Bitcoin – Can the Bulls Muster Up a Weekend Rally?

Bitcoin stuck in the ranges through the early part of the day, with the Bitcoin bulls needing to put some life back into the market to support a breakout.

Price action through the week was limited for Bitcoin, with a 0.06% gain on Friday one of only two days in the week where Bitcoin managed to avoid the red.

3-days in the red left Bitcoin down 0.88% for the current week, with Bitcoin now having fallen short of the 23.6% FIB Retracement level of $6,757 since 18th October, as the steam comes out of Bitcoin and the broader market.

After a relatively range bound start to the day on Friday, Bitcoin rallied to a morning high $6,597.4, breaking through the first major resistance level at $6,575.57 before falling back to the earlier part of the day’s ranges, with resistance at $6,600 pinning Bitcoin back on the day.

An early afternoon intraday low $6,511 held well above the day’s first major support level at $6,469.77, leaving Bitcoin at $6,500 levels through the day, a rare occurrence in the world of Bitcoin and reflective of the lack of volatility in the market.

On the news front, there was some chatter on SEC Commissioner Kara Stein’s view on the setting up of cryptocurrency funds, Stein stating that some internal guidelines on key considerations had been circulated, while she held back from confirming whether any regulated exchange traded funds would be approved before the end of the year.

The regulatory landscape continues to be one of the key obstacles for the SEC to give the green light, with the SEC Commissioner highlighting that there remains a need to get clarity on a range of regulatory issues before the markets can expect institutional money to flood in.

For now the cryptomarket and the Bitcoin bulls in particular, remain optimistic that the SEC will at least give the green light to the VanEck Bitcoin ETF, though it remains to be seen whether issues surrounding valuation, liquidity and custody have been sufficiently addressed.

At the time of writing, Bitcoin was up 0.33% to $6,552.9, with Bitcoin moving from a start of a day morning low $6,524.9 to a morning high $6,560 before easing back, the moves through the early part of the day leaving the day’s major support and resistance levels untested.

For the day ahead, a hold on to $6,550 levels would support a move through the morning high $6,560 to bring the day’s first major resistance level at $6,582.73 into play, while we will expect Bitcoin to fall short of $6,600 levels for a 3rd consecutive day, with the news wires likely to remain relatively silent on the regulatory front through the weekend.

Failure to hold on to $6,550 levels through the morning could see Bitcoin give up the morning’s gain to pullback through the start of the day morning low $6,524.9 to call on support at $6,496.33 before recovering, more material losses unlikely barring particularly negative news hitting the crypto wires.

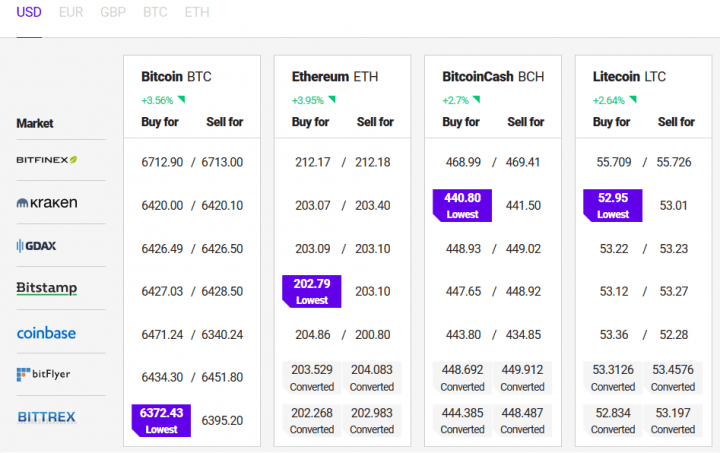

Looking at the broader market, with Bitcoin’s dominance holding at around 53.6% and the crypto total market cap hovering at around $210bn, there’s been very little action across the majors with Ethereum continuing to hold onto the number 2 spot, Ripple’s XRP struggling to close the gap in spite of the Ripple team’s successes in the real world.

Bob Mason

43 minutes ago

Alan Zibluk Markethive Founding Member