The Bigger Picture Behind Bitcoin’s Latest Price Rebound

OPINION

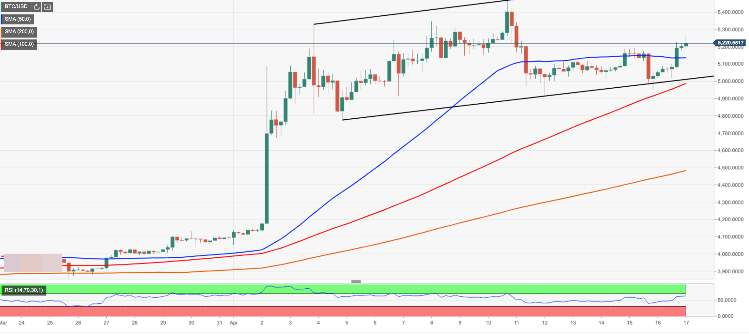

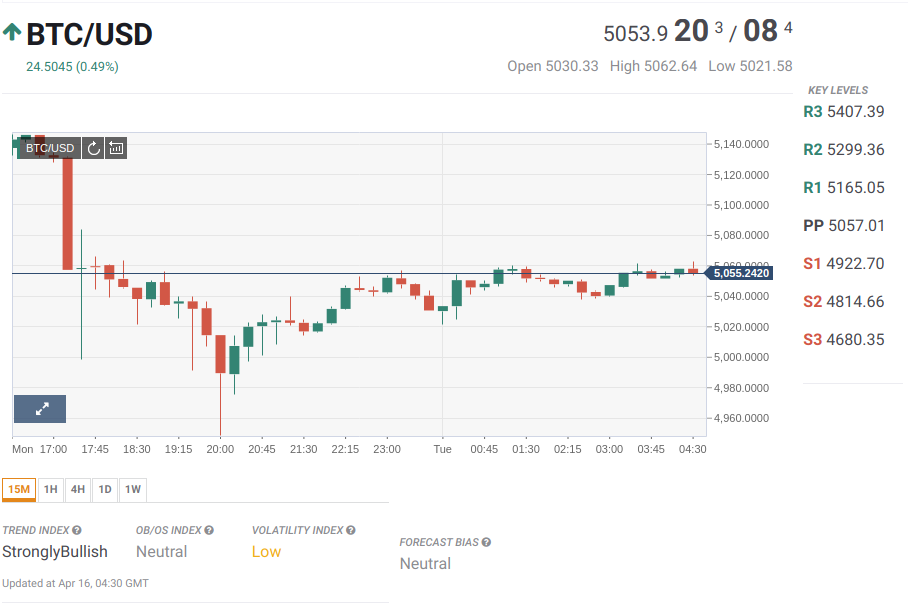

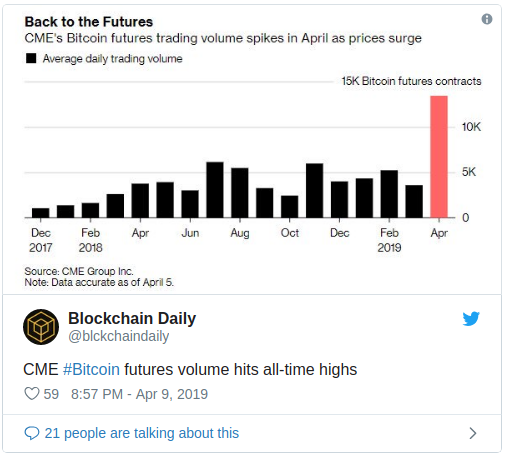

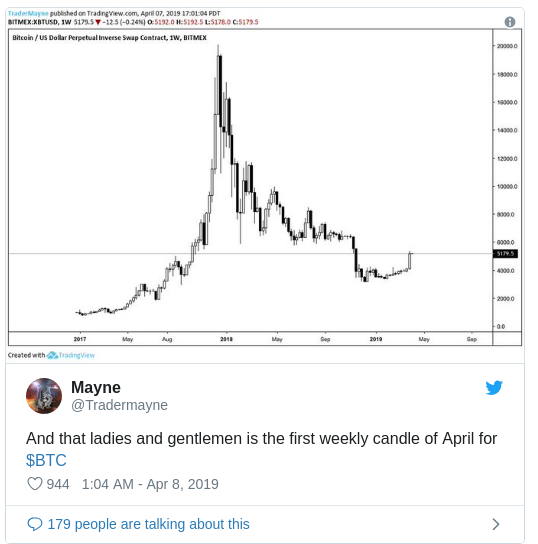

Bitcoin’s out-of-the-blue bounce over the $5,000 mark this month has prompted some predictable pontificating from price-obsessed people within and outside the cryptocurrency community.

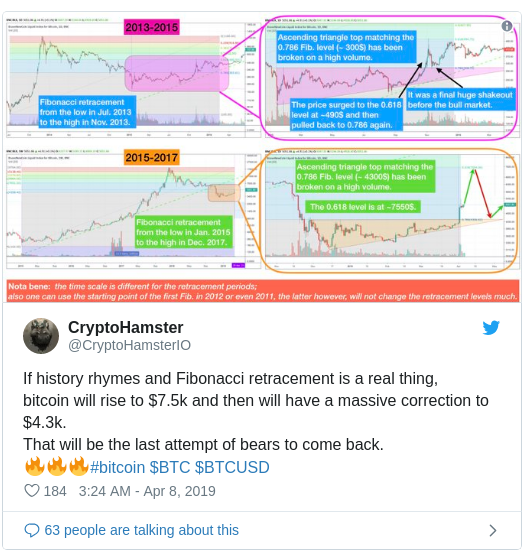

Investors who are long-cryptocurrencies have gleefully pronounced that the Crypto Winter, which began when bitcoin’s bubble burst at the end of 2017, is now mercifully over. The most optimistic are forecasting a rerun of bitcoin’s fall 2015 bounce from its prior post-bubble collapse, which sent it not only back above its 2013 high of $1,150 but all the way to a December 2017 peak of $19,500.

At the same time, bitcoin skeptics have pointed to the seeming lack of fundamental news behind the price rise and declared it meaningless. Typical of the genre, Matt Novak at Gizmodo penned an angry screed titled “Bitcoin Surges 15% Overnight Because Nobody Learned Their Lesson After the Last Crash.”

One of Novak’s insights: “To be clear, bitcoin is absolutely worthless by any real measure. It’s fake money that’s about as practical to use in the real world as Monopoly bills.”

Readers won’t be surprised to hear that I disagree with Novak’s simplistic rant. But I’m also turned off by the knee-jerk cheerleading from crypto traders whenever bitcoin’s price bounces.

There’s something fundamentally wrong with reducing the measure of bitcoin’s worldwide importance to a price metric that’s denominated in a fiat currency that its advocates hope to replace. It pushes the debate into an inane all-or-nothing binary set of predictions: bitcoin is either going to zero or “to the moon.”

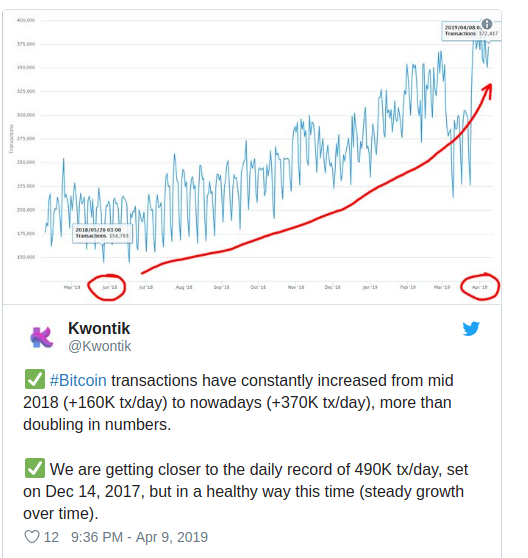

What matters is that 10 years after an unidentified software engineer created it, this decentralized system for recording sequences of transactions continues to do its job, block after block, with no authority in charge, no user able to alter past transactions, and no person or entity able to shut it down.

The more this goes on, the more it reinforces the powerful vision behind bitcoin: a peer-to-peer, disintermediated system for exchanging value around the world. And in that context, we can also think of bitcoin the cryptocurrency – differentiated from bitcoin the system – as a unique, provably scare digital asset that expresses the overall value in that vast potential.

Bitcoin is valuable because it exists

A point that’s lost on critics like Novak is that the longer bitcoin simply survives – in the face of the $90 billion valuation that stands as a de facto bounty for hackers to try to take it down, compromise its security or corrupt it – the more its overall value is confirmed.

Bitcoin is progressively proving itself to be an unstoppable, digital system of global exchange, one that functions outside of the traditional national government-mandated system of currency and banking. That status is what gives bitcoin its value.

Of course, the global impact of the bitcoin value exchange system, and therefore its worth to humanity, will be significantly enhanced if adoption advances to a much wider scale and it is used frequently in the world’s transactions. And, yes, a great deal of development work is still needed if it is to ever reach that point.

(Some recent technological leaps such as the Lightning Network and the emergence of decentralized, non-custodial asset exchange technologies offer hope that this scaling challenge can be achieved, though nothing is guaranteed.)

However, widespread adoption in payments is not necessary for bitcoin to have value. To understand why that’s the case, it’s useful to think about gold, to which bitcoin is often compared.

The power of common belief

Similar to bitcoin, gold is a mutually agreed store of value that, for all intents and purposes, lies outside the control of nation-state governments and banks. It’s not widely used as a day-to-day currency, but it does enjoy a widespread, shared belief in its value.

Where does gold’s value come from? The answer is somewhat tautological: it comes from that same widely held belief, from a shared understanding in gold’s capacity to function as a depoliticized global system of exchange that’s free of manipulation. Sure, we tend to think of gold in terms of its material qualities: that it’s durable and that it’s shiny in a way that connotes beauty. But its lasting worth really derives from the more esoteric notion that human beings have for a long time deeply held a shared belief in its value.

That belief has turned gold into a system for protecting property, a system used through the centuries by refugees, dissidents and investors for moving and storing value and for hedging against lost spending power. That we now have a digital version of this concept, one that’s designed for the borderless, internet-shaped world of the 21st century, is a big deal.

When dealing with debates over bitcoin’s value, it’s also worth going a little way down the rabbit hole of thinking about what money actually is. Not everyone agrees on a definition, but I think it’s useful to think of money as a societally agreed system for storing and exchanging value. The system has to have certain properties for people to reach this agreement – it must fungible, durable, transferable, divisible, etc. – but it’s the agreement itself that gives it its value.

Here, too, is where many of bitcoin’s detractors get lost.

Fixating on the misplaced idea of money as a thing, they exclaim that bitcoin can’t have any value as it isn’t backed by anything. This, of course, also misses the fact that it is backed by the energy and other resources that miners spend to do the computational work needed to secure the bitcoin ledger.

But the bigger point is that bitcoin’s value, as with all forms of money, comes from the existence of a wide agreement in its potential use as a store of value and medium of exchange.

In bitcoin’s case, the agreement is arguably one that involves 35 million people, if Cambridge University’s latest survey of authenticated users is to be believed. This large level of participation is essentially why bitcoin holds a much greater value than the altcoins that are forks of its code.

So, this is why bitcoin at $5,000 is important, not because it’s a sign of that new investors are coming to push up its price again, but because it validates the core proposition of bitcoin’s resilience and promise.

Michael J Casey

Apr 15, 2019 at 04:00 UTC

Alan Zibluk Markethive Founding Member

c

c