Why Silicon Valley is going gaga for Bitcoin

Cryptocurrencies are on a historic tear right now. And Silicon Valley’s infatuation with the industry explains a lot about itself.

Should I buy bitcoin? As a technology reporter, the questions I receive from random people at birthday parties, say, or seatmates on a plane, are usually emblematic of what is going on in the digital world. (And, increasingly, the real one, too, for that matter.) Not too long ago, the predominant question was Should I buy the new iPhone? Then it became Do I need to be on Twitter? or Do I need to be on Facebook? or Do I need to be on Snapchat? (That question has since come full circle to Should I quit Twitter and Facebook?) These days, the question I hear the most—well, besides whether Twitter should ban Trump—is Should I buy bitcoin?

I usually respond with the story of Laszlo Hanyecz. If you’ve come within 500 feet of bitcoin, or any other cryptocurrency, over the past few years, the name alone will make you cringe. Back in 2010, when the currency was in its infancy, Hanyecz went “mining” for bitcoins for a few months and collected 10,000 of them; he subsequently traded them, in what would be the first cryptocurrency transaction in history, to a guy who bought him two Papa John’s pizzas with a couple sides of that tasty, buttery garlic sauce. Back then, Hanyecz’s bitcoins had no value, and the $30 value of two pies and an accoutrement made his individual bitcoin units worth 0.003 cents apiece. Today, at their current market valuation, bitcoin units are worth around $5,800 each, which means Hanyecz’s 10,000 bitcoins would be worth around $58 million. “It wasn’t like bitcoins had any value back then, so the idea of trading them for a pizza was incredibly cool,” Hanyecz told me in 2013, when bitcoin was already valued at $1,242 each. “No one knew it was going to get so big.”

For a lot of people on the periphery of this technology, the extraordinary rise in bitcoin’s value has become cause for alarm. The Web is littered with news articles, blog posts, and white papers warning that bitcoin and its sibling currencies are worth nothing, and the rise and fall of the currencies’ worth, which can fluctuate by billions of dollars a minute, certainly backs that up. But while Jamie Dimon and other bankers might scoff at these digital currencies, Silicon Valley is extremely bullish. There’s a reason, too: if Dimon had invested in bitcoin when he first called it a joke, in 2015, he would have received a tenfold return on his investment.

There are a number of reasons why bitcoin and cryptocurrencies are doing so well right now. One of the more plausible scenarios was outlined this week in a very clever post written by Adam Ludwin, an investor and co-founder of Chain.com, a bitcoin developer platform, which argues that bitcoin is an entirely new asset class, similar to equities and bonds, and that “bitcoin is capitalism, distilled.” The “capitalism” part of the sentence helps explain why some in Silicon Valley are so specifically exuberant about it right now. “In the short-run, there will be extreme volatility as FOMO competes with FUD, confusion competes with understanding, and greed competes with fear (on both the buyer side and the issuer side),” Ludwin wrote. “Most people buying into crypto assets have checked their judgement at the door.”

This gets someone like me a bit nervous about what cryptocurrencies could end up doing to society in the long run. Silicon Valley culture is largely fueled by people who love to decimate industries that don’t work, often without any thought of how the disruption could lead to other negative results happening in society (see the recent social-media debacle around the election ). In typical Valley fantasy, people are seeing only the positive potential with bitcoin, not the potentially ugly outcomes when humans molest it for their own interests.

One of the many factors currently fueling the ascent of bitcoin is the rise of initial coin offerings, or I.C.O.s, where some lucky investors are reaping astounding returns. You can think of these like a traditional initial public offering, or I.P.O., but without the layers upon layers of regulation and government bureaucracy that come with a company going public. With an I.C.O., a start-up raises money for a new venture by selling “coins” that are very similar to shares of a public company. The coins then rise and fall as the company’s value oscillates. In 2014, when the founding of a new cryptocurrency called Ethereum was announced, it raised $18 million by selling a new digital coin called “Ether” for 40 cents per coin. Today, Ethereum has a market cap of around $30 billion. So if you had spent $100 on Ether during the I.C.O., you would have made $74,900 in profit. As Nathaniel Popper detailed in The New York Times earlier this summer, I.C.O.s have been generating billions of dollars in returns for some—and a lot of scams, too.

The lack of regulation in the cryptocurrency world, after all, means that there is a lot of fraud, extreme volatility, and coin values can jump up or down in mere seconds. Someone I recently spoke with who works with, and monitors, the crypto I.C.O. markets pointed out that some of these I.C.O.s feel awfully similar to the Dot Com public offerings of the late 90s, where the public was buying into nothing and ended up with exactly that when the entire market came crashing down and trillions of dollars were wiped off the stock market. In China, I.C.O.s became so troubling that they were banned earlier this year. In September, the People’s Bank of China issued a blunt statement saying that this practice was “illegal and disruptive to economic and financial stability.” I.C.O.s in China were occurring at an astounding rate, with one report claiming that more than $750 million was raised in I.C.O.s in July and August alone. A lot of people think the ban by China is temporary, slowing the dizzying speed of these offerings.

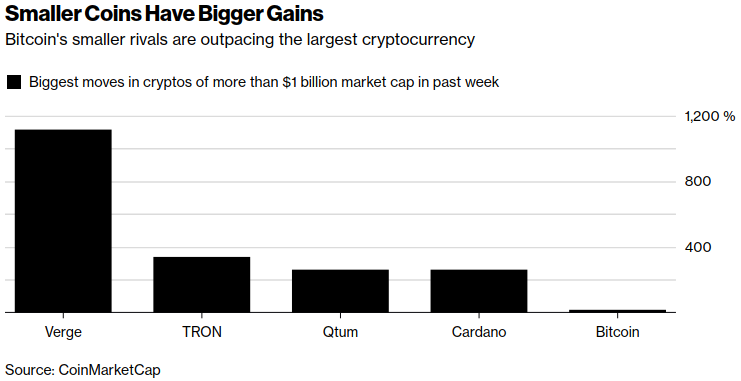

As a result of all the movement in the cryptocurrency market over the past couple of years, there are a lot of options out there for people who want to try their hand in crypto-investing. There’s bitcoin, the first and most well known of all the currencies, which currently oscillates in value at around $5,000 a coin. I’ve heard predictions all over the map, from bitcoins one day being worth as much as $500,000 each to units being worth absolutely nothing if a better coin comes along. (My personal prediction is that they will continue to rise for at least the next couple of years.) Ether had remained relatively flat until earlier this year when it spiked in value to over $350 apiece. (It’s since fallen to $300 each.) The current coin du jour is called Litecoin, which is getting a lot of attention because it’s still priced relatively low, at around $55 each, and is expected to rise considerably over the next year or so on account of new features that will be added to enable more privacy options. Then there are a slew of other coins to explore, including Monero, which is an open-source currency that was developed in April 2014, but which spiked this year after the illegal drug market AlphaBay was taken down. Monero, unlike other currencies, is truly anonymous, making it the perfect currency with which to buy and sell drugs, guns, and other illegal contraband on the Dark Web. If you look at the World Coin Index Web site, you can see a long list of other coins and their values over time, including Ripple, Bitcoin Cash, Qtum, NEO, Nav Coin, NEM, and a number of other coins.

For Silicon Valley, betting on one of these early can mean profiting beyond all imagination, exceeding even the famed 1,000x start-up returns from companies like Facebook and Uber. Earlier this summer, I interviewed Tyler and Cameron Winklevoss, the twins who co-founded The Facebook with Mark Zuckerberg, and they are now obsessively investing in cryptocurrencies. In a settlement with Facebook, the two brothers were awarded $60 million, but to hear them talk about it, it appears their investments in bitcoin and other currencies are going to reap a far bigger return over time. I’ve spoken with countless other people about the current state of bitcoin and cryptocurrency, and I’ve heard two truths that seems consistent. No one—and I mean no one—knows exactly which digital currency will be successful in the future. It could be bitcoin, it could be Litecoin, it could be something that hasn’t even been created yet. But, the other resounding feeling is that these currencies are here to stay in one form or another and there is nothing anyone can do to stop them. Which brings me back to that question that I’m often asked these days: “should I buy bitcoin?”

There’s an old saying in real estate that “you shouldn’t wait to buy, but rather you should buy and then wait.” That’s the way I feel about these cryptocurrencies. If you’re looking for a quick and dramatic financial boost, realize that you could probably get similar odds by buying a plane ticket to Las Vegas, walking into the first casino you see, and putting all your money on black or red. But, if you’re willing to wait it out, there’s a chance that your investment in a cryptocurrency could make for an impressive return over time. Just be prepared to go it the long haul. Or at least until the price spikes tomorrow.

Author Nick Bilton – special correspondent for Vanity Fair.

Posted by David Ogden Entrepreneur

Alan Zibluk – Markethive Founding Member