when his government banned high-value bank notes and a more recent crackdown on internet services like Telegram and Reddit turn people's attention to more decentralized internet services like cryptocurrencies.

The Indian government has proposed banning cryptocurrencies in the country, which could actually be driving more people to cryptocurrencies in the country. In India, Bitcoin is currently trading at a $500 premium.

Facebook's announcement that it will be participating in the Libra Association's digital cryptocurrency–though some cryptocurrency purists have argued that Libra doesn't qualify as a true cryptocurrency since it is not censorship-resistant–clearly contributed to Bitcoin's sudden spike in value as well. Putting its industrial weight behind the principle of cryptocurrencies helps shore up doubts about the value of cryptocurrencies as an asset and may be giving investors some level of reassurance that cryptocurrencies aren't just some dodgy, fake Internet money.

Still, the sudden price spike in Bitcoin can't help but recall its infamous surge in the fall of 2017 and its spectacular collapse in value beginning in January of 2018.

Source: John Loeffler for Interesting Engineering, via BusinessInsider

The rise and fall and rise of Bitcoin value raise a lot of questions about the cryptocurrency. The fundamentals of the currency haven't changed, so it's understandable that many may be looking at its sudden price rise as more evidence that cryptocurrencies are unreliable speculative investments.

On December 13 2016, Bitcoin was selling at $784.30. The price started building quickly over 2017, reaching $3,433 on September 15 2017, after which it soared over the next three months, closing at its all-time high on December 17 2017, Bitcoin was selling at $19,783.21 or more than 2500% its value just 12 months earlier.

The bottom started falling out shortly after that as speculative investors sought to realize their gains, cutting more than $8,000 off its value in just over a month, closing at $11,553.39 on January 19, 2018. The party now most definitely over, Bitcoin's value fell again by close to half, closing at $6,821 on April 1, 2018, eventually reaching its lowest price since the boom almost exactly one year later, closing at $3,254.78 on December 16, 2018.

Since then, it had spent the first quarter hovering in the three-to-four-thousand range, jumping to nearly $5,000 in the beginning of April, where it hovered until the beginning of May when it started to climb again. Since then, it has doubled in value in just under two months.

Is this the start of another round of speculator-driven investment that will collapse just as soon as the last time around? It could, it has happened before after all, and there's nothing about Bitcoin this time around that's all that different than last time. Facebook's entry into the market for cryptocurrencies does shake things up, however, adding a certain about of industrial strength to cryptocurrency that Bitcoin and others didn't enjoy last time around. But major investment banks with more financial industry savvy than Facebook have also been involved in expanding cryptocurrency portfolios, and this hasn't driven sudden spikes in price.

What makes Facebook's involvement in cryptocurrencies more valuable than Goldman Sachs' isn't clear at all. In fact, Facebook's involvement could easily be seen as a negative, given that Facebook is currently under an enormous amount of scrutiny from regulators in both the US and Europe over its privacy practices and issues with its user data.

If you had a stake in cryptocurrencies, probably the last thing you'd want is for Facebook to get involved and muddy-up the crypto-waters. Cryptocurrencies already face enough scrutiny from world governments, hitching their wagon to Facebook as well only makes that problem worse.

Regardless, it remains to be seen if these valuations will last. If past performance is any guide, then we should know in about a month or two as people will either be lamenting that they didn't get in on this whole Bitcoin thing when they had the chance, or they'll be shaking their head at the latest round of poor saps who took out loans to go all in on Bitcoin the day it started collapsing in price.

By John Loeffler

Alan Zibluk Markethive Founding Member